Table of Content

▲- GST on real estate transactions

- What impact does GST have on the real estate sector?

- What impact does GST have on the real estate industry?

- Impact of GST on Real Estate: Influence on Stamp Duty and Registration Charges

- Taxes on purchasing a home before the implementation of GST on property

- 2024 GST on real estate rates

- GST on real estate: Specifically targeting government housing projects

- Goods and Services Tax applied to fees for upkeep services

- GST on real estate rental income

- Goods and Services Tax on home loan

- Builders and developers collecting one-time maintenance deposits will be subject to GST

- Conclusion

On July 1, 2017, the Goods and Services Tax (GST) was implemented in India, representing a significant tax overhaul that changed the way taxes are managed in the nation. Even though the GST on real estate doesn't have direct control over the whole sector, services like constructing buildings, complexes, and civil structures are considered works contract services per Section 2(119) of the CGST Act, 2017. This classification guarantees that these services are in compliance with GST laws.

GST on real estate transactions

GST is applied to the category of real estate:

- 1% allocated for housing that is within financial reach for many people

- Residential installations without the Investment Tax Credit (ITC) are eligible for a 5% discount.

- 12% on business transactions

Please note that GST only applies to properties under construction. There is no requirement to pay GST for a property that is prepared for immediate occupancy. Within legal terms, a project is deemed complete once it receives a completion certificate (CC) from an appropriate authority.

Also Read: Redevelopment vs. New Construction: What Works Better in Cities?

What impact does GST have on the real estate sector?

The GST system has a tax rate of 1% for affordable real estate properties. Residential properties are taxed at a rate of 5% without the option of input tax credit (ITC). Commercial properties in real estate are subject to a 12% GST.

What impact does GST have on the real estate industry?

Since the implementation of GST in 2017, it has become simpler for regular individuals to invest in properties that are still being built, as the previous tax system placed numerous taxes on these types of investments. A unified tax system - GST on property gives buyers a clear idea of the taxes involved in purchasing a home.

The government's decision to simplify the GST rate on affordable real estate has greatly improved investing in affordable property.

Developers have also discovered that the GST regime is extremely beneficial. Previously, developers were required to settle different taxes such as VAT, Central Excise, Entry Tax, LBT, Octroi, and Service Tax, but they found it difficult to utilize the credits for reducing their output tax liability. According to a report by PwC India, the GST system enables Input Tax Credit (ITC) for construction and other services obtained, thereby removing the inefficiency of tax cascading.

Impact of GST on Real Estate: Influence on Stamp Duty and Registration Charges

Even though there have been some demands to remove stamp duty and registration fees on property after the GST was introduced, the government has not addressed this issue. Hence, stamp duty and registration fees are still required for property transactions in India. States impose stamp duty between 5% and 10%, with registration fees set at either 1% of the property value or a fixed sum.

Taxes on purchasing a home before the implementation of GST on property

Before the GST was implemented in 2017, various state and Central taxes were imposed on properties at various points during the building's construction. Despite the increased costs that these taxes incurred for developers constructing properties, they were unable to offset this tax against their output tax responsibilities. Prior to the introduction of the GST on real estate developers had to fulfill specific tax obligations.

- VAT, an abbreviation for Value Added Tax

- Central government imposing excise duty

- Tax levied on products brought into a specific region.

- Same-sex attracted, biromantic, gender nonconforming.

- Tariff duty

- Tax on services, et cetera.

The builders transferred the taxes they paid to the buyer. Moreover, developers were able to raise prices for buyers by manipulating numbers due to the complex tax rates. Determining the relevant rates of VAT, Central Excise, Entry Tax, LBT, Octroi, and service tax for property construction used to be a challenge for the average consumer.

Changes made to the GST on real estate sector

The GST was implemented in place of multiple indirect taxes to create a uniform tax system for taxpayers. Since its introduction, there have been numerous changes made to the category in which real estate GST is imposed.

GST absorbed both Central and state taxes

- Taxes that are imposed by the central government.

- Tax on goods produced or sold within a country.

- Tax on imported goods

- Customs Special Additional Duty.

- Tax on services

- Tax on sales within a specific region

- Additional fees and taxes on the provision of goods and services.

- Taxes imposed at the state level.

- Indicate the Value Added Tax by state.

- Tax on entertainment

- Tax on expensive goods

- Excise Duty imposed by the government.

- Impose additional fees and taxes on the sale of goods and services.

- Advertisement taxes

- Tax on purchases

- Tax obligations on lotteries, betting, and gambling.

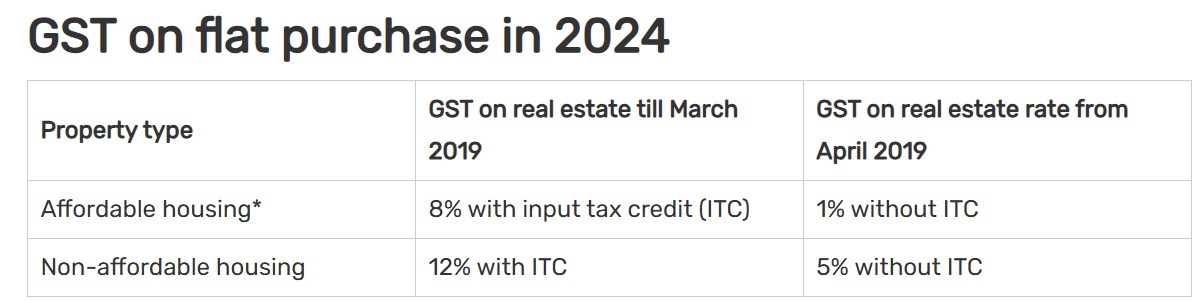

2024 GST on real estate rates

When purchasing properties like flats, apartments, bungalows, and developable land that are not yet completed, homeowners in India are required to pay a GST rate on real estate. The GST imposes a 1% tax rate on affordable real estate properties. The GST for all other properties besides real estate is 5%.

GST on real estate: Specifically targeting government housing projects

The GST rate for affordable housing in the new system will be set at 1% as announced by the government. The housing programs include the Jawaharlal Nehru National Urban Renewal Mission, the Rajiv Awas Yojana, the Pradhan Mantri Awas Yojana, and state government housing initiatives.

Also Read: Why Affordable Housing Projects Are Gaining Popularity in Metro Cities

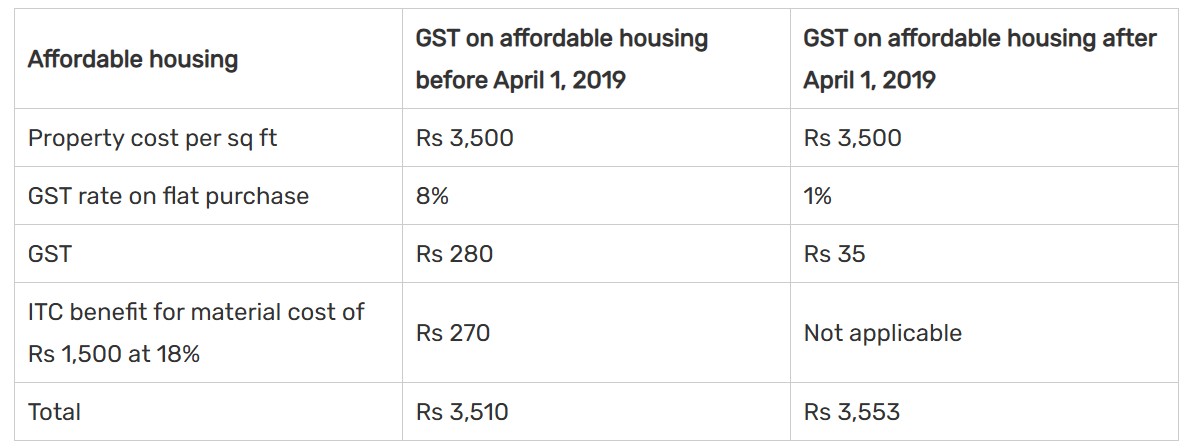

Calculation of GST on real estate affordable properties

Here is a summary of the procedure for calculating the GST for flats in the affordable housing segment before and after the rate change on April 1, 2019:

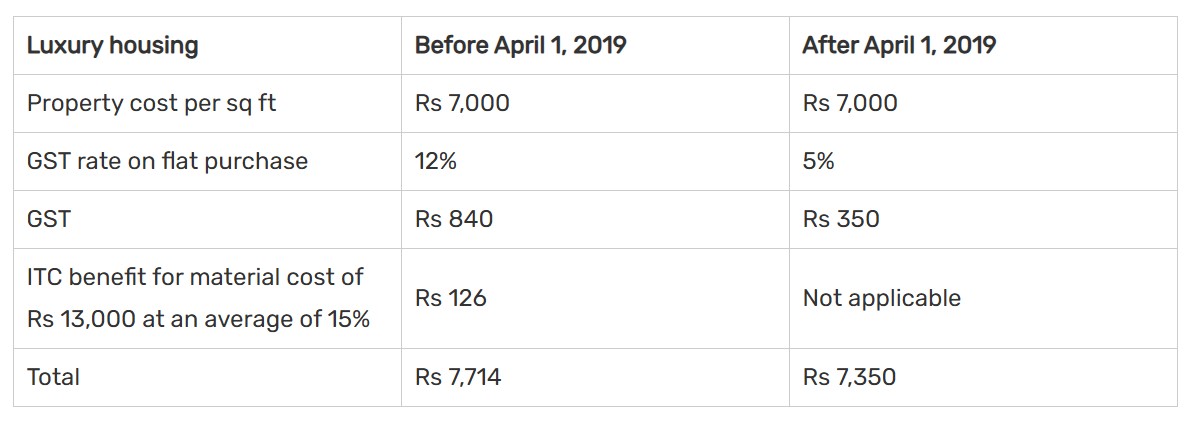

What is the influence of GST on real estate luxury property?

With the new GST rates in place, purchasers of high-end real estate will see greater savings compared to before. Here is an explanation of how to determine the GST for buying a flat in the high-end segment:

Goods and Services Tax on additional fees for business and residential real estate

An 18% GST is imposed on additional fees classified as services related to real estate for both commercial and residential properties. These fees encompass:

- Brokerage

- Consultation regarding legal matters

- Parking facility provided for vehicles.

- Installation of an electric meter

- Installation of a gas pipeline meter

- Fees for connecting to the water supply

- Maintenance of society

- Connection to water

- Fees imposed for growth outside of property boundaries

- Fees for development within the organization

- Cost of home inspection

- Costs associated with insuring a residence

- Fees for processing a home loan

- Costs associated with finalizing a real estate transaction.

Goods and Services Tax applied to construction services

According to a Supreme Court decision dated October 3, 2024, real estate firms are eligible to request Input Tax Credit (ITC) for construction expenses of commercial properties that are rented or leased out.

Even though real estate in India is not directly included in the GST system, several activities and services within the sector are subject to taxation under the new regime. Below are the tax rates for related activities within the construction industry under India's GST system:

- A home that is currently being built was purchased through the PMAY Credit-Linked Subsidy Scheme (CLSS) at an 8% interest rate.

- Newly built house purchased at a 12% discount without the government's financial assistance.

- Works agreement for economical housing at a rate of 12%

Rate of GST on construction materials

GST on real estate real estate in India by including works contracts and construction works, with all materials used in the construction process being subject to GST. In simpler terms, the new regulations also apply to the Indian construction sector, which still faces high tax rates due to a combination of fees on buying different building materials.

What does input tax credit (ITC) mean in the context of GST?

The ITC system of the GST law sets it apart from the previous tax system in India. From the beginning of a construction project to its finish, a property developer incurs taxes repeatedly when buying goods and services. In the GST system, the builder receives input tax credit upon payment of his output tax.

For Example:

A tax of Rs 25,000 must be paid by the developer for his end product. Having already paid Rs 21,000 as input tax for buying materials like steel, cement, and paint, the builder will only owe Rs 4,000 as output tax once the input tax credit is taken into account.

Goods and Services Tax applied to fees for upkeep services

If flat owners pay a maintenance charge of at least Rs 7,500 to their housing society, they must pay 18% GST on real estate residential property.Housing societies or Resident Welfare Associations (RWAs) charging ₹7,500 or more per flat each month must pay an 18% tax on the total amount collected. Housing societies with an annual turnover below Rs 20 lakhs are not required to pay the GST. For the GST to be valid, both requirements must be met – all individuals must pay maintenance charges exceeding Rs 7,500 per month and the RWA's yearly turnover should surpass Rs 20 lakh.

The government also stated that if the fees go over Rs 7,500 per month per person, the whole amount is subject to taxation. If maintenance charges per member are Rs 9,000 per month, 18% GST will be applicable on the full Rs 9,000 amount and not just on the difference amount of Rs 1,500 (Rs 9,000-Rs 7,500). Additionally, individuals who own several apartments within the same residential community will be taxed for each unit individually.

However, RWAs have the right to request ITC for taxes paid on capital goods (such as generators, water pumps, lawn furniture, etc.), goods (like taps, pipes, and other sanitary/hardware fittings), and input services like repair and maintenance services.

GST on real estate rental income

Listed here are inquiries regarding GST:

Whatis the moment that the tenant must pay GST?

Tenants who are registered for GST and rent a residential unit must pay an 18% tax on the rental amount. The GST Council made an announcement regarding this change on July 13, 2022. The updated rule affects individuals who earn more than Rs 20 lakh per year and businesses that generate an income exceeding Rs 40 lakh annually, requiring them to register for GST.

When does the landlord have to pay GST?

The GST system considers the renting of residential property for business use to be a service provided. Landlords are required to pay an 18% GST on real estate rental income from residential flats if the annual rent exceeds Rs 20 lakh under this system. In this situation, landlords must enroll, to remit the GST on their rental revenue. A tax of 18% GST is imposed when renting out commercial properties.

Goods and Services Tax on home loan

Although the borrower is not affected by GST on real estate when repaying a home loan, financial institutions provide various services as part of home loan packages. As these are services, GST becomes applicable. Therefore, when obtaining a home loan, the bank will apply GST to the processing fee, technical valuation fee, and legal fee.

Builders and developers collecting one-time maintenance deposits will be subject to GST

The Gujarat bench of the Authority for Advance Rulings (AAR) affirmed that the GSTon real estate is levied on the one-time maintenance deposit builders gather from home purchasers. As per the official, this fee is classified under service provision and is non-refundable. The AAR also mentioned that the maintenance amount will have the GST deducted when it is used for future maintenance works.

Conclusion

In summary, GST has simplified the tax structure in real estate, offering clear rates for different property types—1% for affordable housing, 5% for residential, and 12% for commercial properties. The introduction of Input Tax Credit (ITC) has reduced the tax burden for developers, promoting efficiency. While stamp duty and registration fees remain, GST has made the taxation process more transparent and streamlined, benefiting both developers and buyers. Overall, the GST regime has brought greater clarity and efficiency to the real estate sector.

Also Read: Essential Guide to Car Parking Regulations in Indian Residential Societies

_1771490516.webp)

_1770976628.webp)

Ans 1. In 2024, the GST on real estate is as follows:Affordable Housing: 1% without Input Tax Credit (ITC).Other Residential Properties: 5% without ITC.Ready-to-Move Properties: No GST if the property has received a completion certificate

Ans 2. GST is calculated based on the property's price per square foot. For affordable housing, the GST is 1% of the total property cost, while for other properties, it is 5%. No GST applies to ready-to-move-in properties with a completion certificate

Ans 3. No, GST is not applicable on the sale of land, as land is exempt from GST. However, it is applicable to the construction of buildings and related works.

Ans 4. To qualify for the 1% GST on affordable housing, the property must be priced up to ₹45 lakh, with a carpet area limit of 60 sq. meters in metro cities or 90 sq. meters in non-metro cities.

Ans 5. GST simplifies the tax structure by replacing multiple indirect taxes. Developers can claim an Input Tax Credit (ITC) on materials used, reducing the overall tax burden. Homebuyers benefit from a more transparent pricing system, but they may still face higher costs for non-affordable properties.

Ans 6. Yes, for commercial properties, GST is applicable at a rate of 18%.

Ans 7. Yes, buyers can benefit from a reduced GST rate (1% or 5%) if the builder adheres to the specified conditions, such as procuring at least 80% of raw materials from registered dealers.

Ans 8. No, GST does not apply to ready-to-move-in properties if the builder has obtained a completion certificate. However, if the property is still under construction and the sale occurs before the certificate is issued, GST will be applicable based on the type of housing.

Ans 9. For commercial real estate, GST is charged at 18%. This rate applies to both the construction services and the sale of properties once completed.

Ans 10. No, homebuyers cannot claim ITC on the GST paid for residential property. ITC is only available to developers or businesses who use the property for commercial purposes.