Table of Content

▲

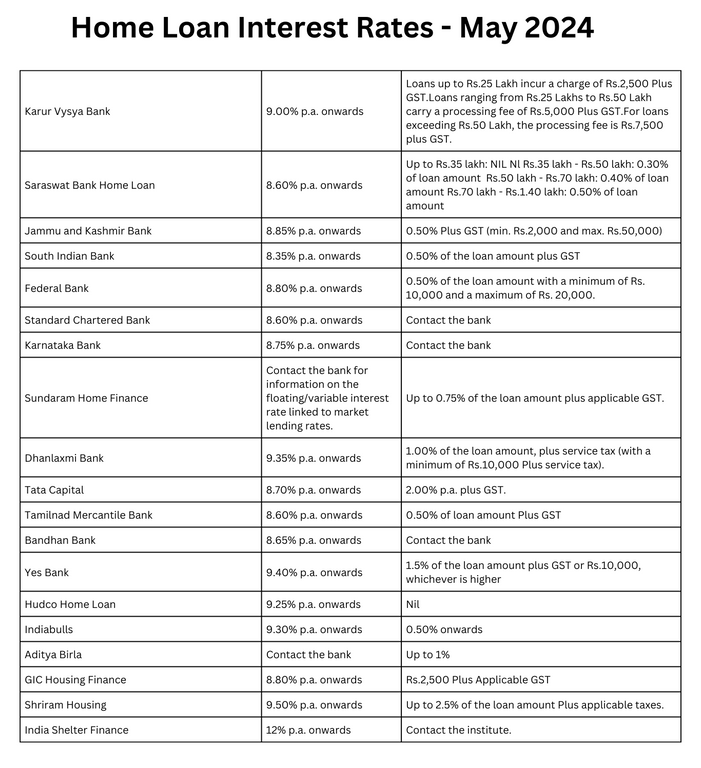

Make a comparison between home loan interest rates, starting from 8.35% p.a., in order to choose the most suitable home loan. Obtain the full compilation of current interest rates on housing loans in India from top banks and financial institutions.

.png)

How to Calculate Interest on Home Loan?

Typically, home loans span over long durations, necessitating an understanding of your total interest commitment from the outset.

You can ascertain this by employing either of the following methods:

- EMI Calculator - To determine the interest amount on your home loan, utilize a home loan EMI calculator. Input necessary details into the provided fields, then click 'Calculate' to receive a comprehensive breakdown of your loan, including the interest payable.

- Home Loan Amount

- Loan Repayment Tenure

- Rate of Interest

- EMI Calculation Formula: You may also employ the subsequent formula to compute your EMI obligation for your home loan: EMI = [P x r x (1+r)^n]/[(1+r)^n-1], wherein P represents the Principal, r denotes the interest rate, and n signifies the number of instalments or loan tenure in months.

Types of Interest Rates in Home Loan

There are mainly two types of home loan interest rates charged by most banks.

1. Fixed Interest Rate:

Under this computation method, the interest rate remains consistent throughout the loan term, ensuring stable interest charges with no fluctuations. Some offers may permit transitioning to a floating rate system after a specified duration in the loan tenure.

Advantage: With a fixed rate, you have clarity on upfront interest charges, shielding your loan from frequent rate shifts and potentially saving money over time in the event of rate hikes.

Disadvantage: If standard lending rates decrease, you won't benefit as the frozen interest component remains unaffected.

2. Floating Interest Rate:

The interest charges on your home loan are contingent upon the current prime lending rates set by the bank. These rates are linked to the bank's most recent published rate, influenced by various factors such as RBI's monetary policy, revisions in lending rates, and the bank's response to these changes.

Advantage: Opting for a floating rate provides the benefit of being charged based on the most recent rate. If rates decrease, you can save on interest charges.

Disadvantage: In uncommon instances, if standard rates increase, the loan may incur higher charges due to being billed at a higher rate.

Note: Certainly! "Floating home loan interest rates are typically lower than fixed home loan interest rates initially."

Also Read: Know the Difference Between: Plot Loan V/S Home Loan

Ans 1. Mortgage Rate Projection for 2024 As inflation slows and the Federal Reserve is able to start cutting the federal funds rate, mortgage rates are expected to trend down as well.

Ans 2. Negotiate with your lender: Sometimes, simply asking your lender for a lower rate or highlighting competing offers can lead to a reduced interest rate. Opt for shorter loan tenure: Shorter loan durations often come with lower interest rates. However, ensure the EMIs fit within your budget.

Ans 3. Whatever the external benchmark, the floating rate loan rates are expected to ease in 2024. In perspective, the RBI raised the repo rate from 4% to 6.5%, from May 2022 to February 2023. External benchmark-linked rate (EBLR) has moved up by a full 2.5 percentage points in this cycle.

Ans 4. Inflation and Fed hikes have pushed mortgage rates up to a 20-year high. 30-year mortgage rates are currently expected to fall to between 6.4% and 6.5% in 2024. Homebuyers might consider buying now and refinancing later to avoid increased competition when rates drop

Ans 5. The average 30-year fixed mortgage rate as of Thursday was 6.99%. By the final quarter of 2025, Fannie Mae expects that to slide to 6.0%

Ans 6. The Reserve Bank of India (RBI) is likely to keep the repo rate at the same level and maintain to its policy stance of 'withdrawal of accommodation' in the upcoming Monetary Policy Committee (MPC) meeting next month. The RBI has kept the repo rate unchanged since April 2023.

Ans 7. Should you buy a property in 2024? Given a choice, one should buy. “There has been growth in property prices and they are only expected to appreciate further,” said Pankaj Kapoor of Liases Foras, adding any time is a good time provided your finances allow you to make that purchase.

Ans 8. 3.35% Current Repo Rate in India - May 2024 As per the announcement made by the Reserve Bank of India (RBI) on 08 February 2024, the current Repo Rate is 6.50%*, which keeps the Repo Rate unchanged as the Monetary Policy Committee (MPC) unanimously decided. The Reverse Repo Rate stands unchanged at 3.35%.