Table of Content

▲

Failing to pay your mortgage can lead to severe legal repercussions. To prevent money problems, make sure to check out the blog for information on how this system operates and steps you can take to safeguard your finances.

Failing to make payments on your mortgage not only damages your credit rating but also hinders your ability to obtain loans from banks or other financial entities in the future. When you borrow money against a property, you must reimburse the entire sum, which includes the principal and interest, through Equated Monthly Installments (EMIs). As long as you keep making timely EMI payments, your connection with the bank stays strong.

Sometimes, situations can become challenging, making it hard to fulfill our financial obligations, especially during times of job uncertainty or income loss due to health issues or disability. In order to prevent loan borrowers from defaulting on payments, the Reserve Bank of India has granted a six month moratorium for all term loans. Read the article to see the consequences of failing to make your mortgage payments and learn how to effectively manage the situation.

What Happens If You Fail to Repay Your Home Loan?

Here is what happens if you miss out on making home loan repayments.

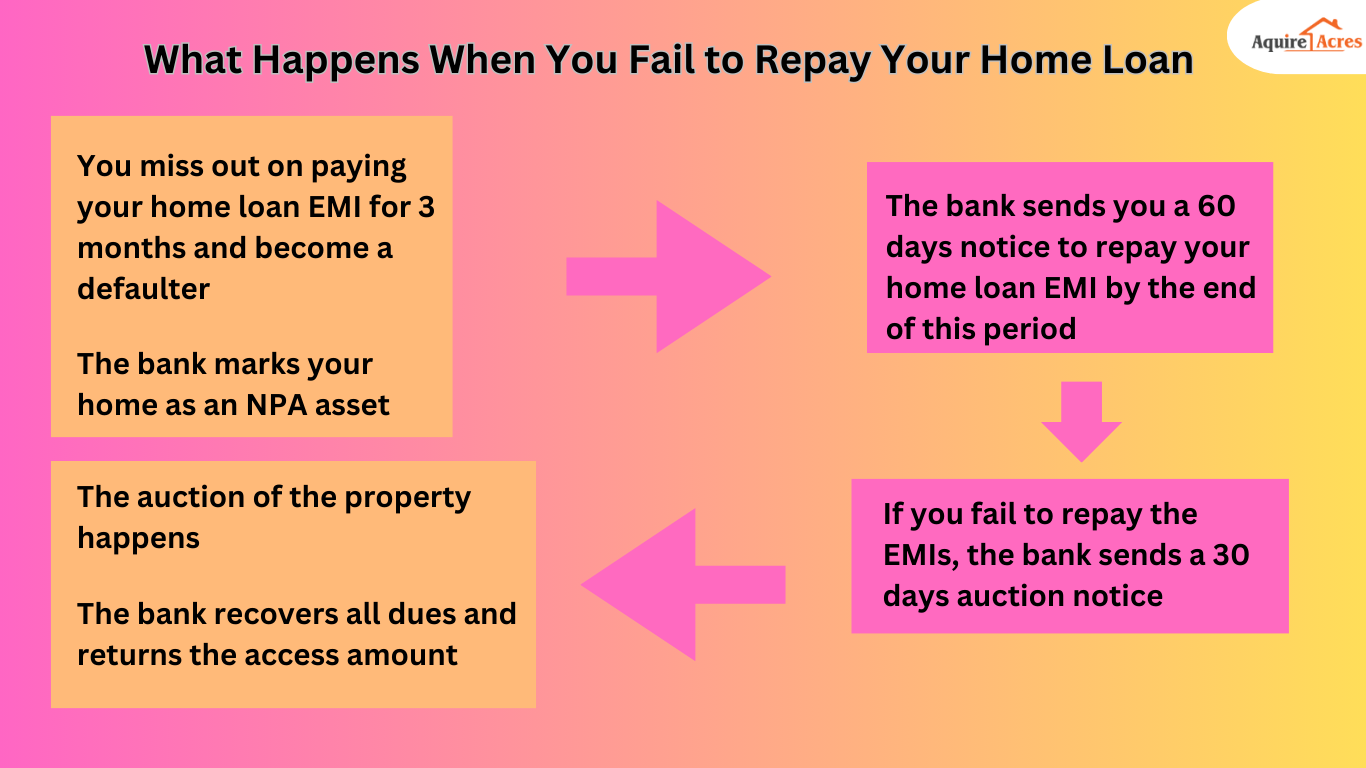

Legal Ramifications: If you fail to make payments for up to three consecutive installments on your home loan, the bank may take possession of your property. However, there are specific procedures governing such situations. Initially, missing the first installment does not prompt action from the bank. For the second missed installment, the bank typically sends a reminder. However, if three consecutive installments are missed, the bank will issue a legal notice demanding repayment and initiate the recovery process.

Home Loan Default: Should you miss three consecutive installments of your home loan repayment, your bank may classify your home as a non-performing asset (NPA). NPAs do not yield income for lenders and prompt them to pursue further actions for loan recovery.

Because every residential mortgage is backed by the property as collateral, the bank or financial institution has the ability to start legal actions to enforce the mortgage. They have the option to sell the asset through a public auction or private treaty after attaching it. They have the option to utilize their rights granted by the Recovery of Debts Due to Banks and Financial Institutions Act, 1993 or the SARFAESI Act. "The second option is the fastest solution," according to Sagar Kadam, who is a Partner at DSK Legal.

Property Seizure: Following the issuance of a legal notice, banks typically allow approximately two months for repayment of missed loan installments. If repayment is not made within this timeframe, the bank will issue an auction notice, indicating the estimated value of the property. Should repayment not commence prior to the auction date, which is typically set one month after the auction notice is received, the bank will proceed with auction formalities. During this six-month period, borrowers have the opportunity to negotiate a settlement by clearing their outstanding dues with the bank.

Credit Score Impact: Delinquent home loan repayments also have repercussions on your credit score. Banks report negative financial information to credit agencies for borrowers who miss payments, which can significantly impact creditworthiness. Most lenders assess credit reports to gauge financial responsibility before approving loan applications. A poor credit score complicates future borrowing from any financial institution.

Future Loan Challenges: Defaulting on a home loan can severely hinder your financial prospects, particularly by making it harder to secure loans in the future. Lenders perceive defaulted borrowers as high-risk, potentially resulting in higher interest rates or denial of credit. Obtaining mortgages, car loans, or credit cards becomes more challenging. Moreover, future loan approvals may necessitate additional documentation or collateral, further complicating credit acquisition. To safeguard creditworthiness, timely home loan payments are imperative.

Also Read: What does the Married Women’s Property Act entail?

Key Measures to Avoid Being a Home Loan Repayment Defaulter

Here is what you can do to avoid being a home loan repayment defaulter.

Loan Restructuring: Initiate a dialogue with your bank to explore options for restructuring your home loan based on your financial circumstances. Present a detailed explanation of what led to the situation and propose a comprehensive financial plan outlining how you intend to rectify it. Restructuring can entail deferring EMIs for a temporary period or reducing the EMI amount, albeit extending the loan tenure. Additionally, negotiating for reduced interest rates on the outstanding amount is feasible.

Asset Liquidation: Consider liquidating other investments earmarked for emergencies, such as bonds, shares, or mutual funds. Alternatively, you may opt to borrow funds from friends or family to fulfill home loan obligations, with the intention of repaying them later. This strategy can help avoid accruing higher interest rates on delayed payments.

Engage Your Relationship Manager: Rather than severing communication channels, engage with your relationship manager at the bank or financial institution to explore available options. Assess these options to determine the most suitable course of action based on your needs. Remember, prudent management of the situation can facilitate the rebuilding of your financial stability.

Debt Consolidation: Explore the possibility of consolidating all outstanding dues, including home loan repayments, by acquiring a personal loan. Despite typically higher interest rates on personal loans compared to home loans, a favorable credit report can secure reduced interest rates on a larger loan amount. This approach allows for home loan prepayment while preserving a favorable credit score.

Property Disposal: As a final recourse, consider selling the property to settle the home loan repayment. However, obtaining lender approval for such transactions is imperative due to default on loan repayments. Notably, self-disposal of the property may yield a higher value compared to the auction estimate determined by the bank.

Also Read: 10 suggestions for avoiding scams from real estate brokers while purchasing a home

Your Rights When Can’t Repay Home Loan

Financial lenders need to follow the proper process to recover dues. Here are a few rights that borrowers have during the proceedings if they default in making their home loan repayment.

Advance Notification: Every borrower is entitled to receive prior notification from the bank regarding impending legal proceedings. Banks and financial institutions are required to adhere to a specific procedure before proceeding with the sale or auction of the borrower's property. According to standard protocol, if home loan installments remain outstanding for more than 90 days, the borrower must be given a notice of 60 days to settle the dues. If the borrower fails to do so, the bank must issue another notice, providing a 30-day period before further action is taken.

Fair Asset Evaluation: The bank is obligated to provide the borrower with a notice containing a fair valuation of their property, along with the date and time of the auction. If the borrower believes the property has been undervalued, they have the right to request a reevaluation or seek an alternative buyer.

Surplus Refund: Borrowers retain the right to oversee the auction process of their property. Following the recovery of the outstanding home loan amount from the auction price, the bank is obligated to refund any surplus amount to the borrower.

What Does it Mean to Default on Home Loan?

Failing to repay a home loan despite receiving numerous notices is considered as default. A home loan consists of collateral that the lender can take if necessary. The lender will refrain from directly taking the property and instead will wait for three months before categorizing the asset as non-performing. The initiation of seizing the property begins with the implementation of the SARFAESI Act, 2002. Despite invoking this act, the lender still allows the borrower a two-month grace period to repay the loan.

Final Thoughts on Defaulting Home Loan Repayments

Explore your options, such as extending the loan tenure, negotiating a lower interest rate, or consolidating debts, and make informed decisions.

- Initiate contact with your bank to outline your plan for addressing missed EMIs.

- Assemble all pertinent home loan documents, including EMI payment receipts, for reference during discussions.

- Develop a compelling financial strategy to demonstrate to the bank how you intend to manage your obligations.

- Request a reasonable grace period to regain financial stability and restore your finances to their previous state.

If you maintain a strong rapport with your bank, they may offer assistance, recognizing your responsible borrowing behavior and your commitment to clearing your dues promptly. Utilize our Home Loan EMI Calculator to estimate the amount you can feasibly pay within a given timeframe. Negotiating and reaching an agreement with your bank is preferable to defaulting on your home loan repayment.

_1713354624.webp)

_1771224636.webp)

Ans 1. The lender will not directly seize the property but they will wait for three months before declaring the asset as a non-performing asset. They start the process of seizing the property by enforcing the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI).

Ans 2. The penalties are usually 1 to 2 per cent of the loan amount. A penal interest, over and above the regular one, will also be levied. These charges can increase a person's financial burden and may lead to a debt cycle. Borrowers get a grace period to repay any pending dues.12

Ans 3. Eviction Your lender may also get a Warrant for Possession. A sheriff (or bailiff) will come to your home, evict you from the premises and change the locks. This does not release you from the obligation to pay your loan. Your lender may sell your home and recover any outstanding balance by taking further legal action.

Ans 4. Defaulting on a loan is considered a civil offence, and criminal charges are not typically applied in such cases. Consequently, genuine loan defaulters are not subject to imprisonment. If you are genuinely unable to repay your loan, it is advisable to engage in negotiations with the lender.