Table of Content

▲- What is MCD Property Tax?

- Who Needs to Pay Property Tax in Delhi?

- Factors Affecting Property Tax in Delhi

- Categories of Properties and Colonies

- How to Pay Property Tax in Delhi

- MCD Property Tax Amnesty Scheme 2025-26 (SUNIYO)

- Rebates and Exemptions

- Deadlines and Penalties

- Property Tax Mutation

- Geo-tagging and Digital Tools

- Checking MCD Booked Property & Property ID

- Contact Information

- Tips for Hassle-Free Property Tax Payment

- Conclusion

Buying a home in Delhi has been one of the biggest milestones of my life, but figuring out the property tax system was a whole different challenge. If you own a property here—or are planning to chances are you’ve wondered:

What is the current property tax in Delhi?

How is it calculated?

Can I pay it online, or do I need to visit an MCD office?

I asked myself the same questions. In 2025, after exploring the MCD portal, working out my dues, and making an online payment from the comfort of my home, I discovered that the process is actually straightforward if you know the steps.

In this guide, I’ll walk you through everything about property tax in Delhi 2025 from calculation methods and payment options to rebates, deadlines, and useful tips—so you can handle it quickly and confidently.

What is MCD Property Tax?

The Municipal Corporation of Delhi (MCD) levies property tax on all properties under its jurisdiction. The tax applies to:

- Residential properties – houses, flats, villas, builder floors

- Commercial properties – shops, offices, hotels, malls

- Industrial properties – warehouses, factories

- Vacant land – plots not used for agriculture

The collected property tax helps maintain and improve essential services such as sanitation, roads, street lighting, sewage management, public health services, and maintenance of parks and civic amenities.

The MCD calculates property tax using the Unit Area System (UAS), which considers multiple factors such as the property’s built-up area, age, usage type, occupancy, and construction type. This ensures that the tax amount is fair and proportionate to the property’s value and category.

Also Read: Urban Extension Road (UER) II: Transforming Connectivity and Real Estate in Delhi NCR

Who Needs to Pay Property Tax in Delhi?

All property owners under the jurisdiction of one of the three municipal corporations must pay:

- South Delhi Municipal Corporation (SDMC)

- North Delhi Municipal Corporation (NDMC)

- East Delhi Municipal Corporation (EDMC)

Eligibility criteria:

- You must be a resident or citizen of Delhi.

- You must own property under MCD jurisdiction.

- You must be 18 years or older.

- You should have a Unique Property Identification Code (UPIC) and verified property details before making payment.

Even if your property is self-occupied or rented out, failure to pay property tax can attract penalties and affect mutation or transfer processes.

Factors Affecting Property Tax in Delhi

Property tax is not a flat rate; the MCD considers multiple factors to determine the tax amount. Here’s a closer look:

|

Factor |

Explanation |

|

Unit Area Value (UAV) |

Value per sq metre assigned based on the property category and locality. |

|

Property Area |

Total built-up area of the property in sq metres. |

|

Age Factor |

Older properties get a lower factor; newer constructions are taxed higher. |

|

Use Factor |

Residential or non-residential use influences tax rate. |

|

Structure Factor |

RCC (reinforced concrete) buildings have a different factor than semi-pucca or kutcha buildings. |

|

Occupancy Factor |

Tax differs for self-occupied vs rented properties. |

Example Calculation:

For a 1,000 sq ft self-occupied residential property in a Category B colony:

- UAV = ₹500 per sq metre

- Area = 100 sq metres

- Age factor = 0.6

- Use factor = 1

- Structure factor = 1

- Occupancy factor = 1

ARV (Annual Rental Value) = 500 × 100 × 0.6 × 1 × 1 × 1 = ₹30,000

Property tax = 12% of ARV = ₹3,600 per year

Including such calculations helps you anticipate the exact amount due and plan your payment schedule accordingly.

Categories of Properties and Colonies

Delhi properties are classified into categories A to H, which affect the unit area value and applicable tax rates:

|

Category |

Unit Area Value (₹/sq m) |

Residential Tax Rate |

|

A |

630 |

12% |

|

B |

500 |

12% |

|

C |

400 |

11% |

|

D |

320 |

11% |

|

E |

270 |

11% |

|

F |

230 |

7% |

|

G |

200 |

7% |

|

H |

100 |

7% |

Each category includes specific colonies, available on the official MCD website. Identifying your category helps you understand the expected tax range.

How to Pay Property Tax in Delhi

There are two main modes: online and offline.

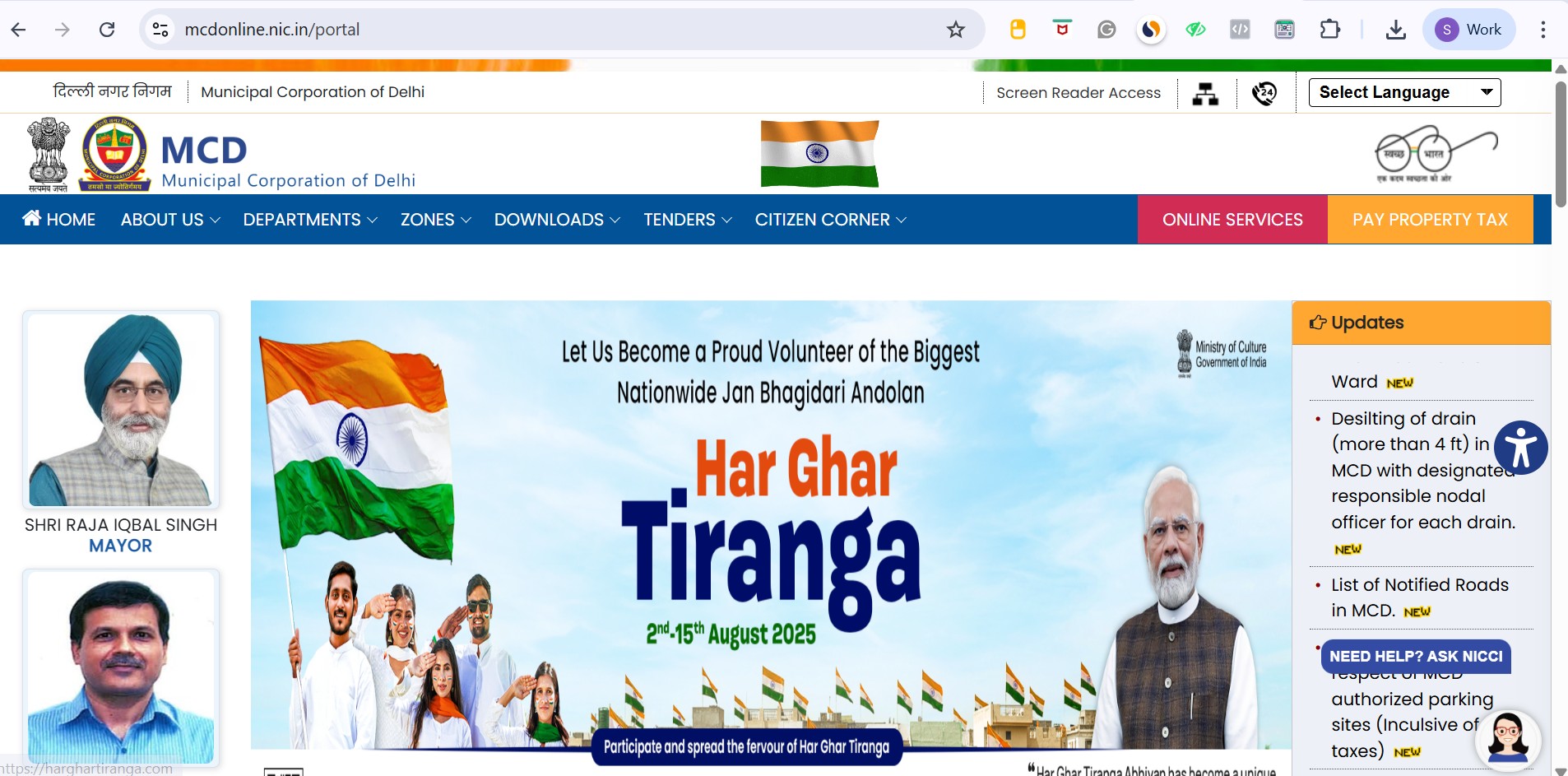

1. Online Payment

Online payment is faster, convenient, and provides instant receipts.

Step-by-step guide:

- Visit MCD property tax portal

- Enter your registered mobile number to generate OTP.

- For first-time users, complete the sign-up process.

- Enter property details: UPIC, ownership info, property type.

- Verify all details carefully and select the applicable financial year.

- Use the Tax Calculator for exact payable amount.

- Choose your payment mode: credit/debit card, net banking, or UPI.

- Download and save the receipt for future reference.

Tips for online payment:

- Double-check all property details before submission.

- Keep your UPIC handy for quick access.

- Pay before deadlines to avoid penalties.

- Take a screenshot of the payment confirmation in addition to the receipt.

Third-party apps & mobile apps:

- MCD311 app: Pay property tax, generate UPIC, check status, and lodge complaints.

- PayTM, Google Pay: Some third-party apps allow payment of municipal property taxes.

2. Offline Payment

Some property owners prefer traditional methods:

- Visit any ITZ cash counter in Delhi.

- Carry documents: property tax bill, ID proof, and latest tax receipt.

- Make the payment and receive a receipt instantly.

Offline payment is reliable, but online payment is recommended for faster processing, rebate eligibility, and convenience.

MCD Property Tax Amnesty Scheme 2025-26 (SUNIYO)

The Sumpattikar Niptaan Yojana (SUNIYO) is designed to help Delhi property owners clear pending dues without penalties:

- Covers dues from 2020-21 to 2024-25

- Interest and penalties are waived for eligible taxpayers

- Arrears prior to 2020-21 are also waived

Scheme validity: 1 June – 30 September 2025

Who can apply: All property owners, including defaulters and those with disputes.

Rebates and Exemptions

Rebates:

- Senior citizens, women, physically-challenged: 30% on one property (up to 200 sq m)

- DDA/CGHS flats: 10% (up to 100 sq m)

- Group housing: 20% if paid by June 30

- Ex-servicemen: 30%

Exemptions:

- Charitable institutions, heritage sites, religious properties

- Properties of gallantry award winners, war widows

- Agricultural land or non-dwelling structures

Taking full advantage of these rebates can significantly reduce your tax liability.

Deadlines and Penalties

- First installment: June 30

- Second installment: December 31

- Late payment penalty: 1% per month on unpaid tax

Paying on time avoids unnecessary penalties and ensures smooth compliance.

Also Read: Delhi Office Market Poised for 5 Million Sq Ft Supply Boost After 10 Years

Property Tax Mutation

Mutation updates property ownership in MCD records and is necessary during sale, inheritance, or transfer:

- Online: Submit documents through the MCD e-mutation portal.

- Offline: Visit MCD office with required documents.

Timely mutation prevents future disputes and ensures that future tax bills are sent to the correct owner.

Geo-tagging and Digital Tools

The MCD now offers geo-tagging services:

- Mobile app allows location tagging of properties

- Features include UPIC generation, merging, transfer, e-receipts, and chatbot support

- YouTube tutorials help taxpayers navigate the process

Geo-tagging ensures accurate property records and faster dispute resolution.

Checking MCD Booked Property & Property ID

- Verify booked properties on the MCD portal.

- UPIC (15-digit code) is mandatory for filing property tax.

- Property ID can also be requested at MCD offices with ownership documents.

Contact Information

NDMC / SDMC Headquarters: Dr SPM Civic Centre, Minto Road, New Delhi – 110002

EDMC Headquarters: 419, Udyog Sadan, Patparganj Industrial Area, New Delhi – 110092

Helpline: 155305

Email: mcd-ithelpdesk@mcd.nic.in

Complaint Registration:

- Online via MCD portal → Citizen Corner → Lodge Complaint

- Track status using complaint reference number

Tips for Hassle-Free Property Tax Payment

- Pay on time to avoid penalties.

- Verify all property details.

- Understand your property category and tax slab.

- Opt for online payment for convenience and instant receipts.

- Keep receipts, UPIC, and relevant documents for future reference.

- Explore rebates and exemptions to reduce liability.

Conclusion

Paying property tax in Delhi is straightforward if you follow the correct steps. Online and offline options, rebates, amnesty schemes, and digital tools make the process smoother than ever. Timely payment not only avoids penalties but also contributes to Delhi’s civic infrastructure, making the city better for all residents.

Whether you’re a first-time property owner or have multiple holdings, understanding the property tax in Delhi system ensures compliance, financial planning, and peace of mind.

_1759225403.webp)

_1770976628.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. All property owners whose properties fall under the jurisdiction of South Delhi Municipal Corporation (SDMC), North Delhi Municipal Corporation (NDMC), or East Delhi Municipal Corporation (EDMC) must pay property tax. This includes residential, commercial, industrial properties, and vacant plots.

Ans 2. Delhi property tax is calculated using the Unit Area System (UAS). Factors include the property’s built-up area, age, type of use (residential or commercial), structure type (RCC, pucca, semi-pucca), and occupancy status (self-occupied or rented). The Annual Rental Value (ARV) is computed, and the tax is typically a percentage of the ARV.

Ans 3. To pay property tax, you need your Unique Property Identification Code (UPIC), property ownership details, property type, and financial year information. For offline payment, carrying your property tax bill, ID proof, and latest receipt is also required.

Ans 4. Online payment is made via the MCD property tax portal. First, register or log in, enter property details, verify information, use the tax calculator, select your payment mode (credit/debit card, net banking, or UPI), and download the receipt for reference. Mobile apps like MCD311 and some third-party apps like PayTM also allow payment.

Ans 5. Yes, offline payments are accepted at ITZ cash counters across Delhi. Bring your tax bill, ID proof, and latest receipt, make the payment, and obtain a receipt instantly. However, online payment is recommended for convenience and rebate eligibility.

Ans 6. Yes. Senior citizens, women, physically-challenged individuals, ex-servicemen, and certain groups like DDA/CGHS flat owners are eligible for rebates. Charitable institutions, heritage sites, religious properties, gallantry award winners’ properties, and agricultural land may be exempted.

Ans 7. The SUNIYO scheme allows property owners to clear pending dues from 2020-21 to 2024-25 without penalties or interest. Arrears prior to 2020-21 are also waived. The scheme is valid from June 1 to September 30, 2025, and applies to all property owners, including defaulters.

Ans 8. The first installment is due by June 30, and the second installment by December 31. Late payments attract a penalty of 1% per month on the unpaid tax. Timely payment ensures compliance and avoids unnecessary charges.

Ans 9. Property tax mutation updates ownership records in MCD records and is required during property sale, inheritance, or transfer. Timely mutation ensures that future tax bills are sent to the correct owner and prevents legal disputes.

Ans 10. You can check your status online on the MCD portal by entering your UPIC and other details. Receipts and payment history are also available digitally for verification.