Table of Content

▲

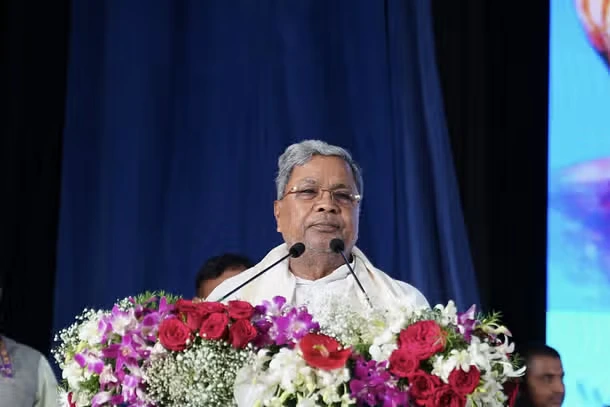

In an important move to improve revenue collection and reduce fraud, the Karnataka government has decided to bring around 1.35 crore properties under the tax net. Chief Minister Siddaramaiah made this announcement during a review meeting with officials of the stamps and registration department. The main aim is to make sure that more properties are properly registered and pay the taxes they owe, which will help the state earn more revenue.

What Is Khata and Why Is It Important?

In Karnataka, "khata" is an official document that is needed to prove property ownership. This document is necessary for paying property taxes, and it is a key part of the property registration process. Without khata, properties cannot be registered properly, and the owners may not be paying the required taxes. The lack of khata for many properties is causing big losses in government revenue.

Also Read: DTCP Survey Flags 7,500 Illegal Buildings Across DLF Phases 1-5

The Problem: Unregistered Properties

In Bengaluru, there are between 7 to 15 lakh properties that do not have khata. These properties are not paying taxes, which is a significant problem for the state. Outside Bengaluru, the issue is even larger. In urban areas, around 30 lakh properties are without khata. In rural areas, including gram panchayat regions, over 90 lakh properties lack proper documentation. This has resulted in a lot of money being lost due to missing property tax payments.

Currently, in the gram panchayat areas, only 44 lakh properties have khata and pay taxes, contributing around Rs 800 crore to the government’s revenue. However, a much larger number 96 lakh properties are not contributing anything.

The Solution: Bringing Properties Into the Tax Net

To solve this problem, the government has decided to take strong action. They want to bring all the unregistered properties into the system so they can start paying taxes. This will help increase the state's revenue and make property records more accurate.

Karnataka's stamps and registration department has already received a large sum of money this year Rs 16,993 crore in property registration fees, 17% higher than the previous year. The government hopes to collect Rs 26,000 crore by the end of current fiscal year, which they expect to do by registering more properties and guaranteeing adequate documentation.

The e-Khata System: A Step Towards Transparency

To make the property registration process easier and more transparent, Chief Minister Siddaramaiah has also urged officials to speed up the rollout of the e-khata system. This digital system will help verify properties and ensure that only those with proper khata records can be registered.

In Bengaluru, the Bruhat Bengaluru Mahanagara Palike (BBMP) has already digitized 23 lakh properties, and 15 lakh of them have successfully downloaded their khata records. However, there is still a lot of work to do. The government is focused on finishing this process quickly so that all properties with verified khata documents can be registered easily.

Why Is This Important?

By improving property documentation and bringing more properties into the tax system, the Karnataka government aims to:

- Increase Revenue: With more properties paying taxes, the state will earn more money, which can be used for public services like education, healthcare, and infrastructure.

- Reduce Fraud: The e-khata system will make the process more transparent and help prevent fake property registrations.

- Simplify the Process: Digital records will make it easier for people to register their properties and access their khata documents.

Karnataka’s efforts to bring 1.35 crore properties into the tax net are an important step toward improving the state’s financial health. The government hopes to reduce revenue losses and make the registration process more efficient by ensuring that all properties are properly documented and paying taxes. The introduction of the e-khata system will play a crucial role in achieving these goals, making property records transparent and trustworthy.

These changes will help the state grow financially and ensure that everyone pays their fair share of taxes, benefiting the entire community.

Also Read: Housing Sales Across Top Eight Cities Touch 3.5 Lakh Mark in 2024

_1771582392.webp)

_1771577585.webp)

Ans 1. Khata is an official document proving property ownership in Karnataka. It is necessary for property registration and tax payments. Without khata, properties cannot be registered properly, leading to lost revenue.

Ans 2. In Bengaluru, 7 to 15 lakh properties lack khata. Outside Bengaluru, approximately 30 lakh urban properties and over 90 lakh rural properties lack proper documentation.

Ans 3. The Karnataka government aims to bring all unregistered properties under the tax net by ensuring they have proper khata records and start paying taxes.

Ans 4. The government expects to collect Rs 26,000 crore by the end of the current fiscal year, with property registration fees already increasing by 17% from the previous year.

Ans 5. The e-khata system is a digital platform designed to simplify property registration and ensure transparency. It will verify properties and ensure only those with proper khata records are registered.

Ans 6. In Bengaluru, 23 lakh properties have been digitized, with 15 lakh properties successfully downloading their khata records.

Ans 7. It will help increase government revenue, reduce fraud, and simplify the property registration process, benefiting the state’s financial health and infrastructure development.

Ans 8. The e-khata system will make property registration more transparent and help prevent fake registrations by ensuring that only properties with valid khata documents are recognized.

Ans 9. It will ensure fair tax contributions, improve public services like education and healthcare, and simplify property registration for residents.

Ans 10. Property owners should ensure they have valid khata records and complete the necessary registration process, especially with the new e-khata system being rolled out