Table of Content

▲

You may have been planning on owning a home for years, but it's important to recognize that the process of buying a house is far from simple. It's both a financially and emotionally intense journey. From saving for down payments to applying for loans and finalizing sale agreements, there’s a lot to manage. Even after taking possession of your new house, you still need to register it in your name. To do this, buyers are typically required to pay an amount known as Stamp Duty. Just like in other cities across India, if you're planning to buy a home in Mumbai, it's crucial to factor in the stamp duty in Mumbai charges before finalizing your overall budget.

Mumbai stamp duty and registration fees

|

Stamp duty Mumbai |

Governed by Maharashtra Stamp Act |

|

Registration charges in Mumbai |

If the property value exceeds Rs 30 lakh, the stamp duty will be 1% of the property value. Otherwise, it will be a flat Rs 30,000. |

|

Online portal |

https://igrmaharashtra.gov.in/ |

|

Rebate for women |

1% |

What Are the Current Stamp Duty Rates in Different Areas of Mumbai?

|

Area |

Stamp duty |

Registration fee |

|

South Mumbai |

5%+1% metro cess |

1% |

|

Central Mumbai |

5%+1% metro cess |

1% |

|

Western Mumbai |

5%+1% metro cess |

1% |

|

Harbour |

5%+1% metro cess |

1% |

|

Thane |

6%+1% metro cess |

1% |

|

Navi Mumbai |

6%+1% metro cess |

1% |

Also Read: Stamp Duty & Registration Charges in Delhi: A Complete Guide

Stamp Duty on Different Types of Conveyance Deeds in Mumbai

|

Conveyance deed |

Stamp duty rate |

|

Stamp Duty on Gift Deeds in Mumbai and Maharashtra |

3% |

|

Stamp Duty on Gift Deed for Residential/Agricultural Property Transferred to Family Members |

Rs 200 |

|

Lease deed |

0.25% of total rent |

|

Power of attorney |

0.25% of the property's market value |

Stamp Duty for Various Property Types in Mumbai

|

Redeveloped project |

The allottee will pay a stamp duty of Rs 100. The stamp duty between the developer and housing society will be determined as per the conveyance deed. |

|

Resale project |

6% of value of project for men 5% of value of project for women |

|

Investors |

Stamp duty exemption period extended to 3 years. |

|

Stamp duty for consulates/ embassies |

Rs 100 |

Registration charges in Mumbai

|

Buyer |

Registration fee |

|

Male |

Property value below Rs 30 lakh: 1%

Property above Rs 30 lakh=Rs 30,000 |

|

Female |

|

|

Joint |

Stamp Duty and Registration Charges for Women in Mumbai

Women get a 1% discount on stamp duty in Mumbai, but this is only for residential properties. However, the discount doesn't apply if the property is jointly registered.

Also, the Maharashtra government has removed the 15-year limit that was previously set for women homebuyers. Now, women can enjoy the 1% stamp duty discount without any time restrictions. This means that a woman can sell the property to a man at any time and still receive the 1% stamp duty discount.

Stamp duty of resale flat in Mumbai

|

Areas in Mumbai |

Stamp duty in Mumbai for men |

Stamp duty in Mumbai for women |

Registration charges |

|

Inside the municipal boundaries of any urban area |

6% of property’s market value |

5% of property’s market value |

1 % of the property value |

|

Within the boundaries of any municipal council, panchayat, or cantonment in the MMRDA area |

4% of property’s market value |

3% of property’s market value |

1 % of the property value |

|

Within the limits of any gram panchayat |

3% of property’s market value |

2% of property’s market value |

1 % of the property value |

Stamp duty on key deed in Mumbai

|

Name of deed |

Stamp duty rate |

|

Stamp Duty on Gift Deeds in Mumbai and Maharashtra |

3% |

|

Stamp Duty on Gift Deed for Residential/Agricultural Property Transferred to Family Members |

Rs 200 |

|

Lease deed |

5% |

|

Power of attorney |

5% for properties in municipal areas, 3% for properties in gram panchayat areas. |

How is stamp duty calculated in Mumbai?

The buyer must pay stamp duty in Mumbai based on the price mentioned in the sales contract. However, you cannot buy or sell property in Mumbai for less than the Ready Reckoner (RR) rate set by the government. This means the property’s value must be calculated according to the current RR rate, and the stamp duty in Mumbai will be calculated accordingly. If the property is priced higher than the RR rate, the buyer will need to pay stamp duty based on the higher price. On the other hand, if the property is priced below the RR rate, the stamp duty will be calculated using the RR rate.

Also Read: GST on Commercial Property : Rates, Adherence, and Tax Benefits

Documents required for property registration in Mumbai:

- Agreement to Sale

- Sale Deed

- Encumbrance Certificate

- Property Tax Receipts

- No-Objection Certificate

- Power of Attorney (if applicable)

- Proof of Stamp Duty and Registration Fee Payment

- Occupancy Certificate (for new buildings)

- Completion Certificate (for under-construction buildings)

- TDS Certificate (for Properties Above Rs 50 Lakh)

- PAN Card of Both Buyer or Seller

- Aadhaar Card of Both Seller or Seller

- Passport-sized Photos of Buyer and Seller

- ID Proof of All Buyer, Seller or Witnesses

- Address Proof of All Buyer, Seller or Witnesses

Factors Influencing Stamp Duty and Registration in Mumbai

Several factors can impact the stamp duty and registration fees for real estate transactions in Mumbai:

1. Property Type: The stamp duty and registration fees can differ based on the property type. For instance, residential properties may have different rates than commercial properties.

2. Property Location: The location of the property is crucial in determining stamp duty and registration fees, as different areas in Maharashtra may have their own rates and rules.

3. Property Value: Stamp duty and registration fees are generally calculated as a percentage of the property's sale price, with higher property values resulting in higher stamp duty.

4. Ownership Type: The type of ownership can also affect the fees. For example, properties owned by a company may attract higher stamp duty compared to those owned by an individual.

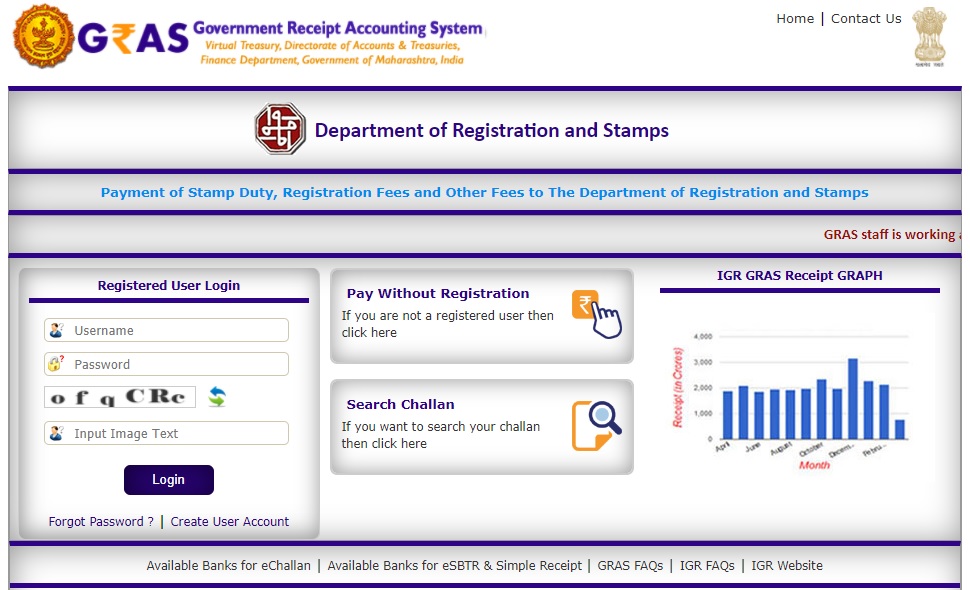

How to Pay Stamp Duty in Mumbai : Online

In Mumbai, homebuyers can pay stamp duty and registration fees online for property registration, as the state supports e-payment via the Maharashtra Stamp and Registration Department through the Government Receipt Accounting System (GRAS). Here’s how to complete the payment:

Step 1: Visit the website: https://gras.mahakosh.gov.in.

Step 2: Choose ‘Pay Without Registration’ if you’re not a registered user. If you are a registered user, simply log in to continue.

Step 3: If you select ‘Pay Without Registration’, a new page will open where you need to choose ‘Citizen’ and select the transaction type.

Step 4: Choose ‘Make Payment to Register your Document’. You can either pay stamp duty and registration fees together or separately.

Step 5: Fill in all required details like the district, sub-registrar’s office, property, and transaction information.

Step 6: Choose your preferred payment method and finalize the payment. After payment, an online receipt will be generated, which you need to present at the sub-registrar’s office when registering the property.

How to Pay Stamp Duty in Mumbai: Offline

To pay stamp duty in Mumbai, you have two options:

1. Purchase Stamp Papers from Authorized Vendors

For transactions with a stamp duty value under Rs 50,000, you can buy the required stamp papers from licensed vendors.

2. Franking

Authorized banks in India provide franking services, where they apply a stamp or denomination on property documents, confirming that the stamp duty for the transaction has been paid.

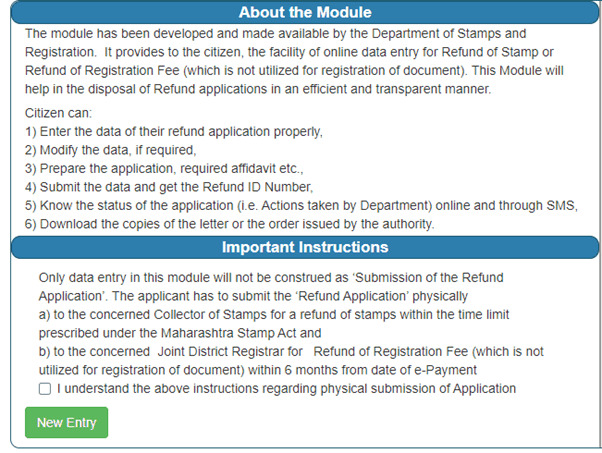

How to Apply for a Stamp Duty Refund Online in Maharashtra

If you want to cancel a property transaction within six months, you can apply for a stamp duty refund with a 10% deduction. Here’s how to do it online:

Step 1: Visit https://appl2igr.maharashtra.gov.in/refund/.

Step 2: Read the terms and conditions, check the box, and click on “New Entry”.

Step 3: Enter your mobile number, OTP, captcha, and click “Submit”.

Step 4: A refund token number will appear. Create and verify your password, enter the captcha, and click "Submit".

Step 5: Choose whether to retrieve old data.

Step 6: Enter the refund token number, select “Refund as Stamp Duty”, and fill in your personal and address details. Then proceed.

Step 7: Provide the stamp purchaser’s details, including bank account information for the refund.

Step 8: Enter the stamp details.

Step 9: Mention the reason for the refund and specify if the document is registered or not.

Step 10: Upload the required documents and proceed. After completing the steps, you will receive an acknowledgment receipt.

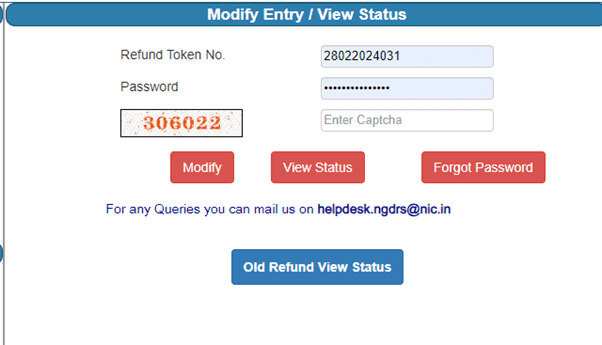

How to Track the Status of Stamp Duty Refund in Mumbai?

Step 1: Visit https://appl2igr.maharashtra.gov.in/refund/.

Step 2: Enter the refund token number, password, captcha, and click on "View Status." If you need to make any changes, click on the "Modify" option.

Step 3: Click on "View Status" to see the refund status.

Tax Advantages on Stamp Duty and Registration Fees in Mumbai

Homebuyers can claim a tax deduction of up to Rs 1.5 lakh on stamp duty in Mumbai charges under Section 80C.

How to Claim Tax Benefits:

- Tax deduction is applicable only in the year the payment is made.

- Only new residential properties qualify for this deduction.

- The property must have a completion certificate (OC) and the owner should have possession.

- The individual who paid the stamp duty (homeowner) can claim the deduction.

- Joint owners can each claim Rs 1.5 lakh under Section 80C.

Understanding the stamp duty and registration fees for property transactions in Mumbai is crucial for anyone looking to buy a home. From knowing the stamp duty in Mumbai rates based on property location to understanding the available rebates for women buyers, it's essential to factor these charges into your overall budget. Whether you're paying online or offline, the process is relatively straightforward if you have all the necessary documents and details.

By staying informed about these charges and the tax benefits you can claim, you can ensure a smoother property buying experience. It's always a good idea to consult with legal and financial experts to help navigate through the complex procedures and avoid any unexpected costs. With this knowledge, you’re now better equipped to make an informed decision when registering your property in Mumbai.

Also Read: Noida to Cancel Plot Allotments for Non-Compliance

_1770976628.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. Stamp duty is a government tax paid for registering a property transaction. It varies based on property value, location, and other factors.

Ans 2. Stamp duty is typically 5% + 1% metro cess for most areas in Mumbai. However, Thane and Navi Mumbai may have rates of 6% + 1% metro cess.

Ans 3. Yes, women get a 1% discount on stamp duty for residential properties in Mumbai. This exemption does not apply to joint ownership registrations.

Ans 4. Registration fees are typically 1% of the property value, with a maximum cap of Rs 30,000 for properties above Rs 30 lakh.

Ans 5. You can pay stamp duty through the Maharashtra Government’s online portal at https://gras.mahakosh.gov.in by filling in the necessary property and personal details.

Ans 6. Documents include Sale Deed, PAN cards of both buyer and seller, Aadhaar cards, proof of payment, Occupancy Certificate, and more.

Ans 7. Yes, you can apply for a stamp duty refund if you cancel the property transaction within six months. A 10% deduction will apply.

Ans 8. Homebuyers can claim a tax deduction of up to Rs 1.5 lakh on stamp duty under Section 80C of the Income Tax Act, provided certain conditions are met.

Ans 9. Stamp duty rates differ across various regions in Mumbai, with areas like South, Central, and Western Mumbai generally charging 5% + 1% metro cess, while Thane and Navi Mumbai charge 6% + 1% metro cess.

Ans 10. Stamp duty on gift deeds is 3% of the property’s market value, while family transfers of residential/agricultural property are charged Rs 200.