Table of Content

▲

There are many jargons that you will encounter while dealing in real estate. One such is the Tax Deducted at Source (TDS) on sale of property. Listed under section 194-IA of Income Tax Act, 1961, the property for which TDS has to be paid is only immovable property such as buildings, plots, etc. This tax has to be deducted by the buyer during a real estate transaction of more than Rs 50 lakh before making the payment to the seller. The buyer has to deduct a TDS of 1% of the total sale value.

Steps to file TDS on property

TDS on property: Form 26QB

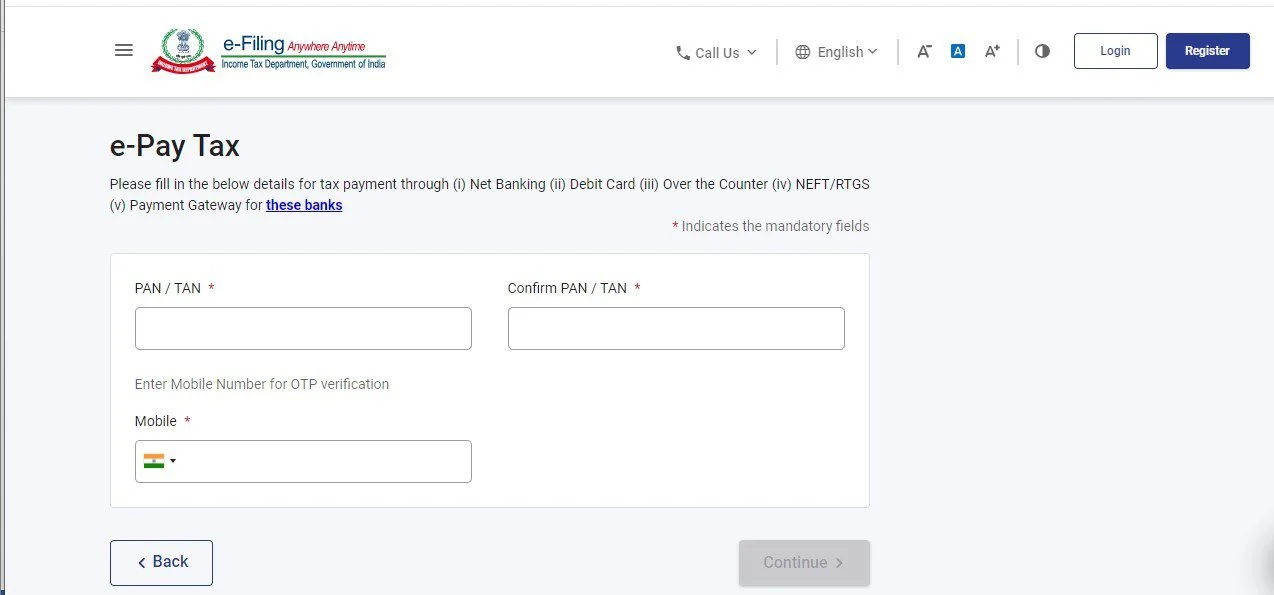

- Log on to https://www.incometax.gov.in/iec/foportal/ and click on e-Pay Tax under Quick Links.

- Enter PAN, confirm PAN, mobile number and continue.

- Click on New Payment.

- Select Proceed under 26 QB (TDS on Sale of Property)

- Fill the form with details such as

- Residential status of seller

- PAN card details of the seller and buyer

- Address/ email of seller and buyer

- Property details

- Amount paid/credited and tax details

Next choose the mode of payment from the following and click on continue to make the payment.

- Net banking

- Debit card

- Bank

- RTGS/NEFT

- Payment gateway

- On making the payment, you will get acknowledgment in the form of a challan that will include information such as CIN, payment details and bank account details.

Once the payment has been made, log on to the TRACES portal at www.tdscpc.gov.in after five days to download Form 16B.

How to download Form 16B?

- Login to the TRACES portal with your PAN.

- Under Downloads menu, select Form 16B for buyer.

- Feed property details for which Form 16B is needed. Enter the assessment year, acknowledgment number, PAN of seller and click on proceed.

- You will see a confirmation screen where you should click on submit request to proceed.

- You will see a success message on submission of download request will appear and download the requested files. You can search for the request with the request number. Select the request row and click on HTTP download button.

Also Read: What is a promissory note?

_1771410929.webp)