Table of Content

▲

A Nationalised Bank is a financial institution that is owned and operated by the government. Public sector banks are also referred to as nationalised banks.

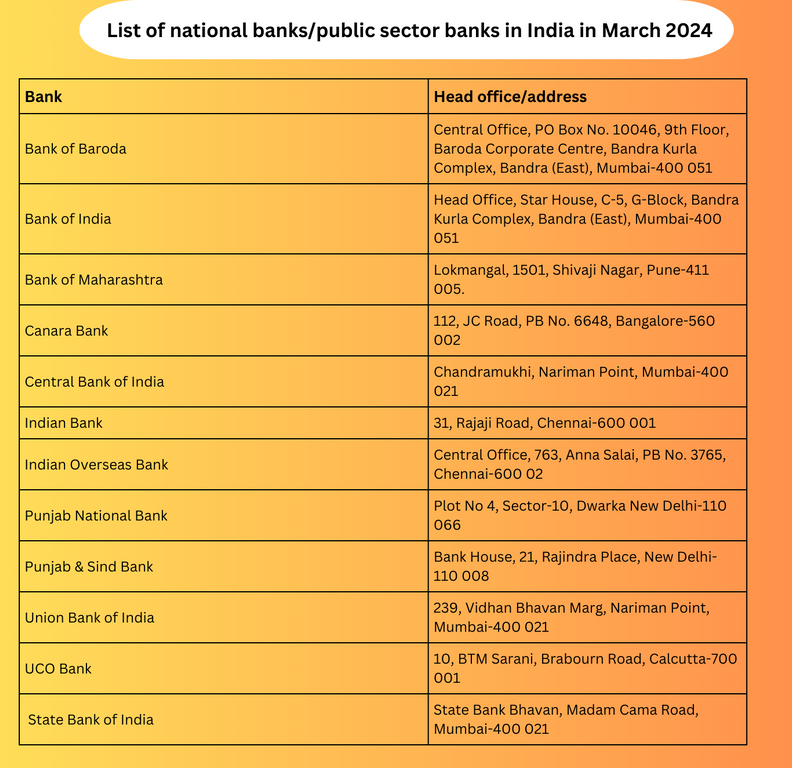

Nationalised banks in India in April 2024

After a government decision in 2021, India saw a notable decrease in the quantity of state-owned banks as 10 PSBs were consolidated into four banks. In April 2024, India has a total of 12 national banks.

1. SBI and its associate banks

The origins of State Bank of India (SBI) can be traced back to the establishment of the Bank of Calcutta in 1806. The oldest bank in the Indian subcontinent is a commercial one. SBI offers a variety of products and services to different types of customers including individuals, businesses, corporations, public entities, and institutional clients using its branches, outlets, joint ventures, subsidiaries, and associate companies.

Head office: State Bank of India, Central Office

Chairman’s Secretariat, P.B. No.12, Nariman Point

Mumbai – 400 021

Associate banks of SBI

All five associates joined State Bank of India on April 1, 2017, in the biggest consolidation effort in India's banking history. The merger of Bharatiya Mahila Bank with SBI also took place in that year.

Associate banks of SBI

State Bank of Bikaner and Jaipur

State Bank of Hyderabad

State Bank of Mysore

State Bank of Patiala

State Bank of Travancore

Bharatiya Mahila Bank

SBI, associated bank products and services

SBI and its affiliated banks offer a diverse array of products and services such as savings accounts, credit cards, fixed deposits, personal loans, home loans, business loans, debit cards, loans against property, car loans, gold loans, Mudra loans, and more.

Also Read: Applying for a home loan - Online vs Offline: Which One Is Better?

2. Bank of Baroda

Founded in July 1908, BoB is India's primary government bank with a robust presence within the country, backed by self-service options. The bank has a distribution network that consists of 8,200 branches, 10,000 ATMs, 1,200 self-service e-lobbies, and 20,000 business correspondents. The Bank operates globally with 100 branches/offices of subsidiaries in 20 different countries.

Bank of Baroda products and services

Bank of Baroda provides various services such as retail banking, rural/agri banking, wholesale banking, SME banking, wealth management, demat services, product inquiry, internet banking, NRI remittances, Baroda e-Trading, interest rate information, deposit products, loan products and ATM/debit cards.

Bank of Baroda address

Head office: Baroda House, Mandvi

Vadodara – 390006

Gujarat

3. Bank of India

Established in September 1906, the bank was privately owned and operated until July 1969 when it was nationalized along with 13 other banks. It has more than 5100 branches across India in all states and union territories. There are a total of 45 international branches, consisting of 23 company-owned branches, 1 representative office, 4 subsidiary branches (equivalent to 20 branches), and one joint venture.

Bank of India products and services

Bank of India provides a wide variety of products and services such as retail banking choices like savings and current accounts, corporate banking solutions, SME banking facilities, agricultural banking services, international banking, NRI banking services, wealth management options, personal and housing loans, vehicle loans, credit cards, internet and mobile banking services, ATM services, insurance products, and investment opportunities.

Bank of India address

Head office: Express Towers

Nariman Point

Mumbai – 400 021

Also Read: All about home loan pre-closure

4. Bank of Maharashtra

Established on September 16, 1935, with a capital of Rs 10 lakh, Bank of Maharashtra (BoM) currently boasts the biggest network of 1,375 branches among all public sector banks in Maharashtra. The lender provides deposit services and dematerialized account facilities at 131 branches. It is equipped with 345 ATMs in its network.

Bank of Maharashtra products and services

Bank of Maharashtra provides a variety of banking services such as retail and corporate banking, SME banking, agricultural banking, NRI banking, government business services, international banking, treasury operations, internet and mobile banking, ATM services, credit cards, insurance products, and investment opportunities.

Bank of Maharashtra address

Head office: Lok Mangal

1501, Shivaji Nagar, Post Box No. 919

Pune – 411 005

5. Canara Bank

Ammembal Subba Rao Pai established Canara Bank in Mangalore, Karnataka in July 1906. The bank has experienced different stages of growth during its hundred years of operation. Over time, the bank has grown its market presence to become a significant financial group with 13 subsidiaries/sponsored institutions in both India and other countries. By September 2023, Canara Bank caters to more than 11.19 crore clients with a total of 9,518 branches and 12,118 ATMs/Recycler situated in every Indian state and Union Territory.

Canara Bank products and services

The services offered by Canara Bank range from retail and corporate banking to NRI banking, government business services, international banking, treasury operations, digital and mobile banking, ATM services, credit cards, insurance products, and investment options.

Canara Bank address

Head office: 112, Jayachamarajendra Road

Post Box No. 6648

Bangalore – 560 002

6. Central Bank of India

Established in 1911 by Sir Sorabji Pochkhanawala, Central Bank of India was the initial Indian commercial bank owned and operated entirely by Indians. The Central Bank of India has branches in all states and 7 Union Territories of India, totaling 4,493 branches, 1 extension counters, and 10 satellite offices as of March 2023.

Central Bank of India product and services

The services offered by this public lender comprise digital banking, deposits, retail loans, agricultural loans, SME loans, corporate banking, NRI banking, and more.

Central Bank of India address

Head office: Express Towers

Nariman Point

Mumbai – 400 021

Head office: Central Office

Chander Mukhi, Nariman Point

Mumbai – 400 021

7. Indian Overseas Bank

Indian Overseas Bank (IOB) was established on February 10, 1937, with the primary aim of focusing on foreign exchange operations in banking to expand the bank's presence internationally. IOB commenced operations at the same time in Karaikudi, Chennai, and Rangoon in Burma (currently Myanmar), and later opened a branch in Penang, Malaysia. During Independence, IOB had 38 branches in India and 7 overseas branches, with deposits totaling Rs.6.64 crores and advances amounting to Rs 3.23 crore.

IOB was among the 14 major banks that got nationalised in 1969. In 1969, just before becoming nationalized, IOB had 195 branches across India, holding deposits totaling Rs.67.70 Cr. and Advances amounting to Rs.44.90 crore. The bank is currently operating in four countries overseas: Singapore, Hong Kong, Thailand, and Sri Lanka.

Indian Overseas Bank product and services

IOB provides a range of retail banking services including savings, current, and term deposit accounts, customized to suit each customer's requirements. The bank offers various types of loans such as car, mortgage, and housing loans. Specialized loans and trade finance solutions are advantageous for small and medium-sized enterprises as well as corporate clients. NRI services and a specialized assistance center provide assistance for Non-Resident Indians, supplying important information and help. Remittance services enable secure global money transfers, while safe deposit boxes offer security for valuable items.

Indian Overseas Bank address

Head office: Central Office

762, Anna Salai, P.B. No. 3765

Chennai – 600 002

8. Indian Bank

Indian Bank, based in Chennai, is a public sector bank in India, founded in 1907. It maintains relationships with 227 foreign correspondent banks across 75 nations. In 2020, Allahabad Bank merged with Indian Bank, propelling it to become the seventh largest bank in India. 41,645 employees and 5,814 branches with 4,929 ATM and cash deposit machines serve more than 100 million customers. The bank's overall business has reached Rs 1,094,752 crore by March 2023.

Indian Bank product and services

Indian Bank provides savings and checking accounts, as well as home and personal loans, along with investment choices such as mutual funds. They offer insurance, support for businesses, international banking, and government programs. Indian Bank provides a diverse range of financial services to meet different requirements.

Indian Bank address

Head office: Indian Bank Building

P.B. No. 1384, 31, Rajaji Road

Chennai – 600 001

9. Punjab National Bank

PNB, India's original Swadeshi Bank, commenced its operations in Lahore on April 12, 1895. The bank was the initial bank solely operated by Indians using Indian funds. Throughout the lengthy history of the Bank, PNB has undergone mergers with a total of 9 other banks. By September 2023, the bank possessed 51,519 delivery channels, comprising 10,092 domestic branches, 2 international branches, 12,645 ATMs, and 28,782 business correspondents.

Punjab National Bank product and services

Punjab National Bank offers savings and checking accounts, home and personal loans, mutual funds, as well as online banking services. They provide insurance, assistance for companies, international banking, and public initiatives.

Punjab National Bank address

Head office: 7, Bhikaji Cama Place, Africa Avenue

New Delhi – 110 066

10. Union Bank of India

Established in 1943, UCO Bank is a governmental organization that operates as a commercial banking institution. The Board of Directors is made up of government officials and skilled professionals such as accountants, management experts, economists, and businessmen. UCO Bank plays a crucial role in offering financial assistance to various sectors like agriculture, industry, trade & commerce, service sector, and infrastructure sector. With over 3,000 service units, including branches both in India and abroad, the bank has a wide network.

Union Bank of India product and services

Union Bank of India provides a range of financial services, including savings and current accounts, home and personal loans, mutual fund investments, and digital banking options. They offer a variety of financial services including insurance, SME and corporate banking, international banking, and government scheme benefits, all customized to meet customers' specific needs.

Union Bank of India address

Head office: Union Bank Building

Central Office, 239, Backbay Reclamation

Post Box No. 93A, Nariman Point

Mumbai – 400 021

11. Punjab & Sind Bank

Established in 1908 in Amritsar by Bhai Vir Singh, Sir Sunder Singh Majitha, and Sardar Tarlochan Singh, Punjab & Sind Bank was founded with the core value of social responsibility towards assisting the less privileged in society. The bank based in Delhi has 1,553 branches throughout India. Out of this number, 635 branches are located in Punjab.

Punjab & Sind Bank product and services

Punjab & Sind Bank provides various financial products and services such as savings and current accounts, home and car loans, mutual funds, and digital banking services. Additionally, they offer insurance, banking solutions for SMEs and corporations, international banking services, and government scheme benefits to make things easier for customers.

Punjab & Sind Bank address

Head office: Bank House

Fourth floor, 21, Rajendra Place

New Delhi – 110 008

12. UCO Bank

Established in 1943, UCO Bank is a commercial bank owned by the government of India. Formerly known as The United Commercial Bank, the bank based in Kolkata has 43 zonal offices spread throughout India. According to the Brand Trust Report 2014, UCO Bank was placed at the 294th position among India's most reputable brands. It climbed 796 spots to reach the 1090th position among India's most trustworthy brands in the Brand Trust Report 2013.

UCO Bank product and services

UCO Bank offers various international banking services, such as NRI Banking through its specialized NRI Corner. The bank provides foreign currency loans, funding, and services for exporters and importers, safe remittance choices, foreign exchange, and treasury services. Residents can also take advantage of Resident Foreign Currency (Domestic) Deposits, in addition to correspondent banking services.

UCO Bank address

Head office: 10, Biplabi Trailokya Maharaj, Sarani

Kolkata – 700 001

Also Read: Latest RBI Guidelines for Home Loans 2024

List of private banks in India in 2024

- Axis Bank Ltd.

- Bandhan Bank Ltd.

- CSB Bank Ltd.

- City Union Bank Ltd.

- DCB Bank Ltd.

- Dhanlaxmi Bank Ltd.

- Federal Bank Ltd.

- HDFC Bank Ltd

- ICICI Bank Ltd.

- Induslnd Bank Ltd

- IDFC First Bank Ltd.

- Jammu & Kashmir Bank Ltd.

- Karnataka Bank Ltd.

- Karur Vysya Bank Ltd.

- Kotak Mahindra Bank Ltd

- Nainital Bank Ltd.

- RBL Bank Ltd.

- South Indian Bank Ltd.

- Tamilnad Mercantile Bank Ltd.

- YES Bank Ltd.

- IDBI Bank Ltd.

Also Read: How are NBFCs providing housing loans in India? What is its impact?

List of scheduled regional rural banks in India in 2024

- Andhra Pragathi Grameena Bank

- Andhra Pradesh Grameena Vikas Bank

- Arunachal Pradesh Rural Bank

- Aryavart Bank

- Assam Gramin Vikash Bank

- Bangiya Gramin Vikas Bank

- Baroda Gujarat Gramin Bank

- Baroda Rajasthan Kshetriya Gramin Bank

- Baroda UP Bank

- Chaitanya Godavari Grameena Bank

- Chhattisgarh Rajya Gramin Bank

- Dakshin Bihar Gramin Bank

- Ellaquai Dehati Bank

- Himachal Pradesh Gramin Bank

- J&K Grameen Bank

- Jharkhand Rajya Gramin Bank

- Karnataka Gramin Bank

- Karnataka Vikas Grameena Bank

- Kerala Gramin Bank

- Madhya Pradesh Gramin Bank

- Madhyanchal Gramin Bank

- Maharashtra Gramin Bank

- Manipur Rural Bank

- Meghalaya Rural Bank

- Mizoram Rural Bank

- Nagaland Rural Bank

- Odisha Gramya Bank

- Paschim Banga Gramin Bank

- Prathama UP Gramin Bank

- Puduvai Bharathiar Grama Bank

- Punjab Gramin Bank

- Rajasthan Marudhara Gramin Bank

- Saptagiri Grameena Bank

- Sarva Haryana Gramin Bank

- Saurashtra Gramin Bank

- Tamil Nadu Grama Bank

- Telangana Grameena Bank

- Tripura Gramin Bank

- Utkal Grameen bank

- Uttar Bihar Gramin Bank

- Uttarakhand Gramin Bank

- Uttarbanga Kshetriya Gramin Bank

- Vidharbha Konkan Gramin Bank

List of scheduled foreign banks in India in 2024

- AB Bank Ltd.

- American Express Banking Corporation

- Australia and New Zealand Banking Group Ltd.

- Barclays Bank Plc.

- Bank of America

- Bank of Bahrain & Kuwait BSC

- Bank of Ceylon

- Bank of China

- Bank of Nova Scotia

- BNP Paribas

- Citibank N.A.

- Cooperatieve Rabobank U.A.

- Credit Agricole Corporate & Investment Bank

- Credit Suisse A.G

- CTBC Bank Co., Ltd.

- DBS Bank India Limited*

- Deutsche Bank

- Doha Bank Q.P.S.C

- Emirates Bank NBD

- First Abu Dhabi Bank PJSC

- FirstRand Bank Ltd

- HSBC Ltd

- Industrial & Commercial Bank of China Ltd.

- Industrial Bank of Korea

- J.P. Morgan Chase Bank N.A.

- JSC VTB Bank

- KEB Hana Bank

- Kookmin Bank

- Krung Thai Bank Public Co. Ltd.

- Mashreq Bank PSC

- Mizuho Bank Ltd.

- MUFG Bank, Ltd.

- NatWest Markets Plc

- NongHyup Bank

- PT Bank Maybank Indonesia TBK

- Qatar National Bank (Q.P.S.C.)

- Sberbank

- SBM Bank (India) Limited*

- Shinhan Bank

- Societe Generale

- Sonali Bank PLC

- Standard Chartered Bank

- Sumitomo Mitsui Banking Corporation

- United Overseas Bank Ltd

- Woori Bank

SBM Bank (India) Limited, a subsidiary of the SBM Group, and DBS Bank India Limited, a subsidiary of DBS Bank, were granted licenses on December 6, 2017 and October 4, 2018, respectively, to operate as wholly owned subsidiaries for banking business in India. They have commenced activities on December 01, 2018 and March 01, 2019, respectively.

Also Read: Consequences of Home Loan Default | Challenges with Home Loan Repayment.

_1772441702.webp)

Ans 1. 12 nationalised banksThe 12 nationalised banks include Punjab National Bank (PNB), Bank of Baroda (BoB), Bank of India (BoI), Central Bank of India, Canara Bank, Union Bank of India, Indian Overseas Bank (IOB), Punjab, and Sind Bank, Indian Bank, UCO Bank, Bank of Maharashtra, and State Bank of India (SBI).

Ans 2. As of 2021, the 12 Public Sector banks in India are State Bank of India, Bank of Maharashtra, UCO Bank, Punjab and Sind Bank, Bank of Baroda, Punjab National Bank, Central Bank of India, Union Bank of India, Indian Bank, Canara Bank, Indian Overseas Bank, Bank of India.

Ans 3. The 12 public sector banks are - State Bank of India, Punjab National Bank, Bank of Baroda, Bank of India, Central Bank of India, Canara Bank, Union Bank of India, Indian Overseas Bank, Punjab and Sind Bank, Indian Bank, UCO Bank, and Bank of Maharashtra.

Ans 4. The oldest bank in India is The Madras Bank (1683), followed by the Bank of Bombay, founded in 1720, which is then followed by the Bank of Hindustan, founded in 1770.

Ans 5. HDFC Bank is a leading private sector bank known for its robust financial performance. It offers a wide range of banking and financial services to retail, corporate, and institutional customers.