Table of Content

▲

India’s real estate sector is entering a phase of cautious optimism in Q2 2025, as revealed by the latest Knight Frank-NAREDCO Real Estate Sentiment Index. While macroeconomic uncertainties persist, developers and financial institutions remain hopeful about steady growth. Notably, luxury housing particularly homes priced above ₹1 crore is emerging as a key driver of this momentum.

India’s Real Estate Market in Q2 2025: A Period of Gradual Rebound

According to the Q2 2025 sentiment index, India’s real estate market in Q2 2025 is showing subtle yet steady signs of recovery. The Current Sentiment Score increased slightly from 54 in Q1 to 56 in Q2, breaking the downward trend seen over the past four quarters. The Future Sentiment Score also rose from 56 to 61, signaling an improving outlook among stakeholders.

A score above 50 in the index reflects positive market sentiment, while anything below indicates pessimism. With both current and future sentiment scores above this benchmark, the sector appears poised for a turnaround.

High-End Housing Drives Demand

Premium residential properties, especially those priced above ₹1 crore, are dominating the demand landscape. Developers are focusing on these micro-markets, launching homes that cater to lifestyle upgrades and preferences shaped by urbanisation and hybrid work trends.

The report indicates that nearly 70% of real estate stakeholders expect the volume of new residential project launches to remain stable or increase in the upcoming months. In contrast, budget and mid-income segments are facing affordability challenges despite financing support, limiting new launches in these categories.

Positive Sentiment Around Pricing and Sales

Expectations around pricing remain stable. Around 94% of stakeholders believe that home prices will either stay the same or rise an outlook similar to that of the previous quarter. Cities like Bengaluru, Chennai, and Delhi NCR have reported double-digit growth in property prices year-on-year, driven by low inventory and sustained demand for branded homes with premium amenities.

Sales sentiment has also improved marginally. In Q2 2025, 52% of survey participants believe residential sales will either hold steady or grow in the next six months, up from 50% in Q1.

Developers Lead in Optimism

One of the standout observations from the Q2 report is the noticeable increase in confidence among developers. Their Future Sentiment Score surged from 53 in Q1 to 63 in Q2 2025. This is largely attributed to more favorable borrowing conditions, thanks to a 100-basis-point cut in repo rates by the Reserve Bank of India earlier this year.

Financial institutions, including banks and private equity firms, also displayed growing positivity. Their sentiment score improved from 57 to 60 in Q2, signaling a more aligned strategy between financiers and developers, especially in the premium housing segment.

South India Emerges as a Real Estate Bright Spot

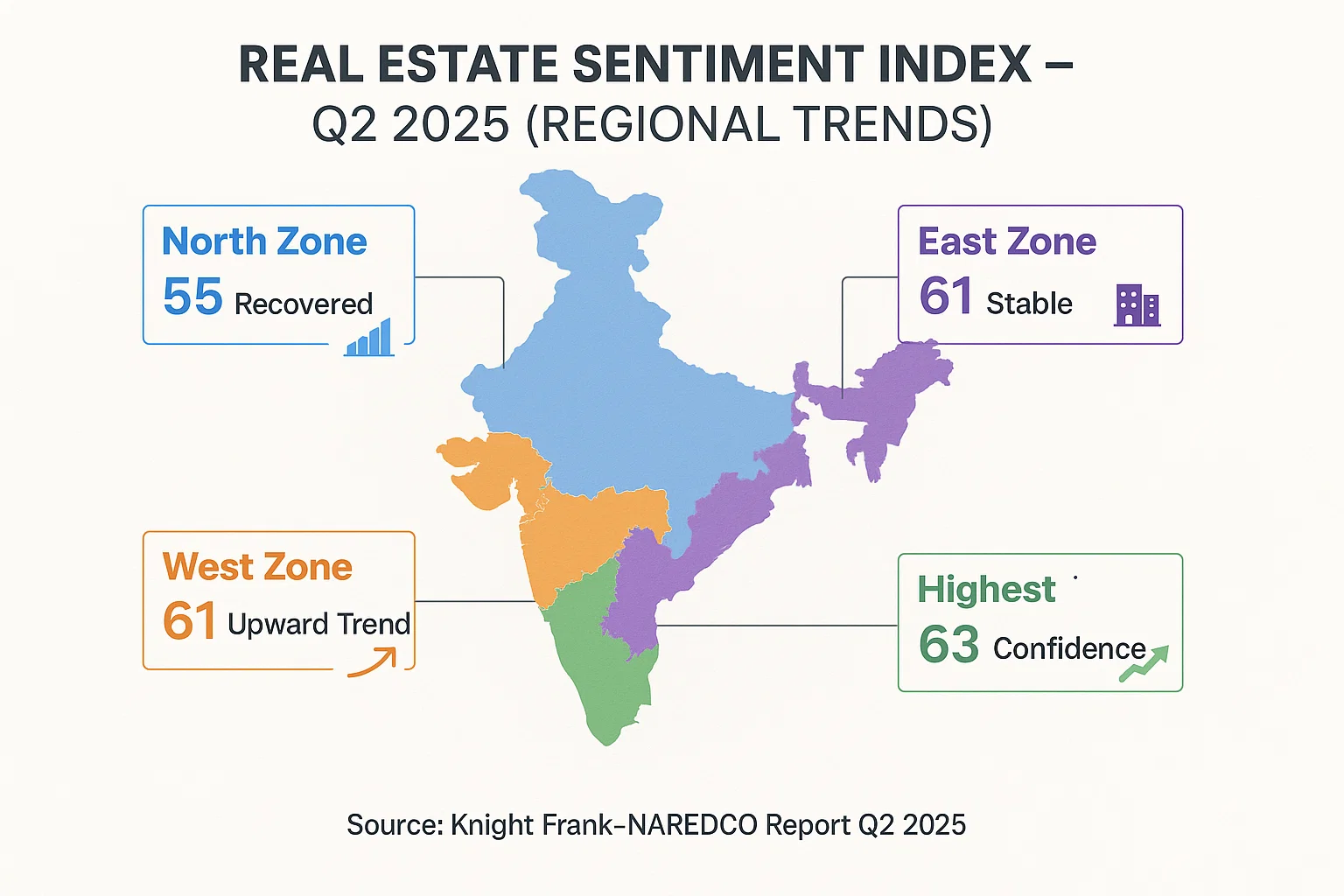

South India, particularly cities like Bengaluru, Hyderabad, and Chennai emerged as the most optimistic region, recording a Future Sentiment Score of 63. This optimism is backed by strong office space absorption, infrastructure development, and a proactive approach from developers in both apartment and plotted developments.

Other regions are catching up. The North Zone recovered from a post-pandemic low of 48 in Q1 to 55 in Q2, fueled by infrastructure upgrades in Delhi-NCR and increased focus on luxury housing. The West Zone, home to Mumbai and Pune, improved from 58 to 61, buoyed by sustained housing demand and commercial absorption. The East Zone remained steady at 61, reflecting stable mid-market activity in Kolkata.

Final Thoughts

India’s real estate market in Q2 2025 appears to be stabilising with cautious optimism. While high-end housing leads the recovery, the entire sector is benefiting from favorable economic signals, improved access to capital, and renewed developer confidence.

With developers responding to consumer demand shifts and financiers backing quality inventory, the stage is set for a more balanced and resilient property market in the months ahead.

Follow AquireAcers Whatsapp Channel to Stay Updated With The Latest Real Estate News

_1771582392.webp)

_1771577585.webp)

Ans 1. The Knight Frank-NAREDCO Sentiment Index shows a mild but positive rebound in India’s real estate sector. The Current Sentiment Score rose from 54 in Q1 to 56 in Q2, while the Future Sentiment Score increased from 56 to 61, signaling growing confidence among developers and financial stakeholders.

Ans 2. Luxury housing, especially homes priced above ₹1 crore, is leading the market recovery. These high-end properties are attracting urban buyers seeking lifestyle upgrades and are driving most of the new project launches.

Ans 3. Yes. According to the survey, 94% of stakeholders believe that home prices will either remain steady or increase, particularly in major cities like Bengaluru, Chennai, and Delhi NCR, where supply remains limited.

Ans 4. Sales sentiment has improved slightly. Around 52% of stakeholders expect residential sales to either hold or rise in the next six months, compared to 50% in the previous quarter, indicating growing market stability.

Ans 5. The mid-income and budget housing segments are facing affordability challenges, despite easier access to financing. As a result, new project launches in these categories are limited compared to the premium segment.

Ans 6. Developer optimism surged, with their Future Sentiment Score jumping from 53 in Q1 to 63 in Q2. This reflects better financing conditions, supportive policy signals, and confidence in premium housing demand.

Ans 7. Financial institutions, including banks and private equity firms, are increasingly aligned with developers. Their sentiment score improved from 57 to 60 in Q2, showing greater willingness to support quality residential projects.

Ans 8. South India emerged as the most confident region, with a Future Sentiment Score of 63. Cities like Bengaluru, Hyderabad, and Chennai are leading the charge, driven by strong infrastructure and consistent residential demand.

Ans 9. The North Zone recovered from 48 to 55, the West Zone improved from 58 to 61, and the East Zone remained stable at 61. These changes reflect rising demand, infrastructure push, and sustained absorption in luxury and mid-segment housing.

Ans 10. The market is showing signs of a cautious but steady recovery. While luxury housing leads the momentum, improved access to capital and increased developer confidence point toward a more resilient and balanced property cycle ahead.