Table of Content

▲

When banks offer home loans to salaried and self-employed individuals for purposes such as buying a plot of land, constructing a house, purchasing a ready-made residence, or refurbishing an existing home, they typically include an additional rate of interest (ROI) on the premium amount when the equated monthly installment (EMI) starts.

These added interest rates on lump sum advances are essential to consider when determining the affordability of a home loan. Factors such as your income, credit score, repayment tenure, loan amount, and relationship with the bank play a significant role in securing an attractive interest rate on the borrowed sum.

Following the Reserve Bank of India's (RBI) decision to pause rate hikes at 6.50%, many Indian banks have adjusted their rates for new home loans available to both salaried and self-employed consumers.

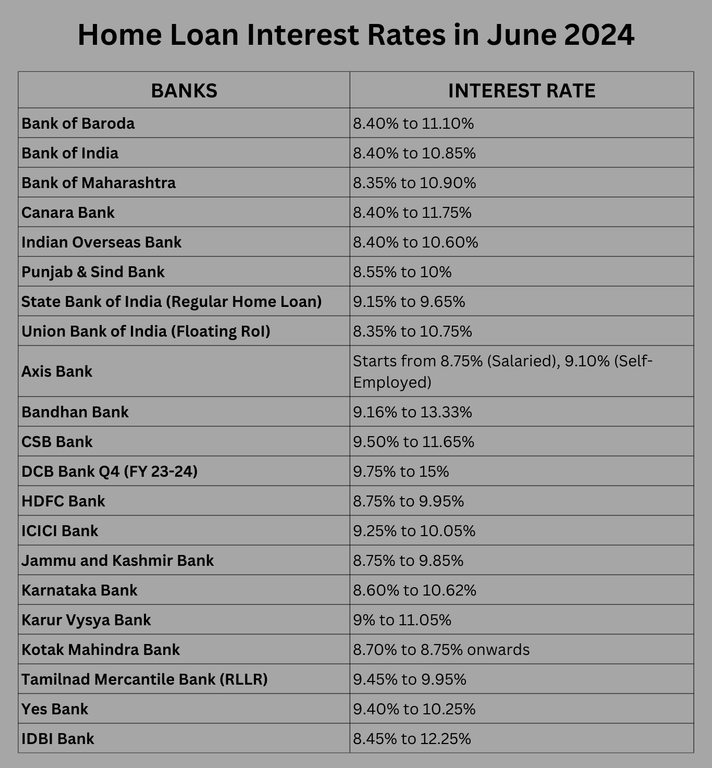

Below is a list of the interest rates applied by major banks in India.

Home Loan Interest Rates in June 2024

The interest rate on home loans is influenced by several factors, including whether the application includes security, a guarantor, or a co-applicant. Other important considerations are the down payment amount, collateral, current income, existing debt, and more. Additionally, many banks offer concessions to women borrowers and senior citizens.

As of June 3, 2024, here are the latest interest rates on new home loans for both employed and self-employed individuals, provided by major Indian banks.

How do Banks Calculate Interest Rates on Home Loans?

Interest rates for home loans provided by banks in India are typically floating, though fixed rates are also available. A fixed rate of interest remains constant for the entire duration of the loan. In contrast, a floating rate means the interest on your EMI is calculated based on the "base rate" (the bank's standard lending rate), the lender's repo-linked loan rate (RLLR), or the marginal cost of fund-based lending rate (MCLR), plus a spread (the difference between the interest rates the bank pays to depositors and receives from borrowers).

The interest rate on floating home loans changes in line with the RBI's adjustments to the repo rate (the rate at which the central bank lends money to other banks). However, this change is only reflected in the floating rate after the "reset period," when the interest rate on your EMI is subject to revisions.

Also Read: Everything regarding LIC home loans in 2024

How to Increase Home Loan Eligibility in 2024

Home loan eligibility determines the maximum amount a bank can borrow from an applicant. Here are some factors to consider:

CIBIL or Credit Score

Applicants with an excellent credit score and a strong repayment history are more likely to secure the maximum home loan amount. While most banks do offer home loans to individuals with lower credit scores, a score of 750 or above is generally considered ideal.

Joint Home Loan

Opting for a co-borrower, typically your spouse, who has a good credit score can significantly enhance your eligibility for a home loan and help share the repayment burden.

Longer Tenure

It helps lower the EMI amount while choosing a more extended repayment period.

Clear Existing Debts

An applicant opting for a home loan may consider clearing the existing debt or ongoing EMIs to boost their eligibility.

Higher Down Payment

Banks typically finance 75% to 90% of the property value, leaving the applicant to cover the remaining amount. To minimize interest payments when the EMI starts, consider making a larger down payment.

How to Select the Best Home Loan

Selecting the best home loan requires a thorough understanding of various aspects to ensure it meets your financial needs. Key factors influencing your choice include:

Rate of Interest

The interest rate is crucial as it determines your monthly payments once the EMI begins. Note that many banks offer women borrowers a discount of 50 basis points on regular rates.

Maximum Loan Amount

The maximum loan amount you can borrow depends on the property's cost and your income level, as well as other eligibility factors. Banks typically finance 75% to 90% of the property's value, taking into account co-applicants, guarantors, and additional security.

Processing Charges

Banks charge a fee to process your loan application. While some banks waive this fee for certain loan amounts and periods, it generally ranges from 0.25% to 3% of the loan amount. Processing fees are often lower for salaried and women borrowers and may be waived for government employees.

Prepayment Charges

These charges apply if you decide to repay your loan before its maturity date and can vary between banks.

Moratorium Period on Home Loans

Home renovation loans typically include a moratorium period of three to six months, during which no payments are required.

Market Offerings

Banks are required to provide all relevant information about their services, interest rates, fees, and more on their websites, apps, flyers, and other materials. This information can help you understand what each bank offers before visiting their website or branch.

Tax Benefits

Home loans offer tax exemptions and deductions under Sections 24, 80C, and 80EE of the Income Tax Act for those who opt for the old tax regime.

By considering these factors, you can select a home loan that best fits your financial situation and goals.

Also Read: Cheapest home loan interest rates: Banks home loan rates for amounts up to Rs 30 lakh 2024

_1771582392.webp)

_1771577585.webp)

Ans 1. Home Loan Interest Rate 2024 Currently, Union Bank of India and Bank of Maharashtra offer the lowest home loan interest rate starting from 8.35% p.a. Punjab National Bank, Bank of India, Indian Overseas Bank and Canara Bank offer rate of interest on home loans starting from 8.40% p.a.

Ans 2. Generally, secured loans tend to have lower interest rates compared to unsecured loans because they are backed by collateral. However, if you do not want to pledge any of your assets as collateral to the lender, then unsecured loans like personal loan is the best financing option.

Ans 3. 8.70% p.a. to 9.30% p.a. 9.05% p.a. to 9.80% p.a. For detailed information on fees and charges such as regulatory/statutory charges, document charges, and specific fees applicable on home loans to salaried, self-employed non-professional, and self-employed professionals, check out Home Loan Processing Fees and Charges.

Ans 4. HDFC Bank offers FD rates of 3.00-7.25% p.a. to the general public and 3.50-7.75% p.a. to senior citizens on tenures ranging from 7 days to 10 years. The bank also offers Tax Saving FDs @ 7.00% p.a. for the general public and 7.50% p.a.

Ans 5. Following closely, HDFC Bank Ltd. provides competitive rates, starting at 8.55 percent for loan amounts in all three categories (up to Rs 30 Lakh, above Rs 30 Lakh & up to Rs 75 Lakh, and above Rs 75 Lakh). Kotak Mahindra Bank has home loans starting at 8.70 percent for loan amounts in all three categories.