Table of Content

▲- Understanding Stamp Duty and Registration Charges

- Key Factors Influencing Gujarat Stamp Duty 2025

- Table 1: Stamp Duty and Registration Charges for Different Property Types

- Table 2: Stamp Duty Rates for Various Agreements in Gujarat 2025

- What's New in Gujarat Stamp Duty 2025?

- How to Calculate Your Stamp Duty and Registration Charges

- Essential Documents for Property Registration

- Payment Methods: Online and Offline Options

- Legal Implications of Non-Compliance

- Conclusion

Home purchasing is an exciting yet complex journey involving careful financial planning and understanding legal procedures. One crucial aspect that often gets overlooked is the payment of stamp duty and registration charges. For prospective homeowners in Gujarat, being well-versed with Gujarat stamp duty 2025 is essential to avoid legal hassles and ensure a smooth registration process.

Understanding Stamp Duty and Registration Charges

Stamp duty is a state-imposed tax on property transactions that validates and legally records the transfer of ownership. On the other hand, registration charges are fees paid to document the property in government records officially. Together, these fees protect your investment from future disputes and legal complications. Under Gujarat stamp duty 2025, these charges are structured to reflect the property's type, location, transaction value, and even the buyer’s gender.

Also Read: Discover RERA Gujarat: Key Insights for Homebuyers & Agents

Key Factors Influencing Gujarat Stamp Duty 2025

Understanding the variables that affect Gujarat Stamp Duty 2025 can help you better plan your budget. The primary factors include:

- Property Type:

Residential, commercial, industrial, and agricultural properties attract varied rates. Typically, residential properties incur a stamp duty of 4.9% of the market value, while commercial properties may attract slightly higher rates. - Property Location:

Stamp duty in Gujarat varies between urban and rural areas. Urban properties generally have higher duty due to elevated market values and increased demand. - Transaction Value:

The duty is calculated on the higher value between the actual sale price and the property's market value, ensuring high-value transactions contribute fairly under Gujarat Stamp Duty 2025. - Buyer’s Gender:

To promote gender equality, the Gujarat government offers a significant incentive—female buyers are exempt from paying registration charges, a key feature of Gujarat stamp duty 2025.

Table 1: Stamp Duty and Registration Charges for Different Property Types

|

Property Type |

Stamp Duty Rate |

Registration Charges |

|

Residential |

4.9% of market value |

1% of property value (Male/Joint) 0 for Female/Female Joint |

|

Commercial |

Approximately 5% |

1% of property value (Male/Joint) 0 for Female/Female Joint |

|

Agricultural Land |

3% |

1% of property value (Male/Joint) 0 for Female/Female Joint |

Table 2: Stamp Duty Rates for Various Agreements in Gujarat 2025

|

Document Type |

Stamp Duty Rate |

|

Lease (Relating to Movable Property) |

2.00% of total amount |

|

Mortgage Deed without Possession (up to 10 Cr) |

0.35% |

|

Mortgage Deed without Possession (above 10 Cr) |

0.70% (Maximum limit: INR 11.2 lacs) |

|

Lease – Rent (Immovable Property) up to 1 year |

1.4% of Rent Amount |

|

Lease – Rent (Immovable Property) 1–3 years |

2.8% of Average Yearly Rent Amount |

|

Lease – Rent (Immovable Property) 3–10 years |

4.9% of Average Yearly Rent Amount |

|

Lease – Premium (Immovable Property) |

4.9% of Advance Premium, Money, or Fine |

|

Conveyance/Exchange/Gift (Immovable Property) |

4.9% of Consideration or Market Value (whichever is higher) |

|

Agreement – Construction/Transfer (Agricultural) |

3.5% of Consideration or Market Value (whichever is higher) |

|

Agreement – Construction/Transfer (Non-Agricultural) |

3.5% of Market Value |

|

Conveyance Deed (Movable Property) |

2% of Market Value or Consideration Amount (whichever is higher) |

|

Partnership (by Immovable Property) |

4.9% of Market Value |

|

Partnership (by Cash & Immovable Property) |

1% of capital (max Rs 10,000) + 4.9% of Market Value |

|

Transfer of Lease |

4.9% of Market Value |

These tables provide a clear snapshot of the applicable rates, helping you quickly assess the financial implications of your property transaction under Gujarat stamp duty 2025.

What's New in Gujarat Stamp Duty 2025?

The Gujarat government has introduced several reforms in the 2025-26 budget to make property registration more accessible and cost-effective:

1. Revised Deed Charges:

-

- Mortgage Deed: Reduced from INR 25,000 to INR 5,000 at 0.25%.

- Lease Deeds: Reduced stamp duty on annual rent for residential and commercial properties for less than one year leases.

- Loan Mortgage Deeds: Fee reduction to INR 5,000 fosters easier access to property financing.

- Inheritance: A daughter inheriting a property now pays a nominal fee of INR 200, replacing the previous percentage-based charge.

2. Digital Initiatives:

E-registration of deeds—such as mortgage, reconveyance, and lease deeds—is now available, enabling homebuyers to complete the registration process from the comfort of their homes. These initiatives are a significant part of the Gujarat Stamp Duty 2025 reforms.

Also Read: Capital Values in the Top 7 Cities Soar by 128% Between 2021 and 2024

How to Calculate Your Stamp Duty and Registration Charges

The Gujarat government has streamlined the calculation process through the Garvi portal. Here’s how you can estimate your charges:

1. Log In to the Garvi Portal:

Access the portal at Garvi Gujarat.

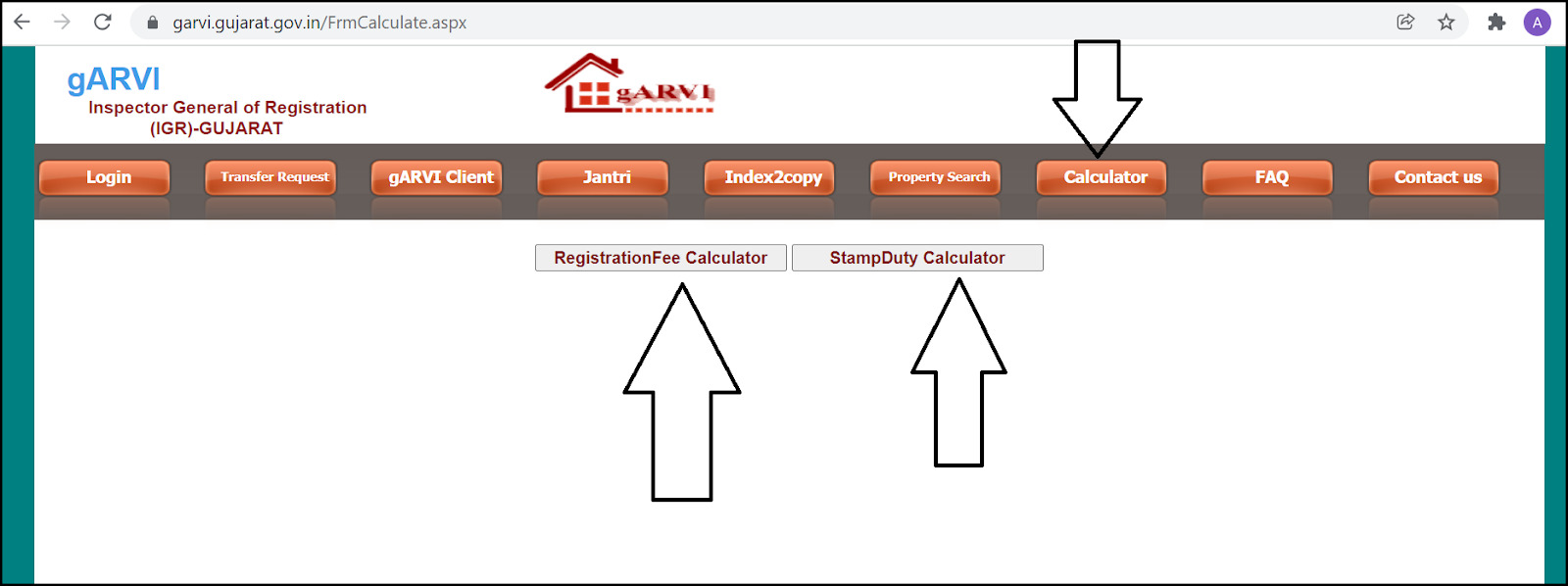

2. Navigate to the Calculator:

Click the 'Calculator' tab and choose between the Stamp Duty Calculator or Registration Fee Calculator.

3. Enter Property Details:

Please provide details such as property type, location, transaction value, and buyer information to compute Gujarat stamp duty 2025 accurately.

.jpg)

4. Review and Pay:

Once the charges are displayed, verify them and proceed with the payment through the Cyber Treasury Portal. An e-challan is generated as confirmation.

5. Book Your Registration Slot:

After successful payment, book an online slot to complete the registration process.

Essential Documents for Property Registration

To ensure a smooth registration process, have the following documents ready:

- Proof of Ownership:

Original title deeds or other relevant ownership documents. - Identity and Address Proofs:

Valid ID and address proofs for both the buyer and the seller. - Application Form:

As specified by the Gujarat Registration Act. - Power of Attorney:

It is required if the transaction is conducted through an authorised representative.

Organising these documents is vital for legally validating your property transaction under Gujarat Stamp Duty 2025.

Payment Methods: Online and Offline Options

Online Payment

- E-Stamping:

Utilize the Garvi portal for a seamless online payment experience. This method minimizes errors and saves valuable time.

Offline Payment

- Franking Centres:

Visit the nearest bank or authorised franking centre to pay the stamp duty and registration fees. - Stamp Papers:

Purchase from authorised stamp vendors as an alternative.

Both options are designed to provide flexibility, ensuring that every homebuyer can easily complete their registration under Gujarat stamp duty 2025.

Legal Implications of Non-Compliance

It is imperative to pay the stipulated stamp duty and registration charges. Failure to do so can result in:

- Invalid Property Registration:

An unregistered property may not be legally recognised, complicating future transactions or disputes. - Penalties:

Late payment can incur a monthly penalty of 2%, with potential fines reaching up to 200% of the outstanding amount.

Staying compliant with Gujarat Stamp Duty 2025 secures your investment and shields you from legal complications.

Conclusion

Navigating the complexities of property registration in Gujarat demands a thorough understanding of the latest reforms and procedures. With the streamlined process and digital initiatives introduced in Gujarat stamp duty 2025, homebuyers can complete their transactions more efficiently while enjoying cost-saving benefits—especially for female buyers who receive significant registration fee waivers.

By keeping informed and prepared, you can transform the daunting process of property registration into a seamless and secure experience. Always refer to official resources like the Garvi portal for the latest updates. Happy home buying!

Also Read: Developers Acquire 2,335 Acres for ₹40,000 Cr in 2024; Tier 1 Cities, 72% Share

(1)_1742293755.webp)

_1770976628.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. Stamp duty is a state-imposed tax that legally validates the transfer of property ownership. It, along with registration charges, protects your investment by ensuring the transaction is officially recorded.

Ans 2. The duty is determined based on property type, location, and the higher value between the actual sale price and market value. Additional factors like buyer’s gender can also influence the final charge.

Ans 3. Yes, female buyers are exempt from paying registration charges, making the overall transaction cost lower and supporting gender equality in property purchases.

Ans 4. he Garvi portal is an online platform where you can input property details to calculate the applicable stamp duty and registration fees accurately. It streamlines the payment process and helps ensure compliance with the latest reforms.

Ans 5. Revised rates reflect current market values, leading to slightly higher upfront costs, but they ensure transparency and fair valuation for property transactions.

Ans 6. Yes, you can use the Garvi portal to calculate and pay stamp duty and registration fees securely, streamlining the process and reducing errors.

Ans 7. You'll need the original title deeds, valid identity and address proofs, the application form as per the Registration Act, and a notarized POA if an authorized representative handles the transaction.

Ans 8. Non-payment can lead to invalid property registration, legal complications, and penalties, including a monthly charge of 2% and potential fines up to 200% of the outstanding amount.