Table of Content

▲- Table Of Contents

- 1. Navi Mumbai Municipal Corporation (NMMC) Property Tax: What & Why

- 2. How to View Navi Mumbai Property Tax (NMMC) Payment Details

- 3. Navi Mumbai Property Tax (NMMC) Payment Methods

- 4. How to View the Navi Mumbai Property Tax (NMMC) Bill

- 5. What is the Navi Mumbai Property Tax (NMMC)Amnesty Scheme?

- 6. Calculating Navi Mumbai Property Tax (NMMC): Manual & Online Methods

- 7. Delay or Non-Payment of Navi Mumbai Property Tax (NMMC)

- 8. How to Change the Name on NMMC Tax Documents

- 9. Updating Navi Mumbai Property Tax (NMMC) Records

- 10. NMMC Grievance Redressal

- 11. Latest News about Navi Mumbai Property Tax (NMMC)

- 12. Summing Up

Table Of Contents

1. Introduction

2.Navi Mumbai Municipal Corporation (NMMC) Property Tax: What & Why

3.How to View Navi Mumbai Property Tax (NMMC)Payment Details

4. Navi Mumbai Property Tax (NMMC) Payment Methods

5.How to View the Navi Mumbai Property Tax (NMMC) Bill

6.What is the Navi Mumbai Property Tax (NMMC) Amnesty Scheme?

7.Calculating Navi Mumbai Property Tax (NMMC) : Manual & Online Methods

8.Delay or Non-Payment of Navi Mumbai Property Tax (NMMC)

9.How to Change the Name on NMMC Tax Documents

10.Updating Navi Mumbai Property Tax Records

11.NMMC Grievance Redressal

12.Latest News about NMMC Property Tax

13.Summing Up

The Navi Mumbai Municipal Corporation (NMMC) imposes property tax on properties in its area, including residential, commercial, and industrial areas. This tax plays a crucial role in funding municipal infrastructure, sanitation, education, and other public amenities in Navi Mumbai. Property owners must grasp the NMMC property tax system, payment options, and regulations to stay compliant and prevent penalties.

1. Navi Mumbai Municipal Corporation (NMMC) Property Tax: What & Why

All property owners in Navi Mumbai are required to pay the NMMC property tax annually. Gathered by the Navi Mumbai Municipal Corporation, this tax aids in funding vital public services such as maintaining roads, providing water, managing waste, and supporting local schools.

Fulfilling this tax obligation is an obligation for property holders and guarantees their involvement in the progress of the city, resulting in the upkeep of quality infrastructure that benefits both property holders and residents.

Also Read: Mukhyamantri Awas Yojana UP: Your Guide to Affordable Housing in Uttar Pradesh

2. How to View Navi Mumbai Property Tax (NMMC) Payment Details

NMMC offers a website where property owners can conveniently view their unpaid tax balance, deadlines, and past payments.

Steps to View Navi Mumbai Property Tax (NMMC) Details Online

- Go to the NMMC's official website and find the property tax category.

- Please input either your property ID or assessment number.

- Examine the information shown, such as overall fees, fines (if applicable), and past payment record.

This function enables property owners to prevent late payments by providing them with the ability to review payment deadlines and remaining balances, guaranteeing punctual payments.

3. Navi Mumbai Property Tax (NMMC) Payment Methods

NMMC provides various payment options for ease of use, giving property owners the choice between online and offline payment methods.

Online Payment Method

- Reach Navi Mumbai Property Tax (NMMC)Payment Portal : Navigate to official website of the NMMC.

- Input Your Property ID : This is a distinct number assigned to your property and helps you to access your tax information.

- Amount Due Check: Confirm that all your dues are cleared including any interest or penalties.

- Proceed to pay: Select net banking,credit/debit card and UPI.

- Make the Payment: Proceed with the transaction and keep the receipt as a record for the transaction done.

Offline Payment Method

Those who wish to use the classical payments can also do so by making NMMC approved payments or at citizen facilitation centers.

- Visit a Center or a Bank Authorized for this Purpose: Go to an NMMC’s authorized bank branch or CFC.

- Give Property Information: Provide your property ID along with other details.

- Select Method of Payment: Payment can be done in cash, by means of a cheque or a demand draft.

- Get Receipt: After carrying out the transaction, please remember to take a receipt for record purposes.

4. How to View the Navi Mumbai Property Tax (NMMC) Bill

To access your NMMC property tax bill, you can download or print it.

- Visit the official portal of NMMC and look for the property tax section.

- Input your property id or assessment number.

- After the bill appears, the bill can also be printed or saved on the computer by the user.

This bill contains information on current charges, previous unpaid bills, and penalties for late payments, if any. Therefore, it is always good to have a hard copy or soft copy of such a document for easier record maintenance and reference when making payments in the future.

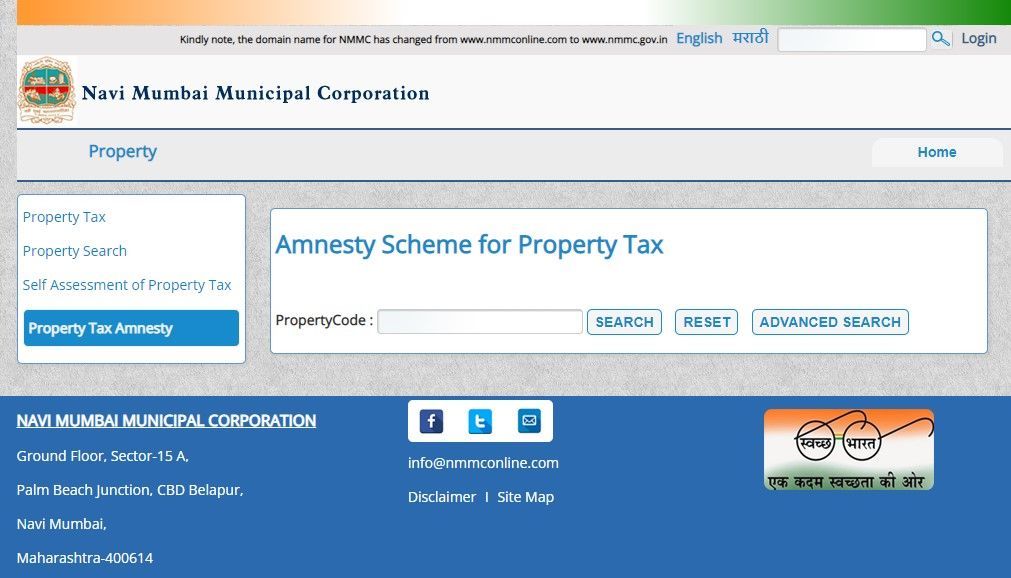

5. What is the Navi Mumbai Property Tax (NMMC)Amnesty Scheme?

The Amnesty Scheme, introduced by NMMC, offers assistance to property owners who have unpaid taxes. Penalties and interest on late payments may be decreased or forgiven as part of this program, facilitating the settlement of unpaid bills.

Benefits: This program can help property owners with overdue payments by alleviating financial strain and preventing legal issues. Regularly monitor the NMMC's official announcements to stay informed about current or upcoming amnesty offers.

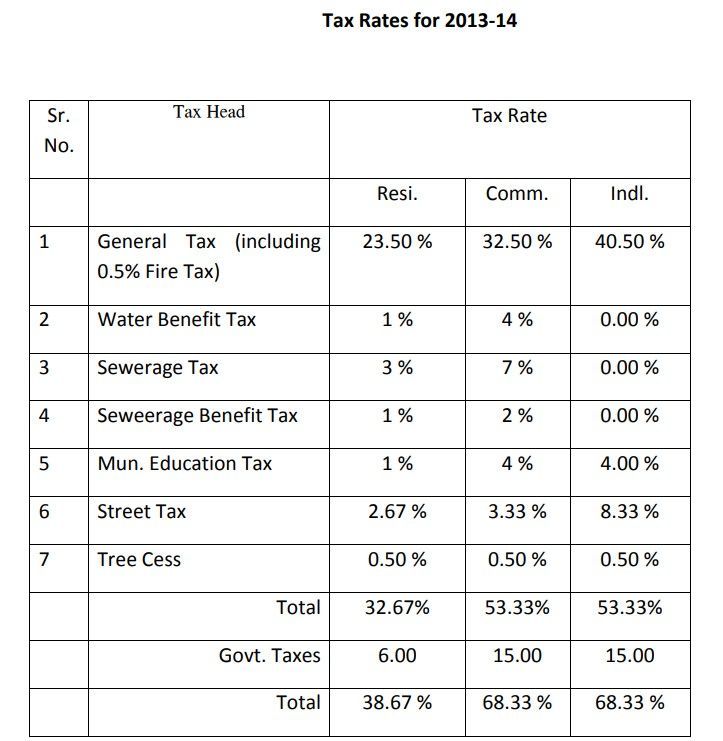

6. Calculating Navi Mumbai Property Tax (NMMC): Manual & Online Methods

Understanding property taxes is important since it helps in knowing the dues and the correct amount that one should pay.

Manual Calculation

The taxes are levied on property depending on its carpet area, location, category (residential or commercial), age, and the rate applicable as prescribed by NMMC.

For example:

Carpet Area x rate per square foot x Tax Rate (property type and zone) = Property Tax

Online Calculation

To reduce the hassle NMMC also provides an online tax calculator service. Below are the steps:

- Visit the property tax section of the NMMC and find the Tax Calculator section.

- Fill in the required information such as carpet area, location, and type of property.

- An estimate will be calculated and ready within a moment based on the existing tax rates of NMMC.

This will make the work less prone to mistakes and give correct figures, making sure that you do not pay excess or less than what you should.

Also Read : Top Indian Cities for NRIs to Invest in Real Estate: A Comprehensive Guide

7. Delay or Non-Payment of Navi Mumbai Property Tax (NMMC)

Penalties are incurred when property tax is not paid promptly, usually in the form of a percentage of the outstanding tax amount. Continual failure to pay can result in serious repercussions, including:

- Escalating Penalties: Imposition of additional fees on the amount still owing.

- Seizure of Property: In worst-case scenarios, the NMMC may take legal measures or the property may be taken without any payment being rendered.

In order to prevent such problems, property owners should keep track and adhere to all payment schedules.

8. How to Change the Name on NMMC Tax Documents

It is important to update the name on tax documents if there has been a change in property ownership through sale or inheritance.

- Steps for Updating Name on NMMC Tax Forms

- Apply for a Name Change - Go to the NMMC office or use the online portal for submission.

- Submit necessary documents such as the deed of sale, mutation certificate, proof of identity, and proof of address.

After submission, the documents are verified by NMMC. After receiving approval, the updated name will be displayed on tax documents.

9. Updating Navi Mumbai Property Tax (NMMC) Records

If you have altered the structure of your property, such as by adding a new floor or renovating, it is important to update NMMC's records to ensure accurate taxation.

Steps for Updating Records:

- Submit revised property blueprints: Give NMMC an updated blueprint and information regarding any modifications.

- Requesting Re-assessment: NMMC will evaluate the property's value again considering the changes, potentially leading to a different tax rate.

10. NMMC Grievance Redressal

The NMMC system for addressing complaints related to property taxes is quite comprehensive. This includes complaints about mistakes in tax calculations, incorrect names in records, and concerns about the payment process.

Filing a Grievance

Online Grievance Portal: Access NMMC’s grievance division, provide the required information and explain your problem.

CFC or NMMC Office Visit: Apart from this, you can also address the matters personally by going to the CFC or NMMC office.

The grievance system in place guarantees that property owners have means of support and are able to resolve any problems relating to the tax account(s) quickly.

11. Latest News about Navi Mumbai Property Tax (NMMC)

Navi Mumbai Municipal Corporation (NMMC) also periodically informs the residents regarding the changes in property cost, amnesty schemes or even the deadline for payment. This ensures that the property owner’s interests are catered for and there is compliance with the existing practices; especially the ones with certain offers or relief policies.

Exemption from payment of property tax for houses up to 500 square Navi Mumbai: Property tax exemption has been announced for residents of Navi Mumbai who own homes, following the directive of Chief Minister Eknath Shinde to MLA Ganesh Naik after their meeting. This directive comes after another high level meeting.

12. Summing Up

For every real estate owner, it is important to manage property tax with NMMC if you are living in Navi Mumbai. Property owners learn to comply with the tax laws, avoid penalties and help in the growth of the city. This is because there are ways to pay tax, tax calculations and additional services and information provided. Also, knowing the recent changes makes it easier to manage the tax with the help of the online resources available where it is easy to comply with taxes.

Also Read : Delhi Mumbai Expressway Map, Route & Real Estate Impact

_1771410929.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. The NMMC property tax is an annual tax levied by the Navi Mumbai Municipal Corporation on all residential, commercial, and industrial properties within its jurisdiction. It helps fund civic amenities such as water supply, sanitation, roads, and infrastructure maintenance.

Ans 2. To pay NMMC property tax online:Visit the official NMMC website.Enter your property ID or assessment number.Review the outstanding amount and select a payment method.Complete the transaction and download the receipt.

Ans 3. Yes, you can pay NMMC property tax offline by visiting authorized banks or Citizen Facilitation Centers (CFCs). Payments can be made via cash, cheque, or demand draft, and you will receive a receipt after the transaction.

Ans 4. You can view your NMMC property tax bill by:Visiting the NMMC website.Entering your property ID or assessment number.The bill will display the current and past dues along with due dates.

Ans 5. Delayed or non-payment of NMMC property tax results in penalties and interest on the outstanding amount. Persistent non-payment may lead to legal notices or even property seizure by the NMMC.

Ans 6. The amnesty scheme is a temporary relief initiative by NMMC that waives or reduces penalties and interest on overdue property taxes. It encourages property owners to clear their dues during a specified period.

Ans 7. You can calculate your property tax:Manually: Using property details like carpet area, usage type, and applicable tax rates.Online: By using the tax calculator on the NMMC website, where you input property details for an instant estimate.

Ans 8. To change the name on property tax documents:Submit a name change application to NMMC.Provide documents like the sale deed, mutation certificate, and ID proof.After verification, the name will be updated in the records.

Ans 9. If there are changes to your property, such as renovations or ownership changes, submit updated property plans and necessary documents to NMMC. They will reassess and update your tax records accordingly.

Ans 10. You can file a grievance by:Visiting the NMMC office or Citizen Facilitation Center.Using the online grievance redressal system on the NMMC website.NMMC will address issues like calculation errors, name changes, or payment disputes.