Table of Content

▲

In the past year, the income tax department scrutinized several salaried taxpayers who had filed income tax returns containing false rent receipts from close relatives and other irregularities. As per media reports, these taxpayers received notices from the department, requesting documentary evidence to substantiate their claims for tax exemption. These notices specifically pertain to the declaration of tax exemptions on house rent allowance under Section 10 (13A) for individuals earning a salary. In case of discrepancies, the department has the authority to impose a penalty of up to 200% of the tax applicable on the misrepresented income.

What are rent receipts?

Rent receipts serve as evidence of rental payments made by tenants to landlords and are crucial for claiming tax deductions related to the HRA (House Rent Allowance) component of your salary. Nevertheless, there have been numerous instances in the recent past where individuals have submitted counterfeit rent receipts to falsely claim HRA benefits. Engaging in such manipulation can lead to serious legal repercussions.

Also Read: How to file TDS on property in 2024?

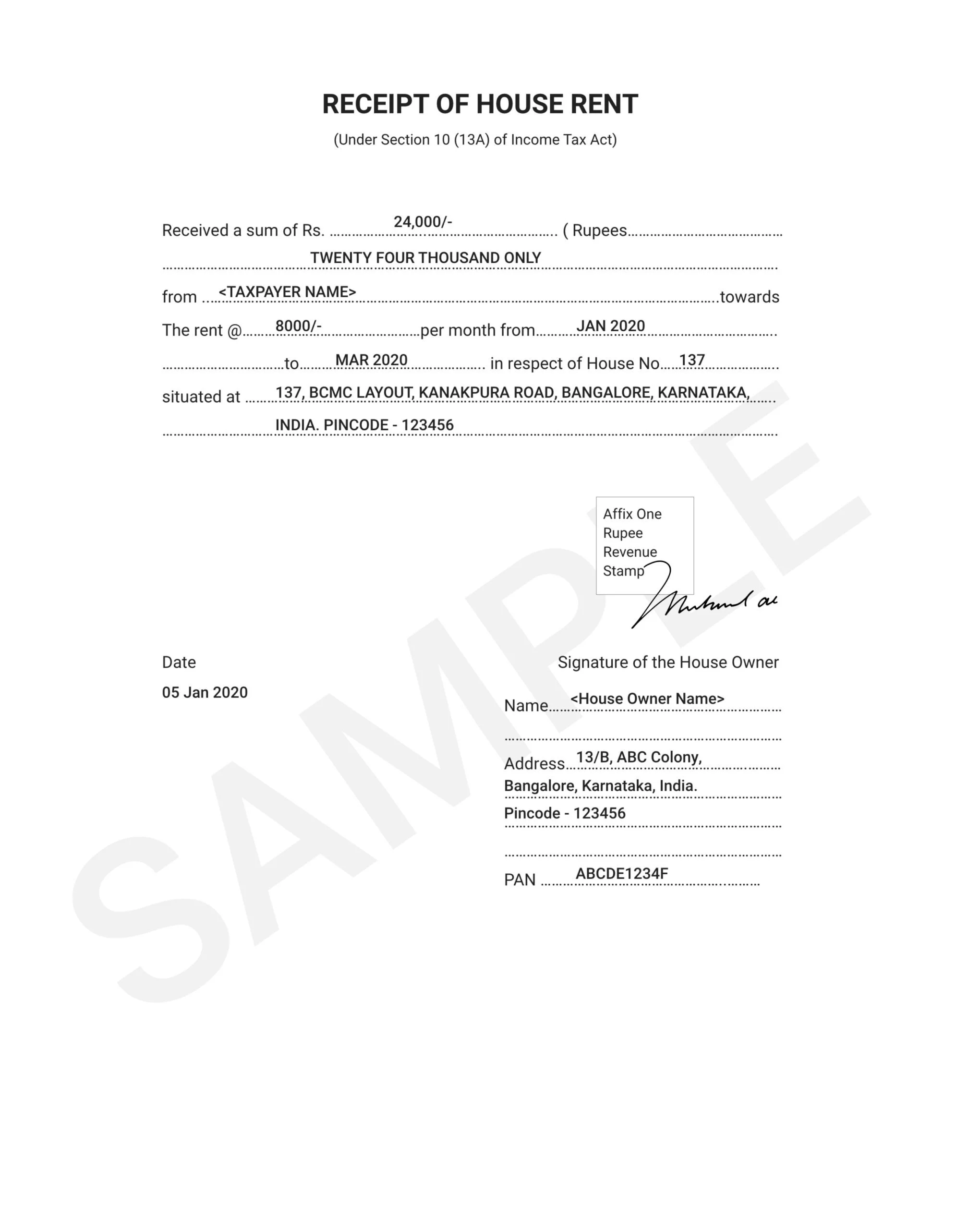

Rent receipt format

What are fake/bogus rent receipts?

According to the IT Act 1961, HRA offered by the employer is not taxable, subject to eligible ceiling worked out based on Basic salary, HRA, and the actual rent paid by the employee. So, HRA helps in significantly bringing down the effective tax outgo of the employees. Some, people despite living in their own homes, produce bogus/ fake rent agreement and receipts for claiming the HRA benefit.

How fake rent receipt are generated

Tenants sometimes generate fake rent receipts using online rent receipt generators or by filling rent details in a rent receipt format and they sign it in the name of a bogus landlord to perpetrate it as an original receipt.

In some cases, employees who live in their own homes transfer the payments to their close relatives like brother or sister and get the rent receipt from them to claim the HRA benefit. Know that claiming HRA deduction in this case is legal for as long as you actually pay the rent to your parents or relatives and they pay income tax on the rental income thus generated.

It is also mandatory to mention the PAN number of the landlord in the rent receipt if the rent payment is more than Rs 1 lakh in a year. In many cases, people who use fake rent receipts do not mention the PAN detail or they mention a wrong PAN detail, which gets revealed during the verification.

In some cases, employees submit the rent receipt to claim HRA calculation & HRA exemption even if they own a home in the same city.

Currently, there is no law that stops a person from staying on rent at their parents’ or relatives’ house. It is mandatory to furnish relevant documents validating the claimed tax exemption. However, many employees fake the rental agreement and rent receipt to claim HRA benefits.

Punishment for submitting fake rent receipts

Using technology, the income tax department monitors your filings and will instantly issue a legal notice asking for proofs in case of any dubious deductions that have been claimed.

If you fail to submit any proof, the taxmam will disallow the claimed exemption. But if the IT department finds your claims to be fake, it will result in penalties for misreporting or under-reporting of income.

The punishment for a fake rent receipt could be very severe and it could land employees into serious trouble. Let us find out various punishments for faking a rent receipt.

The level of punishment for creating a fake rent receipt can vary, depending on the amount of rent and the type of forgery. Here are different types of punishments, for creating fake rent receipts:

Also Read: Section 80EEA: Tax deduction for repayment of home loans

Legal notice

On data mismatch, the department may send a notice seeking valid documents, initiate scrutiny, or cancel the HRA exemption.

The assessing officer can ask for proof of claimed tax deductions. If the person fails to submit the required documents, the authority may reject the claimed exemption. Further, such individuals may have to pay additional taxes, along with interests and penalties.

Up to 50% penalty on tenant

Under Section 270A of the I-T Act, 1961, the assessing officer has the right to impose a penalty of 50% if the income is under-reported by the assessee. This is applicable to a person who intentionally furnishes fake bills or receipts to misreport the income. Moreover, one is liable to pay interest as per sections 234A, 234B and 234C of the income tax act.

Up to 200% penalty on income under-reporting

If the income is under-reported, the department can levy a penalty of up to 200% of the tax applicable on the income misreported.

Verification by income tax department

Here are various ways through which the IT department verifies rent receipts:

- Absence of rent agreement while HRA is claimed by providing the rent receipt

- Wrong or fake PAN details of the landlord mentioned in the rent receipt.

- Non-declaration of HRA benefit in Form 16 by the employer

- Employee has claimed HRA against rent receipt issued by a close relative in the absence of valid supporting documents.

On receiving the notice from the department, the employee must respond within the specified period. If the department has asked for a supporting document, it should be provided without any delay to substantiate the claim.

Further, the department has taken strict measures to tackle the incidents of HRA claims using fake rent receipts. It has introduced new ITR (income tax returns) forms that enable taxpayers to provide specific data of the allowances by selecting it from the dropdown column and the amended Form 16 to keep a tab on such malpractices.

According to the new system, allowances (such as HRA and LTA) must be specified separately in Form 16; thus, ensuring transparency in the system. For this, supporting documents must be submitted to disclose the financial transactions related to the rent that has been paid.

Also Read: What to do if your property documents are lost?

Responsibility of employers to check for fake rent receipts

During verification of the tax returns, the tax department may ask the employer to provide valid proofs for the tax deducted at source under Section 192 of the Income Tax Act and validate the authenticity of documents submitted. Those who submit rent receipts to the employer without additional proof, for instance, rent agreement and payment proofs, may come under the HRA fraud investigation by the I-T department.

According to the Income Tax Appellate Tribunal (ITAT), these false HRA claims can be rejected under the principle of res gestae (the start-to-end period of a felony). The assessee must produce any proof that arises during the routine hiring of premises, including leave and license agreement, letter to society notifying about his/her tenancy, rent payment through bank, cash payments supported with verified sources, cheque payments for electricity and water bills, any correspondence arising during the tenancy period to establish that the transaction of hiring of premises was authentic and was taking place during the mentioned period.

Things to keep in mind to avoid charges related to fake rent receipt

Here are some important points to keep in mind to avoid charges related to fake rent receipts:

- Get a valid agreement from the landlord.

- Try to make rent payments online or through cheque.

- Get the PAN details of the landlord mentioned on the rent receipt, if the rent payment is more than Rs 1 lakh in a year.

- The tenant should keep the record of utility bills paid by them.

- If the landlord is not holding a PAN, a declaration for the same should be taken along with duly filled Form 60.

- If the rent receipt is taken from a close relative, the details of the rent should be mentioned by them in their ITR and the details should match with your rent receipt.

How to generate genuine rent receipts?

Today, there are various virtual service providers like the Housing Edge platform that help your to generate rent receipt online free of cost. All you have to do is to visit these portals, provide the required information and generate free online rent receipts. In our next section, we would explain the step-wise manner in which you could generate an online rent receipt.

_1772441702.webp)

Ans 1. Yes, there is no restriction on claiming the HRA if you live in your parents’ or relative’s home and pay the rent to them. However, it is important to get the rent receipt from them in the prescribed format. Rent receipt, rent agreement, society’s letter of occupancy as a tenant, payment proof, etc., are some important documentary evidences that often play an important role for a valid rental transaction.

Ans 2. A valid rent receipt contains details such as the name of the tenant, rent amount, address of the property, period of rent, signature of the landlord, PAN detail of the landlord (If required), mode of payment, revenue stamp if the rent is paid through cash amounting more than Rs 5,000.

Ans 3. A fake rent receipt is that which is created with the intension to dupe the income tax authorities and avoid paying rightful taxes on your income.

Ans 4. Under the existing rules, tax deductions of up to Rs 1 lakh can be claimed without disclosing your landlord's PAN as per Section 10(13A) of the Income Tax Act, 1961. By providing legal proof of rent payments, a salaried individual can save up to 60% tax on the house rent allowance paid as part of his salary. People with dubious intentions misuse this facility by using fake rent receipts to save taxes.

Ans 5. Since the income tax department has access to all your income and expenses that are linked with your PAN, they are able to see whether you have been paying the amount you have claimed as rent through your rent receipts. In case of any discrepancies between the claim and the proof, the income tax department will send you a notice, and demand further proof.

Ans 6. Under Section 270A of the I-T Act, 1961, the assessing officer has the right to impose a penalty of 50% if the income is under-reported by the assessee. The income tax department may ask you to pay up to 200% of the existing tax liability as a punishment for submitting fake rent receipts.

Ans 7. As long as you actually pay the rent and have the documentary or virtual proof to do so, paying rent to relatives and family members and claiming tax deductions does not amount to fraud.