Table of Content

▲- Types of senior housing communities cater to various needs and preferences:

- Evaluating staff quality

- The market for senior homes in India

- Investment strategies in senior housing

- Property evaluation

- Financial viability

- How much should you save for your retirement?

- Inheritance of senior living properties

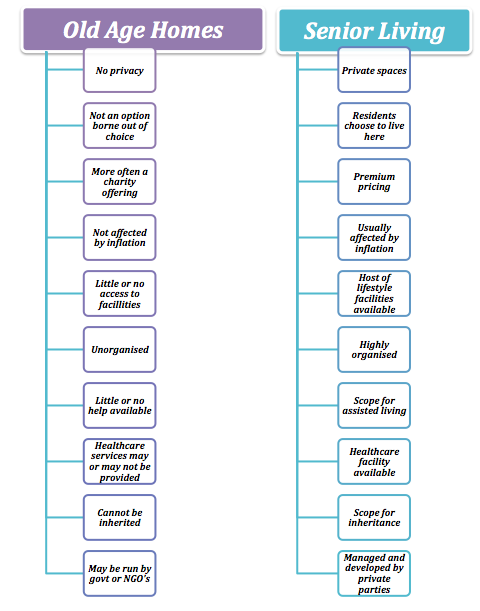

- Old Age Home vs Senior Living

Investing in a senior housing project means selecting a place where older adults can live comfortably and joyfully. It’s crucial to consider amenities such as convenient access to medical care and engaging activities. Having nearby stores and pharmacies adds to the convenience. The building should prioritize safety and ease of navigation, with features that instill a sense of security for everyone. By choosing senior housing, you're choosing a place where seniors can embrace life fully, akin to SC Krishnan, who found happiness at his senior living home at Serene Urbana in Bengaluru.

Types of senior housing communities cater to various needs and preferences:

1. 55+ Communities: These are tailored for individuals aged 55 and older, offering activities like clubs, fitness centres, and social events exclusively for seniors.

2. Luxury Senior Living: Luxury senior living resembles a high-end resort, providing top-notch amenities such as gourmet meals, spas, and chauffeur services for seniors seeking premium living standards.

3. Independent Living: In independent living communities, seniors reside in apartments or houses where they enjoy autonomy while having the option to engage in community activities and receive assistance when necessary.

4. Assisted Living: Designed for seniors requiring assistance with daily tasks like cooking or medication management, assisted living offers private apartments with staff available for support as needed.

5. Memory Care: These communities cater specifically to seniors with memory issues such as Alzheimer's disease, offering specialized care and a secure environment tailored to their unique needs.

6. Skilled Nursing Care: Skilled nursing facilities provide 24/7 medical care and supervision for seniors with serious health conditions requiring ongoing medical attention.

7. Continuing Care Retirement Communities (CCRCs): CCRCs offer a continuum of care within one location, starting from independent living and progressing to assisted living or skilled nursing care as residents' health needs change. This setup allows seniors to remain within the same community despite evolving healthcare requirements.

Also Read: Buying a Home in Your 40s? Here Are 4 Important Tips to Remember

Evaluating staff quality

Here are some steps to consider when evaluating senior living facilities:

1. Observing Interaction: Observe how staff members interact with residents. Are they kind and patient? Do they address residents by name and attend to their needs promptly? For instance, watch how caregivers assist residents with mobility or how nurses manage medication checks.

2. Asking Questions: Inquire about staff qualifications, training, and certifications. Learn if caregivers receive specialized training in senior care. Also, ask about staff turnover rates to gauge job satisfaction and continuity of care.

3. Staff-to-Resident Ratio: Understand the ratio of staff to residents, especially during different times of day and night. A lower ratio typically means more personalized attention. For example, inquire about staffing levels during meal times and overnight shifts.

4. Reviews and Recommendations: Read online reviews and speak with current or former residents and their families. Their experiences can offer insights into how staff members interact with residents and the overall quality of care provided.

5. Quality Assurance Programs: Check if the community implements quality assurance programs such as ongoing staff training. Well-trained staff are better equipped to meet residents' needs effectively.

6. Emergency Response: Inquire about protocols for handling medical emergencies and unexpected situations. Knowing that staff are prepared and responsive can provide peace of mind.

7. Demographics: Recognize the demographic trends in the local area. In India, the senior population is growing significantly, emphasizing the need for senior living facilities and services. Understanding local demographics through census data helps in planning and adapting to meet the evolving needs of seniors.

Understanding these aspects can help you assess and choose a senior living community that meets your expectations and provides the care and support your loved ones deserve.

The market for senior homes in India

Understanding the senior housing market in India requires evaluating the current availability of senior living facilities and assessing the demand for different types, such as independent living or assisted living options. However, gathering accurate information is challenging due to limited data, especially outside major cities, and the informal nature of many senior housing setups. Moreover, varying definitions of "senior living" add complexity to accurately gauging market saturation.

To navigate these challenges effectively, it's essential to rely on real estate market research reports from organizations like Colliers or JLL. These reports often provide valuable insights into the supply of senior housing and potential demand trends. Engaging with industry associations such as the Assisted Living Federation of India (ALFI) can also offer perspectives on existing facilities and growth projections. Local research involving discussions with real estate professionals, developers, and senior care providers is crucial for understanding regional dynamics and identifying development opportunities.

Beyond existing facilities, attention should focus on understanding demographic shifts, such as the rising senior population and socio-economic factors influencing demand. By considering these factors comprehensively, stakeholders can better assess the specific need and type of senior housing required in different parts of India. This approach ensures that future developments align with evolving senior living preferences and effectively meet the needs of seniors and their families.

Investment strategies in senior housing

When considering investing in senior housing, there are several approaches to explore. One option is purchasing an operational senior home, where you start earning immediately from resident fees. However, such properties might require additional investment for modernization, adding to initial costs. Another route involves constructing a new senior home from the ground up. This allows customization to meet specific senior needs but entails substantial upfront capital and construction timelines.

Alternatively, investing in a senior housing Real Estate Investment Trust (REIT) involves buying shares in a company that owns multiple senior homes. This diversifies risk across various properties but limits control over individual management decisions. Another avenue is repurposing an existing building into a senior home, potentially a cost-effective option compared to buying a fully operational facility. Yet, it involves navigating regulatory approvals and addressing building issues.

Each option presents opportunities and challenges, so assessing available capital, risk tolerance, and desired level of involvement in management is crucial when making an informed investment decision in senior housing.

Also Read: Is it worthwhile to purchase roadside land in a village?

Property evaluation

When assessing an existing senior housing facility, it's crucial to focus on several key factors. Start by examining the physical condition of the building, including its electrical systems, plumbing, roof, and overall accessibility for seniors. Look for signs of wear and tear, potential code violations, and any necessary repairs that may be required.

Ensure that the facility meets all fire safety, health, and accessibility regulations specifically designed for senior living environments. If there are deficiencies in these areas, consider the costs involved in bringing the facility up to code standards.

Lastly, evaluate whether renovations are needed to modernize amenities and improve accessibility throughout the facility. Assess the potential costs of these renovations and carefully consider how these updates could impact occupancy rates and rental income.

Conducting a thorough assessment of these aspects will provide a clear understanding of the investment and help in planning for any additional expenses that may arise.

Financial viability

When evaluating the financial viability of a senior housing facility, you need to look at several important things. First, review the historical financials by checking past data such as occupancy rates, rental income, expenses, and net operating income (NOI). This helps you spot trends and find areas that might need improvement. Next, estimate the operating costs, including property taxes, insurance, utilities, staffing, maintenance, and marketing expenses. This gives you a clear idea of the ongoing costs you’ll face.

Then, project the future income by forecasting rental income based on market research, current occupancy rates, and any planned rent increases. Finally, consider exit strategies like selling the property, refinancing, or passing it on. Evaluate potential sale values or refinancing terms to make sure you can get the best returns when you decide to exit the investment.

Also Read: PM to lay foundation stone, inaugurate 84 developmental projects in J&K

How much should you save for your retirement?

Financial experts and wealth managers recommend factoring in an annual inflation rate of 6%. It's essential to also consider the potential cost of a senior living property, which can vary based on your preferred lifestyle. Below are the current market rates for senior living projects, illustrating the range of potential costs.

| Cost of senior living projects | Rental value | Other charges | Costs that come up | Costs that you do not have to worry about |

| Rs 30-70 lakhs (approximate value of 1-3BHK units) | Rs 7,000 per month and onwards | Maintenance, GST | Hike in charges due to inflation, spending on clothes, medicines, food, travel, spending on dependent children | Children’s education if they are independent, fuel cost owing to job-related commute, formal clothing for office |

Inheritance of senior living properties

Also Read: Explore the top 5 upcoming investment areas in Varanasi's real estate market for 2024

_1772441702.webp)

Ans 1. Choosing the Right Retirement HomePay attention to cleanliness, friendliness, and overall ambiance. Ask Questions: Inquire about staff qualifications, resident-to-staff ratios, emergency procedures, and the availability of healthcare services.

Ans 2. As the demand for quality senior care and living options grows, so does the potential for profitable investments. As an investor, one can expect around 8-10% rental income with yearly escalations, depending on the various factors.

Ans 3. Indeed, a good mix of equities (yes, even at age 70), bonds and cash can help you achieve long-term success, pros say. One rough rule of thumb is that the percentage of your money invested in stocks should equal 110 minus your age, which in your case would be 40%. The rest should be in bonds and cash.

Ans 4. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/cash investments); 80 and above, conservative (20% stock, 50% bonds, 30% cash/cash investments).

Ans 5. Some people choose to move into a retirement community at a younger age, but a large majority make the transition between the ages of 75 and 84.