Table of Content

▲- Stamp duty in Haryana in 2025

- Registration Charges in Haryana in 2025

- Documentation needed for property registration

- The process of calculation of stamp duty in Haryana along with its steps

- Methods of Paying Stamp Duty in Haryana via online Portal

- Methods of Paying Stamp Duty in Haryana through banks or other institutions

- Suggestions to Follow When Reserving Time to Register Property in Haryana

- Steps for Registering a Property Deed

- Stamp Duty factors in Haryana that are taken into the calculation

- Benefits of adhering to the Stamp Duty Laws while buying property in Haryana

- What will be the procedure for purchasing e-Stamps online in Haryana?

- Procedure for Purchasing Stamps Offline

- Stamp Duty regulations and by laws in Haryana

- What is the effect if the payment of stamp duty is delayed?

- Haryana Stamp Duty Exemptions

- Contact information for Stamp Duty in Haryana

- Cautions while registering property in Haryana

- Brief Overview Stamp Duty and Registration Fees in Haryana

For any person or business who wants to have legal title with respect to any property situated in the State of Haryana for that matter whether the property is new or transferred one, it is mandatory to get the property registered with the Government of Haryana. The process of registration is inclusive of providing the documents as well as paying the prescribed stamp duty and registration fees. The Stamp Duty in Haryana vary depending on the type of transaction carried out, such as the case of Sale Deeds or Mortgage deeds. This blog incorporates every aspect concerning registration as well as stamp duty in the state of Haryana, for instance, the various types of registration documents, the steps in the process of its online registration as well as more information.

Stamp duty in Haryana in 2025

The stamp duty in Urban areas of Haryana is 7%, whereas in rural areas is 5%. Also, 2% stamp duty has been lowered for the property titled in the woman’s name itself. This is 1% when a man and woman own the property together. Also, Get to know the stamp duty fees of Haryana for different legal documents mentioned in the following sections.

|

Documents |

Urban Area |

Rural Area |

|

Gift Deed |

5% |

3% |

|

Sale or Conveyance Deed |

7% |

5% |

|

Exchange Deed |

8% of the property value or market value, whichever is greater |

6% of the property value or market value, whichever is greater |

|

Loan Agreement |

Rs 100 |

Rs 100 |

|

Partnership Deed |

Rs 22.50 |

Rs 22.50 |

|

General Power of Attorney |

Rs 300 |

Rs 300 |

|

Special Power of Attorney |

Rs 100 |

Rs 100 |

It is also noted that the stamp duty costs are higher in urbanized areas of the state of Haryana to the extent that the costs are higher in Gurgaon while lower rates are observed in Tigaon. Also, the Government of Haryana has lowered the stamp duty costs for females in a bid to motivate them to buy houses. Even the stamp duty costs for males and females vary with a difference of 2%.

|

Jurisdiction |

Male |

Female |

Joint |

|

Urban Area |

7% |

5% |

6% |

|

Rural Area |

5% |

3% |

4% |

Also Read : Famous Real Estate Projects That Were Never Completed in India

Registration Charges in Haryana in 2025

Previously, the cost of registration charges was Rs 15,000. In 2018, the cost of registration was revised by the state government to Rs 50,000. New charges are imposed for certain documents like gift deeds, sale deeds, lease deeds, exchange deeds, partition deeds, collaboration deeds, mortgage deeds, settlement deeds and sale certificates.

|

Property value |

Registration charge |

|

Up to Rs 50,000 |

Rs 100 |

|

Rs 50,001 to Rs 5 lakhs |

Rs 1,000 |

|

Rs 5 lakhs to Rs 10 lakhs |

Rs 5,000 |

|

Rs 10 lakhs to Rs 20 lakhs |

Rs 10,000 |

|

Rs 20 lakhs to Rs 25 lakhs |

Rs 12,500 |

|

Rs 25 lakhs |

Rs 15,000 |

|

Rs 25 lakh- Rs 40 lakh |

Rs 20,000 |

|

Rs 40 lakh- Rs 50 lakh |

Rs 25,000 |

|

Rs 50 lakh-Rs 60 lakh |

Rs 30,000 |

|

Rs 60 lakh-Rs 70 lakh |

Rs 35,000 |

|

Rs 70 lakh-Rs 80 lakh |

Rs 40,000 |

|

Rs 80 lakh-Rs 90 lakh |

Rs 45,000 |

|

Rs 90 lakh and above |

Rs 50,000 |

Documentation needed for property registration

Being a property owner requires one to possess valid documentation to effect the transfer of ownership. Remember that for the registration of property, all documents other than wills shall be lodged with the sub-registrar’s office within four months from the date of execution as per section 23 of the Registration Act of 1908.

- Sale Deed

- The identity of the seller and buyer can be verified with the use of PAN Card, Ration Card, Voter ID, Passport, and Driving License.

- Address proof of both seller and buyer.

- Community No-objection Certificate (NOC) Clearance.

- Identification proof of at least two witnesses.

- Design, drawing or even sketch of the Building/ Structure.

- A set of drawings or pictures describing the Property.

- Title proof- Certificate of assessment regarding mutation or primary sale deed.

The process of calculation of stamp duty in Haryana along with its steps

Stamp duty is based on the circle rate prevailing in the particular place where the property is located. Generally, the property is registered at the circle rate or more in most of the cases. The stamp duty verified in the Jamabandi Haryana portal by the purchaser of the property.

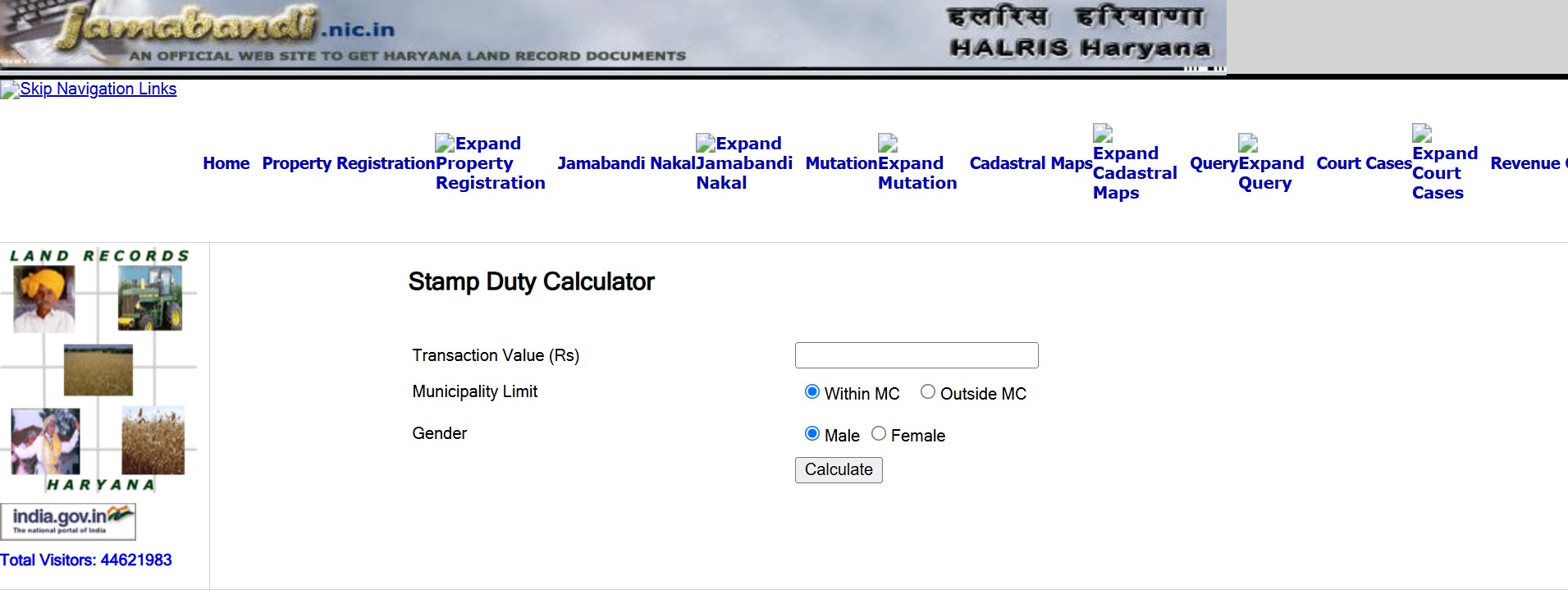

The site jamabandi.nic.in/DefaultPages/StampDuyNew may be accessed for details about stamp duty charges.

- To understand how the stamp duty is computed, you are required to go to the property registration section and click on the Stamp Duty Calculator. Then, based on the Transactional Value, choose either Within MC or Outside MC. Select your gender and hit Compute.

- Once the stamp duty comes out, its equivalent amount must be paid in order to obtain the appropriate stamp paper. This stamp paper can be bought by going in person to the office of the registrar or through a process called franking. Besides, on the e-stamp system, e-stamp paper can be bought as well.

- All you have to do is visit the e-stamp site and join the e-stamp website. Thereafter, payment can be made through any of the online payment methods or the traditional offline payment methods.

Methods of Paying Stamp Duty in Haryana via online Portal

Individuals who wish to pay stamp duty and registration charges online in Haryana need to visit the eGTRAS site of Haryana. This online portal allows buyers to create tax/non tax revenue manually or electronically.

To get an electronic stamp, the person is required to register on the e-GRAS portal.

Methods of Paying Stamp Duty in Haryana through banks or other institutions

Other than the online facility in paying stamp duty, there are other means available in the state of Haryana. First and foremost, head to the government treasury office and acquire stamp papers. It is easy to purchase stamp papers worth more than Rs 10,000. The amount meant for bank stamp paper should be paid to – State bank of India (SBI) bearing account number '0030-Stamp and Registration'. After this step is completed, one should take the stamp paper to the office of the sub-registrar.

Suggestions to Follow When Reserving Time to Register Property in Haryana

In the post e-stamping stage, it is crucial for any homebuyer to book a registration slot on Jamabandi portal. The procedure to book a slot is given below.

- Go through the Property Registration fan section located on top of the Jamabandi site and select the option of “Deed Registration Appointment”.

- Enter the District, Tehsil, and For Next (N) Days. Click on the search button to check for any vacancies.

- On the appointed day, the buyer, seller and two other witnesses are required to show up at the sub-registrar office for completion of registration processes.

Steps for Registering a Property Deed

To register the property deed in Haryana, below are the steps one should follow.

Step 1: Visit Jamabandi’s official site. After that, click on the Property Registration Menu Bar and then on Deed Templates to get the templates.

Step 2: Having gotten the deed template that is suiting for your work, fill in all the parts in the document.

Step 3: On the specified date and time, report to the Registrar’s office. The registration office attendant will forward the deed to the Sub Registrar.

Step 4: As soon as the sub registrar endorses the deed, it will be extracted, and the deed input into HARIS whereby it is land records integrated.

Step 5: When progressing with the registration procedure in HARIS. The officer will capture the details of the seller, buyer, e-stamp paper and transaction fees. A picture will be taken right after this process.

Step 6: The Sub-registrar officer will validate the document by Biometric capture and Abridgment of the particulars of both Purchaser and Vendor. Thereafter the hard copy of the land registry shall be availed to both parties. The Tehsil office also put it up on the Jamaba.

Tax benefits applicable on Stamp Duty while purchasing property in Haryana

In Haryana, a home buyer gets a maximum benefit of ₹1.5 lakh on Stamp Duty and Registration Fees. A taxpayer can avail of stamp duty deduction as provided under section 80C of Income Tax Act 1961. Also, such deductions are admissible for new property purchase only and not for any previously owned property.

Stamp Duty factors in Haryana that are taken into the calculation

The following factors shape the calculation of stamp duty in the state of Haryana.

Gender of the Owner: There are different stamp duty costs for males and females in Haryana, females being the ones with lower costs. The state government has introduced stamp duty rebates to women in the state of Haryana. This is intended to help women who intend to purchase houses.

Property situated: Urban settings are charged higher rates of stamp duty as compared to the rural constraints. Property prices in highbrow areas within the city limits will tend to be higher.

Type of property: Such rates of stamp duty in the state of Haryana also changes with the specific type of the property be it residential, commercial or even industrial.

Facilities: Properties that provide high-quality facilities will attract higher stamp duty costs.

Age of a property: In the state of Haryana, sieving through the issues concerning stamp duty rates, old properties generally cost lower to stamp duty charges compared to younger properties. Such is the manner in which the stamp duty charges operate within the territorial limits of the state of Haryana.

Age of an Owner: There is an advantage for the elderly citizens as opposed to the younger ones in matters of stamp duty costs. Like in most regions in India, the aged people pay lesser amounts in stamp duty fees than the younger people.

Also Read : Top Indian Cities for NRIs to Invest in Real Estate: A Comprehensive Guide

Benefits of adhering to the Stamp Duty Laws while buying property in Haryana

While one understands that there are Stamp Duty Charges in Haryana which are based on the location, type, and value of property, let us be informed of the benefits that paying Stamp Duty has.

Here are the advantages of Stamp Duty in Haryana:

Legal Recognition: It is important to pay stamp duty as it helps in lawfully bearing a transaction i.e. gives credence which is needed in the entitlement of the assets Transferred.

Proof of Ownership: Aang Orchards Haryana Stamp Duty Paid Media receipts act as proof of having that particular property. This gives the buyer a stamped paper that helps establish ownership of the property and save it for all future legal transactions about the property.

Prevents legal issues: When stamp duty is paid in Haryana, it implies that the property is free from any sorts of legal wrangles or issues.

Stamp Duty when rates are paid during purchase of a property serves to protect the interests of the buyer. It ensures that the buyer is the legal owner of the property and there are no issues, restrictions or conflicts related to the ownership.

The government can also utilize the revenues collected from stamp duties to carry out development works for the improvement of infrastructure. This helps in improving the standard of living amongst the citizens and also enhances the development of the state as a whole.

What will be the procedure for purchasing e-Stamps online in Haryana?

In case you are thinking of buying electronic stamps for stamp duty and registration fees in Haryana, this is what you need to know:

- The e-GRAS system is the most preferred for online transactions remitting tax and non-tax revenue.

- You have to be a registered user on the application portals to purchase e-stamps.

- The system is simple and allows both off-line and on-line payment.

Procedure for Purchasing Stamps Offline

If you are opting for the offline way of buying stamp paintings in Haryana, then the following is the procedure:

- One can visit the treasury office and get stamp papers worth more than ten thousand rupees.

- Simply make the payment into the bank namely State Bank of India (SBI) under the name ‘0030-Stamp and Registration’.

- This option works quite well for those who do not like to make payments through online means and prefer making physical payments.

Stamp Duty regulations and by laws in Haryana

Here are the few points that must be observed before the stamp duty payment is made as well:

- Every registered property pays stamp duty within the registration day or the next working day. If registration pertains to a property that is outside of the country, it has to be done within three months.

- Property execution is the act of signing the property transaction documents by both the buyer and the seller.

- All the individuals who form an agreement must appear in the stamp paper.

- A stamp paper should not make six months from the date if the transaction.

- Furthermore, in the state of Haryana, there is an alternative facility for payment of stamp duty, that is use of adhesive stamps. During execution, the adhesive stamp is peeled off and after that the adhesive stamp cannot be used again.

What is the effect if the payment of stamp duty is delayed?

When stamp duty in Haryana is not paid when it is due, a fine will be levied that is exorbitant in nature in accordance with provision 23 of the Registration Act of 1908. The fines may be up to ten times the registration fees. In the state, every instrument is required to be registered, within the four months after its execution, except for a Will.

Haryana Stamp Duty Exemptions

In Haryana, some specific categories of home buyers like women and first time home buyers are given stamp duty exemptions . These buyers may be eligible for offers or lesser stamp duty charges. Also, any such property transactions that deal with social services availing agricultural lands, may also be free of stamp duty charges.

In another remark that was made recently, even the Chief Minister of Haryana proclaimed that there would be no stamp duty on purchasing sites that will house cows in cow shelters. Other than the no tax with respect to land for cow shelters and installing them tax free then the government shall also increase the amount provided as subsidy for dry grass feds to cows from the normal 5 to 20 shillings per cow.

Also, it was reiterated by the government that there are no requirements to apply for a change of land use for the purpose of constructing new cowsheds on the land.

Contact information for Stamp Duty in Haryana

Below is the information about the customer service department of Stamp Duty in Haryana that you wanted to know:

Address: Haryana Revenue & Disaster Management Department. Located in New Haryana Secretariat, Sector-17, Chandigarh.

Contact Person: Under Secretary Revenue

Contact Number: 0172-2714033

Cautions while registering property in Haryana

While the process of property registration sounds simple, it is advisable for the applicant to remain vigilant and informed. A lapse, in this case, could be even as small as a spelling error and result to delays or huge penalties. Therefore, do not make the errors that are listed and elaborated below.

The most common error made is submission of incomplete forms. Ensure that you have all the required documents before applying for the property.

There is a need to ensure that the stamp duty and registration charges are calculated correctly to avoid any embarrassing last minute surprises on the amounts payable.

Evaluating property has its challenges and people can make dissatisfied choices. There may be lawsuits trouble associated with the low estimation of the values of properties.

Brief Overview Stamp Duty and Registration Fees in Haryana

In addition, we have thus learnt the purpose of stamp duty and registration fee of which are payable in the state of Haryana. Under the Indian Stamp Act 1899, it is obligatory to pay a stamp duty. In the state of Haryana, the stamp duty ranges from 5% to 8%, the value varying with the category of document that includes sale or conveyance orders, exchange deeds, loan agreements, partnership Agreements among others, and even gift Deeds. The registration charges in the state of Haryana could amount to Rs50,000 depending on the value of property. Purchase an electronic stamp without any stress by visiting the e-GRAS system. If using the web option makes you uncomfortable, you can also purchase stamp paper and pay in cash in the office.

Also Read : Investor’s Guide to Real Estate Laws: Safeguard Your Property and Profits

_1731919940.webp)

Ans 1. Stamp duty is a tax levied by the Haryana government on property transactions, such as buying or selling a property. It is paid at the time of registration to legally validate the transaction.

Ans 2. The stamp duty rates in Haryana may vary based on the property value and location. For residential properties, the rate is generally around 7% for men, 6% for women, and 5% for joint ownership.

Ans 3. Yes, certain exemptions or reductions in stamp duty may apply to specific cases such as first-time homebuyers, properties in rural areas, or properties under government schemes like affordable housing.

Ans 4. The property registration charge in Haryana is typically 1% of the property's market value or agreement value, whichever is higher, up to a maximum limit.

Ans 5. Yes, stamp duty is applicable on gift deeds in Haryana. The rate of stamp duty on a gift deed is usually 4% of the property's market value.

Ans 6. Yes, Haryana allows online payment of stamp duty and registration charges through the official Haryana government portal for ease and convenience.

Ans 7. Common documents include the sale deed or agreement of sale, proof of identity, proof of ownership, and the property’s sale agreement, along with payment receipts for stamp duty and registration fees.

Ans 8. If stamp duty is not paid on time, the property transaction is not legally valid, and there may be penalties and interest charges imposed by the government.