Table of Content

▲

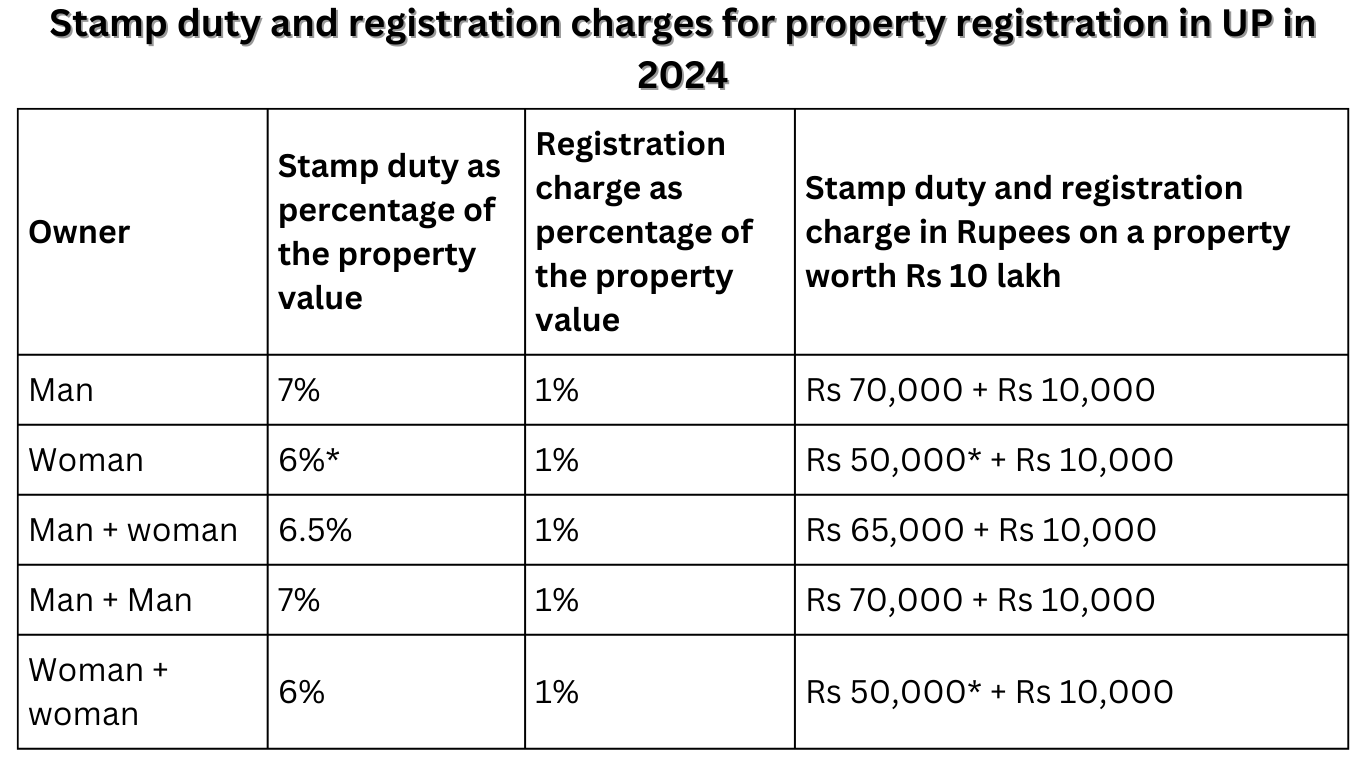

Homebuyers in Uttar Pradesh (UP) are required to pay government-regulated stamp duty and registration fees during property registration in the state. This guide provides information on the stamp duty applicable in UP for property registration in 2024.

Note: In Uttar Pradesh, women are given a 1% discount on stamp duty fees. However, this discount is only valid for transactions worth up to Rs 10 lakh.

It's important to note that in any state, including UP, property registration cannot occur below the circle rates set by the government. Even if the property is being registered below these rates, buyers are still obligated to pay stamp duty based on the circle rate value.

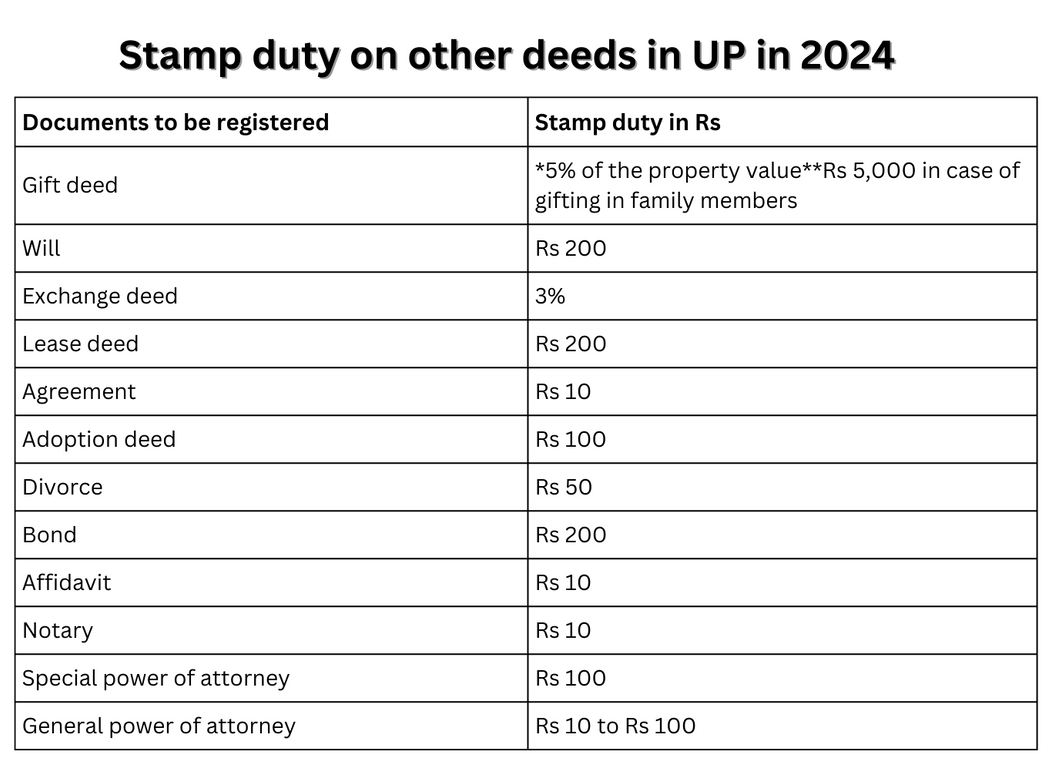

Stamp duty on property gifting within a family in UP in 2024

On February 10, 2024: In Uttar Pradesh, property transfers among blood relatives will now incur a standardized stamp duty of Rs 5,000 following the passage of a Bill by the State Assembly.

The Indian Stamp (Uttar Pradesh Amendment) Bill-2024, which stipulates a Rs 5,000 stamp duty for property transfers between blood relatives, was approved by the Uttar Pradesh Assembly on February 9.

Additionally, an extra processing fee of Rs 1,000 must be paid along with the Rs 5,000 stamp duty.

The Uttar Pradesh Cabinet, in a meeting chaired by Chief Minister Yogi Adityanath on June 15, 2022, decided to reduce the stamp duty and registration charges for property transfers within a family. The cabinet lowered the overall stamp duty and registration charge for such transactions to Rs 7,000, comprising Rs 6,000 for stamp duty and Rs 1,000 for processing fees. However, this stamp duty waiver is applicable only for a limited period of six months and for specific transfers.

Also Read: How are a temple and an airport changing Ayodhya’s real estate?

Who are family members for this purpose?

The reduced charges will be applicable only on property transfers to one’s

- Father

- Mother

- Brother

- Sister

- Spouse

- Son

- Daughter

- Son-in-law

- Daughter-in-law

- Grand children from son’s as well as daughter’s side

Previously, property owners in UP were subject to a stamp duty of 7% on property transfers within their family, in addition to a 1% registration charge. This meant that for a property valued at one crore, an owner would have to pay Rs 8 lakh as stamp duty and registration charges, even when transferring the asset to a family member without any monetary exchange.

The high stamp duty rates led many property owners in UP to opt for transfers within the family using a power of attorney, which incurred a mere Rs 100 fee. This resulted in significant revenue loss for the state government. Moreover, the elevated rates dissuaded many owners from transferring their property among family members during their lifetime.

Property transfers among family members can be facilitated through drafting and executing a gift deed, relinquishment deed, or partition deed.

Stamp duty laws in Uttar Pradesh

In accordance with Section 17 of the Uttar Pradesh Registration Act, 1908, any property transaction exceeding Rs 100 in value necessitates the registration of the sale deed at the sub-registrar’s office. This requirement ensures that all property transactions in the state are registered, thereby obtaining legal validity as per the law.

Stamp duty for women in UP

In Uttar Pradesh, women receive a discount on stamp duty for property registration, but only for properties below a certain price limit, similar to other states. Women pay a 6% stamp duty on properties costing Rs 10 lakh or less, instead of the 7% stamp duty that men are charged as owners. Nonetheless, in Uttar Pradesh, both males and females are required to pay the same stamp duty when the property's price exceeds Rs 10 lakh.

Property registration charge in UP in 2024

In 2020, the Uttar Pradesh government announced updated rates for stamp duty and registration fees for property and other transactions, removing the previous limit of Rs 20,000 on charges. Currently, the registration fee is determined as 1% of the sale amount. If a property worth Rs 50 lakhs is being registered, the buyer must allocate Rs 50,000 for the registration fee.

Stamp duty UP calculation example

Ram Singh, purchasing an 800 sq ft property in a location with a circle rate of Rs 5,000 per sq ft, will yield a circle rate-based value of Rs 40 lakhs for the property.

If the property is registered at this value, Ram will incur a stamp duty of 7%, totaling Rs 2.80 lakhs.

However, even if the property is registered at a lower value, Ram will still be liable to pay stamp duty based on the circle rate, which is Rs 40 lakhs. For instance, if the property is registered at Rs 50 lakhs, Ram will still owe 7% stamp duty on the Rs 40 lakhs circle rate, amounting to Rs 3.50 lakhs.

Additionally, Ram will be required to pay a registration charge of Rs 50,000.

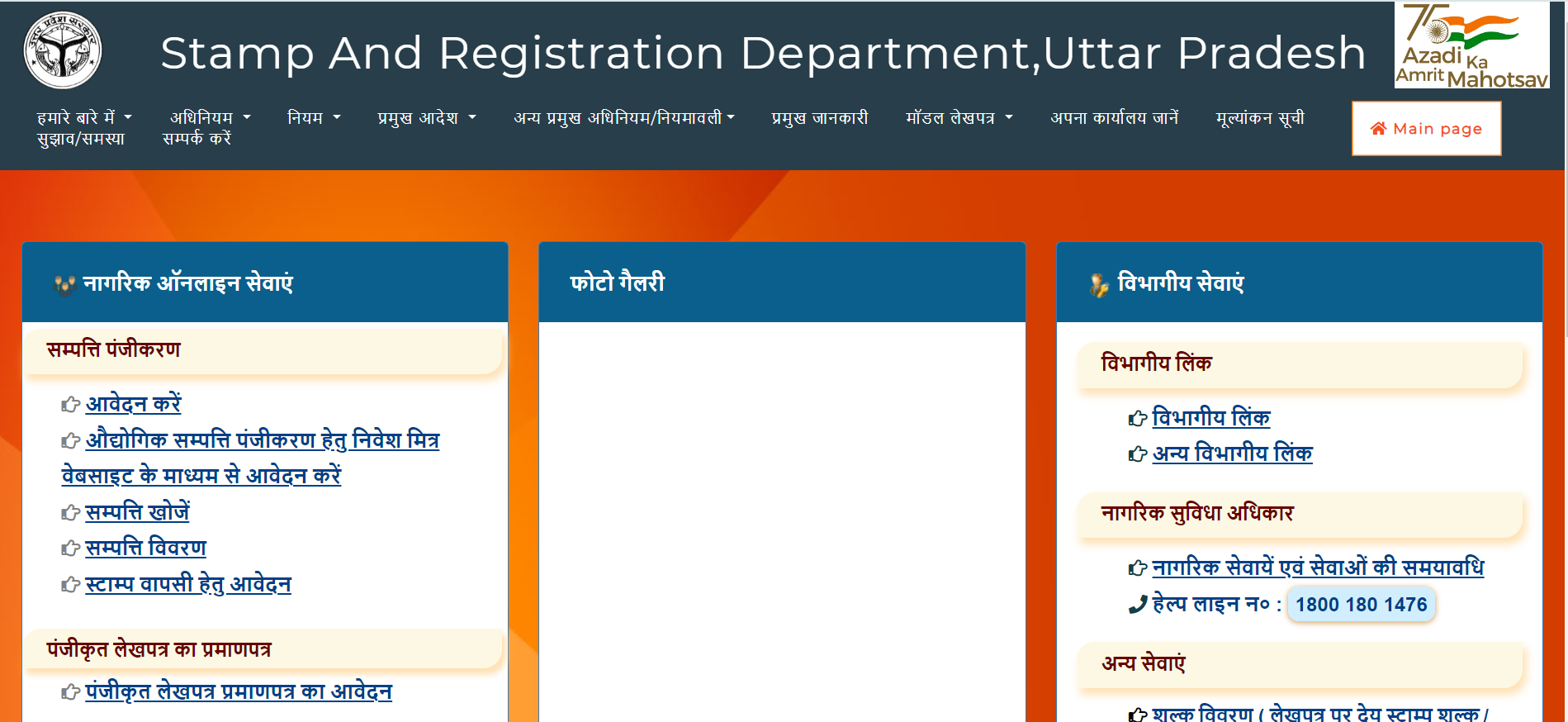

How to pay stamp duty online in UP?

Log on to the Stamp and Registration Department UP portal (click here). Note here that the page will initially open in Hindi. Once you select the ‘आवेदन करें’ option, you will have the option to switch to English.

Apply for registration now and generate an application number by choosing the 'New Application' option.

Upon registration with your credentials, you can log in as a registered user. Subsequently, you will input the particulars of the property, buyer, seller, and witnesses. Once all details are provided, the system will automatically compute the stamp duty and registration charges for your property. Upon payment of the stamp duty, a receipt number will be generated. It's essential to retain this number for future reference and schedule an appointment for property registration at the sub-registrar’s office.

Also Read: Uttar Pradesh Government Plans Property Tax Reforms to Boost Revenue Collection

Property registration at sub-registrar’s office in UP

After completing the online payment of stamp duty, both the buyer and the seller, accompanied by two witnesses, must visit the Sub Registrar’s Office (SRO). At this office, property registration undergoes two stages, each overseen by different officials.

Firstly, an Operator at the SRO office verifies the details submitted in the online application, captures thumb impressions and photos. Simultaneously, the sub-registrar examines all the information in the application, cross-referencing it with the original documents provided.

Is paying stamp duty on property registration a must in UP?

For any property valued above Rs 100, the buyer is obligated to settle stamp duty and registration charges for the transaction to be registered in the government's records, as mandated by the provisions of the Registration Act of 1908. Failure to register renders the property exchange between buyer and seller legally invalid, depriving the buyer of legal ownership of the property title. Additionally, non-registration constitutes non-compliance with the law, resulting in potential monetary penalties.

UP stamp duty office contact information

Stamps and Registration Department,

2nd Floor, Vishwas complex,

Vishwas Khand -3, Gomti Nagar, Lucknow, 226010

Also Read: Uttar Pradesh extends policy for property transfer to kin at minimal cost

_1771410929.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. The Uttar Pradesh Assembly on Friday passed the Indian Stamp (Uttar Pradesh Amendment) Bill-2024, which has a provision that the transfer of a property between blood relatives can be done by paying a stamp duty of Rs 5,000.

Ans 2. Male owners must pay 7% of the total value of a property as stamp duty. Female owners must pay 6% of the property value as stamp duty. Homes jointly owned by a male and a female member draw 6.5% stamp duty, and homes jointly owned by two females draw 6% stamp duty.

Ans 3. Stamp duty and registration charges in Bangalore are the same for both genders, but the stamp duty rates vary based on the property's value. 5% on properties above Rs. 45 lakh. 3% on properties within Rs 21-45 lakh. 2% on properties less than Rs 20 lakh.

Ans 4. In Uttar Pradesh, the stamp duty is 7% of the transaction value, and the registration charges are 1% of the transaction value.

Ans 5. Buyers have to pay 1% of the property value as the registration charge in UP.

Ans 6. Stamp duty value is calculated based on several factors, primarily market value, transaction value, or ready reckoner rates set by local governments. These rates are used to assess the tax payable on legal documents like property transactions.

Ans 7. The Goods and Services Tax (GST) law doesn't include stamp duty or registration charges. This is because stamp duty is a specific fee imposed by state governments and is neither classified as goods nor services under the GST Act. Therefore, no GST on stamp duty and registration can be imposed.

Ans 8. The GRM method determines the market value of a property by multiplying the gross rent multiplier (GRM) by the property's annual gross rental income. The formula to compute the GRM divides the sale price of a property by its annual gross rental income, which can be rearranged to isolate the price variable.

Ans 9. Visit the UP Bhulekh portal. Select your district, tehsil, and village. Choose the specific service or information you want to check, such as land records, land maps, or property details. Enter any required property details or search parameters.

Ans 10. Documents Required for Property Registration in Uttar Pradesh Deed Document. Copy of Aadhar/Pan of Buyer, Seller & Witness. Copy of updated Khatauni. Copy of updated Khasra. Map of land (including Quadriplegic)

Ans 11. The property registration fee is the amount paid in addition to the stamp duty for registering the property in their name. The amount is 1.00% of the total cost of the property depending on the location of the property and the charges may vary depending on the state laws.