Table of Content

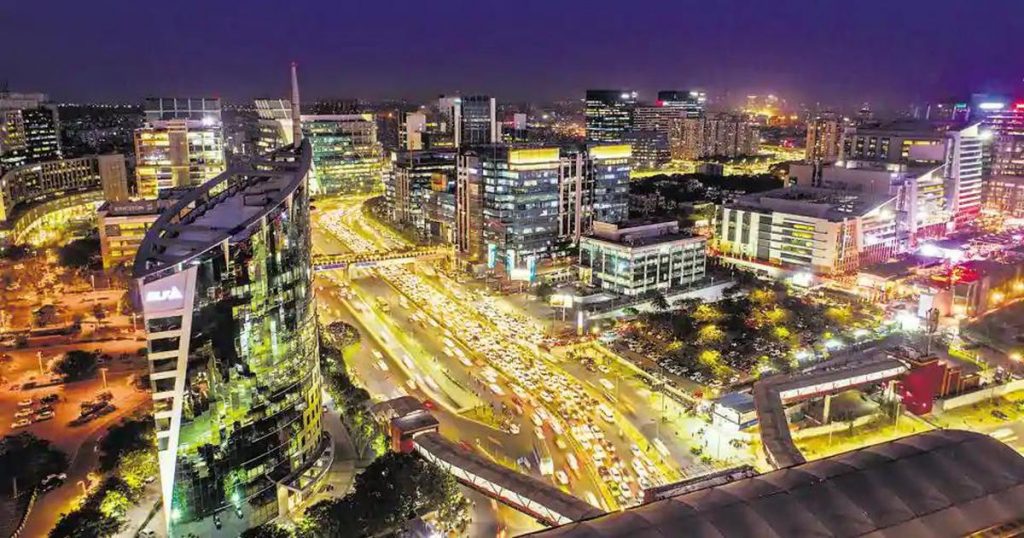

▲ New Delhi: DLF Ltd NSE Major Real Estate Company, 0.65%, sold nearly 90 detached apartments worth over Rs 300 crore in Gurugram and plans to launch more of these projects as demand for luxury residential properties has picked up in recent months.

The company plans to launch freestanding floors in DLF Stage I-IV in Gurugram, New Gurugram, and Panchkula, among others.

“We recently launched 88 residences in the form of premium detached apartments (at Rs. 3.75 - 4.25 crores each), distributed over 22 plots, in DLF City Phase 3 ... on Gurugram. They were sold at a record price, said Akash Uri, Senior Sales Executive. And DLF Manager.

The company plans to launch similar products in Panchkula, TriCity, New Gurgaon, and wherever there is an opportunity in DLF Phases 1 through 4, he told PTI.

"With real estate becoming more attractive as a preferred asset class compared to other traditional alternatives, homebuyers are looking to protect their accumulated savings by investing in long-term assets," said Urey.

He said the planned projects are still an attractive investment option due to the lower cost of investment, compared to ready-to-move properties.

He added that the planned parcels/projects provide high returns.

Ohri said the COVID-19 pandemic has attracted demand for reliable and orderly developers.

The company plans to launch similar products in Panchkula, TriCity, New Gurgaon, and wherever there is an opportunity in DLF Phases 1 through 4, he told PTI.

"With real estate becoming more attractive as a preferred asset class compared to other traditional alternatives, homebuyers are looking to protect their accumulated savings by investing in long-term assets," said Urey.

He said the planned projects are still an attractive investment option due to the lower cost of investment, compared to ready-to-move properties.

He added that the planned parcels/projects provide high returns.

Ohri said the COVID-19 pandemic has attracted demand for reliable and orderly developers.

Regarding the consumer profile, he said that in addition to the local buyers, NRIs make up a large portion of the buyer base that is investing in the planned parcels/projects.

“Planned developments have seen a surge in investment in recent years. For example, according to recent research not conducted by a leading real estate analysis firm, DLF City Phase 1-4 plots in Gurugram have and saw an average rise of 229% From 2009 to 2019. "

DLF, the country's largest real estate company, is aiming to achieve sales reserves of 2,500 crores in the current fiscal year, which is slightly better than the previous year, despite the COVID-19 epidemic.

During the financial year 2019-20, DLF sales reserve reached Rs 2,485 crore.

Full-time DLF Manager Ashok Tyagi recently said, "Demand is back in the housing market. Inquiries from potential home buyers are increasing."

He said the COVID-19 pandemic has prompted people to think about homeownership.

Regarding the consumer profile, he said that in addition to the local buyers, NRIs make up a large portion of the buyer base that is investing in the planned parcels/projects.

“Planned developments have seen a surge in investment in recent years. For example, according to recent research not conducted by a leading real estate analysis firm, DLF City Phase 1-4 plots in Gurugram have and saw an average rise of 229% From 2009 to 2019. "

DLF, the country's largest real estate company, is aiming to achieve sales reserves of 2,500 crores in the current fiscal year, which is slightly better than the previous year, despite the COVID-19 epidemic.

During the financial year 2019-20, DLF sales reserve reached Rs 2,485 crore.

Full-time DLF Manager Ashok Tyagi recently said, "Demand is back in the housing market. Inquiries from potential home buyers are increasing."

He said the COVID-19 pandemic has prompted people to think about homeownership.

DLF sales bookings in the first half of this financial year exceeded Rs 1,000 crores as sales in the second quarter increased sharply to Rs 853 crores from Rs 152 crores in the preceding quarter.

"Our target is to achieve sales of 750 million rupees each in the December and March quarters," said Tyagi.

DLF posted a 48% decrease in its consolidated net profit of Rs 232.14 crore for the quarter ending September 2020. Its net profit was Rs 445.83 crore in the prior-year period.

Total revenue decreased to Rs. 1,723.09 crore in the second quarter of this fiscal year from Rs. 1,940.05 crore in the corresponding period of the previous year.

DLF's net debt was at Rs. 5,215 crore at the end of the September quarter.

DLF sales bookings in the first half of this financial year exceeded Rs 1,000 crores as sales in the second quarter increased sharply to Rs 853 crores from Rs 152 crores in the preceding quarter.

"Our target is to achieve sales of 750 million rupees each in the December and March quarters," said Tyagi.

DLF posted a 48% decrease in its consolidated net profit of Rs 232.14 crore for the quarter ending September 2020. Its net profit was Rs 445.83 crore in the prior-year period.

Total revenue decreased to Rs. 1,723.09 crore in the second quarter of this fiscal year from Rs. 1,940.05 crore in the corresponding period of the previous year.

DLF's net debt was at Rs. 5,215 crore at the end of the September quarter.

_1773395099.webp)