Table of Content

▲ You could have to pay taxes on the rental income you receive if you live in India and make your living by renting out property. According to the Indian Income Tax Act, rental property income is taxed. There are, nevertheless, a limited number of exemptions that can help you keep taxable rental income off the taxman's radar. This article will cover a variety of topics, including how to compute a property's gross yearly value, how to reduce your tax on rental income, Section 24's application to such taxes, and more.

Tax on Rental Income

The income from the house or building is taxed under the heading "Income from House Property" in accordance with the Income-tax Act. It will be regarded as rental income and assessed as income from other sources if you have rented out a property to someone and received rent from it. Additionally, you will be taxed under the "Income from Other Sources" category if you get revenue from vacant land.Tax on Rental Income: Is Tax imposed on Vacant House

In case an individual owns more than one property in his or her name-Self Occupied Properties- then you can treat any one property as Self Occupied Properties (SOP). The other property is treated as Deemed Let Out Property (DLOP) under Section 24. DLOP property put at par with a let out property when taxation is concerned. So, the rental value is considered as the gross taxable rent for such property.Under which Section is Tax on Rental Income is Charged

How Is Tax in Rental Income Calculated?

Conditional Deductions on Tax on Rental Income

There are few conditional deductions that can be claimed under the three circumstances:-

- Owner or his family stays in the property. In this case a deduction of up to Rs 2 lakh can be claimed on home loan.

- If a house is not used by any person then the same technique is used, meaning a deduction for up to Rs 2 lakh can be claimed.

- If a property is rented out then you can deduct the entire home loan interest amount.

Home loan interest rate deduction amount will be restricted to Rs 30,000 if:-

- Home loan is taken before 1-04-1999 to purchase or construct a property

- Home loan is taken on or after 1-04-1999 for reconstruction, renovation or expansion of property

- If a loan is borrowed on or after 1-04-1999, however the construction of property was not completed within 5 years from the date of loan disbursement

Tax on Rental Income: How is Gross Annual Value (GAV) determined

Gross Annual Value (GAV) of a property is determined in a following manner:-

Tax on Rental Income: What are the Deductions Available Under Section 24?

Also Read: Seven ways to get the Section 80C tax rebate

Income Tax on Rental Income: How Much Rent is Tax Free?

Tax on Rental Income: How Is Taxable Rental Income Calculated

| Income from Rented Property | Amount in Rs |

| Gross Annual Value (Amount collected as rent annually) | 3,60,000 (30,000 per month) |

| Deduct: Municipal Taxes | 30,000 |

| Net Annual Value | 3,30,000 |

| Deduct: 30% standard deduction | 99,000 (30% of 3,30,000) |

| Home loan interest | 80,000 |

| Income from house property | 151000 |

Also Read: SBI Home Loan

- Receiving rent from farm house

- Income from local authority

- Income from an approved scientific research association

- Income from educational institute

- Income from trade union

- Property rented for charitable purpose

- Property income of a political party

- If you use use property for your own business

- Self-occupied property

How to File for Income Tax on Rental Income for NRIs

Here is a step by step guide to file for tax on rental income for NRIs:-

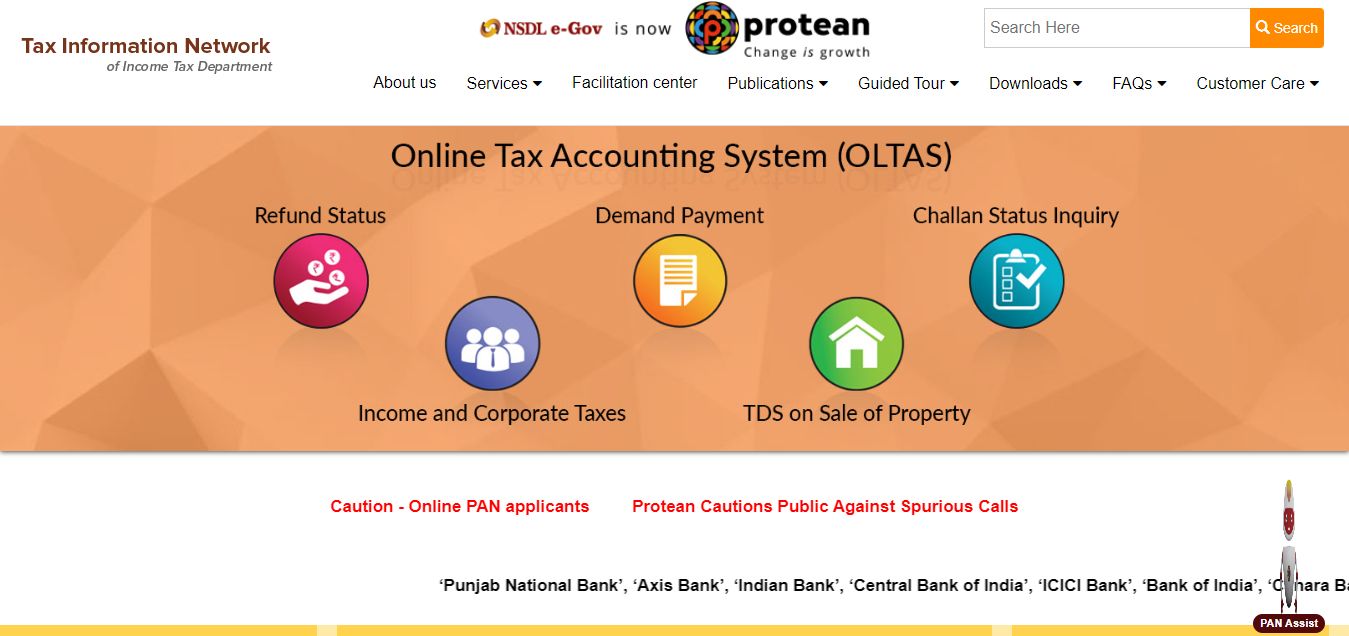

- Step 1: You need to get a tax account number (TAN) from a portal of the Tax Information Network of the Income Tax Department.

- Step 2: Once you have got the TAN number, the tenant should deduct 31.2 percent tax at source and submit that amount to the tax authorities. This amount has to be paid at 7 months of the calendar month. Rest of the amount is paid by the tenant to the property owner.

- Step 3. To make the payment, you should fill in Form 15CA and submit it to the IT department. It is mandatory to pay the taxes on rental income irrespective of the amount.

Homepage of the TIN website for tax on rental income payments

Homepage of the TIN website for tax on rental income payments

Tips to Save Tax on Rental Income

- Maintenance charges: One of the easiest ways to save tax is to exclude maintenance charges from the rent received. Some people include maintenance charges in the rent, which increases the whole rent amount; in a way, it grows tax on the rent income. For example, if you are charging a rent of Rs 30,000 and have included Rs 5000 as maintenance charges, you will pay tax on the total Rs 30,000. However, you can save tax on Rs 5000 by excluding such costs from maintenance charges. For this, you only have to write one line in a rent agreement stating- Tenant can pay maintenance directly to society association.

- Joint property: You can save on tax on rental income if you choose to buy a property jointly with a family member you trust (your husband, wife, or parents). In this scenario, the rental revenue is split in half, and you can avoid paying taxes on the amount of the rental income allocated to the other family member.

- Municipal taxes: You can deduct municipal taxes like sewage tax, property tax from rental income tax. But remember that all these municipal taxes have to be paid by the owner of a property, not a tenant. Such payments will reduce your rental income and thus reduce your tax liability.

- Semi-furnished or fully furnished property: You can ask the tenant to pay these fees individually and not include them in the rent if you are renting out a property with amenities like WiFi, DTH, Pipeline, etc. As a result, you will have to pay less tax on your rental revenue.

Therefore, there are alternatives to reduce your tax burden if your rental income is higher than what the Income Tax Department has pre-determined. Section 24 of the Income Tax of India imposes a tax on rental income. By taking normal deductions, jointly owning property, and many other strategies, you can reduce your tax on rental income.

Income Tax on Rental Income: Are Charitable Trusts Eligible for Standard Deduction?

The standard deductions under Section 24(A) for income tax on rental income are not available to charitable trusts. When purchasing property, charitable trusts can deduct these expenses as capital outlays. The Income Tax Appellate Tribunal's Delhi branch passed this regulation in February 2023.

Income Tax on Rental Income: Tax Imposed on Vacant Houses

In India, a vacant home is nevertheless considered to be occupied. Before the financial year 2019–2020, if an Indian citizen owned two or more properties, only one of them was regarded as being occupied by the owner while the others were regarded as being rented out. The owner could choose a self-occupied or rented out property. Two homes may be chosen by the owner to be used as self-occupied after the fiscal year 2020. For income tax purposes, the other properties may be regarded as real estate that is rented out.

_1770976628.webp)

_1771582392.webp)

_1771577585.webp)