Table of Content

▲- Property Registration and Stamp Duty in Haryana

- Stamp Duty in Haryana 2024

- Stamp Duty Charges by Jurisdiction

- Registration Charges in Haryana 2024

- Documents Required for Property Registration

- Required Documents:

- How to Calculate Stamp Duty in Haryana

- How to Pay Stamp Duty in Haryana Online

- How to Pay Stamp Duty in Haryana Offline

- How to Book a Slot for Property Registration in Haryana

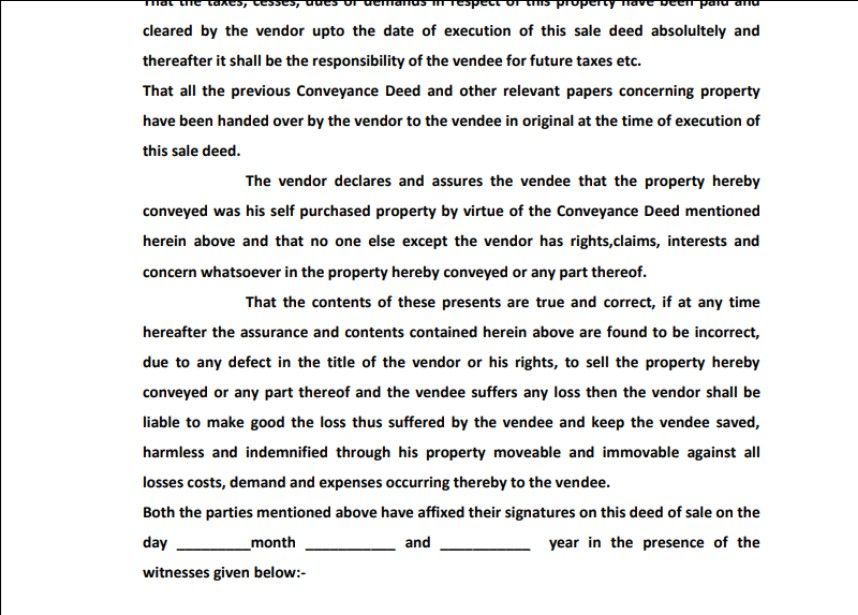

- Procedure for Registering a Property Deed in Haryana

- Stamp Duty in Haryana: Tax Benefits

- Factors Considered While Calculating Stamp Duty in Haryana

- Benefits of Paying Stamp Duty in Haryana

- How to Purchase e-Stamps Online in Haryana

- Buying Stamps Offline in Haryana

- Tips for Paying Stamp Duty in Haryana

- Consequences of Delayed Stamp Duty Payment

- Stamp Duty in Haryana Exemptions

- Contact Details for Stamp Duty in Haryana

- Conclusion on Stamp Duty in Haryana

Property Registration and Stamp Duty in Haryana

To become a legal owner of property in Haryana, whether it’s new or transferred, you must register it with the Haryana government. This process involves submitting documents and paying stamp duty and registration charges. The stamp duty in Haryana varies depending on the type of transaction; different costs apply to Sale Deeds and Mortgage Deeds. This article provides comprehensive information about stamp duty in Haryana, including the required documents for registration, the online registration process, and more.

Stamp Duty in Haryana 2024

Here are the stamp duty charges in Haryana for various documents:

| Documents | Urban Area | Rural Area |

|---|---|---|

| Gift Deed | 5% | 3% |

| Sale or Conveyance Deed | 7% | 5% |

| Exchange Deed | 8% of the property value or market value, whichever is greater | 6% of the property value or market value, whichever is greater |

| Loan Agreement | Rs 100 | Rs 100 |

| Partnership Deed | Rs 22.50 | Rs 22.50 |

| General Power of Attorney | Rs 300 | Rs 300 |

| Special Power of Attorney | Rs 100 | Rs 100 |

Stamp duty charges in urban areas of Haryana are higher. For instance, Gurgaon has higher charges compared to Tigaon. The Haryana government also offers lower stamp duty charges for females to encourage women homebuyers. There is a 2% difference between male and female stamp duty charges.

Stamp Duty Charges by Jurisdiction

| Jurisdiction | Male | Female | Joint |

|---|---|---|---|

| Urban Area | 7% | 5% | 6% |

| Rural Area | 5% | 3% | 4% |

Also Read: Haryana RERA imposes penalty on Gurugram developer

Registration Charges in Haryana 2024

Previously, registration charges were Rs 15,000, but in 2018, the state government increased them to up to Rs 50,000. These charges apply to documents like gift deeds, sale deeds, lease deeds, exchange deeds, partition deeds, collaboration agreements, mortgage deeds, settlement deeds, and sale certificates.

| Property Value | Registration Charge |

|---|---|

| Up to Rs 50,000 | Rs 100 |

| Rs 50,001 to Rs 5 lakhs | Rs 1,000 |

| Rs 5 lakhs to Rs 10 lakhs | Rs 5,000 |

| Rs 10 lakhs to Rs 20 lakhs | Rs 10,000 |

| Rs 20 lakhs to Rs 25 lakhs | Rs 12,500 |

| Rs 25 lakhs | Rs 15,000 |

| Rs 25 lakh- Rs 40 lakh | Rs 20,000 |

| Rs 40 lakh- Rs 50 lakh | Rs 25,000 |

| Rs 50 lakh-Rs 60 lakh | Rs 30,000 |

| Rs 60 lakh-Rs 70 lakh | Rs 35,000 |

| Rs 70 lakh-Rs 80 lakh | Rs 40,000 |

| Rs 80 lakh-Rs 90 lakh | Rs 45,000 |

| Rs 90 lakh and above | Rs 50,000 |

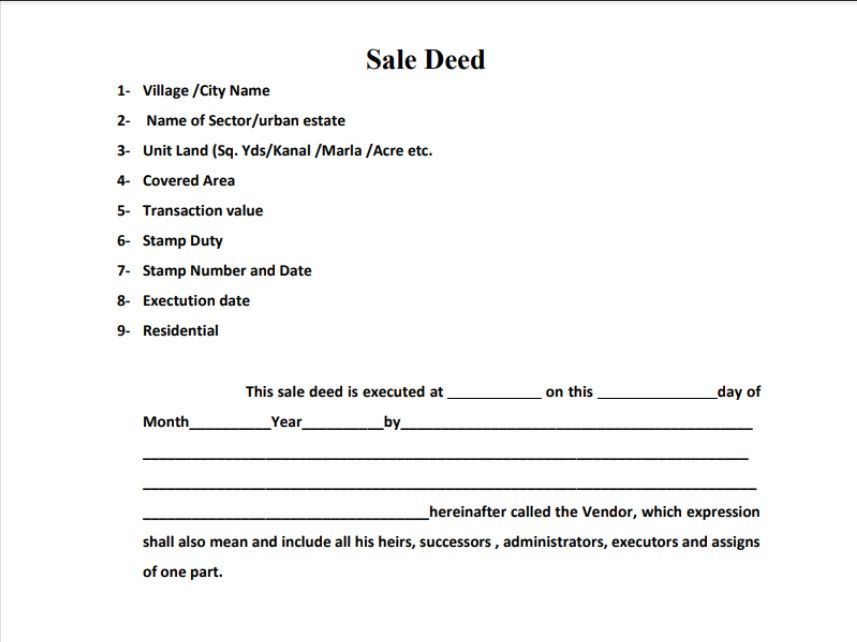

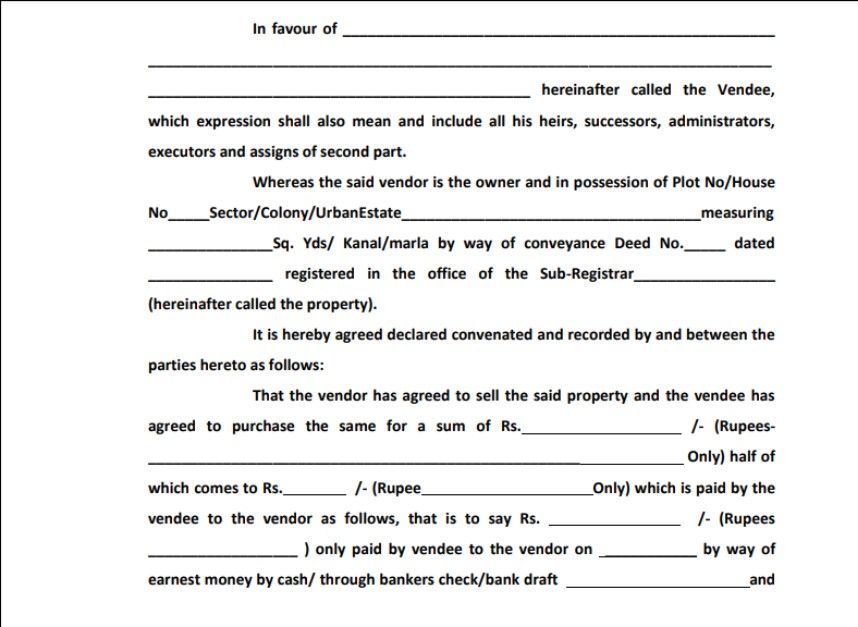

Documents Required for Property Registration

To register a property and become a legal owner, you need to submit several documents. As per Section 23 of the Registration Act, 1908, all papers except wills should be submitted to the sub-registrar's office within four months of execution.

Required Documents:

- Sale deed

- Identity proof of seller and buyer (PAN Card, Ration Card, Voter ID, Passport, Driving License)

- Address proof of seller and buyer

- No-objection Certificate (NOC) from society

- Identity proof of two witnesses

- Map or plan of the building

- Digital photograph of property layout

- Ownership proof (Copy of assessment of Mutation or original sale deed)

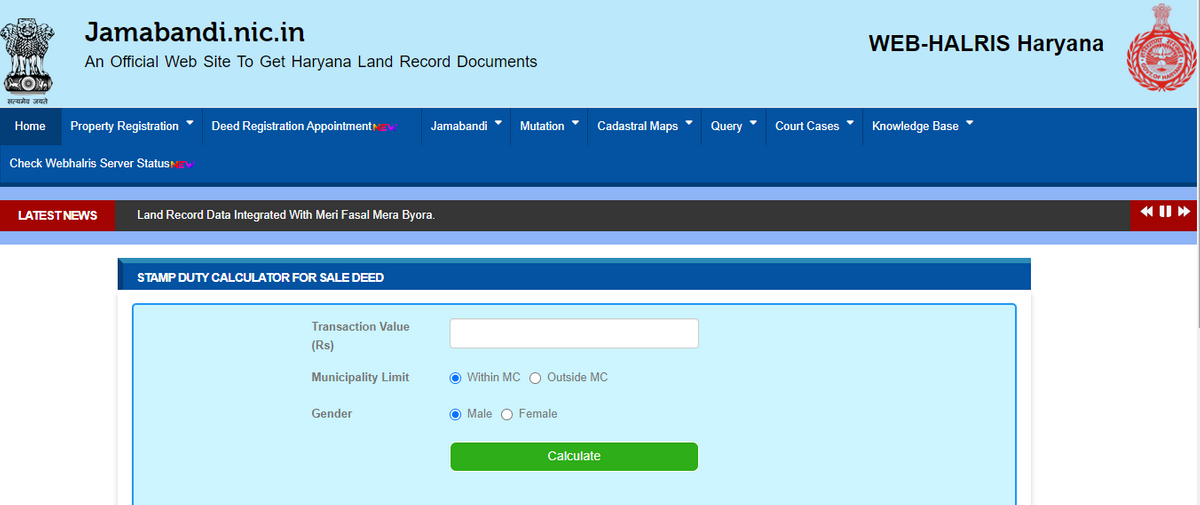

How to Calculate Stamp Duty in Haryana

Stamp duty in Haryana is calculated based on the circle rate of the locality where the property is situated. Typically, the property is registered at the circle rate value or higher. Property buyers can check the stamp duty rates on the Jamabandi Haryana website.

To calculate the stamp duty:

- Go to the property registration section and click on the Stamp Duty Calculator.

- Enter the Transactional Value and select either Within MC or Outside MC.

- Choose the appropriate Gender option and click Calculate.

Once the stamp duty is calculated, you need to obtain a stamp paper. This can be done by visiting the sub-registrar’s office physically or using the franking method. Alternatively, you can get an e-stamp paper from the e-stamp platform by registering on the website and making an online or offline payment.

How to Pay Stamp Duty in Haryana Online

To pay stamp duty and registration charges in Haryana online, visit Haryana’s eGTRAS (Online Government Receipts Accounting System) platform. This platform allows buyers to make tax/non-tax revenue payments both manually and online. Note that to get e-stamps, you must register on the e-GRAS portal.

How to Pay Stamp Duty in Haryana Offline

You can also pay stamp duty in Haryana offline. Follow these steps:

- Purchase stamp papers from the treasury office. You can buy stamp papers for amounts exceeding Rs 10,000.

- Submit the stamp paper amount to the State Bank of India (SBI) under the head ‘0030-Stamp and Registration’.

- Submit the stamp paper to the sub-registrar’s office.

Also Read: What is Haryana Mukhyamantri Shehri Awas Yojana?

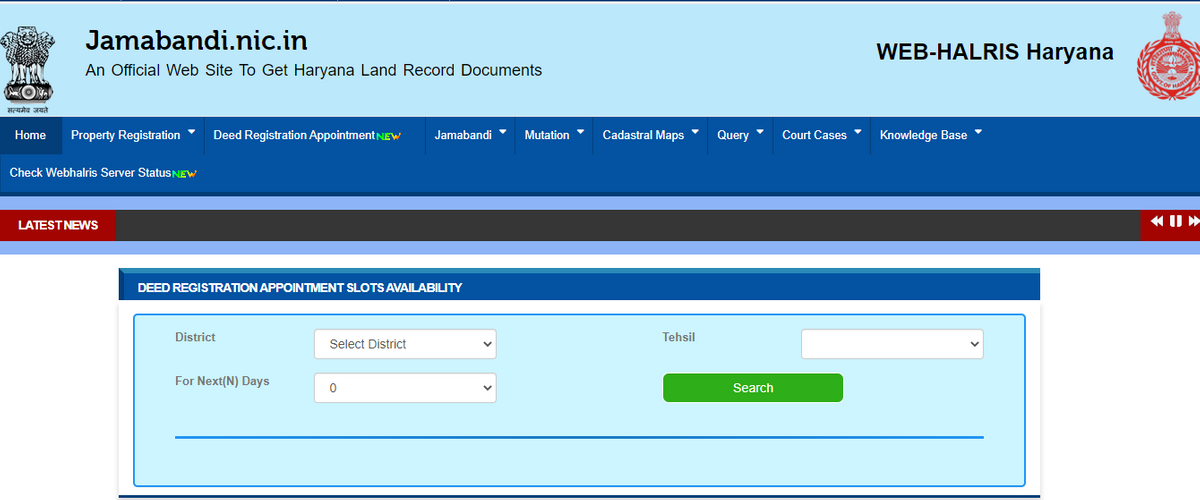

How to Book a Slot for Property Registration in Haryana

After e-stamping, homebuyers should book a slot for property registration on the Jamabandi website. Follow these steps to book a slot:

- On the Jamabandi website, click on Property Registration and select Check Deed Appointment Availability.

- Enter details such as District, Tehsil, and the desired number of days ahead. Click Search to check availability.

- The buyer, seller, and two witnesses should visit the sub-registrar’s office on the booked slot day to complete the registration process.

_1723013895.webp)

_1772441702.webp)

_1770976628.webp)

Ans 1. Stamp Duty Rates for Property Transactions in HaryanaIn rural areas of Haryana, the stamp duty applicable on such deeds is 5%, while in urban areas, it is 7% of the property's value. Gift Deed: When a property is gifted to another person without any exchange of money, a gift deed is executed.

Ans 2. The stamp duty charges in Gurgaon are classified based on the fact whether the area lies within the municipal limit or not. If the property is under municipal limits, the stamp duty charges in Gurgaon is 7% for male buyers, 5% for female buyers and 6% for joint buyers.

Ans 3. Property Registration Charges in Haryana 2023.The registry rate in Haryana is 1% of the cost of the property. So if the property costs Rs 20,00,000, the registration fee is Rs 20,000. The registration fees in Haryana vary depending on the value of the property.

Ans 4. Stamp duty is 3% on properties worth INR 45 lakhs, 2% on properties less than INR 20 lakhs, and 5% on those worth over INR 45 lakhs. How is stamp duty calculated in Karnataka?

Ans 5. Stamp Duty onGift Deed in Blood Relation in Haryana. In Punjab and Haryana, a gift of immovable property to a blood relative is exempt from stamp duty. Parents, children, grandchildren, sisters, and spouses would all be eligible for the exemption as per the transfer of property from parent to child in India guidelines ...