Table of Content

▲

Latest News on Pradhan Mantri Awas Yojana 2023

Mandatory to display PMAY Logo & beneficiary Details on Houses constructed under PMAY

The Union government has issued a crucial directive to state governments regarding the Pradhan Mantri Awas Yojana (PMAY). According to this directive, states are required to ensure that the housing units constructed under PMAY prominently display the PMAY logo and details of the beneficiaries. The government emphasizes that the logo should be displayed in its standard format, and no modifications are allowed.

Pradhan Mantri Awas Yojana (PMAY) is the flagship scheme of the Union Government, aimed at addressing the shortage of housing in both urban and rural areas. Under this scheme, eligible beneficiaries receive financial assistance on home loans for purchasing a house. PMAY is implemented through four verticals: Beneficiary Led Construction (BLC), Affordable Housing in Partnership (AHP), In-Situ Slum Redevelopment (ISSR), and Credit Linked Subsidy Scheme (CLSS). States and Union territories are urged to adhere to the specified guidelines for displaying the PMAY logo on housing units.

Meghalaya sets a target of 1.40 Lakh PMAY houses for the current Financial Year

December 1, 2023: In a positive development, the Northeastern state of Meghalaya has set a target of constructing over 1.40 Lakh houses under the Pradhan Mantri Awas Yojana (PMAY). The state government is making steady progress in terms of the development of affordable housing units for the citizens. In the last four years, the target number of houses under PMAY was 40,000-50,000. However, for this Financial Year, the Meghalaya government is all set to complete over 1.40 lakh houses.

PMAY is the flagship affordable housing scheme of the Government of India. The Union government and state government share the subsidy provided to the eligible beneficiaries. For the Hilly and North-eastern states, cost sharing for PMAY is done in a 90:10 ratio. Under the PMAY CLSS, a credit-linked subsidy is given to the beneficiaries for the development/ renovation/construction of a home under the scheme.

About Pradhan Mantri Awas Yojana (PMAY)

Initiated in 2015, the Pradhan Mantri Awas Yojana (PMAY) is a governmental effort in India aimed at providing affordable housing options for economically disadvantaged segments of society. The PMAY initiative sets a goal of constructing approximately 20 million affordable houses by March 31, 2022. The Pradhan Mantri Awas Yojana Gramin (PMAY-G) has been extended until the year 2024, with a revised total target of 2.95 crore pucca houses.

Since its inception, PMAY has significantly transformed the dynamics of the real estate market by substantially reducing the cost of homeownership for the urban poor. If you are considering owning a home through the Pradhan Mantri Awas Yojana scheme, here is a comprehensive guide to everything you need to know about the PMAY (Pradhan Mantri Awas Yojana) scheme.

We've covered the PMAY eligibility criteria & parameters, subsidy calculation, how to apply PMAY online/offline, and all other information you want to understand about the PMAY housing scheme 2023-24. Let's start with the benefits of Pradhan Mantri Awas Yojana scheme or PMAY Yojana-

PMAY Scheme Benefits

- To rehabilitate slums with the help of private developers.

- To promote affordable housing for the weaker sections through the Credit Linked Subsidy Scheme.

- To construct affordable houses in partnership with the public and private sectors.

- To provide subsidies for beneficiary-led individual house construction.

Pradhan Mantri Awas Yojana Eligibility 2024 (PMAY Eligibility)

-

A Beneficiary can be a husband, wife, and unmarried daughters/sons

- A Beneficiary should not own a pucca house, which means the house should not be in his/her name or any other member of the family across India.

- Any adult, irrespective of his/her marital status, can be treated as a separate household altogether.

Beneficiaries Under PMAY Scheme 2024

- Middle Income Groups (MIG I) with annual income between Rs. 6 -12 Lakh

- Middle Income Group (MIG II) with annual income between Rs. 12 -18 Lakhs

- Low-income Groups (LIGs) with annual income capping between Rs. 3 -6 Lakh

- Economically Weaker Section (EWS) with an annual income capping Up to Rs. 3 Lakh

- Economically Weaker Section (EWS) with an annual income capping Up to Rs. 6 Lakh only for MMR, Mumbai, Maharashtra.

Under the Pradhan Mantri Awas Yojana, beneficiaries falling into the categories of LIG (Low-Income Group) and MIG (Middle-Income Group) are exclusively eligible for the Credit Linked Subsidy Scheme. However, those belonging to the Economically Weaker Sections (EWS) are entitled to comprehensive assistance. To be classified as a beneficiary in the LIG or EWS category, the applicant is required to submit an affidavit substantiating their income proof.

Pradhan Mantri Awas Yojana Eligibility Parameters

|

Particulars |

EWS |

LIG |

MIG I |

MIG II |

|

Total household income |

Upto Rs 3 Lakhs |

Rs 3 -6 Lakhs |

Rs 6 -12 Lakhs |

Rs 12 -18 Lakhs |

|

Max loan tenure |

20 years |

20 years |

20 years |

20 years |

|

Max dwelling unit carpet area |

30 sq. m. |

60 sq. m. |

160 sq. m. |

200 sq. m. |

|

Max loan amount allowed for subsidy |

Rs 6 Lakhs |

Rs 6 Lakhs |

Rs 9 Lakhs |

Rs 12 Lakhs |

|

Subsidy |

6.50% |

6.50% |

4.00% |

3.00% |

|

Discount rate for net present value (NPV) calculation of interest subsidy (%) |

9.00% |

9.00% |

9.00% |

9.00% |

|

Max. interest subsidy amount |

Rs 2,67,280 |

Rs 2,67,280 |

Rs 2,35,068 |

Rs 2,30,156 |

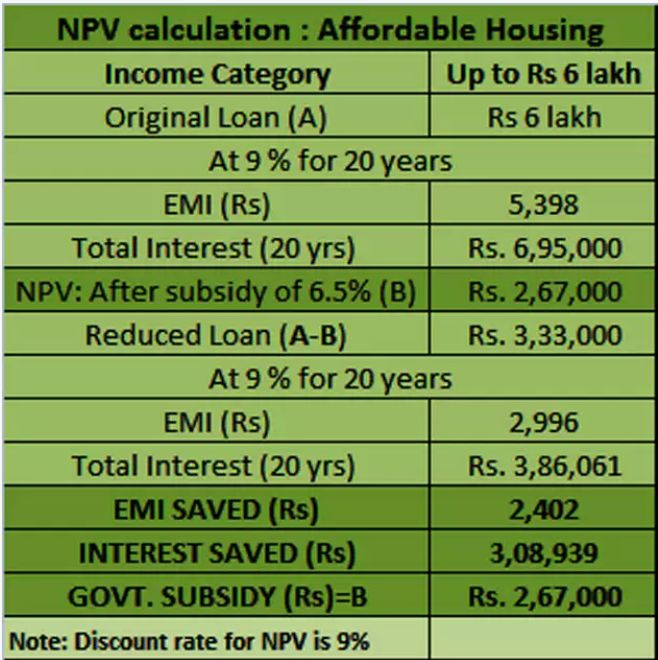

How does Pradhan Mantri Awas Yojana Work?

An Illustration to help you understand-

Assume that you fall in the MIG-II category (i.e. your total household income is between Rs 12-18 Lakhs). You are planning to buy a house worth Rs 50 Lakhs. Your minimum down payment would be 20%, i.e. Rs 10 Lakhs, and you can arrange the remaining amount of Rs 40 Lakhs through a loan.

However, under PMAY 2022, MIG-2 category applicants are eligible for a subsidy of 3% on loans of upto Rs 12 Lakhs. Therefore, for the remaining Rs 28 Lakhs of the loan, you will have to pay regular (non-subsidized) interest rates to the lender.

Pradhan Mantri Awas Yojana Subsidy Calculation (PMAY Subsidy)

What are the Main Components of the Pradhan Mantri Awas Yojana Scheme?

The government has created the following four components to ensure a maximum number of people are covered, depending on their income, finances, and availability of land.

1. Credit Linked Subsidy Scheme (CLSS) - PMAY

|

Type |

Purpose of loan |

Household Income (Rs) |

Subsidy Interest |

Max. Carpet Area |

Validity |

Max. Interest Subsidy Amount |

Women Ownership |

|

EWS & LIG |

Construction/ Extension/ Purchase |

Up to Rs 6 lakh |

6.50% |

60 sq m |

2022 |

R. 2.67 lakh |

Yes |

|

MIG -1 |

Construction/ Purchase |

Rs 6-12 lakh |

4.00% |

160 sq m |

2019 |

Rs. 2.35 lakh |

No |

|

MIG -2 |

Construction/ Purchase |

Rs 12-18 lakh |

3.00% |

200 sq m |

2019 |

Rs. 2.30 lakh |

No |

2. In-situ Slum Redevelopment (ISSR) - PMAY

Under this scheme:

- Financial assistance of Rs. 1 lakh will be provided to slum residents eligible for this scheme to build houses

- Private investors will be selected through the bidding process (whoever offers the best price for this project)

- During the construction period, slum residents will be provided with a temporary accommodation

3. Affordable Housing in Partnership (AHP) - Pradhan Mantri Awas Yojana 2022

This program seeks to offer financial aid, amounting to a maximum of Rs. 1.5 Lakhs from the Central Government, to families classified under the Economically Weaker Sections (EWS) for the purpose of buying and building homes. The State or Union Territory has the option to collaborate with either private organizations or agencies for the development of such housing projects.

Under this scheme:

- The state/UT shall set an upper limit price for units planned to be provided to buyers under EWS.

- Carpet area is considered for deciding the value to make the constructed houses economically affordable.

- There will be no profit margin on the homes constructed by the State/UTs without the involvement of a private party.

- In the case of private developers, the State / UTs will decide the sale price using a transparent method based on Center / State / ULB incentives.

- The central grant will be applicable only for housing projects that have 35% of the total units built for EWS

4. Beneficiary-led Individual House Construction/Enhancements (BLC) - Pradhan Mantri Awas Yojana 2023-24

This scheme applies to families under EWS who can’t avail of the benefits of the previous three schemes (CLSS, ISSR, and AHP). Such beneficiaries are likely to get financial assistance of Up to Rs. 1.5 Lakh from the Central Govt. for constructing or renovating an existing house.

Under this scheme:

- The Centre will provide unit support in plain areas between Rs 70,000 and Rs 1.20 lakh and hilly and geo-difficult regions between Rs 75,000 and Rs 1.30 lakh

- It’s mandatory to provide personal and other identity documents (relating to landing ownership) to the Under Local Bodies (ULBs)

- Residents from other slums that haven’t been redeveloped can take advantage of this policy if they own a kutcha or semi-pucca home.

- The State shall establish a program for monitoring construction progress by using geo-tagged photographs.

Also Read: PMAY Gramin List 2023-24: Pradhan Mantri Awas Yojana Gramin Beneficiary List

How to Apply for PMAY 2023 Online @ pmaymis.gov.in?

You can apply for PMAY scheme both online and offline.

Step 1: Visit the official website of PMAY (Pmay gov in)

Step 2: Click on the Citizen Assessment option under the Menu tab.

Step 4: Once the Aadhar number is submitted, he/she will be taken to the application page.

Step 5: The PMAY applicant must proceed to enter all required details on this page, including income details, personal details, bank account details and other required information.

Step 6: The pmay applicants must recheck all information before submission.

Step 7: As soon as a person clicks on the 'Save' option, he/she will find a unique application number.

Step 8: You must download the filled-in application form.

Step 9: Finally, the person can submit the form at his/her nearest CSC office or a financial institution/bank offering her home loan.He/she should submit all necessary documents along with the form.

PMAY Beneficiary List: How to find your name in PMAY List?

The Government releases an annual list of beneficiaries on the basis of SECC 2011 data. To check your name in Pradhan Mantri Gramin Awas Yojana list, take the following steps:

- Visit the PMAY beneficiary list website (Pmay gov in)

- Enter your registration number.

- Click on ‘Submit’ to view the status.

- Pradhan Mantri Awas Yojana - Gramin has been one of the most important rural development schemes initiated by the government. If you are looking to get a house under this scheme and if you are eligible, keep a track on the annual beneficiary list.

How to check Pradhan Mantri Awas Yojana Application Status (PMAY Status)?

You can take the following steps to check the status of your Pradhan Mantri Awas Yojana application:

- Visit the office PMAY Track Assessment Website (Pmay gov in).

- Track the status in one of the two ways: 1. Enter your Name, Your Father’s Name, and Mobile Number. 2. Enter your Assessment ID and Mobile Number.

How to Apply for PMAY 2023 Offline?

If you wish to apply offline for Pradhan Mantri Awas Yojana (PMAY), you can directly go to any CSC office near you to get an application form. Fill in the PMAY application form and submit it right there along with other required documents.

Documents required for Pradhan Mantri Awas Yojana

You will need the following documents to apply for PMAY scheme:

- Consent to use Aadhar information

- An affidavit stating that you (or your family members) do not own a pucca house

- Identity proof such as Aadhar card or Voter ID

- Bank account details

- Swachh Bharat Mission registration number

- Job card number - as registered under MGNREGA (Optional)

Pradhan Mantri Awas Yojana Bank List

You can get a subsidized loan under the Pradhan Mantri Awas Yojana scheme from any scheduled Commercial Bank, Housing Finance Company, State Cooperative Bank, Urban Cooperative bank, Regional rural bank, or any other institution as may be identified by the MoHUA.

Summing up Pradhan Mantri Awas Yojana (PMAY)

In conclusion, the Pradhan Mantri Awas Yojana, or PMAY Scheme, has enabled millions of Indians to achieve the dream of owning their own homes. By utilizing the PMAY list and checking the PMAY beneficiary status online, individuals can verify the status of their home loans. The government releases the PMAY beneficiary list to facilitate easy online verification, allowing citizens to conveniently confirm their inclusion in the PMAY beneficiary list.

Also Read: PMAY or Pradhan Mantri Awas Yojana Eligibility Criteria

(2) (1) (1)_1732086657.webp)

_1771582392.webp)

_1771577585.webp)

Ans 1. Visit PMAY official website for PMAY beneficiary list. 1. On the website, from the 'Select Beneficiary' download box you select 'Request by name'. 2. Enter your adhaar card number. 3. If the Adhaar number is in the register, you can see the beneficiaries

Ans 2. 1. Visit PMAY official website. 2. Select 'Citizen Assessment' from the menu. 3. Select the 'Track Your Assessment'state. 4. Choose search options: name, name of the father, type of ID, or evaluation id. 5. Enter mobile number, State, city, district, father name, ID type, ID number. 6. By entering assessment ID and enrolling cellphone number, you can check the PMAY application status

Ans 3. 1. Visit pmaymis.gov.in. 2. Choose 'Citizen Assessment' and click any option between 'Benefits in other three components' and 'For slum residents.' 3. Enter your aadhar card details. 4. You are redirected to the application page where the PMAY online application form has been filed. Your name, bank account, annual income information, contact specifics, & other specifics are required. 5. Click 'Save' and enter a captcha code. 6. Now, you can download it for future reference and print it.

Ans 4. If you are eligible for the PM Awas Yojana Scheme and submit the application, the bank will obtain the PMAY Subsidy benefits from the National Housing Bank. The subsidy will be paid to the bank of the requester once it has been confirmed. The money is then passed on to the loan account.

Ans 5. The PMAY Urban or Pradhan Mantri Awas Yojana is December 31, 2024.

Ans 6. Families with annual revenues between INR 3 and 18 lakhs shall be eligible. The applicant or any other family member should not have a pucca house in any area of the country. Check here the complete details of

Ans 7. Budget 2023: PM Awas Yojana allocation enhanced by 66% to Rs 79,000 crore.

Ans 8. The Pradhan Mantri Awas Yojana (PMAY) scheme is available to families with an annual income of up to INR 18 lakhs. To be eligible for the scheme, individuals must not own a permanent house in any part of India.

Ans 9. Pradhan Mantri Awas Yojana (PMAY) is a government-launched scheme which aims to provide housing with water connection to every eligible family by 2022. State Bank of India (SBI), in order to help achieve this mission, has launched SBI PMAY under which eligible applicants can apply for this home loan scheme.

Ans 10. Challenge 6: Lack of skilled workforce India massively lacks skilled labourers in all stages of project completion – construction, project development, plumbing, electricity etc. A shortage of around one crore skilled workers poses as a major challenge towards the achievement of a mammoth goal of PMAY.

Ans 11. On August 15, 2023, Prime Minister Narendra Modi announced a new government housing scheme to provide subsidised loans for small urban homes in the next five years. The $7.2 billion subsidy scheme aims to offer an annual interest subsidy of 3 to 6.5% (Rs. 9 lakh) on home loans.