Table of Content

▲

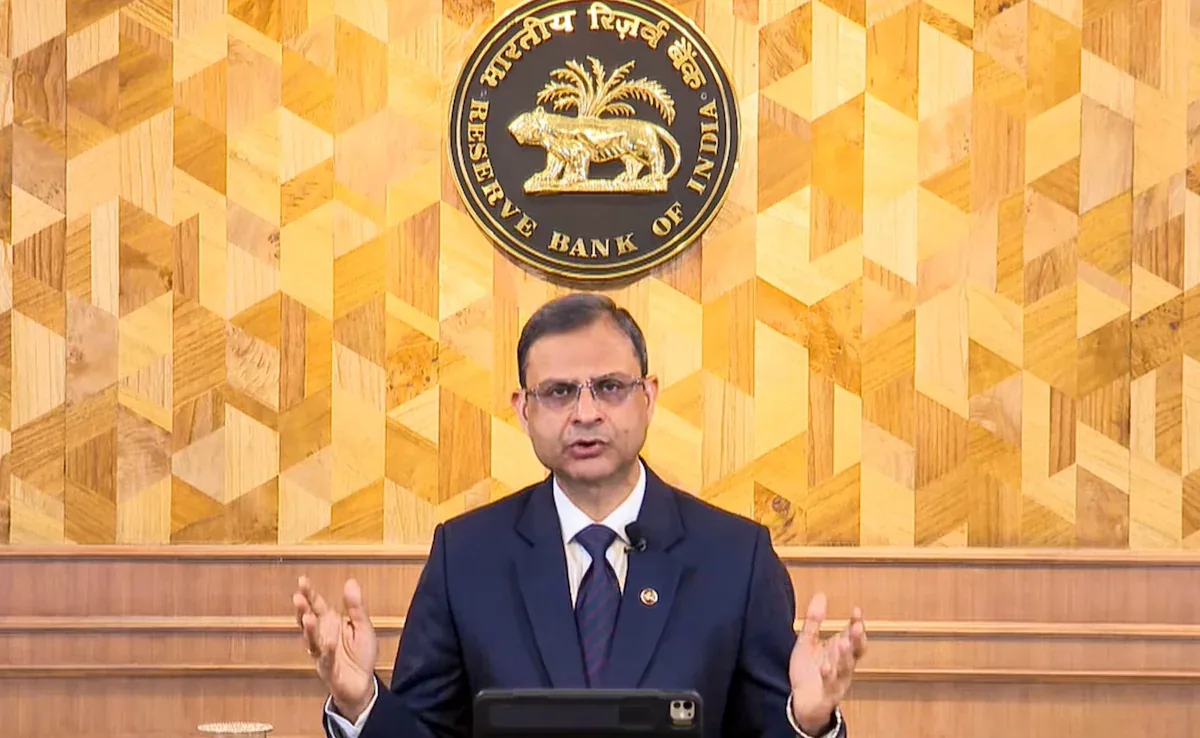

The Reserve Bank of India (RBI) has decided to keep its key policy rate, the repo rate, unchanged at 5.5% in its latest monetary policy review on October 1. This decision marks the second consecutive time the central bank has maintained status quo, even as it has already reduced the repo rate by 100 basis points earlier this year. By holding the rate steady, RBI holds repo rate at a level that ensures home loan EMIs remain stable, offering relief to existing borrowers and supporting buyer confidence during the crucial festive season.

While stability in interest rates provides short-term comfort, the decision reflects a cautious approach by the Monetary Policy Committee (MPC) in the face of global economic uncertainty, inflation risks, and the need for full transmission of past cuts.

RBI Holds Repo Rate: What Does It Mean?

The RBI’s October 1 announcement confirmed that the repo rate the rate at which RBI lends short-term funds to commercial banks will stay unchanged at 5.5%. The MPC voted unanimously to maintain a neutral stance.

This move comes after significant monetary easing earlier in 2025, when RBI cut the repo rate by 100 basis points to encourage borrowing and stimulate demand. Despite that, the central bank has chosen not to introduce additional cuts at this stage, signaling that it wants earlier reductions to filter through the system before making further adjustments.

By deciding that RBI holds repo rate steady, the central bank is prioritizing macroeconomic stability, even as real estate stakeholders were hoping for another round of rate cuts.

Also Read: SC Grants Conditional OCs for Six Godrej Nest Towers, Relieving 400+ Noida Buyers

Impact on Home Loan Borrowers and Developers

For home loan borrowers, the RBI’s decision brings stability. Existing borrowers will not see any change in their EMIs, while new buyers benefit from predictable borrowing costs. With the repo rate steady, home loan interest rates offered by banks and housing finance companies are likely to remain stable in the near term.

Developers also stand to gain. Predictable borrowing conditions allow real estate companies to plan capital-intensive projects more efficiently. For a sector that thrives on long-term planning and financing, stable interest rates reduce uncertainty.

The timing is particularly important. With the festive season underway traditionally the busiest period for property transactions the fact that RBI holds repo rate at 5.5% is expected to help sustain the momentum in homebuying.

Experts Weigh In on RBI’s Decision

Industry leaders and real estate experts have largely welcomed the decision, though with a hint of caution.

Anuj Puri, Chairman of ANAROCK Group, said that keeping the repo rate unchanged ensures continuity for borrowers and sustains buyer confidence during the festive quarter. Similarly, Praveen Sharma, CEO of REA India (Housing.com), noted that the steady repo rate provides a positive signal to homebuyers at a time when purchase intent peaks.

However, some experts argue that while stability is good, affordability could have improved further with an additional rate cut. Samantak Das, Chief Economist at JLL India, pointed out that inflation remains within comfort levels, suggesting that there was room for a cut. Still, by maintaining stability, RBI holds repo rate to protect against global volatility and preserve long-term economic balance.

Why RBI Chose Status Quo Instead of a Cut

The RBI’s decision reflects multiple considerations beyond real estate. Global trade tensions, volatile commodity prices, and geopolitical uncertainty all influenced the MPC’s cautious stance.

Another reason is the need for complete transmission of earlier cuts. The central bank reduced the repo rate by 100 basis points since February 2025, and not all of those reductions have yet been passed on to borrowers. Allowing time for the system to adjust ensures better policy effectiveness.

Additionally, the government’s recent GST reforms on construction materials are expected to reduce project costs, providing indirect support to the housing sector. By choosing stability for now, RBI holds repo rate while letting these complementary reforms take effect.

Impact on Affordable and Mid-Income Housing

The affordable and mid-income housing segments remain highly sensitive to borrowing costs. Although a steady repo rate prevents EMIs from rising, it does little to enhance affordability.

Experts argue that a rate cut combined with GST reforms would have been a game-changer for this segment. Affordable housing, in particular, has shown early signs of slowing after strong growth in the first half of 2025. Without additional relief, demand may not accelerate as much as developers hoped.

Still, the fact that RBI holds repo rate at 5.5% provides stability and ensures no immediate setbacks for potential buyers in these critical segments.

Developers and Industry Outlook

From a developer’s perspective, the RBI’s stance is a mixed bag. On one hand, consistent interest rates allow for careful project planning and execution. On the other, many developers were hoping for a rate cut to stimulate fresh demand, especially in the affordable and mid-market categories.

Industry bodies like NAREDCO have already urged the RBI to consider reducing rates further in its next MPC meeting. Lower rates, they argue, would not only boost housing sales but also stimulate allied industries such as cement, steel, and home interiors. This ripple effect would accelerate growth across the real estate value chain.

Still, by ensuring stability, RBI holds repo rate to support a more balanced growth trajectory for the sector.

Also Read: Festive Season Boosts Mumbai Property Deals: Registrations +32%, Duty +47%

Festive Season Sentiment and Future Outlook

The festive season is traditionally associated with higher property registrations and strong sales. Already, metros like Mumbai and Pune have reported surging demand in September ahead of the festive quarter.

The RBI’s decision to keep rates steady is expected to further bolster consumer sentiment. Buyers who were on the fence may now feel more confident about making a purchase, knowing their EMIs will not change in the short term.

Looking ahead, experts hope the central bank will consider accommodative measures in 2025 if inflation remains under control. For now, RBI holds repo rate steady, striking a balance between supporting growth and maintaining economic stability.

Conclusion

The RBI’s decision to keep the repo rate unchanged at 5.5% is a critical move for India’s housing market. By ensuring home loan EMIs remain stable, RBI holds repo rate to protect buyer sentiment during the festive season while giving developers the confidence to plan ahead.

While stability boosts confidence, it does not fully address affordability challenges, particularly in the affordable and mid-income segments. Industry stakeholders will be watching closely to see if the central bank moves toward further cuts in upcoming policy reviews.

For now, the decision reflects a balanced approach sustaining housing demand, supporting developers, and aligning with broader economic reforms setting the stage for steady real estate growth in the festive months ahead.

Ans 1. It means the Reserve Bank of India has decided to keep its key policy rate, the rate at which it lends short-term funds to commercial banks unchanged at 5.5%. This decision ensures stability in home loan interest rates and borrowing costs for both existing and new borrowers.

Ans 2. With the repo rate unchanged, banks are likely to maintain current home loan interest rates. This keeps EMIs steady, offering relief to existing borrowers and giving potential homebuyers confidence during the festive season.

Ans 3. The RBI took a cautious approach due to global economic uncertainties, inflation risks, and the need for full transmission of earlier rate cuts. The central bank also wants to observe the impact of previous cuts and complementary measures like GST reforms before making further adjustments.

Ans 4. Stable interest rates allow developers to plan capital-intensive projects efficiently. Predictable borrowing costs reduce financial uncertainty, although some developers were hoping for additional cuts to boost demand in affordable and mid-income segments.

Ans 5. Yes, maintaining repo rate stability is expected to support buyer sentiment during the festive period. Consumers can make purchasing decisions confidently, knowing their EMIs will not increase immediately.

Ans 6. While stability prevents EMIs from rising, it does not actively enhance affordability. Additional rate cuts would have been needed to significantly lower borrowing costs, particularly for affordable and mid-income housing.

Ans 7. Industry experts generally welcome the stability, noting it sustains buyer confidence and allows developers to plan projects. Some suggest that further cuts could provide extra momentum, especially in the affordable housing sector.

Ans 8. These segments benefit from stable EMIs, preventing immediate setbacks. However, without additional rate cuts, affordability improvement and demand acceleration may remain limited.

Ans 9. Complementary measures like GST reforms on construction materials, improved infrastructure, and ongoing urban development also support the housing sector. Combined with stable interest rates, these reforms help maintain steady real estate growth.

Ans 10. The RBI’s status quo decision strikes a balance between growth and economic stability. Homebuyers can expect EMIs to remain steady, developers gain predictable borrowing conditions, and festive season demand is likely to remain strong. Future rate cuts may be considered if inflation remains under control.