Table of Content

▲

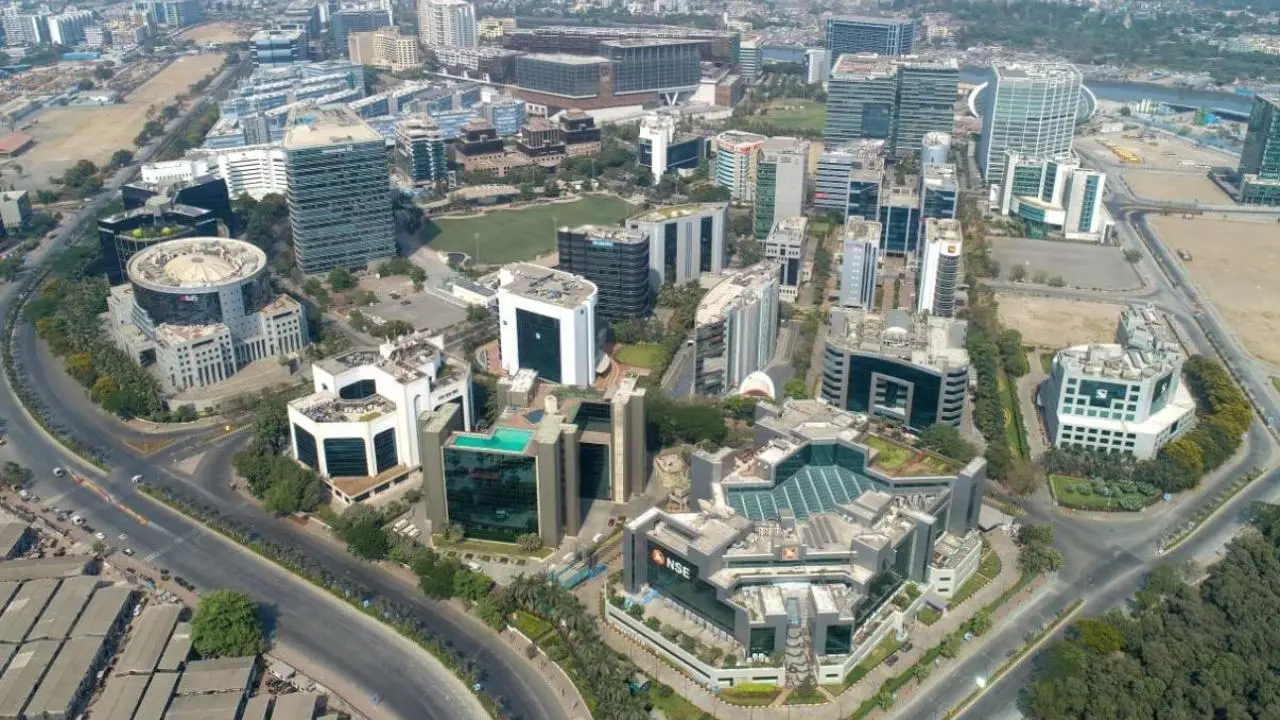

For many NRIs, Mumbai remains one of the most reliable and rewarding destinations for real estate investment in India. Its strong economic base, global connectivity, expanding infrastructure, and stable rental demand make it a natural choice for both long-term capital appreciation and steady rental income. But with so many micro-markets evolving across the city, choosing the right locality can be overwhelming.

This guide breaks down the 10 best NRI-friendly areas in Mumbai into Premium, Upper-Mid, Mid-Range, and Emerging Markets, and provides price trends, rental yields, and long-term potential for each.

Why NRIs Prefer Investing in Mumbai

- High international connectivity through Chhatrapati Shivaji Maharaj International Airport.

- Strong rental market driven by corporate, IT, BFSI, and entertainment sectors.

- Large-scale infrastructure upgrades such as coastal roads, metro corridors, trans-harbour links, and new expressways.

- Reliable long-term appreciation in premium and upcoming corridors.

- Easy NRI ownership rules under FEMA, with transparent processes under RERA.

Also Read: 11 Posh Areas in Mumbai: The Ultimate Guide to Luxury Living

Top 10 Mumbai Localities for NRI Property Investment

1. Bandra West (Pali Hill / Carter Road)

Category: Premium

Price Range: ₹43,000–₹65,000 per sq.ft (higher for ultra-luxury)

Rental Yield: 2.0–2.5%

Why NRIs Choose It:

Bandra West continues to be an aspirational neighbourhood for NRIs who want a combination of coastal living, vibrant social life, and strong brand value. Limited supply and constant redevelopment ensure long-term price appreciation. Ideal for those seeking luxury assets that grow steadily over time.

2. Juhu

Category: Premium

Price Range: ₹45,000–₹1,00,000+ per sq.ft

Rental Yield: ~2%

Why NRIs Choose It:

Juhu attracts NRI investors looking for sea-facing apartments or high-end bungalows. The area’s exclusivity, celebrity neighbourhoods, and premium lifestyle continue to drive demand and ensure stability.

3. Powai

Category: Upper-Mid

Price Range: ₹24,000–₹38,000 per sq.ft

Rental Yield: 2.5–3.0%

Why NRIs Choose It:

Powai offers an urban township feel with world-class amenities, tech parks, schools, and a cosmopolitan environment. It’s one of Mumbai’s strongest rental markets with consistent demand from corporate professionals.

4. Andheri West

Category: Upper-Mid

Price Range: ~₹31,000 per sq.ft

Rental Yield: 2.5–3%

Why NRIs Choose It:

A vibrant residential and commercial mix, metro access, entertainment hubs, and excellent connectivity make Andheri West a solid investment for rental income and mid-term appreciation.

5. Andheri East (Business District Side)

Category: Upper-Mid

Price Range: ₹23,000–₹29,000 per sq.ft

Rental Yield: 2.8–3.2%

Why NRIs Choose It:

Ideal for NRIs looking to tap into strong rental demand from corporate tenants due to its proximity to airport, business parks, and MNC hubs.

6. BKC (Bandra Kurla Complex)

Category: Premium

Price Trend: Among the highest in Mumbai; varies by project

Rental Yield: 2–3%

Why NRIs Choose It:

BKC is Mumbai’s prime financial district. Luxury residential projects around BKC appeal to NRIs working in global finance, consulting, or tech, offering unmatched connectivity and prestige.

7. Kanjurmarg

.jpg)

Category: Mid-Range

Price Range: ₹22,000–₹28,000 per sq.ft

Rental Yield: ~3%

Why NRIs Choose It:

A growing hotspot for value investments, Kanjurmarg sits next to Powai but offers relatively lower entry prices. With steady demand and new developments, it offers a healthy mix of appreciation and rental returns.

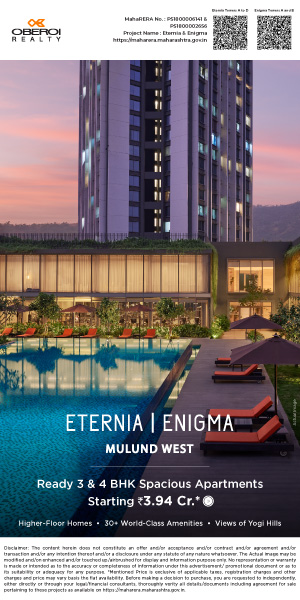

8. Mulund (West)

Category: Mid-Range

Price Range: ₹21,000–₹28,000 per sq.ft

Rental Yield: 3–3.5%

Why NRIs Choose It:

Mulund offers planned layouts, green pockets, and major redevelopment opportunities. It’s especially favoured by NRIs looking for family-friendly neighbourhoods at a more affordable entry point.

9. Navi Mumbai (Vashi / Kharghar / Seawoods)

Category: Emerging

Price Range:

- Vashi: ₹19,000–₹28,000 per sq.ft

- Kharghar: ₹12,000–₹16,000 per sq.ft

Rental Yield: 3–4%

Why NRIs Choose It:

Navi Mumbai has become a major NRI attraction due to its modern planning, growing infrastructure, and the upcoming Navi Mumbai International Airport. Affordable entry points with strong growth potential make it ideal for long-term investors.

10. Panvel / Ulwe / Taloja (Airport Growth Belt)

Category: Affordable–Emerging

Price Range: ₹6,500–₹12,000 per sq.ft

Rental Yield: 3–5%

Why NRIs Choose It:

These nodes offer the highest percentage growth potential, especially once the Navi Mumbai airport becomes fully operational. Best suited for NRIs seeking long-term capital appreciation at a low entry cost.

Also Read: From South Mumbai to Thane The Real Cost of 2 BHK Homes in 2025

Quick Investment Recommendations for NRIs

For Luxury + Long-term Appreciation

- Bandra West

- Juhu

- BKC

For Rental Income + Balanced Pricing

- Powai

- Andheri West

- Andheri East

For Value + Redevelopment Gains

- Kanjurmarg

- Mulund

- Thane (optional addition)

For High Future Appreciation (Budget-friendly)

- Navi Mumbai (Kharghar/Ulwe)

- Panvel

NRI Property Investment Checklist

- Use NRE/NRO/FCNR accounts for payments.

- Verify RERA registration and title documents.

- Check actual rental demand in the micro-market.

- Review society redevelopment plans where applicable.

- Factor in TDS, capital gains tax, and repatriation rules.

Conclusion

Mumbai’s real estate landscape offers a range of opportunities for NRIs, from ultra-luxury coastal homes to high-growth suburban markets. Your choice ultimately depends on your investment objective, whether it’s prestige, steady rental income, or long-term appreciation. With the right neighbourhood and a well-planned strategy, Mumbai can be one of the strongest real estate assets in an NRI portfolio.

_1772441702.webp)

Ans 1. Some of the most preferred areas for NRIs in 2025 include Bandra West, Juhu, BKC, Powai, Andheri West, Andheri East, Mulund, Kanjurmarg, and fast-growing Navi Mumbai and Panvel regions. These micro-markets offer a mix of luxury options, strong rental demand, and long-term appreciation potential.

Ans 2. Bandra West remains an NRI favourite because it offers a premium coastal lifestyle, upscale social infrastructure, and consistent property appreciation. Limited supply and ongoing redevelopment ensure that luxury homes here continue to hold strong long-term value.

Ans 3. Yes, Juhu is ideal for NRIs who prefer high-end, sea-facing homes or luxury bungalows. Its exclusivity, celebrity-driven demand, and stable pricing make it a secure and aspirational investment option.

Ans 4. Powai is popular among NRIs because it offers a modern township environment with tech parks, schools, lakeside landscapes, and strong rental demand. It’s also one of Mumbai’s most stable mid-to-upper premium markets with consistent occupancy from corporate professionals.

Ans 5. Andheri West is attractive due to its connectivity, metro access, entertainment hubs, and thriving rental market. NRIs looking for strong tenant demand and mid-term appreciation often choose this neighbourhood.

Ans 6. Yes, Andheri East is one of the best rental markets in Mumbai for NRIs. Its proximity to the airport, corporate parks, and business hubs ensures constant demand from executives and long-stay corporate tenants.

Ans 7. BKC is Mumbai’s top financial district and attracts global professionals, making it an elite residential choice. Its luxury projects, excellent connectivity, and high-end social infrastructure make it ideal for NRIs who prefer prestige and long-term stability.

Ans 8. Both Kanjurmarg and Mulund offer quality housing, lower entry prices, and strong appreciation potential. Kanjurmarg benefits from Powai’s spillover demand, while Mulund appeals to NRIs seeking greener, family-friendly neighbourhoods with upcoming redevelopment.

Ans 9. Navi Mumbai is emerging as an NRI hotspot due to its planned infrastructure, cleaner environment, and the upcoming international airport. Areas like Vashi, Kharghar, and Seawoods offer good rental yields and excellent long-term appreciation prospects.

Ans 10. Yes, these areas offer some of the highest appreciation potential because they lie directly in the airport growth belt. Once the Navi Mumbai airport becomes fully operational, rental demand and capital values in Panvel and Ulwe are expected to rise significantly.