Table of Content

▲

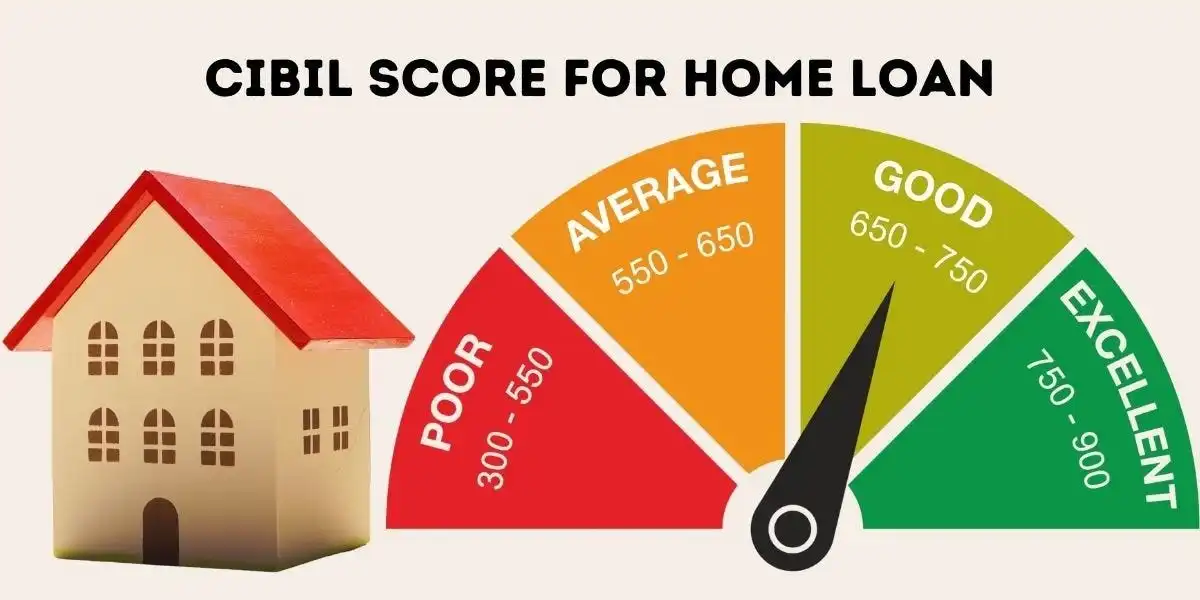

Your credit score, such as your CIBIL score, directly influences the interest rate you'll pay on a home loan. It reflects your credit history—responsibly managing past debts, including loans and credit card payments, boosts your score. Lenders determine your loan's interest rate based on your score, affecting your monthly EMIs and overall affordability. Maintaining a good credit score ensures a smoother borrowing process. Use a home loan EMI calculator to estimate your EMIs beforehand for better financial planning.

Credit score of 760 and above

Having a credit score of 760 and above is ideal for home loans, ensuring that lenders offer you the most favorable interest rates. This score reflects your responsible debt management history and minimal financial obligations that could affect your ability to repay a home loan. If your score falls within this range, it's important to maintain it. You can expect competitive interest rates ranging from 8.50%* to 15.00%* per annum.

Also Read: Here's a brief overview to financially prepare yourself for purchasing a home

Credit score between 700 and 760

A credit score in this range is generally viewed as good to moderate, varying by lender. It's sufficient for obtaining approval for a home loan, though you may incur a slightly higher interest rate.

To secure a lower interest rate, enhance your creditworthiness. Review your CIBIL report to ensure past loans are closed successfully, and focus on reducing your credit utilization ratio. Higher credit usage increases this ratio, which in turn lowers your credit score.

Credit score below 700

A credit score below 700 is considered modest, often seen in first-time borrowers or those with limited credit history. Lenders may approve your home loan at a higher interest rate in such cases.

To improve your score, consider options like taking a collateral-free personal loan and repaying it promptly. Another strategy is opting for a home loan with a lower Loan-to-Value (LTV) ratio, ideally 80% or less. This means you contribute at least 20% of the home's value upfront, which can increase your chances of securing a home loan at a favorable interest rate.

Before applying for a home loan, check your credit score and choose a lender offering competitive rates and additional benefits like Bajaj Finserv Home Loans, which feature straightforward eligibility criteria and perks such as a three-EMI holiday.

Inculcate the following financial habits to improve your credit score for a home loan:

- Acquire fewer debts before you take a home loan

- Ensure you pay your credit card dues in full

- Increase your credit card limit if you have higher usage

- Repay EMIs for existing debts on time

- Avoid making too many loan enquiries right before you apply for a home loan

Now that you know how crucial your credit score is to make your home loan EMIs more affordable, keep a check on it, and work on improving it.

Bajaj Finserv gives you pre-approved offers on personal loans, home loans, business loans and a host of other financial products. These offers simplify the process of availing of finance and save time. All you have to do is share a few basic details and check out your pre-approved offer.

Also Read: Bajaj Housing Finance launches Sambhav Home Loans

_1771582392.webp)

_1771577585.webp)

Ans 1. Automated EMI repayments, timely payments on credit card bills, disciplined expenditure, and appropriate financial management help to maintain a positive CIBIL score above 800.

Ans 2. Avoid taking on too much debt at one time If you take multiple loans at once, it will show that you are in an unforgiving cycle where you have insufficient funds. As a result, your credit score will fall further. On the other hand, if you take a loan and repay it successfully, it will boost your credit score.

Ans 3. If your score is between 650 and 700, you have a consistent payment history and low credit utilisation, it may take only a few months to reach a score of 750. However, if you have a poor credit score, missed payments, high credit utilisation, and derogatory marks on your credit report, it could take several years.

Ans 4. A 750 credit score is considered excellent and above the average score in America. Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. A score of 750 puts you in a strong position.

Ans 5. The time taken to improve the CIBIL™ score can normally be around 4-12 months, depending on your consistency in reflecting good credit behaviour. A credit score close to 750 is considered good and it will take lesser time to further improve such a credit score.