Table of Content

▲- Stamp duty, registration fee on property registry in UP in 2024

- Stamp duty on other deeds in UP in 2024

- Stamp duty on property gifting within a family in UP in 2024

- Who are family members for this purpose?

- Stamp duty laws in Uttar Pradesh

- Stamp duty for women in UP

- Property registration charge in UP in 2024

- Stamp duty UP calculation example

- How to pay stamp duty online in UP?

- Property registration at sub-registrar’s office in UP

- Is paying stamp duty on property registration a must in UP?

- UP stamp duty office contact information

Homebuyers in Uttar Pradesh (UP) are required to pay stamp duty and registration fees set by the government when registering a property. This guide will help you understand the applicable stamp duty and registration fees for property registration in UP in 2024.

Stamp duty, registration fee on property registry in UP in 2024

| Owner | Stamp duty as a percentage of the property's value. | Registration fee as a percentage of the property's value. | Stamp duty and registration fee in rupees for a property valued at Rs 10 lakh. |

| Man | 7% | 1% | 75,000 + Rs 10,000 |

| Woman | 6%* | 1% | 55,000* + Rs 10,000 |

| Man + woman | 6% | 1% | 60,000 + Rs 10,000 |

| Man + Man | 6% | 1% | 75,000 + Rs 10,000 |

| Woman + woman | 7% | 1% | 55,000* + Rs 10,000 |

It's important to note that property buyers cannot register a property at a price lower than the circle rates set by the government in any state. Even if the property is registered below these rates, buyers are still required to pay stamp duty and registration fees based on the circle rate value.

Also Read: What does the Married Women’s Property Act entail?

Stamp duty on other deeds in UP in 2024

| Documents to be registered | Stamp duty in Rs |

| Gift deed | *5% of the property value

**Rs 5,000 in case of gifting in family members |

| Will | Rs 200 |

| Exchange deed | 3% |

| Lease deed | Rs 200 |

| Agreement | Rs 10 |

| Adoption deed | Rs 100 |

| Divorce | Rs 50 |

| Bond | Rs 200 |

| Affidavit | Rs 10 |

| Notary | Rs 10 |

| Special power of attorney | Rs 100 |

| General power of attorney | Rs 10 to Rs 100 |

Stamp duty on property gifting within a family in UP in 2024

February 10, 2024: a significant change occurred in Uttar Pradesh regarding property transfers among blood relatives. Following the passage of the Indian Stamp (Uttar Pradesh Amendment) Bill-2024 by the State Assembly, a fixed stamp duty of Rs 5,000 is now applicable for such transactions.

This amendment bill, endorsed on February 9, introduced the provision allowing property transfers between blood relatives with a nominal stamp duty of Rs 5,000. Additionally, an additional processing fee of Rs 1,000 is required alongside the stamp duty.

The decision to reduce stamp duty and registration charges for familial property transfers was made by the Uttar Pradesh Cabinet on June 15, 2022. Under the leadership of Chief Minister Yogi Adityanath, the cabinet approved a total stamp duty and registration charge of Rs 7,000 for these transactions. This amount includes Rs 6,000 for stamp duty and Rs 1,000 for processing fees. However, it's important to note that this stamp duty waiver is valid for a limited period of six months and is applicable only to specific transfers.

Who are family members for this purpose?

The reduced charges will be applicable only on property transfers to one’s

- Father

- Mother

- Brother

- Sister

- Spouse

- Son

- Daughter

- Son-in-law

- Daughter-in-law

- Grand children from son’s as well as daughter’s side

Also Read: What is a leave and licence agreement?

Previously, property transfers within families in Uttar Pradesh incurred a stamp duty of 7% and a 1% registration charge. This meant that for a property valued at one crore rupees, the owner had to pay Rs 8 lakh in stamp duty and registration charges, despite transferring the asset to a family member without any monetary exchange.

The steep stamp duty rates led many property owners in UP to opt for transfers within the family using a power of attorney, which involved a minimal payment of just Rs 100. Consequently, this resulted in significant revenue loss for the state government. Moreover, the high rates discouraged property owners from transferring their assets among family members during their lifetime.

Property transfers among family members can be facilitated through the drafting and execution of various legal documents, such as gift deeds, relinquishment deeds, or partition deeds.

Stamp duty laws in Uttar Pradesh

According to Section 17 of the Uttar Pradesh Registration Act, 1908, any property transaction exceeding the value of Rs 100 requires registration at the sub-registrar’s office. This ensures that all property transactions in the state are legally recognized and valid under the law.

.jpg)

Stamp duty for women in UP

Similar to several other states offering reduced stamp duty for women during property registration, Uttar Pradesh provides a discount to women buyers, but only for properties falling within a specific price range. Instead of the 7% stamp duty applicable to male owners, women pay a reduced rate of 6% for property registrations valued at Rs 10 lakh or less. However, for properties exceeding Rs 10 lakh in value, both men and women are subject to the same stamp duty rates in Uttar Pradesh.

Property registration charge in UP in 2024

In 2020, the Uttar Pradesh government introduced revised stamp duty rates and registration fees for property transactions, eliminating the previous provision that limited the maximum charge to Rs 20,000. Under the new regulations, the registration fee is calculated as 1% of the sale consideration. For instance, if a property valued at Rs 50 lakhs is being registered, the buyer is required to allocate Rs 50,000 for the registration charge.

Stamp duty UP calculation example

Let's consider Ram Singh purchasing a property with an 800 sq ft carpet area, located in an area where the circle rate is Rs 5,000 per sq ft. This means the circle rate-based value of the property would be 800 x 5,000 = Rs 40 lakhs.

If the property is being registered at this value, Ram will need to pay 7% of this amount as stamp duty, totaling Rs 2.80 lakhs.

Even if the property is registered at a lower amount, Ram will still be required to pay 7% of Rs 40 lakhs as stamp duty since the property cannot be registered below the circle rate. For example, if the property is registered at Rs 50 lakhs, Ram will have to pay 7% of Rs 50 lakhs, amounting to Rs 3.50 lakhs.

Additionally, Ram will incur a registration charge of Rs 50,000.

Also Read: What documents can you use as address proof in India?

How to pay stamp duty online in UP?

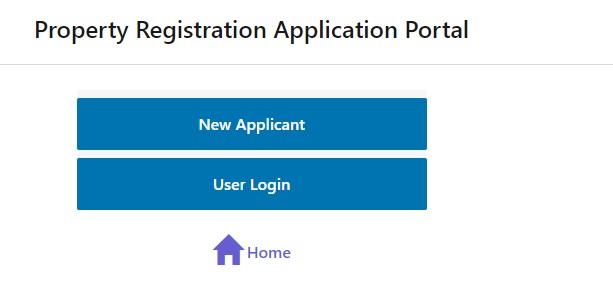

To access the Stamp and Registration Department UP portal, visit the website by clicking here. Please note that the page may initially appear in Hindi. However, after selecting the 'आवेदन करें' option, you will be able to switch to English.

Now, apply for a registration and create an application number by selecting the ‘New Application’ option.

After registering with your credentials, you can log in as a registered user. Then, you'll need to input details regarding the property, buyer, seller, and witnesses. Once you've filled in all the necessary information, the system will automatically calculate the stamp duty and registration charges for your property. Upon payment of the stamp duty, a receipt number will be generated. It's important to save this number for future reference. Additionally, you'll need to schedule an appointment for property registration at the sub-registrar’s office.

Property registration at sub-registrar’s office in UP

After completing the online payment of stamp duty, both the buyer and the seller, accompanied by two witnesses, need to visit the Sub Registrar’s Office (SRO). At the SRO, property registration is conducted in two stages by two officials.

Firstly, an Operator at the SRO office will verify the details provided in your online application. They will also capture your thumb impressions and photo during this stage.

Secondly, the sub-registrar will review all the details in your application and cross-reference them with your original documents.

Is paying stamp duty on property registration a must in UP?

For any property valued above Rs 100, the buyer must pay stamp duty and registration charges to officially register the transaction in the government's records. This obligation is mandated by the Registration Act of 1908. Failure to register the transaction means that the property exchange between the buyer and seller lacks legal validity, depriving the buyer of legal ownership of the property title. Additionally, it constitutes non-compliance with the law, resulting in potential monetary penalties.

UP stamp duty office contact information

Stamps and Registration Department,

2nd Floor, Vishwas complex,

Vishwas Khand -3, Gomti Nagar, Lucknow, 226010

Also Read: How to remove co-owner name from property title deed?

_1772441702.webp)

_1771410929.webp)

Ans 1. The Uttar Pradesh Assembly on Friday passed the Indian Stamp (Uttar Pradesh Amendment) Bill-2024, which has a provision that the transfer of a property between blood relatives can be done by paying a stamp duty of Rs 5,000. Finance and Parliamentary Affairs Minister Suresh Khanna piloted the bill.

Ans 2. The cost of stamp duty is generally 5-7% of the property's market value. Registration charges tend to be 1% of the property's market value. As such, these charges can run into lakhs of rupees.

Ans 3. Stamp duty and registration fees payment process Visit the IGRS UP portal: https://igrsup.gov.in/ Select the service and enter property details. Calculate fees. Generate a payment challan.

Ans 4. In Uttar Pradesh, the stamp duty is 7% of the transaction value, and the registration charges are 1% of the transaction value.

Ans 5. If the reduction is not applicable, the stamp duty chargeable in Uttar Pradesh on transfer of a property in family members or outside blood relation attracted a stamp duty of 7% of the value of the property mentioned in the transfer instrument or 7% of the circle rate of such immovable property, whichever is higher.