Table of Content

▲- Stamp Duty in Delhi

- Registration charges in Delhi

- A Step-by-Step Guide to Calculating Stamp Duty in Delhi

- Methods for Paying Stamp Duty in Delhi

- Documents Required for Property Registration in Delhi

- Registration fees in Delhi are plotted.

- Factors Affecting Stamp Duty in Delhi

- Penalties for Not Paying or Delaying Stamp Duty Payments

- Tax Relief on Stamp Duty and Registration Charges

- Conclusion

In India, states impose property transaction taxes, with stamp duty being a major revenue source for local governments. In Delhi, property buyers are required to pay stamp duty during the registration process as per the Registration Act of 1908.

Stamp Duty in Delhi

|

Buyer type |

Stamp duty in Delhi |

Stamp duty in NDMC area |

Stamp duty in Delhi Cantonment Board Area |

|

Male |

6% |

5.5% |

3% |

|

Female |

5% |

3.5% |

3% |

|

Joint |

5% |

4.5% |

3% |

Registration charges in Delhi

|

Buyer type |

Registration charges in Delhi |

Registration charges in NDMC area |

Stamp duty in Delhi Cantonment Board Area |

|

Male |

1% |

1% |

1% |

|

Female |

1% |

1% |

1% |

|

Joint |

1% |

1% |

1% |

Every purchaser, regardless of gender, is required to pay a registration fee of 1% of the property's transaction amount, along with the stamp duty in Delhi. Consequently, when purchasing a property, a man will incur a total cost of 7% of the property price (comprising of 6% stamp duty in Delhi and 1% registration fee), whereas a woman will bear a total cost of 5% (comprising of 5% stamp duty and 1% registration fee). If there is co-ownership, the total payment is 6%.

Also Read: Upcoming Affordable Housing Projects in Gurgaon 2024

A Step-by-Step Guide to Calculating Stamp Duty in Delhi

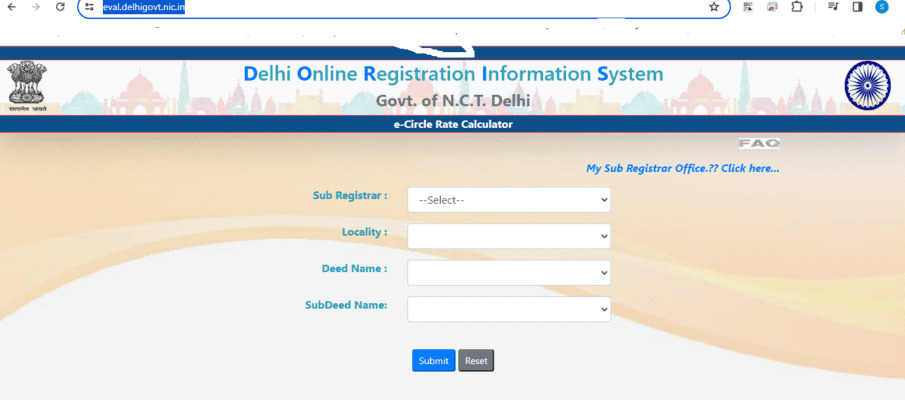

- Go to the authorized webpage: https://eval.delhigovt.nic.in/

- Complete the information requested below:

- Owner's gender

- Location of the property

- Size of the property

- Kind of property

- Parking space and region available (if relevant)

- Value of consideration

- Kind of apartment (government or private)

- Amount of levels in the structure

Once you have entered the information, the stamp duty amount for the transaction in Delhi will be displayed on your screen.

Methods for Paying Stamp Duty in Delhi

Stamp duty in Delhi now needs to be paid online due to the implementation of e-stamping. To complete a payment, go to the official website of the Stock Holding Corporation of India Limited (SHCIL), which oversees e-stamping in Delhi: www.shcilestamp.com.

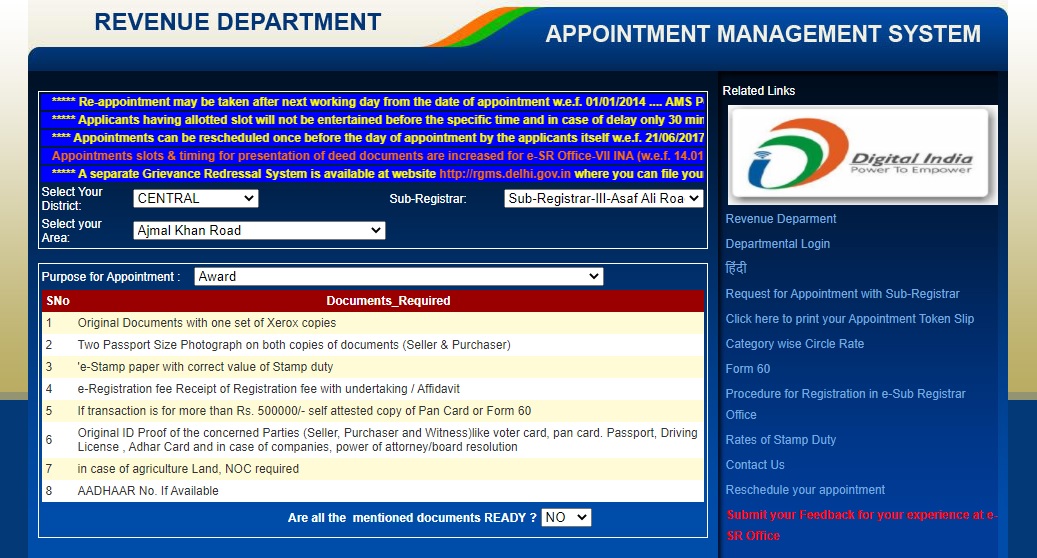

Payment options include net banking, debit/credit cards, and authorized collection centers (ACC) that accept cash payments. Once the payment has been made, buyers need to arrange a meeting with the sub-registrar's office by visiting srams.delhi.gov.in.

Documents Required for Property Registration in Delhi

- Deed of sale

- Identity and address proofs for the buyer, seller, and witnesses.

- Two small photos of buyers and sellers that are the size of a passport.

- Procure an electronic stamp paper with the accurate stamp duty amount in Delhi.

- Electronic proof of payment for registration fees

- Self-certified duplicate of PAN card/Document 60

- No-objection certificate (NOC) is required when registering land or plot.

- Original documents along with one photocopy of each.

- Two witnesses need to provide proof of their identity and address.

- Evidence of payment for Tax Deducted at Source

Also Read: Eastern Peripheral Expressway: Bridging Noida, Faridabad, and Ghaziabad to Delhi-NCR

Property Registration Transfer Fee in Delhi

Apart from the stamp duty in Delhi, buyers of homes are also required to pay a transfer fee during the registration process. The Delhi government has given the green light for an increase in transfer duty rates for properties worth more than ₹25 lakh, starting in July 2023.

Women and transgender individuals will be charged a 3% transfer tax (previously 2%), while men will be charged 4% (previously 3%).

Registration fees in Delhi are plotted.

Stamp duty in Delhi is also imposed on the registration of plots. The rates stay consistent with those for similar properties.

- Men purchasing: 6%

- Women shoppers: 4%

- Ownership shared by multiple parties: 5%

- Male buyers will be charged 5.5% for plots under NDMC control, while female buyers will be charged 3.5%.

Factors Affecting Stamp Duty in Delhi

Multiple elements impact the stamp duty in Delhi, rendering it a crucial component of real estate deals.

- Location of the property: Urban and premium areas lead to increased stamp duty as a result of the elevated property value.

- Circle Rates: Properties are categorized from A to H, and stamp duty is determined by either the circle rate or the actual transaction value, whichever is greater.

- Usage of Property: Stamp duties for commercial properties are usually higher compared to residential properties.

- Age of property: New properties in Delhi command higher stamp duty compared to older properties, which have depreciated in value.

- Amenities like pools or gyms in properties raise their value and also raise the stamp duty.

- Discounts based on gender: Female property buyers in Delhi can take advantage of reduced stamp duty rates, providing them with financial incentives.

- Elderly individuals: Although Delhi does not provide specific discounts for senior citizens, certain states do.

- Varieties of Deed: Various deeds, such as sale or gift deeds, are charged with different stamp duty rates.

- Market fluctuations arise from economic situations and supply-demand factors affecting property values and subsequent stamp duty in Delhi.

Penalties for Not Paying or Delaying Stamp Duty Payments

Not paying the accurate stamp duty in Delhi punctually can result in serious repercussions. Legal documents that do not have the necessary stamp duty are deemed invalid in court and cannot be utilized.

Monetary Penalties:

Fines are incurred due to delays in paying stamp duty. In Delhi, a fine of 2% per month is charged on the outstanding tax, with a cap at 200%.

Interest Charges:

Along with fines, interest accrues on overdue stamp duty from the date of document signing until total payment is received.

Process of E-Stamping in Delhi

Delhi's e-stamping system offers a safe and effective method for paying stamp duty in Delhi, decreasing dependence on traditional stamps and lowering the chances of fraud.

Authorized Collection Centers (ACCs):

SHCIL has collaborated with authorized collection centers such as banks and post offices in Delhi for buyers to make stamp duty payments. These centers provide secure e-stamp certificates for transactions that cannot be tampered with.

Online Payment Options:

Buyers in Delhi can pay stamp duty using net banking or debit cards. Once the payment is done, the e-stamp certificate can be instantly generated and printed out.

Tax Relief on Stamp Duty and Registration Charges

Homebuyers can avail deductions up to ₹1.5 lakh for stamp duty and registration charges on residential properties as per Section 80C of the Income Tax Act.

- The deduction is applicable when payments are made within the financial year.

- This deduction applies only to newly purchased residential properties.

- The property must be fully constructed, and the buyer should have legal ownership.

- If multiple people own something together, each of them can use part of the deduction, as long as it doesn't exceed ₹1.5 lakh.

- The tax deduction is only an option in the previous tax system.

Keep payment receipts and the official sale document to be eligible for this deduction when filing taxes.

Conclusion

Having a thorough grasp of the stamp duty and registration charges is essential when dealing with property transactions in Delhi, as they play a major role in determining the total cost of purchasing a property. Taking into account these costs is crucial when considering your purchase, as they depend on factors such as property location, type, and whether you are purchasing as an individual or with a partner. The implementation of e-stamping has made it easier to pay, providing a more transparent and secure way to meet your responsibilities.

Furthermore, comprehending the consequences of late payments and the possibility of tax deductions on stamp duty and registration fees can help simplify your process of purchasing a property. To guarantee a successful and lawful property transaction in Delhi, it is important to stay updated and follow the appropriate regulations.

Also Read: Noida Greater Noida Expressway: Route Map, Insights, Updates, and Real Estate Landscape

_1772441702.webp)

_1770976628.webp)

Ans 1. The stamp duty rate for male buyers in Delhi is 6%, except in certain areas where it varies.

Ans 2. Yes, female buyers benefit from lower rates, with a stamp duty rate of 5% in most areas of Delhi.

Ans 3. The registration fee in Delhi is 1% of the property’s transaction value, regardless of the buyer's gender.

Ans 4. For joint ownership (male and female), the stamp duty rate is typically 5% in Delhi.

Ans 5. Stamp duty in Delhi must be paid online via the e-stamping process through authorized platforms like SHCIL or its authorized collection centers.

Ans 6. Key documents include the sale deed, identity and address proofs, PAN card, e-stamp certificate, and payment receipts for stamp duty and registration fees.

Ans 7. Yes, penalties include fines of up to 200% of the unpaid amount and interest charges.

Ans 8. Yes, under Section 80C of the Income Tax Act, you can claim deductions for these charges up to ₹1.5 lakh for residential properties.