Table of Content

▲

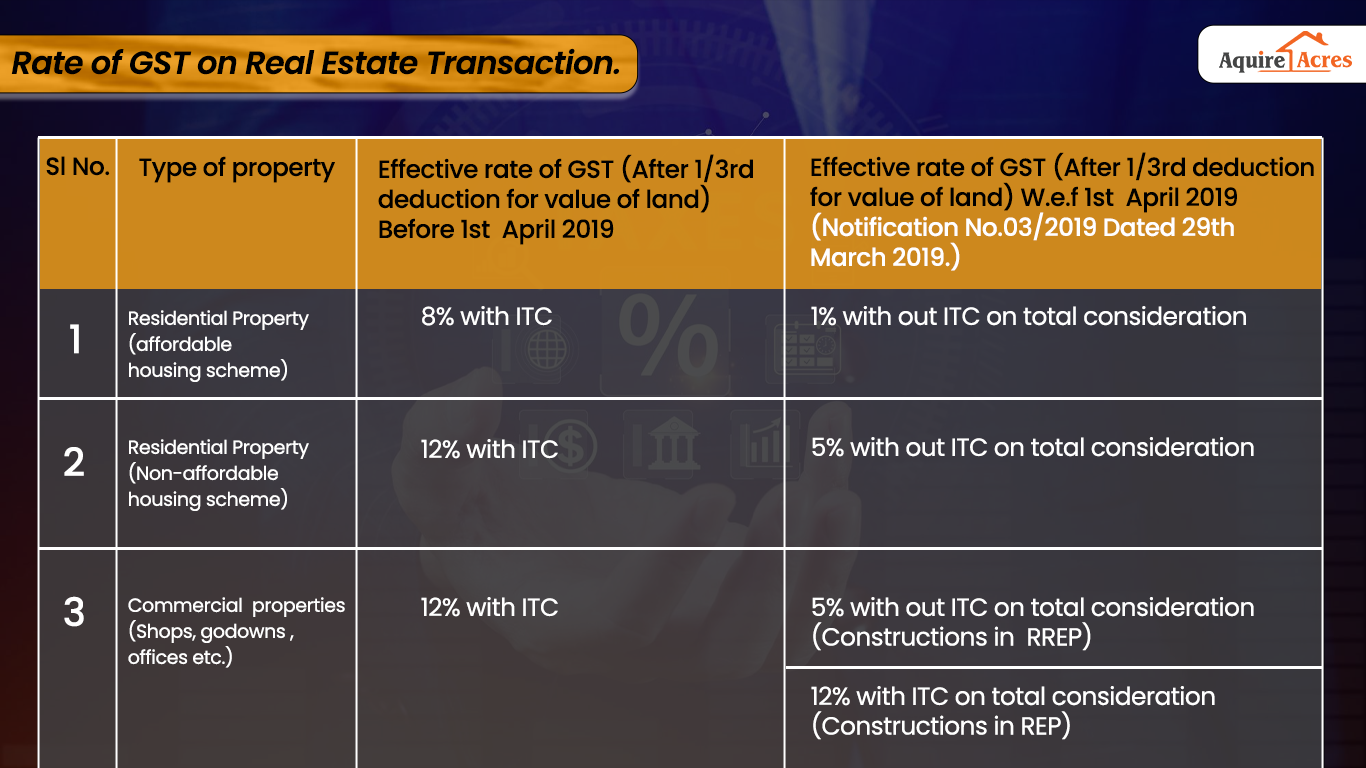

A real estate transaction involves transferring property rights between parties, such as sellers and buyers. In a "Residential Real Estate Project," commercial apartment space cannot exceed 15% of the total area. According to GST law, constructing complexes or buildings falls under works contract services, treated as a service supply. Sale of land and buildings, post-completion certificate issuance or first occupation, isn't considered goods or services under Schedule III of the CGST Act, 2017.

As per CBIC Circular No. 177/09/2022-TRU dated August 3, 2022, land can be sold either in its current state or after certain development activities like leveling, installing drainage, water, or electricity lines, etc. It's clarified that selling such developed land is still considered the sale of land under Sr. No. 5 of Schedule III of the Central Goods and Services Tax Act, 2017, and therefore does not incur GST.

As stated in Para 5(b) of Schedule II of CGST Act, 2017, providing construction services for a complex, building, civil structure, or part of it, including those intended for sale, is considered a service unless full payment is received after completion certificate issuance or first occupation. In order to impose GST, there must be a transaction involving the provision of goods or services, or both, in exchange for payment as part of conducting business activities.

So, GST is applicable only on under construction building, flat & apartment including commercial property (Shops, godowns , offices etc.) and not on sale or transfer of property after issuance of completion certificate or after its first occupation.

A) Conditions for new tax rate:

a) The availability of input tax credit shall be restricted.

b) A minimum of 80% of inputs and input services must be purchased from registered entities. In case of a shortfall below 80%, the builder must pay taxes through the reverse charge mechanism.

c) Services such as granting development rights, long-term lease of land (with upfront payments like premiums, 'salami,' development charges, etc.), or FSI (including additional FSI), electricity, high-speed diesel, motor spirit, and natural gas will not be considered for the 80% procurement requirement mentioned above.

d) Developers are obligated to pay tax at 18% for any shortfall in procurement value, except for cement and capital goods, which are taxed at their respective applicable rates. Tax paid under reverse charge for input and input services will be considered as procured from registered entities.

e) Procurements from both registered and unregistered entities must be tracked project-wise, and any shortfall, along with tax payments, should be reported by June 30 of the subsequent financial year. However, tax on cement received from unregistered entities must be paid in the month of receipt. Unavailed input tax credit must be reported monthly by indicating it as ineligible credit in GSTR-3B.

B) Valuation of Supply

For developers, the worth of construction services offered as compensation for development rights or FSI shall be considered equivalent to the total sum charged for similar units in the project by unrelated purchasers, excluding the land value, around the time of transferring such development rights or FSI.

Regarding landowners, the service value of transferring development rights or FSI instead of residential or commercial units by an individual shall be deemed equal to the value of comparable units charged from unrelated buyers around the time of transferring such development rights or FSI.

C) Definition / clarification issued by TRU , Govt of India Dated 7th May 2019

1) Affordable housing:

A residential dwelling with a floor space of 90 sqm in non-metropolitan areas and 60 sqm in metropolitan areas, with a value up to Rs. 45 lakhs (for both metropolitan and non-metropolitan cities). Bengaluru, Chennai, Delhi NCR (Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, and Faridabad), Hyderabad, Kolkata, and Mumbai (entire MMR) are classified as Metropolitan Cities.

2) Ongoing Projects:

A project which meets the following conditions shall be considered as an ongoing project.

(i) The project must have obtained a commencement certificate from the relevant authority, if required, by March 31st, 2019. Additionally, a certified architect, chartered engineer, or licensed surveyor must confirm that construction work, including earthwork for site preparation and foundation excavation, commenced by March 31st, 2019.

(ii) If a commencement certificate is not mandatory for the project, it still needs certification from the aforementioned authorities confirming that construction began by March 31st, 2019.

(iii) The project must not have received a completion certificate or witnessed its first occupation by March 31st, 2019.

(iv) At least some apartments in the project must have been booked on or before March 31st, 2019. Furthermore, the promoter must have received at least one installment payment from a flat buyer, credited to the promoter's bank account, before April 1st, 2019.

At least some apartments in the project should have been booked prior to 1 April 2019. At least one instalment should have been received from the flat buyer and should be credited to the bank account of the promoter.

3) RREP (Residential Real Estate Projects) :

A "Residential Real Estate Project" refers to a "Real Estate Project" where the carpet area of commercial apartments constitutes no more than 15 percent of the total carpet area of all apartments within the project.

4) Commencement certificate

A "commencement certificate" refers to the document, whether termed a commencement certificate, building permit, or construction permit, issued by the relevant authority. It authorizes the promoter to initiate development activities on an immovable property in accordance with the approved plan.

5) What is the criteria to be used by an architect, a chartered engineer or a licensed surveyor for certifying that construction of the project has started by 31st March, 2019

If the earthwork for site preparation for a project has been finished and excavation for foundation has begun by March 31, 2019, the project will be deemed to have commenced by that date.

6) How will works contract services provided by a contractor to a developer or promoter be categorized and taxed under the new regulations effective from April 1, 2019?

(i) New project after 1.4.2019 and ongoing projects where option has been exercised for new rate and

(ii) Ongoing projects where option has not been exercised for new rate?

The rate of tax applicable on the work contract service provided by a contractor to a promoter for construction of a real estate project shall be 12% or 18% depending upon whether such work contract service is provided for construction of affordable residential apartments or residential apartments other than affordable residential apartments. Rate of tax applicable on such work contract service provided by a contractor to a promoter on construction of commercial apartments shall be 18%(irrespective of option exercised by developer-promoter).The relevant entries of the notification are at items (iv), (v), (va) and (vi) against sl. no. 3 of the table in Notification No. 11/2017-Cenral Tax (rate) dated 28-06-2017 prescribing rate of 12% for works contract services of construction of affordable apartments/ apartments being constructed under schemes specified therein. In case of works contract services for construction of other apartments, rate of 18% as prescribed in item (xii) against sl. no. 3 of the table in Notification No. 11/2017-Cenral Tax (rate) dated 28-06-2017 shall be applicable.

7) Can a developer take deduction of actual value of Land involved in sale of unit instead of taking deduction of deemed value of Land as per Paragraph 2 to Notification No. 11/2017-CTR ?

No. Valuation mechanism prescribed in paragraph 2 of the notification No. 11/2017- CT (R) dated 28.06.2017 clearly prescribes one- third abatement towards value of land.

8) Land Owner being an individual is not engaged in the business of land relating activities and thus whether the transfer of development rights by an individual to a promoter is liable for GST and whether the same will fall within the scope of “Supply‟ as defined in Section 7 of CGST / SGST Act, 2017?

The term business has been assigned a very wide meaning in the CGST Act and it includes any trade, commerce, manufacture, profession, vacation, adventure, or any other similar activity whether or not it is for a pecuniary benefit irrespective of the volume, frequency, continuity or regularity of such activity or transaction. Therefore, the activity of transfer of development rights by a land owner, whether an individual or not, to a promoter is a supply of service subject to GST.

9) Can a buyer excise option to pay tax at new or old rate in respect of balance instalments after April 2019 in respect of flat/apartment booked prior to 1st April 2019 and paid some instalments with 12% GST ?

The buyer cannot exercise option to pay tax at the new or old rates. It is the builder, who has to exercise the option to pay tax on construction of apartment .

_1770976628.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. The GST on affordable housing category is 1%. GST on Non-affordable category real estate is 5%. GST on sale of commercial propertyis 12%. GST on an under-construction property is 12%.21 Feb 2024

Ans 2. However, under GST a single rate of 12% is applicable on under construction properties whereas no GST is applicable on completed or ready to sale properties only if the Completion Certificate (CC) has been issued.

Ans 3. Things to Remember about GST on Real Estate Under GST residential property with a maximum of 15% commercial space will be treated as residential property. The applicable GST on a commercial unit is 12%. Landowners have to pay GST only if the tenant is a commercial firm.

Ans 4. The ruling follows the circular by the Central Board of Indirect Taxes and Customs (CBIC) released on August 3, 2022, after the GST Central Council meeting. The circular equates the sale of plots after essential development on the land. Thus, it is not subject to Goods and Services Tax (GST).