Table of Content

▲

Paying rent using a credit card is gaining popularity in India, thanks to the convenience and rewards it offers. But with so many platforms available, how do you pick the right one? This guide breaks down the best platforms to make rent payments hassle-free, cost-effective, and rewarding.

Let’s dive into the details and explore the features, fees, and benefits of the most trusted platforms to pay rent with a credit card in 2024.

- ePayRent

ePayRent is a platform designed specifically for rent payments. Its secure interface and efficient service make it a top choice for tenants and landlords.

Why Choose ePayRent?

- Smooth rent transfers to landlords.

- Helps you maintain a record for tax benefits.

- Secure payment gateway.

Fees: ~1.5% to 2% (plus GST).

Ideal For: Tenants looking for simplicity and ease.

Benefits:

- Helps generate rent receipts for tax exemption (HRA benefits).

- Enables automatic payments for hassle-free management.

- Secured and encrypted transactions.

Also Read: Ayodhya’s Real Estate Pauses a Year After Ram Temple Inauguration

- CRED

CRED transforms paying rent into a rewarding experience. Known for its sleek design and exclusive offers, CRED ensures you get more out of every transaction.

Why Choose CRED?

- Earn CRED coins that can be redeemed for discounts and offers.

- Minimal charges during special promotions.

- Fast and intuitive user experience.

Fees: ~1.5% to 2%.

Ideal For: Tenants who love earning rewards on their payments.

Benefits:

- Earn CRED coins that can be redeemed for exclusive deals, discounts, and gift vouchers.

- Offers curated cashback campaigns during rent payments.

- Fast, intuitive, and seamless user experience.

- MyGate

MyGate is not just a rent payment platform but a comprehensive app for gated community residents. It simplifies your lifestyle while managing rent payments.

Why Choose MyGate?

- Option for recurring payments.

- Built-in landlord verification.

- Complete community management tools.

Fees: ~1.5% to 2%.

Ideal For: Residents of housing societies and gated communities.

Benefits:

- Enables easy recurring rent payments with reminders.

- Ensures landlord verification for secure transfers.

- Also manages community-related payments like maintenance charges.

- PayZapp (By HDFC Bank)

.jpg)

If you’re an HDFC Bank customer, PayZapp is your go-to platform for rent payments. It offers smooth integration with HDFC credit cards and exclusive rewards.

Why Choose PayZapp?

- Special benefits for HDFC users.

- Reliable and secure payments.

- Convenient bill and rent management.

Fees: ~1.5% to 2%.

Ideal For: HDFC credit cardholders.

Benefits:

- Exclusive cashback and discounts for HDFC Bank customers.

- Multiple payment options like UPI, cards, and wallets for flexibility.

- Secure and reliable payment processing.

- Paytm

Paytm has been a trusted digital payment platform for years. Its versatility extends to rent payments, where you can enjoy regular cashback and promotions.

Why Choose Paytm?

- Cashback campaigns that reduce costs.

- Easy-to-use interface for payment tracking.

- Multi-purpose app for financial transactions.

Fees: ~2%.

Ideal For: Paytm users who want to maximize cashback opportunities.

Benefits:

- Instant payments with clear transaction records.

- Cashback offers to reduce overall transaction costs.

- Versatility as it supports multiple payment services, including utility bills.

- Paymatrix

Paymatrix is a specialized platform for rent payments, designed to simplify the process for tenants while offering financial tools.

Why Choose Paymatrix?

- Flexible payment schedules.

- Automatic invoices for tax filing.

- Improves credit scores with timely payments.

Fees: ~1.5% to 2%.

Ideal For: Tenants who value financial tracking and flexibility.

Benefits:

- Generates automated invoices for accurate record-keeping.

- Allows flexible payment schedules, ensuring timely payments.

- Boosts credit score with regular and timely payments.

- Freecharge

Freecharge lets you pay rent while enjoying cashback and discounts, making it a wallet-friendly option.

Why Choose Freecharge?

- Occasional discounts and cashback offers.

- Seamless and fast transactions.

- Easy integration with other payment methods.

Fees: ~2%.

Ideal For: Budget-conscious users making smaller rent payments.

Benefits:

- Occasional cashback and discounts to reduce transaction costs.

- Simple, fast, and efficient payment process.

- Secure gateway for hassle-free payments.

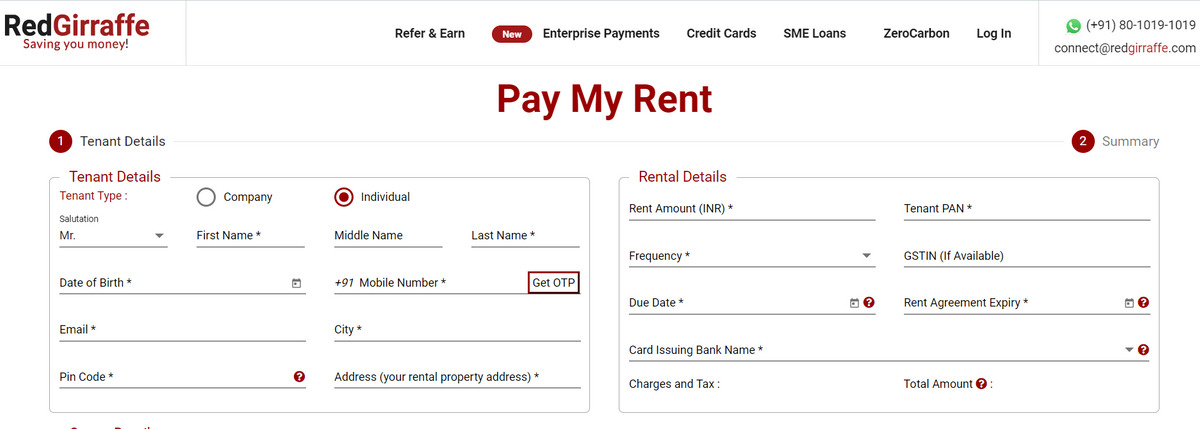

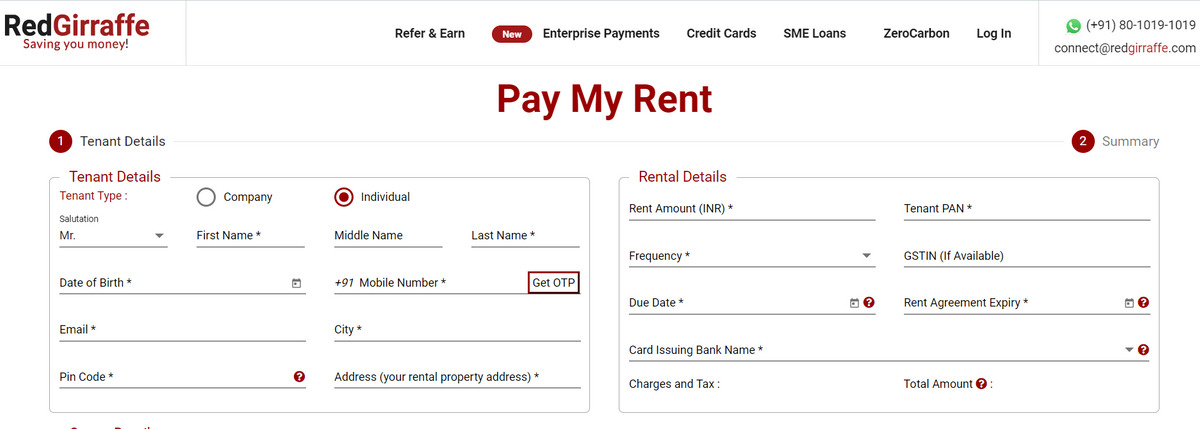

- RedGiraffe

RedGiraffe is a game-changer when it comes to rent payments. With its low transaction fees, it’s perfect for those looking to save money while ensuring secure transfers.

Why Choose RedGiraffe?

- Lowest transaction fees in the market (~0.39% + GST).

- Transparent, landlord-friendly processes.

- Direct integration with multiple banks.

Fees: ~0.39% (plus GST).

Ideal For: Tenants who prioritize low fees and secure payments.

Benefits:

- Offers the lowest transaction fee (~0.39% + GST) among all platforms.

- Transparent processes ensure landlords receive payments directly.

- Easy integration with multiple banks, making it tenant-friendly.

Which Platform Should You Choose?

Here’s a quick comparison to help you decide:

|

Platform |

Key Benefits |

Fees |

Best For |

|

ePayRent |

Easy and straightforward |

~1.5% to 2% |

Hassle-free payment processing |

|

CRED |

Rewards and cashback |

~1.5% to 2% |

Reward enthusiasts |

|

MyGate |

Gated community services |

~1.5% to 2% |

Residents of societies |

|

PayZapp |

HDFC-specific perks |

~1.5% to 2% |

HDFC credit cardholders |

|

Paytm |

Frequent cashback offers |

~2% |

Users familiar with Paytm ecosystem |

|

Paymatrix |

Rent management and financial tools |

~1.5% to 2% |

Tenants needing flexibility |

|

Freecharge |

Quick and simple payments |

~2% |

Budget-conscious renters |

|

RedGiraffe |

Extremely low transaction fees |

~0.39% + GST |

Cost-effective payments |

Additional Benefits of These Platforms

- Financial Flexibility:

Platforms like Paymatrix and ePayRent offer flexible scheduling to ensure you never miss a payment.

- Earn Rewards:

CRED, Paytm, and Freecharge provide cashback and rewards, letting you save more with every transaction.

- Tax Efficiency:

Rent receipts generated by platforms such as ePayRent and Paymatrix help you claim HRA benefits during tax filing.

- Low-Cost Transactions:

RedGiraffe's low transaction fees make it an ideal choice for large rent payments.

- Security:

MyGate and PayZapp prioritize secure landlord verification and encrypted transactions for safe payments.

Why Pay Rent with a Credit Card?

- Convenience: No need to visit your landlord or bank; pay with a few taps on your smartphone.

- Rewards: Platforms like CRED and Paytm offer cashback or reward points on transactions.

- Emergency Support: Credit cards provide a buffer during financial crunches.

- Record Keeping: Rent receipts from platforms like ePayRent and Paymatrix help during tax filing.

Tips for Choosing the Right Platform

- Compare Fees: Choose platforms like RedGiraffe if you want to minimize charges.

- Look for Rewards: Opt for CRED or Paytm to make the most out of cashback offers and reward points.

- Consider Usability: Platforms like MyGate and ePayRent are ideal for those looking for simplicity.

- Check Compatibility: HDFC customers can benefit significantly from PayZapp.

Final Thoughts

Paying rent with a credit card is no longer just about convenience—it’s about maximizing rewards, saving time, and improving financial tracking. Platforms like RedGiraffe and Paymatrix focus on cost-effectiveness, while apps like CRED and Paytm cater to reward lovers. Evaluate your needs and select the platform that aligns best with your preferences.

_1772441702.webp)

_1752219110.webp)

Ans 1. Yes, paying rent using a credit card is safe when done through secure platforms like ePayRent, CRED, or MyGate, which use encrypted payment gateways.

Ans 2. RedGiraffe offers the lowest transaction fees at ~0.39% + GST, making it the most cost-effective option.

Ans 3. Yes, platforms like ePayRent and Paymatrix provide rent receipts that can be used to claim HRA benefits during tax filing.

Ans 4. Most platforms charge a fee ranging from ~0.39% to 2% of the rent amount. Some platforms may waive fees during promotional periods.

Ans 5. CRED and Paytm are ideal for earning rewards, cashback, and points on rent payments.

Ans 6. Yes, platforms like MyGate and ePayRent offer recurring payment options, ensuring timely transfers.

Ans 7. While there are no direct tax benefits, you can use rent receipts generated by platforms to claim HRA benefits.

Ans 8. Most platforms accept all major credit cards. However, some like PayZapp offer additional perks for HDFC Bank credit cardholders.

Ans 9. Compare transaction fees, rewards, ease of use, and security features. For minimal fees, choose RedGiraffe; for rewards, opt for CRED or Paytm.

Ans 10. Yes, these platforms transfer the rent directly to landlords’ bank accounts, ensuring transparency and security.