The introduction of GST on construction materials has streamlined the taxation system by subsuming various state and central government taxes. Additionally, the government imposes GST on construction contracts. Before July 2017, the taxation on goods and services was highly complex, involving multiple taxes such as excise duties, Octroi, VAT, and customs duties. However, the implementation of the Goods and Services Tax (GST) has simplified this process, eliminating these numerous taxes.

Understanding GST on construction is crucial, as this sector employs approximately thirty million people nationwide and contributes around two hundred billion worth of assets annually. To regulate activities within the construction sector, the concept of Works Contract has been introduced.

Previously, central taxes included service tax, excise duty, central sales tax, customs duty, central surcharges, and cesses. Additionally, state taxes encompassed VAT, luxury tax, entertainment tax, purchase tax, state excise duty, and taxes on gambling, advertisements, lotteries, betting, surcharges, and cesses. The GST reform has consolidated these various indirect taxes, providing a unified regime for all taxpayers.

Works Contract in GST on Construction

The concept of a works contract is comprehensive, encompassing agreements related to constructing structures on a property. It includes details about the raw materials and products used in completing a project. For instance, the GST on construction of residential houses covers the rates for bricks, cement, painting, wallpaper, bathroom fittings, and more. The GST on construction contracts encompasses activities such as:

- Apartment

- Residential complex

- Single residential units

- Industrial buildings

- Multi and single-story buildings

- Administrative and commercial buildings

The activities included in GST on construction contracts encompass:

- Building

- Construction

- Fabrication

- Erection

- Completion

- Fitting out

- Installation

- Improvement

- Modification

- Maintenance

- Repair

- Renovation

- Commissioning and alteration of immovable property

- Transferring of properties in goods

Under the CGST Act of 2017, taxpayers are required to pay GST only on under-construction properties, with no GST applicable to ready-to-move-in properties. Despite this clear guideline, many people struggle with calculating GST on under-construction properties. To address this challenge and understand the calculation process, continue reading for a detailed explanation.

Different rates of GST on construction materials

Construction sites use a variety of materials such as cement, sand, bricks, and marble, each with its own GST rate. To manage the costs of these goods, a detailed taxation system was introduced. However, the GST on construction materials can vary depending on the specific material, making calculations challenging for both dealers and buyers. Here’s an overview of these GST rates:

|

Construction Material

|

GST Rate

|

|

Cement

|

28%

|

|

Steel and Iron

|

18% (varies)

|

|

Bricks

|

5%

|

|

Sand and Aggregates

|

5%

|

|

Timber and Wood

|

18%

|

|

Tiles and Ceramics

|

18%

|

|

Electrical Fittings

|

5% – 18%

|

|

Paints and Varnishes

|

18%

|

|

Pipes and Fittings

|

18%

|

|

Glass

|

18%

|

|

Roofing Materials

|

5% – 18%

|

|

Hardware and Fasteners

|

18%

|

|

Concrete Blocks

|

5%

|

|

Plaster and Mortar

|

18%

|

|

Roofing Tar and Bitumen

|

18%

|

|

Insulation Materials

|

18%

|

|

Aluminum Products

|

18%

|

|

Plywood and MDF

|

18%

|

|

Granite and Marble

|

18%

|

|

Plastic Pipes and Fittings

|

18%

|

Search how to calculate GST under construction property with examples if you face trouble understanding how to use these rates.

Immovable and movable properties

|

Taxation Rates for Residential and Commercial Properties (GST on Construction)

|

|

Sr No

|

Nature of Service

|

Gross Rate

|

Effective Rate

|

|

1

|

Affordable residential apartment in a RREP (Commenced on or after 01.04.2019 or ongoing projects opted for new rates) intended for sale

|

1.5 Percent

|

1 Percent

|

|

2

|

Residential apartment (other affordable residential apartments) in a RREP (commenced on or after 01.04.2019) or ongoing projects opted for new rates), intended for sale

|

7.5 Percent

|

1 Percent

|

|

3

|

Commercial Apartments in a RREP (commenced on or after 01.04.2019 or ongoing projects opted for new rates) intended for sale

|

7.5 Percent

|

5 Percent

|

|

4

|

Affordable residential apartment in REP, other than in a RREP (commenced on or after 01.04.2019, or ongoing projects opted for new rates), intended for sale

|

1.5 Percent

|

1 Percent

|

|

5

|

Residential apartment (other than affordable residential apartments) in REP other than in a RREP (Commenced on or after 01.04.2019, or ongoing projects opted for new rates) intended for sale

|

7.5 Percent

|

5 Percent

|

|

6

|

Ongoing projects in specified schemes (of lower rate of tax) where the promoter has not opted for new rates

|

12 Percent

|

8 Percent

|

|

7

|

Commercial Apartments in REP other than in RREP

|

18 Percent

|

12 Percent

|

|

8

|

Ongoing Residential apartments as on 31.03.2019 , other tha affordable residential apartments, where promoter has chosen to pay at old rates (other than mentioned from 1 to 6 above)

|

18 Percent

|

12 Percent

|

GST Rates on Construction Services and Materials

The GST rate for construction services is generally 18%. However, this rate can vary based on the type of construction. For affordable housing, the GST rate is reduced to 1%. Input services and construction materials typically attract an 18% GST rate, while other segments might be taxed at 5%. When it comes to Input Tax Credit (ITC), the GST rate on construction services can range from 8% to 10%.

Also Read: Learn how to improve your CIBIL score for Home Loan

Example Calculation for GST on Under Construction Property:

To illustrate, if the material and labor cost amounts to 75 INR, with 45% of this being subject to GST, the tax will be 33.75 INR. Applying an 18% GST rate on this amount results in 6.075 INR. If the profit is 25 INR, the total sale amount before tax would be 106.43 INR. After applying a 5% GST on construction, the final amount rises to 111.75 INR, assuming no ITC.

For more detailed examples, many tutorials are available to guide you on calculating GST for under-construction properties.

GST Rates on Construction Materials:

- Cement: All types, including aluminous, slag, and portland cement, are taxed at 12%.

- Sand: Rates vary by type; for tar sand, oil shale, and similar, it is 18%, while natural sand and metal-bearing sand are taxed at 5%.

- Pebbles, Crushed Stones, and Gravels: These materials are taxed at 5% for residential and other constructions.

- Bricks: The rate for building bricks is 5%, which will increase to 12% from April 1, 2022.

- Tiles and Ceramic Goods: These materials have a GST rate of 18%, while concrete and glass-based bricks can be taxed up to 28%.

- Marble and Granite: GST is 12% for blocks and 28% for non-block forms.

- Building Stones: Slabs and blocks made from basalt, sandstone, etc., are taxed at 5%.

- Coal: GST rate is 5%.

- Steel and Iron Products: These materials are taxed at 18%.

- Mica: Taxed at 12%.

- Tiles: Bamboo flooring and earthen tiles are taxed at 18% and 5%, respectively, while cement, plastic, and concrete tiles may attract up to 28%.

- Interiors: Wallpapers, paints, and electrical appliances are taxed at 28%, while bathroom fixtures and pipe fittings have an 18% GST rate.

To accurately calculate GST on construction, refer to the rates listed above. For detailed guidance, consult resources or tutorials that offer examples on how to calculate GST for under-construction properties. This will help you determine the exact amount and charges for construction materials.

GST Rates on Real Estate Projects

The Goods and Services Tax (GST) has significantly transformed India's tax system, offering both advantages and challenges. As of April 2019, there have been revisions to GST rates for residential properties. Here’s a summary of the current GST rates applicable to real estate:

- Under-Construction Properties: GST on under-construction properties is 5%, excluding Input Tax Credit (ITC) benefits.

- Affordable Housing: For properties priced below Rs 45 lakh, the GST rate is 1%, excluding ITC benefits. Affordable housing includes properties with a carpet area of less than 60 sqm in metropolitan areas and less than 90 sqm in non-metropolitan areas.

- Commercial Properties: These are subject to a GST rate of 12%, with ITC benefits. Understanding these GST rates on construction can help in making informed decisions about real estate investments and transactions.

Also Read: What are your options if you default on your home loan EMIs?

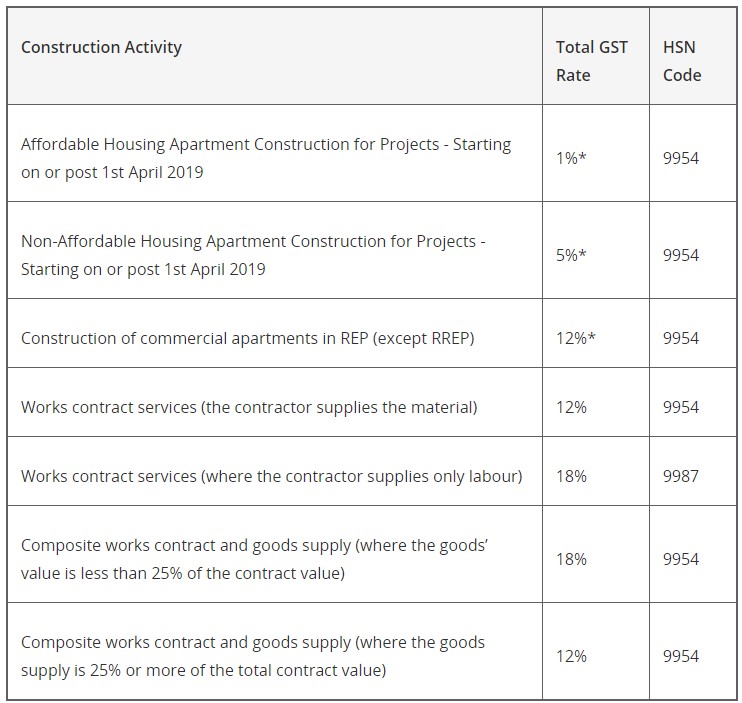

GST Rate and HSN Code for Building Construction Services

Know here the GST rate and HSN code for different construction activities in India:

HSN Code for Building Construction with Material

The HSN Code for Building Construction with material is also 9954. Check out below the HSN Code table for Construction Material.

|

Building Material

|

HSN Code

|

|

Bricks

|

6901

|

|

Cement

|

2523

|

|

Concrete Blocks

|

6810

|

|

Steel

|

72

|

|

Tiles

|

6907

|

|

Electrical Fittings

|

8536

|

|

Plumbing and Sanitary Fittings

|

7418

|

|

Glass

|

7007

|

Legal Judgments on GST on Construction

Gujarat High Court: GST Applies Only to Construction Costs, Not Land

In a significant ruling, the Gujarat High Court has clarified that GST on construction is applicable solely to the cost of construction and not to the land value. The court ruled that during the sale of a commercial plot, villa, or flat, GST should only be levied on the construction costs. The cost of land, including the undivided share in the land, is exempt from GST. This judgment provides relief to homebuyers who were previously charged GST based on land value.

AAR Ruling: ITC Not Allowed for Prefabricated Structures

The Telangana Authority of Advance Ruling (TAAR) has issued a key decision regarding Input Tax Credit (ITC). According to this ruling, ITC is not permissible for construction projects involving prefabricated technology. The TAAR determined that structures made with prefabricated technology are considered immovable property, and hence, ITC on such inward supplies, including construction services, is blocked under Section 17 (5) (d) of the CGST Act, 2017.

Rajasthan AAR: Construction Services Taxed at 18% GST

The Rajasthan Authority of Advance Ruling (AAR) has decreed that construction services provided under contract with the Rajasthan Housing Board will attract GST at a rate of 18%. The ruling addressed whether work contracts under the CM Jan Awas Yojana should be taxed at 9% CGST and SGST after January 1, 2022. Initially set at 6%, the rate was revised to 9% following updated GST rules on construction.

GST Refund for Unregistered Homebuyers on Canceled Contracts

Recent developments indicate that unregistered homebuyers will soon be able to claim a refund of GST paid on construction services if a contract is canceled. Currently, there is no procedure for such refunds when the contract for constructing a flat or house is canceled, and the time for issuing a credit note has passed. The GST Council has recommended amending the CGST Rules, 2017, to establish a procedure for unregistered buyers to claim these refunds.

Conclusion: GST on Construction

The introduction of GST on construction has had a profound impact on the real estate sector. Understanding the nuances of this tax is crucial for smooth financial operations. In India, GST on construction is typically 18%, but for affordable housing (from April 2019), the rate is reduced to 1%, while non-affordable housing remains at 12%.

Also Read: Latest RBI Guidelines for Home Loans 2024

Ans 1. GST on Under-Construction PropertiesGST Council's 33rd Amendment reduced under-construction property tax from 12% to 5%. For affordable homes up to INR 45 lakhs, a reduced tax rate of 1% is now applicable. However, this tax relief is available for properties that are not qualified for the Input Tax Credit (ITC).

Ans 2. GST rate on construction services and materials. In general, the GST rate on construction services is 18%. However, this rate varies in the construction sector as for affordable housing; it is 1%. Further, the input service and construction materials rate is 18%, while other segments have 5%.

Ans 3. GST Rates in 2024 – GST Structure and & Slabs in IndiaThe Central Board of Indirect Tax and Customs (CBIC) divides GST slab rates in India into five categories: 0%, 5%, 12%, 18%, and 28%. Additionally, some goods and services are subject to a cess, which is a surcharge levied over and above the GST rate.

Ans 4. Under the GST regime, the buyer is responsible for paying the GST on under-construction properties. The developer or builder collects the tax amount from the buyer and subsequently remits it to the government.

Ans 5. The GST rate on construction services is generally 18%. However, there are a few exceptions to this rule. For example, the GST rate on affordable housing projects is 1%, and the GST rate on the construction of certain infrastructure projects, such as roads and bridges, is 5%.

Ans 6. Currently, the GST Exemption Limit is set at Rs. 40 lakhs for goods and Rs. 20 lakhs for services. Businesses with annual revenues below these limits are not mandated to register for GST; however, they may opt to do so voluntarily.

Ans 7. How to calculate GST on an under-construction property? Example: Suppose that an under-construction property worth Rs 1000 is sold to a buyer by a builder. Then to calculate the GST on building, Rs 300 will be counted out as the land value and the GST on construction would apply only on the remaining Rs 700.

Ans 8. RCM applies to specific situations mentioned in the GST law. If a builder is providing construction services, the application of RCM would depend on various factors, including the nature of the services provided, the terms of the contract, and the provisions of the GST law in force.

Ans 9. The GST rate for construction services is 18%.

Ans 10. GST council has also recommended to exempt the supply of services made between various zones/ divisions under Ministry of Railways (Indian Railways). Notification No. 04/2024-CT(R) dated 12.07.2024 has been issued in this regard and effective date of implementation of the said notification is 15.07.2024