Table of Content

▲

As individuals typically view a house as a once-in-a-lifetime investment, they frequently push their financial limits to acquire the best property possible. Given that purchasing a house represents one of the most substantial financial commitments in a person's lifetime, it is crucial to employ objective criteria to determine the affordable extent of such an investment.

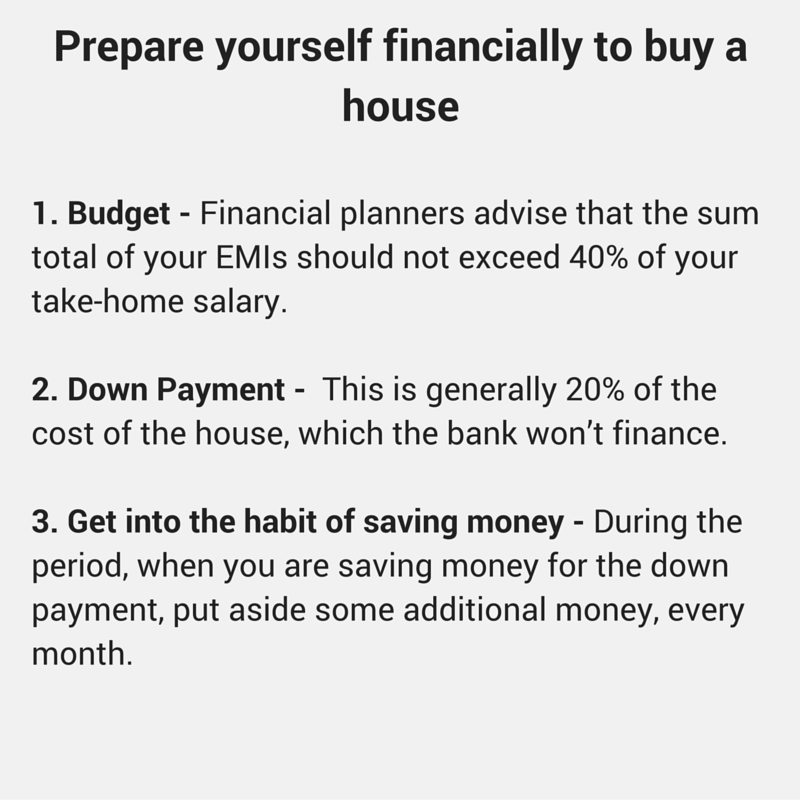

Budget

Financial planners advise that the sum total of your EMIs should not exceed 40% of your take-home salary. Thus, if your take-home salary is Rs 1 lakh, your EMI should ideally, not exceed Rs 40,000 each month. If you have other loans, then the EMI that you can pay on your home loan, gets whittled down further.

Now, imagine that Rs 40,000 is the EMI that you can pay, on your home loan. If the interest rate is 9.75% and you take a loan for 15 years, the maximum amount that you can borrow, is Rs 38 lakhs (source: emicalculator.net). Supposing that the bank will only give you a loan for 80% of the value of the property and 20% must come out of your own pocket, then, you can at best, buy a property worth around Rs 47 lakhs.

If you wish to increase the loan amount, you can club your spouse’s income with yours and borrow more. However, this option has a pitfall. Whenever you decide to start a family, you may go from being a double-income to a single-income family and the inflow of money into your household will dip.

Ensure that there is sufficient money remaining throughout the loan tenure after EMI payments to cover daily expenses and other needs like entertainment and education.

Additionally, factor in uncertainties related to employment. Prasunjit Mukherjee, the head of the Kolkata-based financial services firm Plexus Management, recommends establishing a contingency fund. This precautionary measure ensures you won't face difficulties in meeting your EMIs, even in the event of job loss for a certain duration.

Down payment

It's essential to save money systematically for the down payment on your house, typically set at 20% of the house's cost, which the bank typically doesn't finance. If your plan is to buy a house within the next three years, consider low-risk instruments like fixed deposits and fixed maturity plans (FMP). For a longer horizon of five to seven years before purchasing a house, conservative investors may choose monthly income plans (MIPs) in mutual funds. Investors with a higher risk appetite can explore balanced funds or even equity funds.

Get into the habit of saving money

During the period, when you are saving money for the down payment, put aside some additional money, every month. This will give you a rough idea of how much you can afford to spend on the EMI, without stretching your budget excessively.

Finally, remember that one needs to be flexible, when buying a house. “Education and retirement are goals that cannot be compromised upon. However, in case of buying a house, a goal of five years can easily be extended to seven, without doing any damage in most cases,” says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors. If you had invested in an equity fund or even in a balanced fund, for making the down payment and the equity market is faring poorly, you can defer your purchase by a year or two.

Also Read: What is default in real estate? What are its consequences?

_1772441702.webp)