Table of Content

▲- Table of Contents:

- 1. What is Pradhan Mantri Awas Yojana (PMAY)?

- 2. Benefits of PMAY

- 3. Eligibility Criteria for PMAY 2024

- 4. Documents Required for PMAY Application

- 5. How to Apply for PMAY Online 2024

- PMAY Online Form 2024

- 6. Step-by-Step Guide to Fill PMAY Online Form

- 7. Subsidy under PMAY (Credit Linked Subsidy Scheme - CLSS)

- 8. Checking Your PMAY Application Status Online

- 9. How to Correct Errors in Your PMAY Application

- AquireAcres.com POV

The Pradhan Mantri Awas Yojana (PMAY) is a government initiative aimed at providing affordable housing to the economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG) in India. The scheme is designed to help millions of Indians achieve the dream of owning a home.

In this comprehensive guide, we'll explain how to apply for PMAY online in 2024, eligibility criteria, the benefits of the scheme, the documentation required, and the step-by-step process of filling out the application.

Table of Contents:

- What is Pradhan Mantri Awas Yojana (PMAY)?

- Benefits of PMAY

- Eligibility Criteria for PMAY 2024

- Documents Required for PMAY Application

- How to Apply for PMAY Online 2024

- Step-by-Step Guide to Fill PMAY Online Form

- Step 1: Visit the Official PMAY Website

- Step 2: Choose the Relevant Category

- Step 3: Fill in the Application Form

- Step 4: Submit the Form and Acknowledge

- Subsidy under PMAY (Credit Linked Subsidy Scheme - CLSS)

- Checking Your PMAY Application Status Online

- How to Correct Errors in Your PMAY Application

- Frequently Asked Questions (FAQs)

1. What is Pradhan Mantri Awas Yojana (PMAY)?

The Pradhan Mantri Awas Yojana (PMAY) was launched in 2015 with the mission of providing affordable housing for all by the year 2022. The scheme focuses on promoting affordable housing in urban and rural areas, aiming to help people from lower-income groups become homeowners.

PMAY is divided into two major categories:

- PMAY-U (Urban): This focuses on providing affordable housing in urban areas.

- PMAY-G (Gramin): This targets affordable housing for people in rural areas.

Both schemes are aimed at building houses with proper infrastructure, sanitation, and electricity, ultimately improving the quality of life for beneficiaries.

2. Benefits of PMAY

PMAY offers several benefits, making it an attractive option for aspiring homeowners:

- Interest Subsidy: Eligible beneficiaries can avail interest subsidies on home loans under the Credit Linked Subsidy Scheme (CLSS). The subsidy can range from 3% to 6.5%, depending on the income group.

- Affordable Housing: PMAY focuses on providing affordable housing to the EWS, LIG, and MIG groups by subsidizing loan interest and offering other financial incentives.

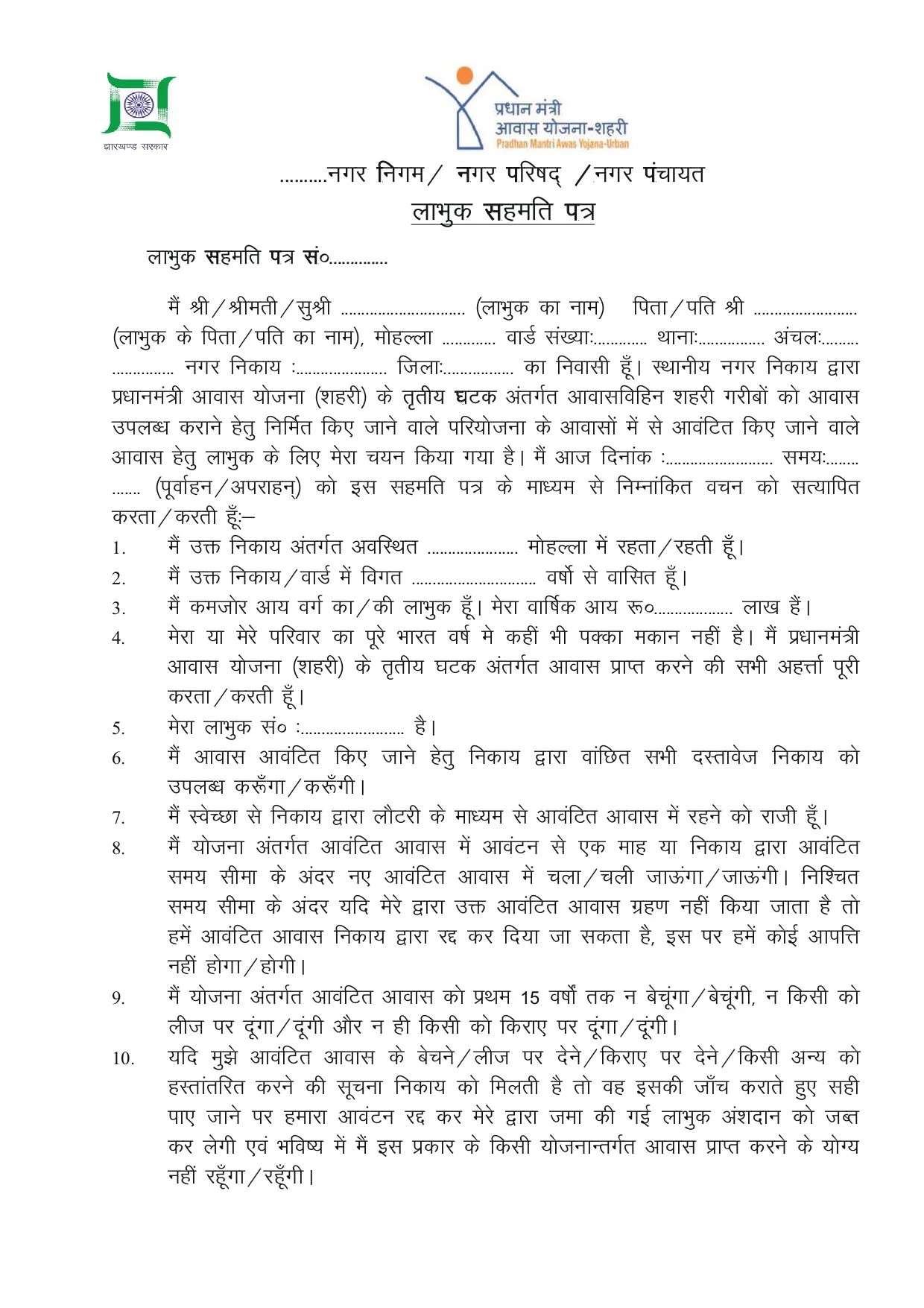

- Women Empowerment: The scheme encourages women to become homeowners by offering subsidies for houses registered in the name of women.

- Eco-friendly Homes: Homes built under the PMAY scheme are designed to be environmentally sustainable with proper sanitation and water facilities.

- Inclusive Growth: PMAY ensures that everyone, including people with disabilities, widows, transgender individuals, and senior citizens, has access to affordable housing.

3. Eligibility Criteria for PMAY 2024

Before applying for PMAY online, it’s essential to understand the eligibility criteria:

- Income Groups:

- Economically Weaker Section (EWS): Annual household income up to ₹3 lakh.

- Low-Income Group (LIG): Annual household income between ₹3 lakh and ₹6 lakh.

- Middle-Income Group I (MIG I): Annual household income between ₹6 lakh and ₹12 lakh.

- Middle-Income Group II (MIG II): Annual household income between ₹12 lakh and ₹18 lakh.

- First-Time Home Buyer: The applicant or their family must not own a pucca house anywhere in India.

- Age: The applicant should be between 21 to 70 years of age.

- Family Composition: The applicant’s family should consist of the applicant, their spouse, and unmarried children.

- Women Ownership: For EWS and LIG groups, it is mandatory to register the house in the name of a female member of the household.

- Location: The property must be located within statutory towns as per the 2011 Census or updated definitions.

4. Documents Required for PMAY Application

To apply for PMAY online, you will need to provide several documents. These include:

- Identity Proof: Aadhaar card, Voter ID, Passport, Driving License, or PAN card.

- Address Proof: Aadhaar card, Utility bills (electricity, water), Passport, or Ration card.

- Income Proof: Salary slips, Income Tax Returns (ITR), or bank statements.

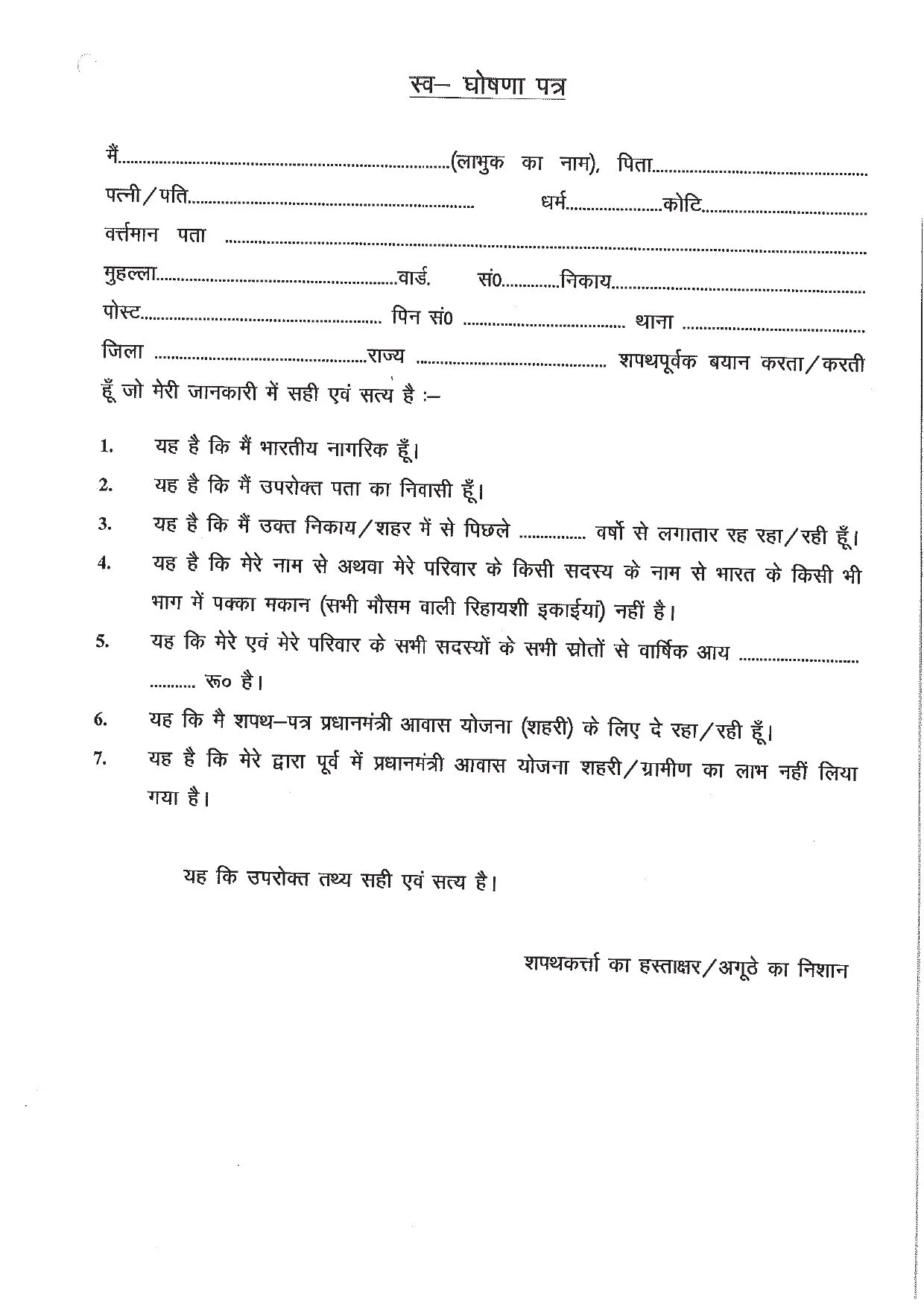

- Proof of No Pucca House: An affidavit confirming that the applicant does not own a pucca house in India.

- Proof of Age: Aadhaar card, Passport, or Birth certificate.

- Bank Account Details: Passbook or canceled cheque for subsidy transfer.

- Property Documents: If available, sale agreement, property title, or ownership documents.

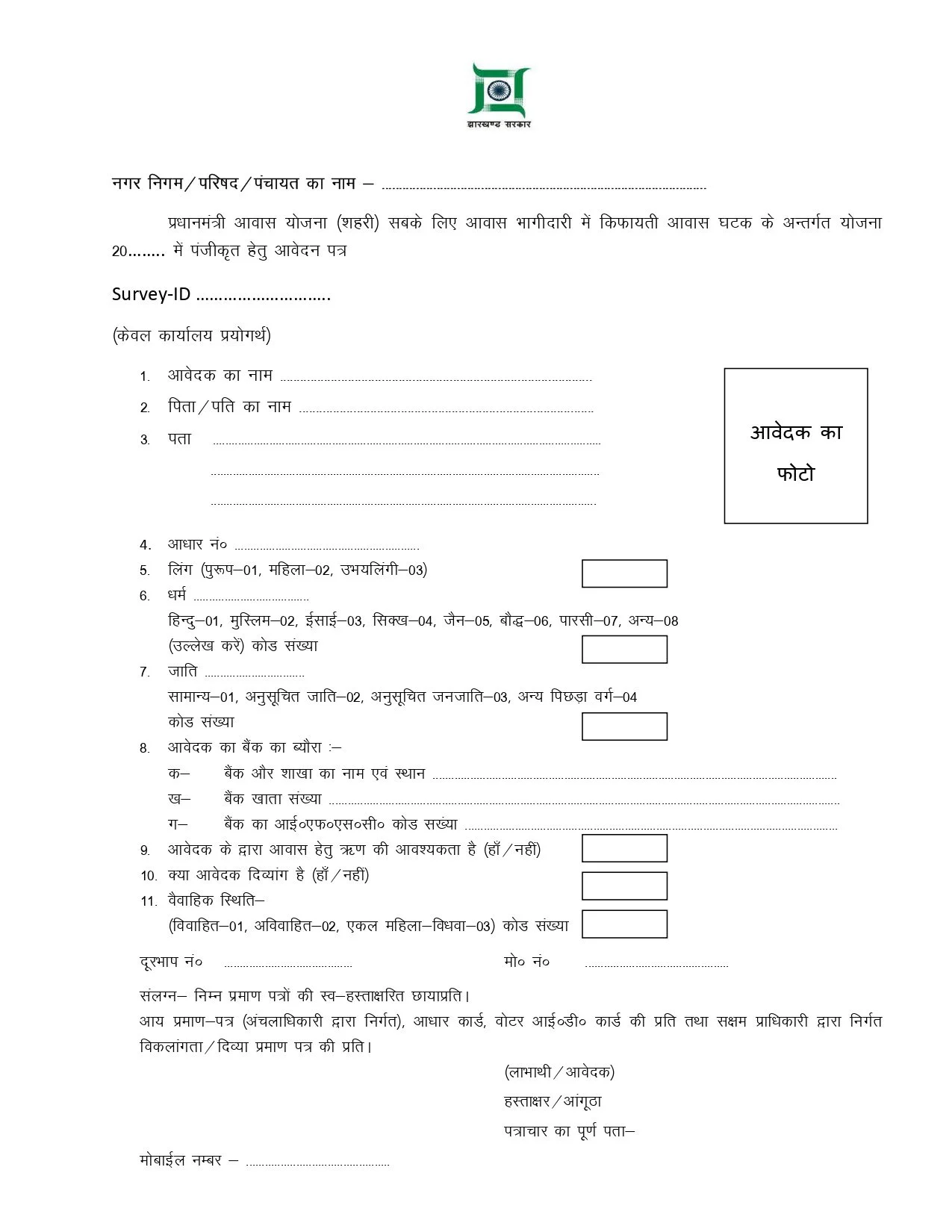

5. How to Apply for PMAY Online 2024

You can easily apply for PMAY online by following these steps. The entire process is designed to be user-friendly, and applicants can complete it without visiting any government office.

PMAY Online Form 2024

6. Step-by-Step Guide to Fill PMAY Online Form

Step 1: Visit the Official PMAY Website

To begin, you need to visit the official Pradhan Mantri Awas Yojana website. The URL for the website is: https://pmaymis.gov.in

Once on the website, you will find options to apply for the Urban (PMAY-U) or Gramin (PMAY-G) schemes, depending on your location.

Step 2: Choose the Relevant Category

On the homepage, you’ll see two application categories under the “Citizen Assessment” section:

- Slum Dwellers: For those living in slum areas.

- Benefits under 3 Components: For EWS, LIG, and MIG categories who do not live in slums.

Select the category that applies to you.

Step 3: Fill in the Application Form

Once you’ve chosen the relevant category, you’ll be directed to the application form. Here’s what you’ll need to do:

- Enter Your Aadhaar Number: This is mandatory to avoid duplication and ensure transparency.

- Personal Details: Fill in your name, contact number, and other personal information.

- Family Details: Provide information about your family members and their Aadhaar numbers (if available).

- Income Details: Mention your annual household income.

- Residential Address: Fill in your current address, including pin code.

- Bank Details: Provide your bank account details where you want the subsidy credited.

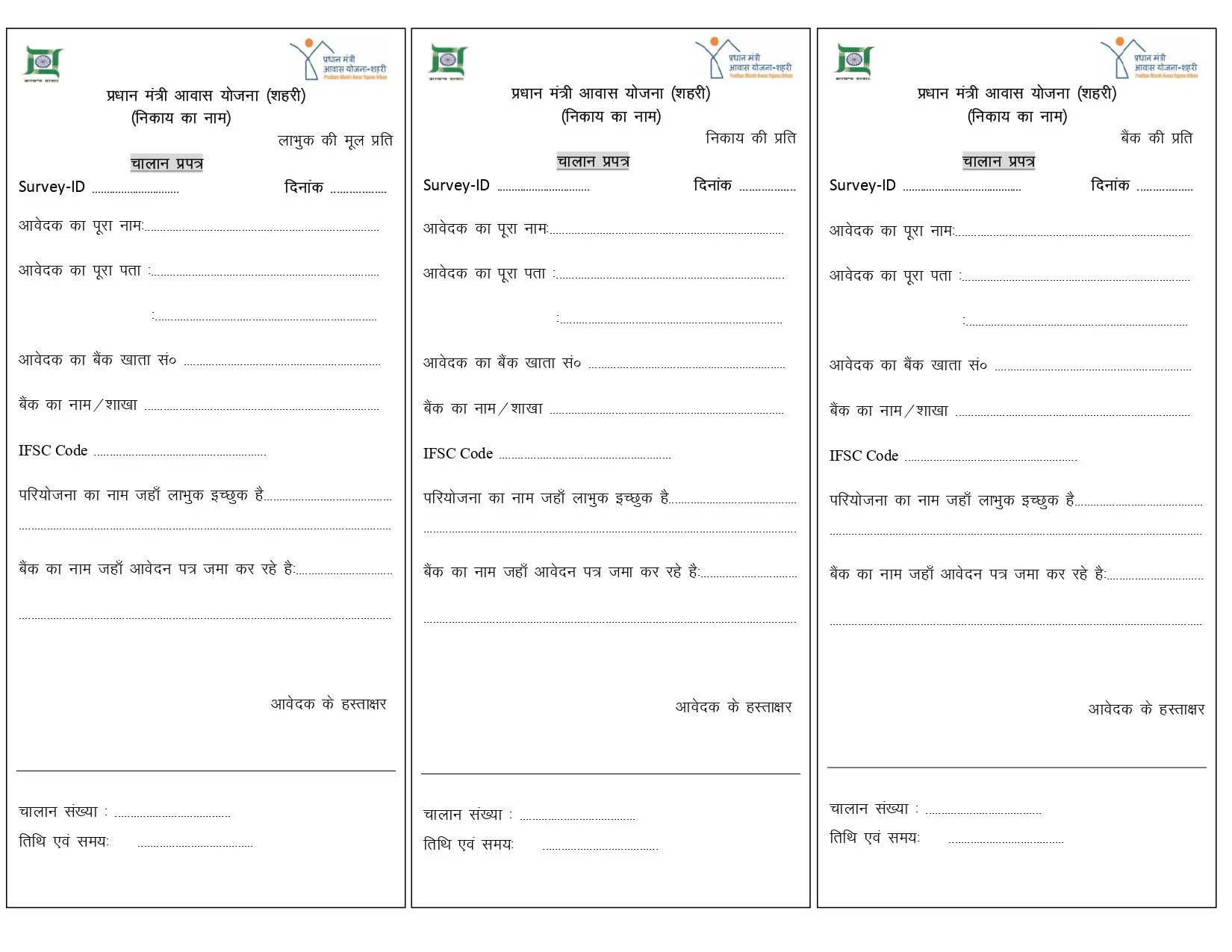

Step 4: Submit the Form and Acknowledge

After you have filled in all the details, double-check the information for accuracy. Once you’re sure everything is correct, click on the “Submit” button. You will receive an acknowledgment slip with a unique application number. Make sure to save or print this acknowledgment for future reference.

7. Subsidy under PMAY (Credit Linked Subsidy Scheme - CLSS)

One of the major attractions of PMAY is the Credit Linked Subsidy Scheme (CLSS), which offers interest subsidies on home loans to eligible applicants.

How the Subsidy Works:

- EWS/LIG: Subsidy of 6.5% on loans up to ₹6 lakh.

- MIG I: Subsidy of 4% on loans up to ₹9 lakh.

- MIG II: Subsidy of 3% on loans up to ₹12 lakh.

This subsidy significantly reduces the overall cost of the home loan, making it easier for applicants to buy a home.

8. Checking Your PMAY Application Status Online

Once you’ve submitted your PMAY application, you can check the status online by following these steps:

- Visit the official PMAY website: https://pmaymis.gov.in

- Click on the "Citizen Assessment" option.

- Select "Track Your Assessment Status."

- Enter your application ID or Aadhaar number.

- The status of your application will be displayed on the screen.

9. How to Correct Errors in Your PMAY Application

If you find any mistakes in your application, you can correct them by following these steps:

- Visit the PMAY website.

- Go to the “Citizen Assessment” section.

- Select the "Edit Assessment Form" option.

- Enter your application ID and Aadhaar number to access your form.

- Make the necessary corrections and submit the form again.

(2) (1) (1)_1732086657.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. PMAY is a government initiative aimed at providing affordable housing to the homeless and economically weaker sections of India.

Ans 2. Individuals from the Economically Weaker Section (EWS), Low Income Group (LIG), Middle Income Group (MIG), and specific categories such as women, SC, ST, and OBC are eligible for PMAY.

Ans 3. You can apply online by visiting the official PMAY website and following the steps for filling in your details and submitting the required documents.

Ans 4. After applying, you can track your application status through the PMAY website using your application number or registered mobile number.

Ans 5. The key documents include Aadhaar card, proof of income, bank account details, identity proof, and property documents.