Table of Content

▲

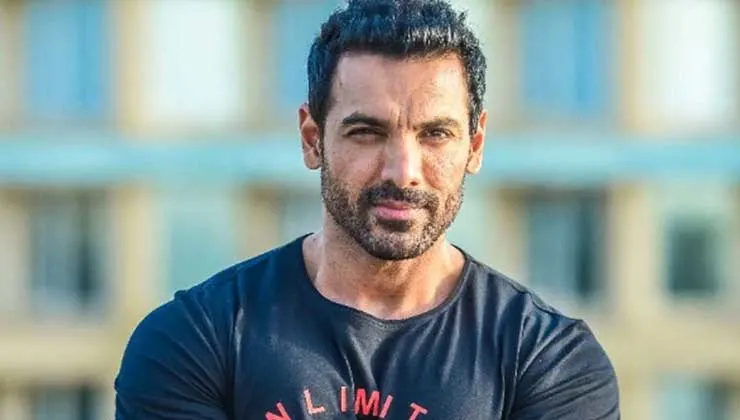

Bollywood icon and savvy investor John Abraham has ventured into the real estate market by leasing out three premium properties in Bandra West, Mumbai. These properties, housed within The Sea Glimpse Co-operative Housing Society, are poised to generate an impressive ₹4.3 crore in rental income over the next five years. This strategic move underscores John’s sharp financial acumen and highlights the enduring appeal of Mumbai’s luxury real estate segment.

Leasing Agreement Highlights

The agreement spans a five-year period, offering both structure and growth. According to the Inspector General of Registration (IGR) documents, the monthly rent for these properties begins at ₹6.30 lakh in the first year and steadily rises to ₹8 lakh by the fifth year.

Key Financials:

- Stamp Duty & Security Deposit: The lease was registered with a stamp duty of ₹1,12,600, accompanied by a ₹36 lakh security deposit.

- Rent Escalation: The deal includes an 8% annual rent hike for the first two years, tapering to 5% increases for the following three years.

This arrangement ensures not only consistent income for the actor but also aligns with market-driven rental trends, adding long-term value to his assets.

Also Read: Bollywood Icon Jaideep Ahlawat Invests ₹10 Crore in Luxury Mumbai Apartment

Bandra West: The Location Advantage

Bandra West, often referred to as the "Queen of the Suburbs," continues to be one of Mumbai’s most coveted neighborhoods. Known for its vibrant lifestyle, upscale amenities, and proximity to major business and entertainment hubs, it remains a hotspot for luxury housing.

What Makes Bandra Special?

- Proximity to Key Landmarks: The location offers easy access to major commercial areas, transport facilities, and leisure hotspots.

- Celebrity Appeal: The suburb has long been a favorite among Bollywood stars and high-profile professionals, enhancing its desirability among renters seeking exclusivity and prestige.

Why This Lease Matters

This strategic leasing deal benefits both parties involved:

- For the Tenants: The properties provide access to a luxurious lifestyle in one of Mumbai's most upscale neighborhoods, backed by transparent lease terms and a credible landlord.

- For John Abraham: It establishes a reliable source of income while preserving the properties' value through continued use and maintenance.

The Celebrity Real Estate Trend

John’s foray into leasing reflects a broader trend among celebrities leveraging high-value assets for financial gain. Properties in sought-after locations like Bandra West not only command premium rents but also see consistent appreciation in market value over time.

Also Read: Housing Supply in Tier-2 Cities Sees a Major Cooldown in Q1 2025: What's Behind the 35% Drop?

Market Insights:

- Celebrity-owned properties set benchmarks, influencing rental values in premium markets.

- Such high-profile transactions reinforce investor confidence in Mumbai’s real estate landscape.

Final Thoughts

John Abraham’s decision to lease out these properties showcases his ability to maximize his investments strategically. By securing a well-structured agreement that ensures escalating returns, he exemplifies how luxury real estate can be an effective tool for sustained financial growth.

As Mumbai’s luxury housing market flourishes, such deals serve as a testament to the city’s thriving real estate potential and the importance of thoughtful investment practices.

Follow AquireAcers Whatsapp Channel to Stay Updated With The Latest Real Estate News

_1771490516.webp)

Ans 1. John Abraham is a Bollywood actor and entrepreneur who has successfully ventured into the real estate market. He recently leased out three luxury properties in Bandra West, Mumbai, which are set to generate a total rental income of ₹4.3 crore over the next five years.

Ans 2. The properties are leased at a starting monthly rent of ₹6.30 lakh, increasing to ₹8 lakh by the fifth year. The lease includes a stamp duty payment of ₹1,12,600 and a security deposit of ₹36 lakh. An annual rent escalation of 8% for the first two years and 5% for the next three years ensures consistent income growth.

Ans 3. Bandra West, known as the "Queen of the Suburbs," is one of Mumbai's most sought-after neighborhoods. It offers proximity to business hubs, excellent infrastructure, high-end amenities, and a vibrant lifestyle, making it a prime location for luxury housing and celebrity residences.

Ans 4. This leasing arrangement provides John with a steady and increasing income stream while maintaining the value and usability of his properties. It also reflects his strategic approach to leveraging high-value assets for long-term financial gain.

Ans 5. The deal highlights the resilience and attractiveness of Mumbai's luxury housing market. High-profile celebrity transactions like this one set benchmarks for rental values and reaffirm investor confidence in the city's real estate landscape.

Ans 6. Celebrities increasingly leverage their high-value properties to generate rental income or capitalize on market appreciation. Such transactions demonstrate how luxury real estate can serve as both a financial asset and a lifestyle statement.

Ans 7. For tenants, these properties offer the opportunity to reside in one of Mumbai's most exclusive neighborhoods with transparent lease terms and the credibility of a renowned landlord.

Ans 8. This deal reinforces the appeal of premium locations like Bandra West and highlights the potential of luxury real estate as a stable investment. It also sets an example for structuring mutually beneficial lease agreements in the high-end property market.

Ans 9. By securing a lease agreement with built-in rent escalations and leveraging the prime location of his properties, John demonstrates a calculated approach to maximizing the returns on his investments while safeguarding asset value.

Ans 10. The structured rent escalation ensures a predictable and growing income stream, aligning with inflation and market trends. It also benefits the landlord by increasing the asset’s revenue-generating potential over time.