Table of Content

▲- Pradhan Mantri Awas Yojana PMAY Home Loan: A Comprehensive Guide

- Key Highlights of PMAY Scheme for PMAY Home Loan

- PMAY Features and Benefits

- Eligibility Criteria for PMAY Scheme

- PMAY Home Loan Illustration

- List of Banks Offering PMAY Home Loan

- Top 5 Banks Offering PMAY Home Loan

- Highlights of the PMAY Home Loan Scheme

- Quick Facts About PMAY

- Wrapping Up: Best Bank for PMAY Home Loan

Pradhan Mantri Awas Yojana PMAY Home Loan: A Comprehensive Guide

Pradhan Mantri Awas Yojana (PMAY) is an initiative by the Government of India to provide housing to the urban poor by 2022. Launched in 2015 under the Ministry of Housing and Urban Affairs (MoHUA), the scheme aims to boost home ownership through a subsidy on home loan interest rates under the Credit-Linked Subsidy Scheme (CLSS). Many banks offer PMAY home loans, and eligibility criteria and documentation requirements vary between them. To make it easier for you, we have listed below some of the best banks for PMAY Home Loans.

Key Highlights of PMAY Scheme for PMAY Home Loan

Here are the key highlights of the PMAY scheme, which forms the basis for PMAY home loans:

|

Particulars |

EWS |

LIG |

|

Home loan amount for interest subsidy |

Up to Rs 6 lakh |

Up to Rs 6 lakh |

|

Maximum Interest Subsidy Amount |

Rs. 2,67,280 |

Rs. 2,67,280 |

|

Maximum loan tenure |

20 years |

20 years |

|

Discounted rate for calculation of net present value |

9 percent |

9 percent |

|

Dwelling unit size |

Up to 30 sq.m. |

Up to 60 sq.m. |

|

Duration of scheme |

2015-2024 |

2015-2024 |

|

Quality of house construction |

BIS Codes, National Building Code, NDMA guidelines |

|

|

Approvals for the building design |

Mandatory |

Mandatory |

|

Basic civic amenities |

Mandatory |

Mandatory |

PMAY Features and Benefits

The government aims to provide two crore pucca houses to the urban poor, equipped with basic amenities like water, electricity, and sewage. Key features and benefits of the PMAY scheme include:

- A grant of Rs. 1 lakh per house for slum rehabilitation by the Central Government.

- A subsidy of up to 6.5% on home loans.

- Affordable houses constructed in partnership with the public and private sectors.

- Encouragement for women to be house owners or co-applicants.

- Priority accommodation for senior citizens and differently-abled people on the ground floor.

- Use of eco-friendly and sustainable materials as per National Building Code (NBC) and National Disaster Management Authority (NDMA) guidelines.

- Mandatory approval of building design.

Also Read: Home Loan from a Bank vs Housing Finance Company (HFC) - Which to Choose

Eligibility Criteria for PMAY Scheme

To be eligible for the CLSS linked PMAY scheme, the following criteria must be met:

- EWS (Economically Weaker Section): Annual income up to Rs 3 lakh.

- LIG (Low-income Groups): Annual income between Rs 3-6 lakh.

- A beneficiary can be a husband, wife, and unmarried daughters/sons.

- The applicant should not own a pucca house in any state and no family member should own a house across India.

- Priority is given to applicants from Scheduled Castes, Scheduled Tribes, economically weaker sections (EWS), fishermen communities, and flood-affected areas.

PMAY Home Loan Illustration

- Home loan amount: Rs 6 lakh

- Tenure: 240 months

- Subsidy amount: Rs 2,67,280

- Home loan amount to be paid: Rs 3,32,720

- EMI: Rs 1387 per month

List of Banks Offering PMAY Home Loan

Subsidized home loans can be availed from recognized banks or NBFCs under the Ministry of Housing and Urban Affairs. Here are some financial institutions offering PMAY Home Loan:

Public Sector Banks:

- Allahabad Bank

- Andhra Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- IDBI Bank Ltd.

- Indian Bank

- Indian Overseas Bank

- Oriental Bank of Commerce

- Punjab & Sind Bank

- Punjab National Bank

- State Bank of India

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

Private Sector Banks:

- Axis Bank Ltd.

- Bandhan Bank Ltd.

- Catholic Syrian Bank

- City Union Bank

- DCB Bank Ltd.

- Dhanlaxmi Bank Ltd.

- Deutsche Bank AG

- ICICI Bank Ltd.

- IDFC Bank Ltd.

- J&K Bank

- Karnataka Bank Ltd.

- Karur Vysya Bank Ltd.

- Kotak Mahindra Bank Ltd.

- Lakshmi Vilas Bank

- Nainital Bank Ltd.

- SBM Bank (Mauritius) Ltd.

- South Indian Bank Ltd.

- Tamilnad Mercantile Bank Ltd.

- The Federal Bank Ltd.

- Yes Bank

Additionally, many regional rural banks, co-operative banks, housing finance companies, and small finance banks offer PMAY home loans.

For more information on PMAY Home Loans and to check your eligibility, visit the official PMAY website or contact the banks directly.

Also Read: What is the difference between flat rate interest and reducing rate interest?

Top 5 Banks Offering PMAY Home Loan

We have listed the top banks for PMAY Home Loans based on their eligibility criteria and documentation processes:

Bank of Baroda

- Interest Rate: Starts at 6.75% per annum

- Tenure: Up to 30 years

- Headquarters: Vadodara, Gujarat

- Documentation: Minimal; includes address proof, identity proof, income proof, and PMAY house design approval.

- Customer Service: Excellent, available anytime for assistance.

State Bank of India (SBI)

- Interest Rate: Starts at 6.65% per annum

- Tenure: Up to 30 years

- LTV (Loan to Value) Ratio: 90%

- Headquarters: Mumbai, Maharashtra

- Processing Charges: Currently waived due to a festive offer.

- Documentation: ID proof, property documents, income proof, and bank statements.

Axis Bank

- Interest Rate: Starts at 6.75% per annum

- Tenure: Up to 30 years

- Ranking: Third-largest private bank in India

- Application: Can apply online or at the nearest branch.

- Approval Time: Generally within 3 to 7 days.

HDFC Bank

- Interest Rate: Competitive and low

- Customer Service: Known for exceptional service

- Documentation: Identity proof, address proof, income proof, and proof of falling within the EWS or LIG category.

- Approval Time: Typically within a few days if eligible.

ICICI Bank

- Interest Rate: Subsidized for PMAY

- Headquarters: Vadodara

- Documentation: Standard documents; no additional documents required for PMAY Home Loan.

- Process: Easy and streamlined.

How to Track Credit Linked Subsidy Scheme (CLSS)

Once you have applied for the PMAY scheme, follow these steps to track your CLSS status:

- Visit the official PMAY CLSS tracker website.

- Enter your Application ID and click on Status.

- Enter the OTP received on your registered number.

- The application phases will be displayed, with completed stages in green and those in process in blue.

- PMAY CLSS Helpline Numbers

For any queries related to PMAY CLSS, you can contact the following customer care numbers:

- HUDCO: 1800-11-6163, Email: hudconiwas@hudco.org

- NHB: 1800-113-377, 1800-113-388, Email: clssim@nhb.org.in

- SBI: 1800-11-2018, Email: clsspmayurban@sbi.co.in

Highlights of the PMAY Home Loan Scheme

- Subsidized Interest Rate: Home loans are offered at a low 6.50% p.a. interest rate for 20 years.

- Priority for Special Groups: Senior citizens and differently-abled people get preferential ground floor allocations.

- Eco-Friendly Construction: Use of sustainable and environmentally conscious technologies.

- Pan-India Coverage: PMAY homes are being constructed in 4,041 statutory towns, with initial priority given to 500 Class I cities in three phases.

- Early Credit-Linked Subsidy: Implemented at the beginning of the project.

Quick Facts About PMAY

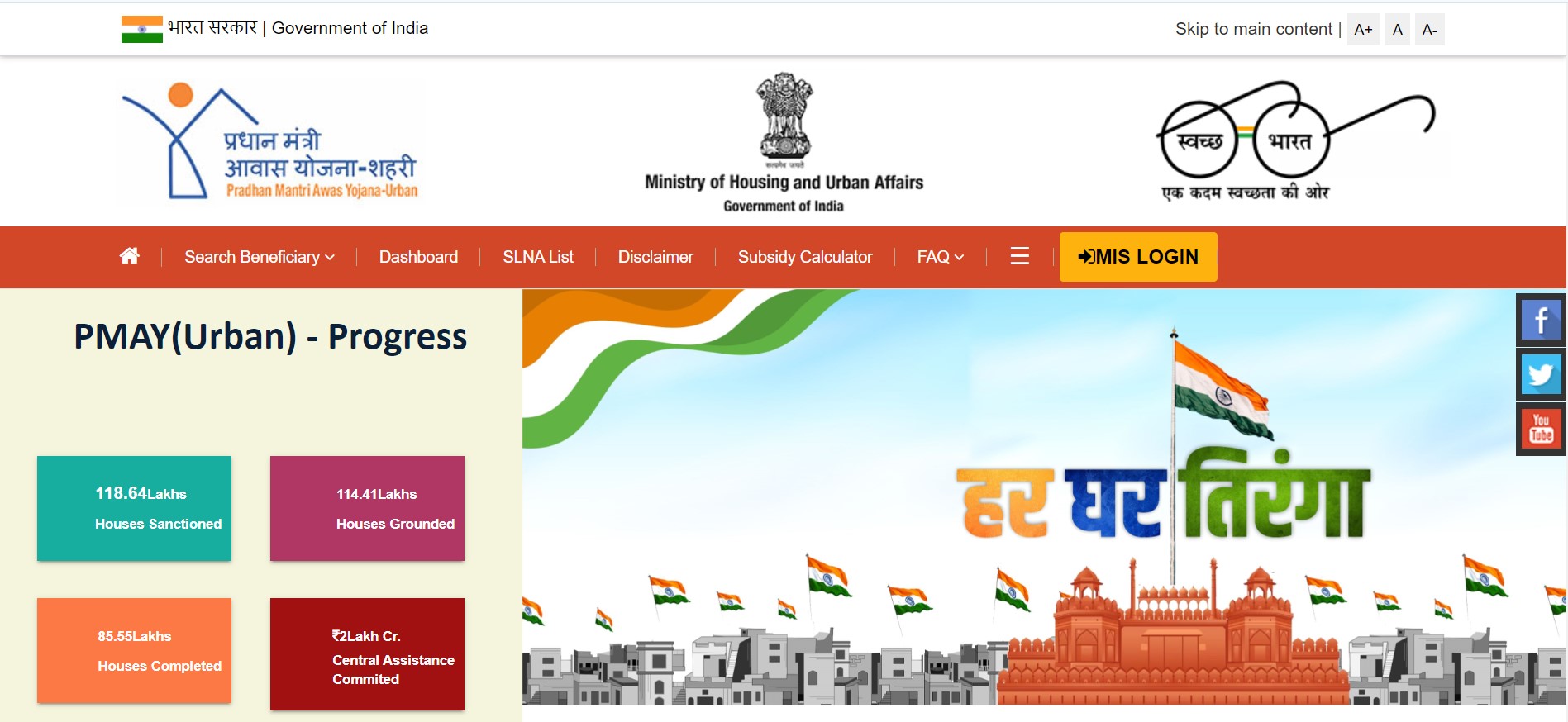

- Official Website: PMAY MIS

- Launch Date: 25th June 2015

- Expected Completion: By 31st December 2024

- Toll-Free Numbers: 1800-11-6163 (HUDCO), 1800-11-3377, 1800-11-3388 (NHB)

- Complaints or Suggestions: grievance-pmay@gov.in

- Office Address: Pradhan Mantri Awas Yojana, Ministry of Housing and Urban Affairs, Nirman Bhawan, New Delhi-110011 Contact: 011 2306 3285, 011 2306 0484 Email: pmaymis-mhupa@gov.in

- PMAY Guidelines: Download Manual

Wrapping Up: Best Bank for PMAY Home Loan

Multiple banks offer PMAY Home Loans, which readily sanction the loan to eligible beneficiaries. The PMAY Home Loan can only be availed by those in the EWS or LIG category with an annual income up to Rs 6 lakh, and who do not own a pucca house anywhere in India. While no single bank is universally the best for PMAY Home Loan, you can consider SBI, Bank of Baroda, ICICI Bank, HDFC Bank, or Axis Bank for faster approval and good customer service.

Also Read: Pradhan Mantri Awas Yojana Documents: Check Complete List

_1723032900.webp)

(2) (1) (1)_1732086657.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. However, the loan can be availed only by those who do not own a pucca house anywhere. No single bank (depending on person to person) is best for a PMAY home loan; you can avail of SBI, Bank of Baroda, ICICI Bank, HDFC Bank or Axis Bank for faster approval and good customer service.

Ans 2. 8) Housing Finance companies - CanFin Homes, Indiabulls Housing Finance, Aadhar housing Finance, Hudco. Housing finance companies, particularly those focused on low ticket housing, would likely be a beneficiary of the PM Awas Yojana.

Ans 3. हालांकि, लोन केवल उन्हीं लोगों को मिल सकता है जिनके पास कहीं भी पक्का घर नहीं है। PMAY होम लोन के लिए कोई भी एक बैंक (व्यक्ति दर व्यक्ति के आधार पर) सबसे अच्छा नहीं है; आप तेज़ स्वीकृति और अच्छी ग्राहक सेवा के लिए SBI, बैंक ऑफ़ बड़ौदा, ICICI बैंक, HDFC बैंक या एक्सिस बैंक का लाभ उठा सकते हैं।

Ans 4. Udyogini Scheme:1.00 lakh to maximum of Rs. 3.00 lakhs. Subsidy is 50% of the loan amount, Income limit of the family should be below Rs. 2.00 lakhs.

Ans 5. Union Budget 2024: Investment of Rs.10 lakh crore under PM Awas Yojana. Investment of Rs.10 lakh crore will cater one crore urban poor under the PM Awaas Yojana – Urban 2.0 and will provide central assistance of Rs.2.20 lakh crore over next five years.

Ans 6. The initiatives include Viksit Bharat by 2047, Rooftop Solarisation Scheme, Atmanirbhar Oil Seeds Abhiyan, Employment Linked Incentive Schemes, a New Skilling Programme, Pradhan Mantri Janjatiya Unnat Gram Abhiyan, Credit Guarantee Scheme for MSMEs, NPS Vatsalya, and changes to schemes like PM Awas Yojana, Skill Loan ...

Ans 7. 6.5%SBI PMAY offers home loans to eligible families at a 6.5% rate of interest per annum.

Ans 8. For security purposes, lenders do not sanction a mortgage loan with an LTV of 100%. You can avail a maximum of 80% of the property's present market value as a loan from a lender.

Ans 9. The PMEGP offers a maximum subsidy of Rs. 25 lakh for businesses in the manufacturing sector and Rs. 10 lakh for those in the business or service sector. Subsidy rates vary based on factors like applicant category, business location, and project nature.

Ans 10. This subsidy is provided to MSMEs for induction of well established and improved technologies in specified sub-sectors or products approved under the scheme. This scheme provides an upfront subsidy of 15% on institutional credit up to Rs. 1 crore (i.e. a subsidy cap of Rs.