Table of Content

▲

At the behest of Maharashtra Chief Minister Eknath Shinde and Deputy Chief Minister Devendra Fadnavis, the Maharashtra government introduced the Maharashtra Mudrank Shulk Abhay Yojana 2023, a stamp duty amnesty scheme, during a cabinet meeting on November 23, 2023.

What is Maharashtra Mudrank Shulkh Abhay Yojana?

As per a directive from the Maharashtra government, the Maharashtra Mudrank Shulkh Abhay Yojana entails that the IGR Maharashtra will waive all stamp duty fees and penalties imposed on property documents, whether registered or not, between January 1, 1980, and December 31, 2020.

Why is the stamp duty amnesty scheme announced?

In every property transaction, buyers are obligated to remit a specific tax to the government, known as stamp duty and registration charges, in accordance with the Maharashtra Stamp Act of 1958. Any sale deeds or conveyance deeds lacking proper stamping are not legally recognized in court, as stipulated in section 34 of the Maharashtra Stamp Act. To rectify such documents, property owners must settle the deficient stamp duty along with a penalty at a rate of 2% per month on the deficit. This sum can accumulate to over 400% of the original stamp duty, placing a significant financial burden on the property owner. Additionally, the non-payment or partial payment of stamp duties by members often hinders housing societies from obtaining deemed conveyance.

The amnesty scheme will regularise the property ownership by providing relief on stamp duty to be paid and the penalty too.

Maharashtra stamp duty amnesty scheme: Eligibility

- Documents that are registered with the sub-registrar of assurances but are not properly stamped.

- Documents that are not registered and where stamp duty has not been paid.

- Note that all documents should have been executed on stamp paper that has been brought from authorised vendors or franking centres. Documents that are executed on fraudulent stamp papers or those bought from Telgi vendors will not be able to avail the benefits of this scheme.

Maharashtra stamp duty amnesty scheme: Implementation

To be rolled out in phases by the IGR Maharashtra, the first phase will be from December 1, 2023 to January 31, 2024. The second phase will be from February 1, 2024 to March 31, 2024.

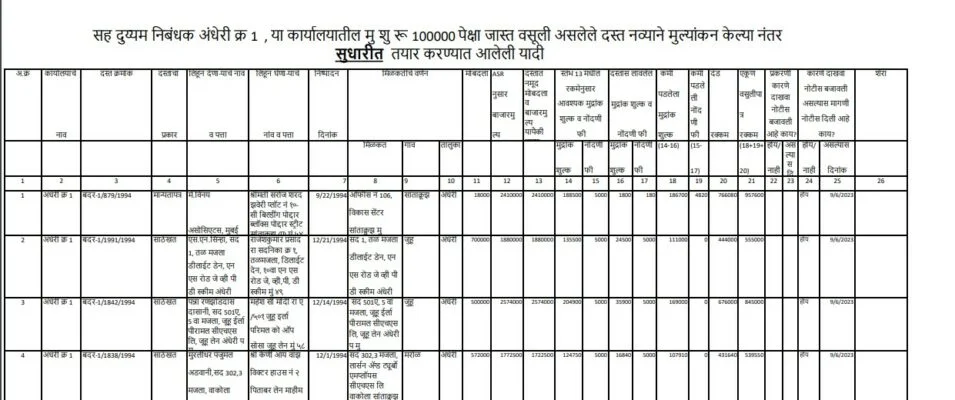

As per the directive issued by IGR Maharashtra on December 7, 2021, for all properties with stamp duty and penalty amount upto Rs 1 lakh, a full waiver is granted. For all properties with stamp duty and penalty being above Rs 1 lakh, a 50% waiver on stamp duty and a 100% waiver on penalty will be granted, mentioned an IE report.

In phase-2, the Maha government will give a waiver of 80% in both stamp duty and penalties for amounts ranging up to Rs 1 lakh. All stamp duty and penalty amounts exceeding Rs 1 lakh, will get a 40% waiver on stamp duty and a 70% waiver on the penalties.

Properties registered from January 1, 2000 to December 31, 2020 will get a 25% waiver in stamp duty fees for amounts up to Rs 25 crore. The state will offer a 20% waiver on stamp duty amounts more than Rs 25 crore. Also, for penalties below Rs 25 lakh, a 90% rebate will be granted and for penalties above Rs 25 lakh, a penalty of Rs 25 lakh will be charged.

As part of Phase- 2 of the scheme, IGR Maharashtra will offer a 25% waiver in stamp duty fees for amounts up to Rs 25 crore. The state will offer a 20% waiver in stamp duty if the stamp duty fee is more than Rs 25 crore. Also, for penalties below Rs 50 lakh, a 80% rebate will be given and for penalties above Rs 50 lakh, a penalty of Rs 50 lakh has to be paid.

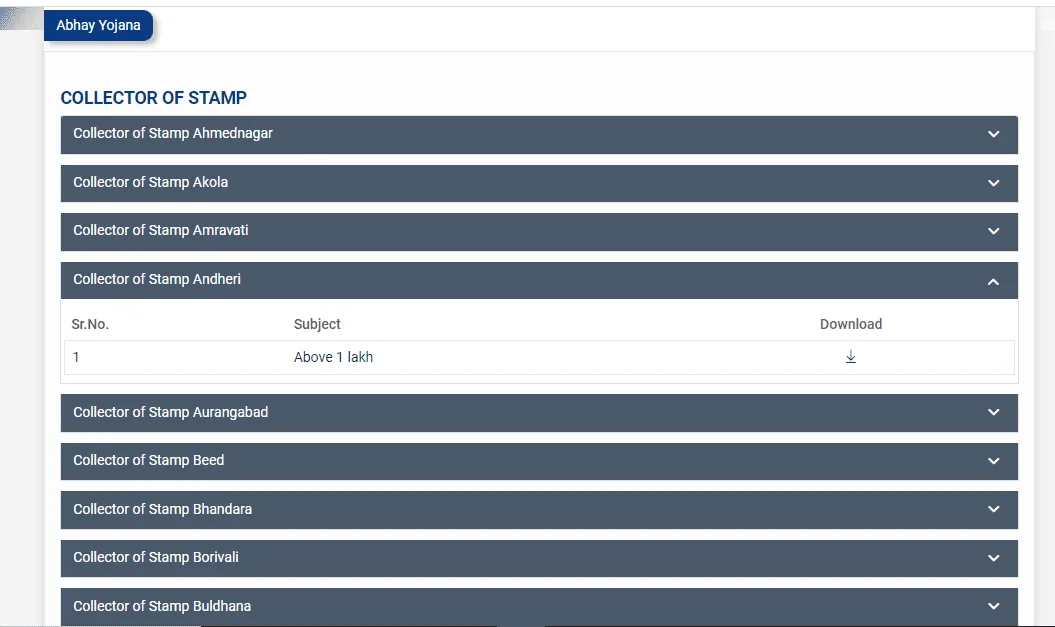

Abhay Yojana: Collector of stamp

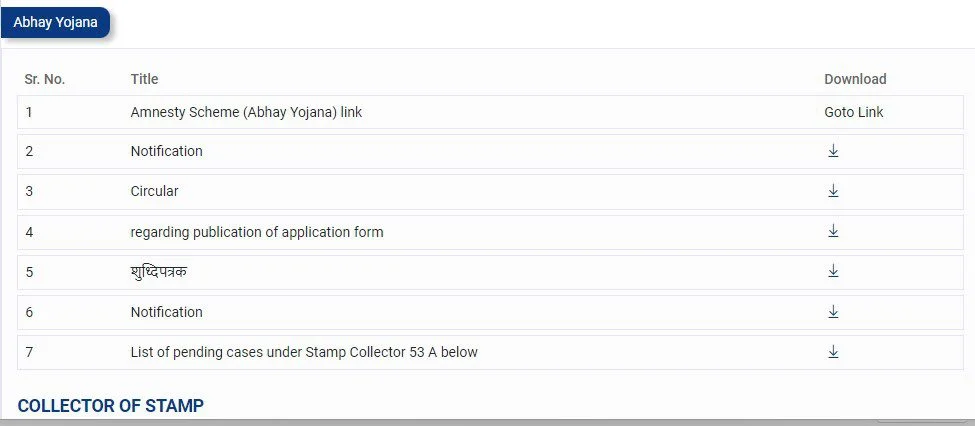

Visit the IGR Maharashtra website and click on Abhay Yojana present on the right side of the page to download details related to regularising the property documents.

You will reach

After downloading, you will get all details regarding the rebate offered to you under the amnesty scheme.

You can also check the list of pending cases under stamp collector 53 A below. Citizens should contact the office of Joint District Registrar and Stamp Collector of the concerned district to take advantage of this

Also Read: By March2024, the Surat section of the Delhi–Mumbai highway will open.

_1770632737.webp)

_1770284675.webp)

Ans 1. The Mudrank Shulh Abhay Yojana can be applied by the owner, successor or power of attorney (PoA) holder.

Ans 2. There will be no refund given to any property owner if he paid the stamp duty before the amnesty scheme was announced.

Ans 3. Those who are availing the amnesty scheme should pay the deficit amount within seven days of getting the notice from IGR Maharashtra

Ans 4. The first phase is from December 1, 2023 to January 31, 2024.

Ans 5. The second phase is from February 1, 2024 to March 31, 2024.