Table of Content

▲- At what point does mutation of property carry out?

- Significance of mutation of property

- Who needs to complete property mutation?

- Does the property owner have a deadline for changing the land through mutation?

- Mutation of property VS Registration of property

- What is the process for applying for mutation of property (Land)?

- What documents are required for mutation of property?

- What is the process for mutation of property?

- What is the process of mutation of property?

- How much time does it take to complete mutation of property?

- What is the mutation of property fee?

- Fee for mutation of property

- What happens if the mutation of property is left unfinished?

- Summary

Mutation of property is the procedure in which the name listed in official records is altered when a property is transferred to a new owner. Land and property changes aid the local government in determining property tax responsibility, utility fees, etc. and charging them appropriately. Different names are used for the process in varying states. The local area has various names for this process. In Uttar Pradesh and Bihar, the procedure is referred to as Dakhil-Khariz (entry-omission). This guide provides a comprehensive discussion on mutation, its significance, necessary paperwork, and consequences of delaying mutation.

At what point does mutation of property carry out?

Whenever a property is transferred, a mutation procedure is required. The act of changing property occurs under the following conditions:

- When you purchase real estate.

- When you receive ownership of a property through inheritance.

- When you inherit a property via a gift or inheritance.

- When you buy a property with the help of a power of attorney.

Also Read: Emaar India Unveils Eco-Friendly Luxury Residential Project in Gurugram

Significance of mutation of property

- Resale of property: It is a crucial document required for selling your property.

- Verifies rightful possession: This is the legal process through which ownership of a property is transferred from the seller to the buyer in a property sale. Therefore, with mutation present, it is possible to determine the correct owner of the property.

- No disagreements: Because ownership is clearly established, there are no legal disputes or conflicts over property ownership. This also avoids the possibility of property being sold to two different individuals due to lack of legal paperwork, which can result in double dealing.

- It is necessary to carry out property mutation in order to have documents as evidence for paying electricity and water bills, as well as for proving one's identity for different reasons.

- Property tax: This paperwork is also necessary to understand and timely pay property taxes. Not paying property tax on schedule could lead to a penalty or possibly the municipal body seizing your property.

Who needs to complete property mutation?

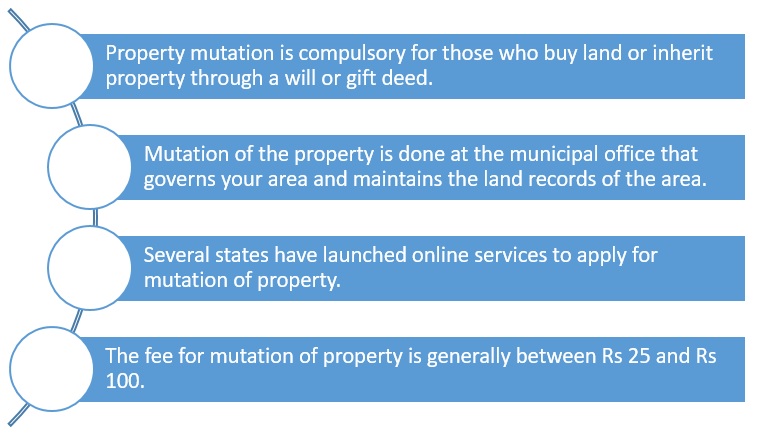

Individuals who purchase land or apartments or receive them through inheritance or gifting must complete the property mutation process.

Does the property owner have a deadline for changing the land through mutation?

Land buyers must complete the mutation process immediately, while flat and apartment buyers can do it at their convenience. Nevertheless, it is important to complete the task as soon as possible in order to maintain organization of your property documents.

Mutation of property VS Registration of property

| Mutation of property | Registration of property |

|

|

What is the process for applying for mutation of property (Land)?

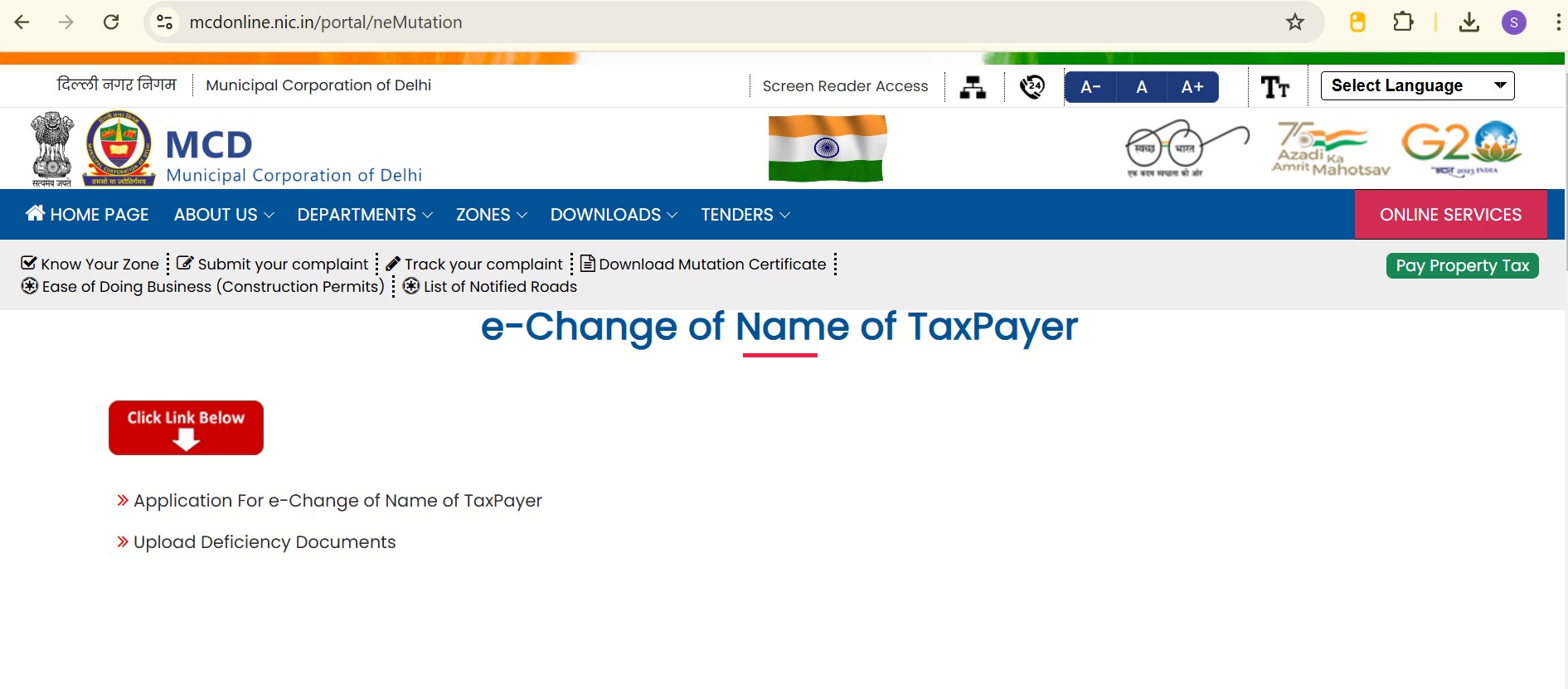

Local authorities in your region oversee land records, and it is necessary to complete the mutation process for your land or property. Although online mutation services are available in various states, a personal visit to the municipal office is still required to finish the task.

In Bihar, landowners have the option to complete land mutation online. Efforts have been made by states like West Bengal to transition the process to be fully online, but it is still a work in progress.

What documents are required for mutation of property?

Although the specific paperwork needed for finalizing the mutation of property may differ depending on the state, the purchaser must still provide the following documents:

- Accurately completed application form for property mutation.

- Duplicate of the sale/deed of ownership

- Sworn statement on stamped paper

- Bond of indemnity

- Duplicate Aadhaar Card

- - Revenues from property taxes

- Duplicate of will or inheritance certificate or death certificate of the owner (if needed)

What is the process for mutation of property?

- The purchaser needs to visit the town hall, bringing all necessary documentation.

- Once the application is submitted, the department will conduct a physical verification of the property before issuing the property mutation certificate.

- Since many states now permit online property transfers, you can easily go to the relevant official portal to proceed with the procedure.

- You can also verify the previous mutation or 'dakhil kharij' records on the official website by entering the property and owner details.

Also Read: How FDI (Foreign Direct Investment) Is Shaping Indian Real Estate in 2024

What is the process of mutation of property?

In this case, we will discuss how property mutation works in Uttar Pradesh for properties situated in the state capital, Lucknow.

Step 1: Go to the official website. You can locate the House Mutation option on the main menu. Press on it.

Step 2: Upon opening the new page, you will see the choices 'New Property Mutation' and 'Mutation Status'. To submit, select the 'New Property Mutation' choice. If you have submitted a mutation application already, you can select the 'Mutation Status' option to verify it.

Step 3: When a new page appears, provide your mobile number, house ID, and security pin in order to generate an OTP. This one-time password will be sent to the mobile number you have registered.

Step 4: Subsequently, you will be required to provide various details in a comprehensive property mutation form that will be displayed.

- Owner of the property.

- Identifier for a specific property.

- Location of the property

- Pin for property identification.

- Property type

- Cause for genetic change

You will need to provide relevant documents as proof when submitting. Once you have paid the property mutation fee, the property mutation process will be finished.

How much time does it take to complete mutation of property?

After you turn in your application and necessary documents, it may take the local government 15 to 30 days to update the record and provide you with a property mutation certificate. If there is a change in the land, it will take at least one month for the records to show the new land ownership.

What is the mutation of property fee?

Although the specific paperwork needed for the mutation procedure may differ depending on the state, the buyer must provide the following documents:

- Properly completed property mutation application form.

- Duplicate of the sale/deed of title

- Sworn statement on stamped papers

- Bond of indemnity

- Replica of Aadhaar Card

- Receipts from property taxes

- Duplicate of testament or inheritance certificate or certificate of death of the owner (if needed)

Fee for mutation of property

While a few states require a small payment for property and land mutation, others apply a property mutation rate based on a percentage of the property value.The cost of changing property ownership varies from Rs 25 to Rs 100 in specific states.

In areas with higher fees, property mutation charges could amount to at least 1% of the property's cost. It is important to also recognize that property mutation fee is a one-time obligation.

What happens if the mutation of property is left unfinished?

Buyers often delay the property mutation process because the penalty is low (usually ranging from Rs 25 to Rs 100) and they can do it at their convenience. It is recommended to finish the property mutation process once all other tasks related to the purchase are done. When you decide to sell the property later on, you will require evidence of the mutation. Moreover, performing a property mutation right after buying a property is much safer in terms of transferring ownership legally.

Summary

Property mutation is an important legal procedure that modifies land records to show changes in ownership following a sale, inheritance, or transfer. This blog highlights the significance of property mutation in order to uphold precise records and prevent legal conflicts. It lists the required paperwork such as the sale agreement, property tax records, and inheritance documents, as well as the varying fees based on the specific area. The procedure includes submitting necessary paperwork, then having the property physically verified by the authorities. Procrastinating on starting property changes can lead to fines, and although the procedure is simplified in several areas, it is still a crucial part of ensuring seamless property deals.

Also Read: Upcoming Affordable Housing Projects in Gurgaon 2024

_1771410929.webp)

Ans 1. Mutation of property refers to the process of transferring property ownership in land records after a sale, inheritance, or other changes in ownership.

Ans 2. Property mutation is essential for updating government records, ensuring legal ownership, and paying property taxes under the correct name.

Ans 3. Commonly required documents include the sale deed, property tax receipts, death certificate (in case of inheritance), and an application for mutation.

Ans 4. The fees for property mutation vary by state or municipality. It typically includes processing charges, stamp duty, and administrative fees.

Ans 5. Failure to mutate property records can lead to legal complications, disputes, and difficulties in selling the property later.

Ans 6. The time frame for property mutation varies by jurisdiction but generally takes 15-30 days after submitting the application and required documents.

Ans 7. In many regions, property mutation applications can be submitted online through the local municipal or revenue department’s portal.

Ans 8. No, property mutation does not confer ownership. It is a record update for tax purposes and reflects possession, not legal title.