Table of Content

▲

With India solidifying its position in the global market, several sectors and companies have experienced significant expansion, leading to a rise in real estate costs.

In order to control the increasing real estate costs and protect the rights of home purchasers, the government implemented the Real Estate (Regulation and Development) Act, 2016, which oversees and monitors the real estate industry across all states.

What is RERA Act?

RERA, also known as the Real Estate Regulatory Authority, was established in 2016. The main objective of the RERA Act, 2016, is to safeguard the interests of homebuyers and promote growth in the real estate sector. The RERA law is enforced in every state to oversee the real estate industry. The legislation enables quick and efficient resolution of conflicts.

The RERA Act requires all residential or commercial real estate projects with a land area over 500 square meters to be registered with RERA before they can be launched. Signing up with RERA aids in bringing transparency to the execution of the projects introduced.

RERA Act and Rules

According to Section 84 of the Real Estate (Regulation and Development) Act, 2016, State Governments are expected to establish the regulations for implementing the Act within six months of its start date.

- On October 31, 2016, the government, via the HUPA Ministry, issued the basic guidelines for the Real Estate (Regulation and Development) Act, 2016.

- These rules apply to Union Territories such as Chandigarh, Lakshadweep, Daman & Diu, Dadra & Nagar Haveli, and Andaman & Nicobar Islands.

Some Points Under Real Estate Regulation and Development (RERA)

- Security measures under the RERA act stipulate that a minimum of 70% of funds from buyers and investors must be deposited into a dedicated account. Builders are then allocated this portion for construction and land-related expenses exclusively. Prior to signing the sale contract, developers cannot demand more than 10% of the property's value as an advance payment.

- In terms of transparency, builders are obligated to furnish original project plans to buyers and are prohibited from altering these plans without the buyer's consent.

- Fairness standards mandated by RERA dictate that properties must be sold based on carpet area rather than high-density area. In the event of project delays, buyers reserve the right to either reclaim their full investment or opt for continued investment with monthly returns.

- Regarding quality assurance, builders are obliged to address any buyer grievances within 5 years of purchase, resolving them within 30 days of complaint submission.

- Furthermore, regulators are barred from engaging in marketing, selling, constructing, investing in, or booking land plots without proper registration with RERA. All investment advertisements post-registration must include a unique project-wise registration number.

Also Read: How to download RERA registration certificate?

Benefits of RERA

RERA has a number of benefits for the buyer, the promoter, and the real estate agent. These include:

- Standardization of carpet area calculation: Prior to RERA, builders had flexibility in determining project prices, often resulting in inflated carpet areas. However, RERA introduced a uniform formula for calculating carpet area, preventing manipulation to increase prices.

- Reduced builder insolvency risk: Previously, developers could transfer funds between projects, posing a risk to buyers. RERA mandates that 70% of funds raised must be deposited into a single bank account, with withdrawals subject to certification by engineers, chartered accountants, and architects.

- Advance payment limitations: RERA restricts builders from accepting more than 10% of the project cost as advance or application fees, alleviating the pressure on buyers to quickly source funds and make substantial payments.

- Buyer rights in case of defects: Within 5 years of possession, builders are obligated to rectify structural defects or quality issues within 30 days at no cost to the buyer.

- Equal interest payments in case of default: RERA ensures that both parties pay the same amount of interest in case of delays, eliminating the previous imbalance where buyers faced lower interest rates for delayed possession compared to delayed payments.

- Protection against false promises: If builders fail to deliver on promised features, buyers are entitled to full repayment of advance payments, with potential additional interest payments.

- Resolution for title defects: Buyers discovering title defects at possession have the right to claim unlimited compensation from the promoter.

- Right to project information: Buyers are entitled to comprehensive project information, including layout plans, execution details, and completion status.

- Grievance redressal mechanisms: RERA provides avenues for complaints from buyers, promoters, or agents, with the option to escalate to the Appellate Tribunal if unsatisfied with RERA's decision.

Impact of the RERA Act:

Following the enforcement of the Real Estate (Regulation and Development) Act, 2016, the registration of sale deeds for project units cannot be conducted at the sub-registrar's office without obtaining Occupancy Certificates or Completion Certificates. Currently, registrations are occurring without these certificates, with little concern for the legal repercussions. Despite awareness of the implications of the RERA Act, the Department of Stamps & Registrations has not taken measures to prevent the unlawful registration of such properties. Here are some of the impacts observed:

- Reduction in project launches: Promoters and builders may delay launching new projects as they familiarize themselves with the implications of the Real Estate (Regulation and Development) Act, 2016. However, honest promoters, builders, and developers stand to benefit from reduced competition.

- Elimination of dishonest builders: Dishonest builders may struggle to sustain themselves in the market after the implementation of the RERA Act.

- Promotion of financial discipline: The addition of 32 sections to the Real Estate (Regulation and Development) Act, 2016 is expected to foster financial discipline in the sector.

- Formalities for project changes: Developers will be required to adhere to several formalities if they intend to make changes to the project after its commencement. While this may lead to short-term chaos in the real estate industry, it is anticipated to enhance customer confidence in the long run, encouraging increased investments.

View this post on Instagram

Carpet Area Defined Under RERA Act

The Real Estate (Regulation and Development) Act, 2016 has introduced guidelines for developers regarding the sale of apartments based on the carpet area.

- As per the Act, carpet area refers to the total floor area within the walls of the apartment that can be utilized, excluding spaces like open terraces, balconies, and shafts. This standardized definition of carpet area aims to prevent buyers from being misled by unscrupulous promoters.

- Due to high loading factors, developers can increase the saleable area, thereby reducing the rate per square foot on the inflated saleable area. This can be confusing for homebuyers, who may believe they are getting favorable rates without realizing that the flat size remains unchanged, only the loading factor is adjusted.

Adhering to the carpet area standard ensures clarity regarding the usable area and facilitates cost per square foot analysis. It also simplifies comparison among different projects.

Also Read: HIRA and RERA Act under Ministry’s scrutiny for co-existence

How to Ensure that the Property is RERA Compliant?

Here are the key considerations to determine if a property is compliant with RERA:

- Property Registration: Properties exceeding 500 square meters must be registered under the RERA Act prior to project launch or advertising.

- Escrow Account Deposits: Builders are required to demonstrate that 70% of the total payment has been deposited into a designated escrow account, ensuring funds are not diverted for other purposes.

- Consent Acquisition: Builders must obtain all necessary consents before advertising a new project. Early bird booking discounts and pre-launch offers will no longer be available.

Penalties Under RERA

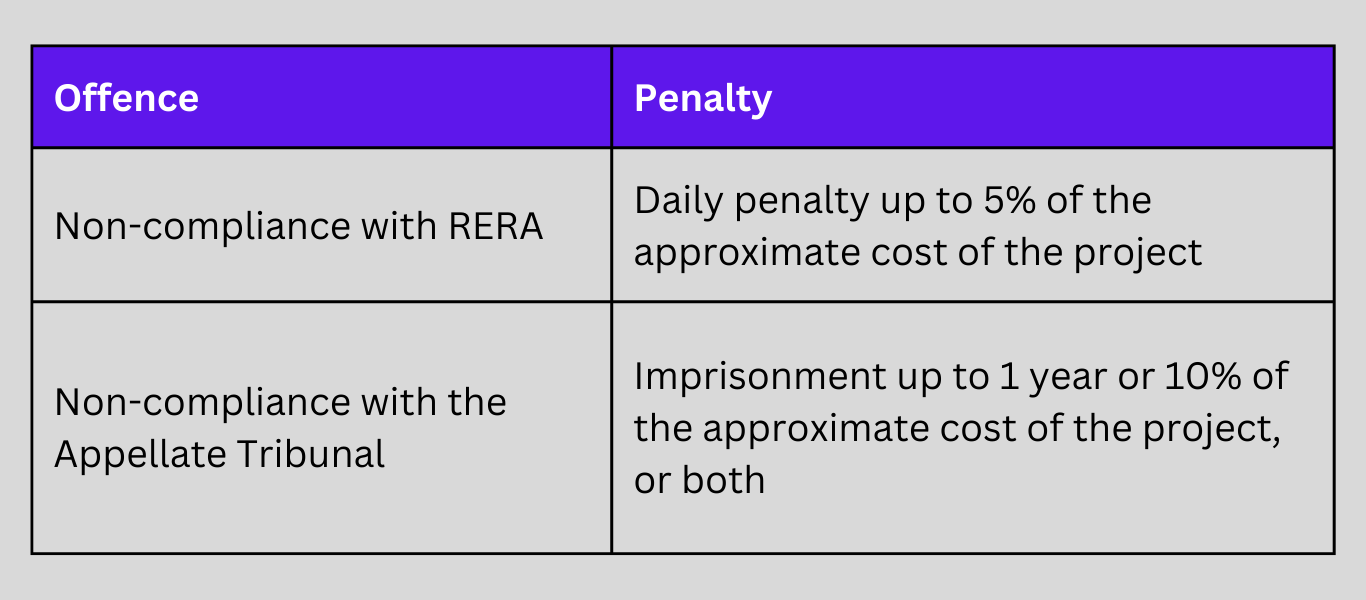

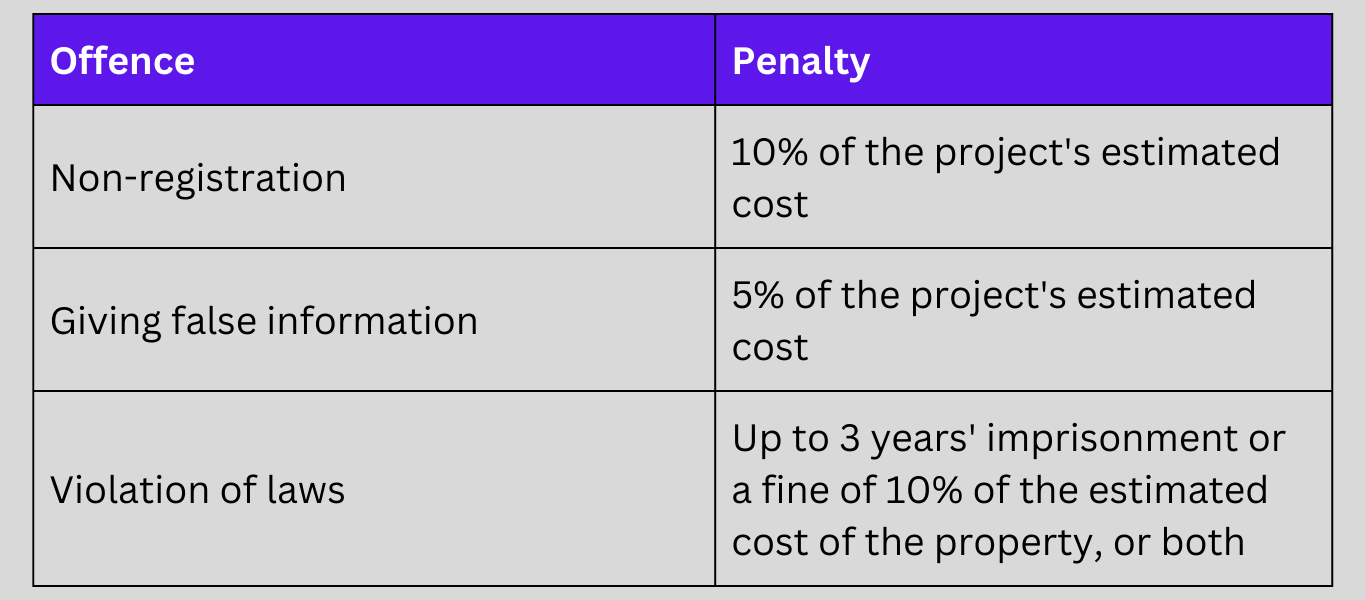

For Buyers

For Promoters

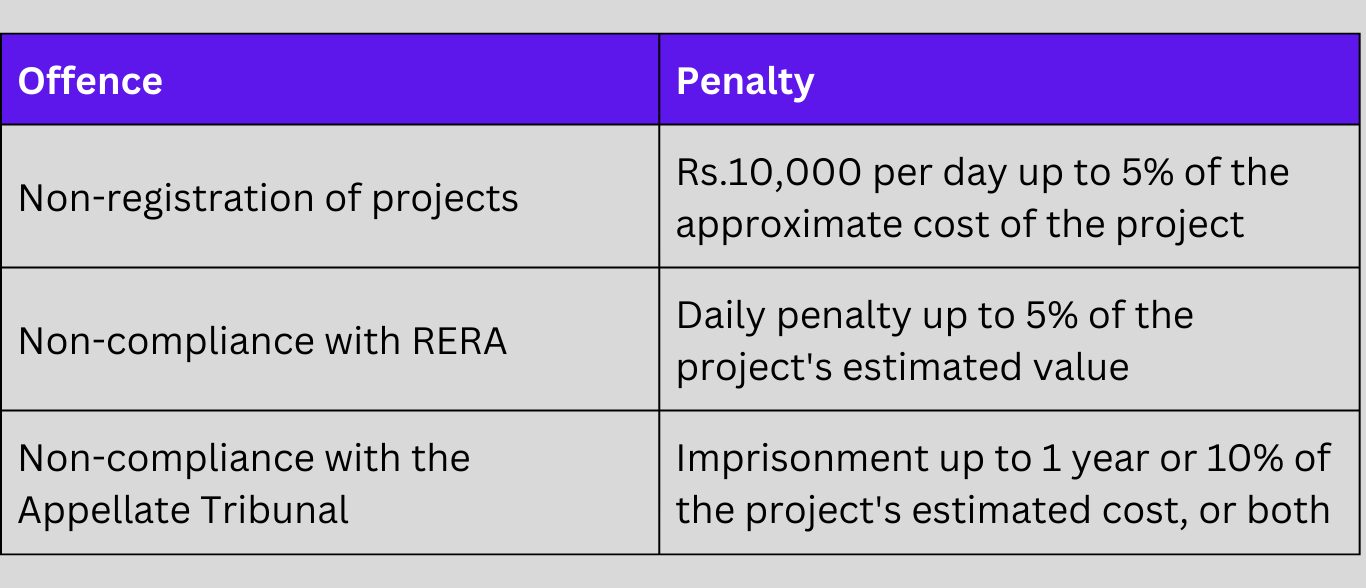

For Agents

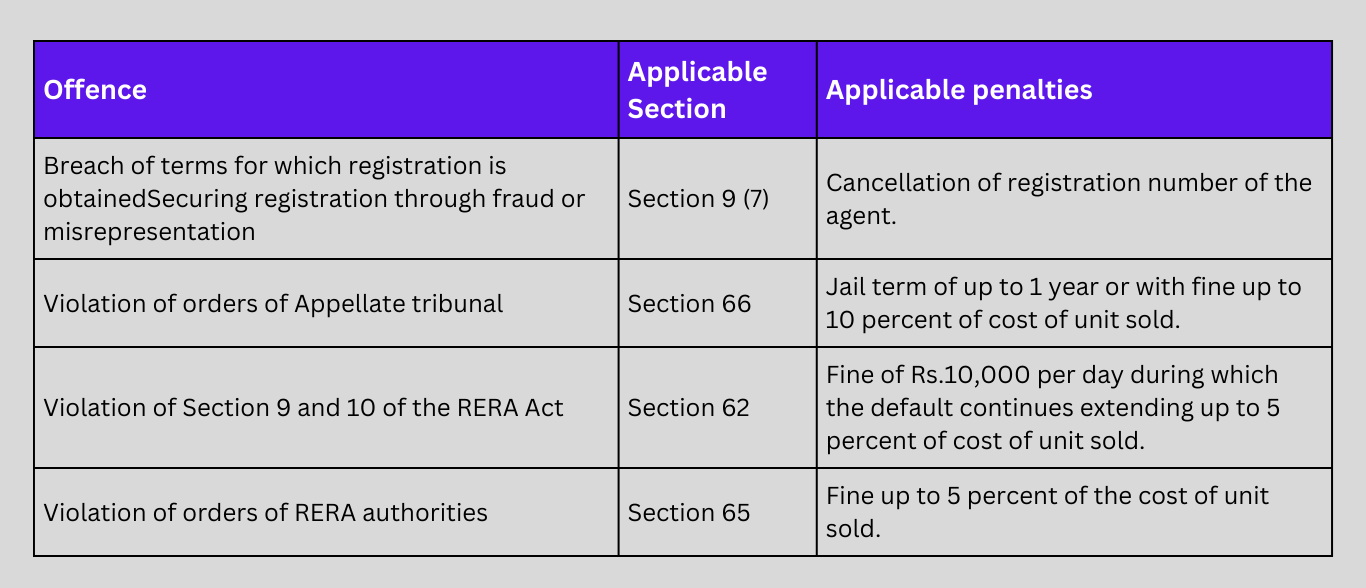

Applicable penalties under RERA

According to the Real Estate (Regulation and Development) Act, 2016 (RERA), specific violations can lead to penalties being enforced. The following are specific violations that result in penalties according to the relevant sections.

List of States that have Enforced RERA ACT

How to Register Projects Under RERA

For Promoters

For Real Estate Agents

How to File a Complaint

Documents Required to Register a Project Under RERA

Also Read: MahaRERA drafts model guidelines for senior citizen homes

_1715595803.webp)

_1768985363.webp)

Ans 1. An Act to establish the Real Estate Regulatory Authority for regulation and promotion of the real estate sector and to ensure sale of plot, apartment or building, as the case may be, or sale of real estate project, in an efficient and transparent manner and to protect the interest of consumers in the real estate sector ...

Ans 2. The Act establishes a Real Estate Regulatory Authority (RERA) in each state for regulation of the real estate sector and also acts as an adjudicating body for speedy dispute resolution. The bill was passed by the Rajya Sabha on 10 March 2016 and by the Lok Sabha on 15 March 2016.

Ans 3. RERA aims to promote transparency, accountability, and efficiency in the real estate industry, protecting the interests of both buyers and developers.

Ans 4. The Real Estate Act is intended to achieve the following objectives: ensure accountability towards allottees and protect their interest; a) infuse transparency, ensure fair-play and reduce frauds & delays; b) introduce professionalism and pan India standardization; c) establish symmetry of information between the ...

Ans 5. The registration granted shall not be revoked unless the promoter has been given a 30 days written notice to state the grounds why the registration should not be canceled by them and produce the sufficient cause to the authority.

Ans 6. Regulation of the Real Estate Sector: RERA ensures transparency in project development and execution by mandating that all projects be registered with the regulator. Developers cannot market, advertise or sell units in an unregistered property. Every phase of construction has to be registered as a standalone project.

Ans 7. Salient Features of the RERA Act If there is any default from the promoter or buyer side, they must pay an equal interest rate. A penalty must be paid if the Appellate Tribunal's order is not complied with. This can be imprisonment for up to 3 years or 10% of the approximate cost of the project.

Ans 8. Section 4 of the Act provides for details / information and undertaking to be provided by the promoter to the Authority for registration of the project. The mechanism for registration i.e. the requisite forms to be filled, the fees to be paid etc. are to be determined by the Rules made by the appropriate Government.

Ans 9. A person who converts an existing building into apartments for the purpose of selling it to other persons shall also be a promoter i.e., a person re-developing an existing building or part thereof for the purpose of selling it shall be construed as 'Promoter'.

Ans 10. The Real Estate (Regulation and Development) Act, 2016 aims to establish the Real Estate Regulatory Authority (RERA) to regulate and promote the real estate sector in India. It also aims to protect the interests of homebuyers by ensuring transparency, accountability, and timely delivery of projects.