Table of Content

▲

A dwelling encompasses far more than mere walls and a roof. It evokes a spectrum of emotions and reflections within us. For some, it represents security; for others, it embodies comfort. Still, for another set, it signifies status and achievement. However, there's another dimension to consider when it comes to a dwelling—the numerical aspect. The financial dimension holds significance as acquiring a home often constitutes the most substantial monetary transaction in an average Indian's life. Deciding between buying a home over renting is a dilemma many wrestle with.

HERE ARE 9 REASONS WHY OWNING A HOME IS MORE ADVANTAGEOUS THAN LIVING ON RENT:

1.NO LANDLORD HASSLES:

Owning your home puts you in charge. You don't have to contend with a landlord, whether it's for minor fixes or a complete renovation of your space. Renting often proves burdensome in various aspects. You rely on the landlord for essentials like water, electricity, upkeep, and nearly every other necessity. Choosing to buy a home over renting alleviates these dependencies and empowers you with autonomy over your living environment.

Also Read: The Latest Home Loan Interest Rates: Apr 5, 2024

2.EMOTIONAL SECURITY:

When you invest in a house, you furnish your family with their exclusive sanctuary—a home. Following a lengthy day at work, compounded by exhausting commutes and persistent stress, coming back to your personal haven ignites a feeling of security and solace that cannot be replicated. Ultimately, there's no substitute for the unique sense of ease and authenticity that a 'home' provides, making the choice of buying a home over renting all the more significant.

3.NO UNCERTAINTY:

With your own home, you're free from the fear and anxiety stemming from the potential termination of a lease agreement by the landlord. Additionally, there's no need to deal with the hassle of renewing the rental agreement annually or repeatedly negotiating rent. Opting to buy a home over renting eliminates these uncertainties and inconveniences, providing a sense of stability and permanence.

4.NO COMPROMISE:

Rent represents an expenditure, and typically, the inclination is to minimize expenses. Consequently, you might find yourself making compromises on various fronts like location, size, and amenities. Conversely, when you opt for buying a home, you ensure that the property you select aligns with your expectations. This choice prioritizes meeting your needs and desires over making concessions, distinguishing the advantages of buying a home over renting.

5.EASY FINANCING OPTIONS:

Acquiring your dream home has become more accessible now, thanks to the availability of convenient financing options. There's no need to wait until your 40s or 50s to accumulate funds for your dream home; you can purchase it in your 20s and become a proud homeowner with the mortgage fully paid off by the time you reach 50 or even earlier. It's crucial to carefully select a home loan provider who can offer flexibility in managing your mortgage repayment, tailoring the home loan EMI to accommodate your current and future income patterns. This emphasizes the advantages of buying a home over renting, enabling individuals to realize their homeownership aspirations earlier in life.

6.TAX BENEFITS ON HOME LOAN:

The repayment of your home loan principal and interest not only helps you build equity but also offers appealing tax benefits. It's important to note that renting is often more costly than just the monthly rent you pay. Your overall expense tends to be higher because you don't earn any interest on the significant deposit paid to the landlord, especially in premium locations, throughout the lease duration. This underscores the advantages of buying a home over renting, where your investments contribute to long-term financial growth and stability.

Also Read: Latest RBI Guidelines for Home Loans 2024

7.BUILDING YOUR OWN ASSET:

Instead of solely spending on rent, opting to pay the home loan EMI allows you to gradually build your own asset. With each installment, your equity in your home increases. This highlights the advantage of buying a home over renting, as your payments contribute towards ownership and long-term financial security.

8.HOME AS AN INVESTMENT:

When you anticipate residing in a specific city for an extended period, it becomes prudent to invest in buying a house. This way, you cultivate a sense of belonging and permanence, aligning yourself with the city's lifestyle. It signifies a significant step towards establishing roots and stability in life. Additionally, property values generally appreciate over time, meaning that purchasing a home also serves to augment your wealth gradually. Procrastinating your property acquisition will necessitate a larger investment later on, on top of the rent payments made over an extended duration. Thus, opting to buy a home over renting not only fosters a sense of belonging but also presents a valuable opportunity for long-term financial growth.

9.CONFORMING TO SOCIAL NORMS:

Ultimately, purchasing your own home represents a noteworthy achievement and triumph within society. Your wealth and status are often gauged by the property you possess. Therefore, opting to buy a house can substantially elevate your social standing. This underscores the significance of buying a home over renting, as it not only fulfills a personal milestone but also enhances your societal recognition and esteem.

THE NUMBERS ARGUMENT

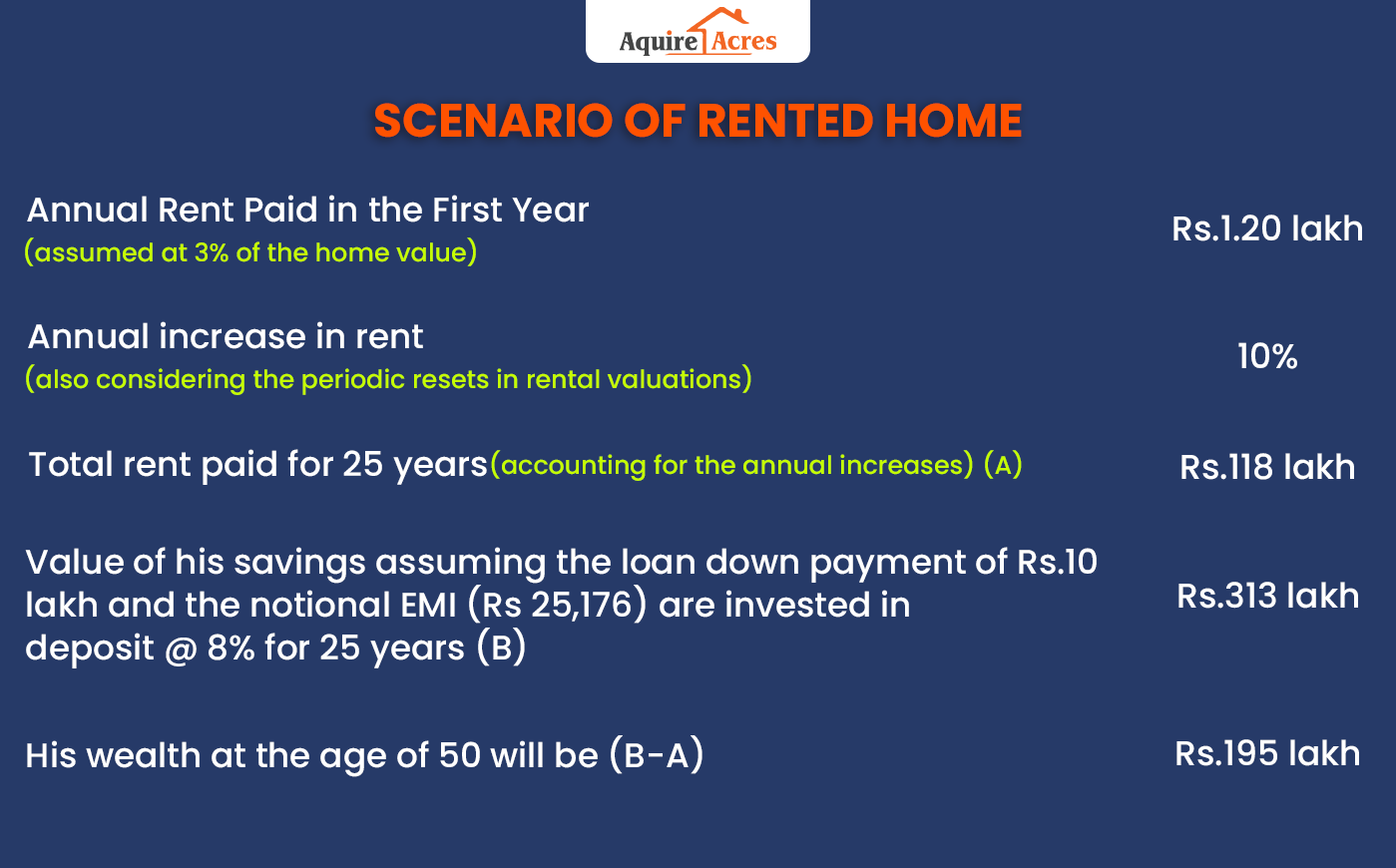

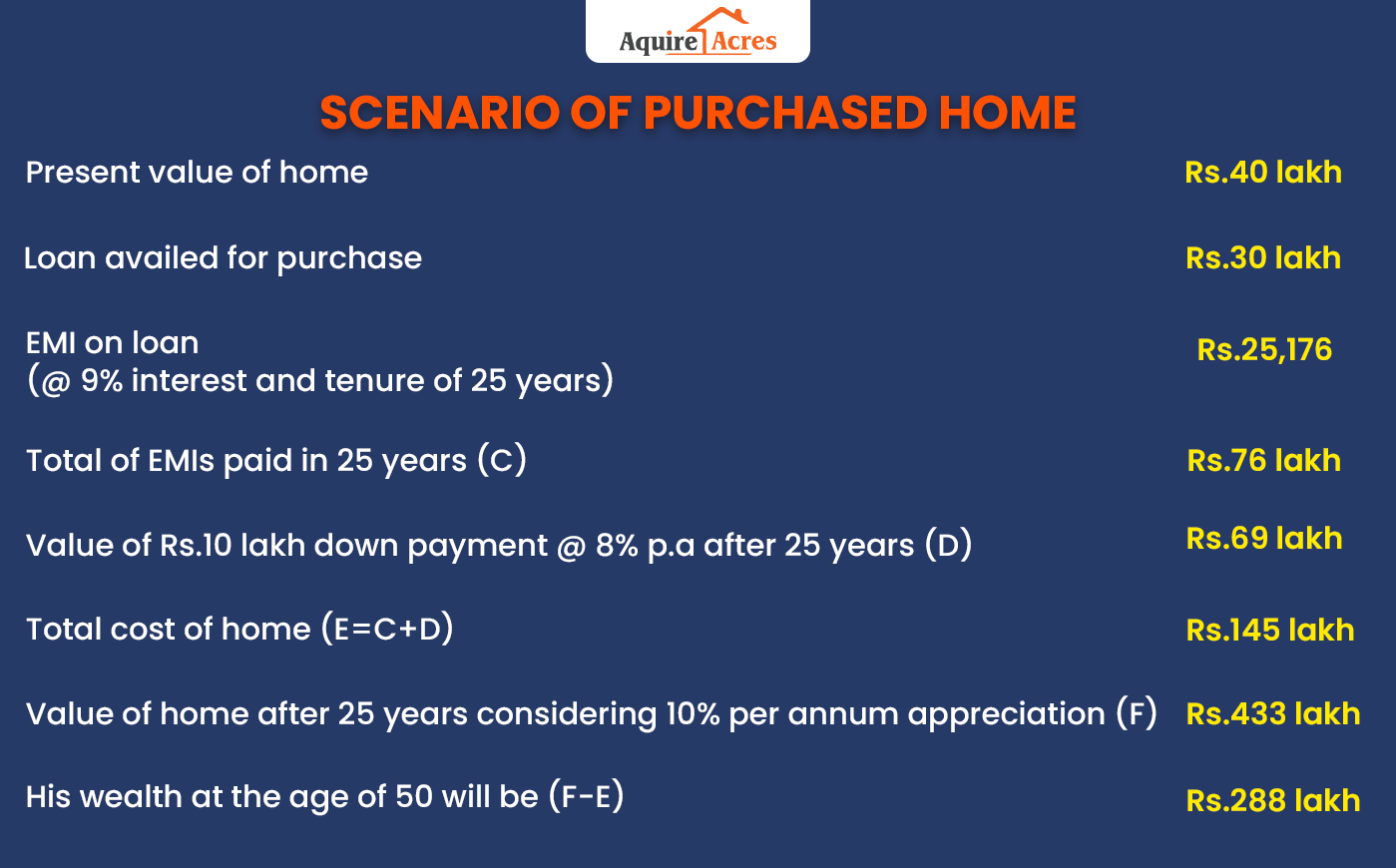

While the arguments favoring the purchase of a home are predominantly qualitative, there's also a quantitative aspect to consider in the rent versus buy debate. Let's examine two scenarios involving Sanjay, aged 25. In one scenario, he opts to buy a house immediately upon securing a permanent job. In the other scenario, he continues to reside in rented accommodation while investing his savings in a bank deposit earning 8% interest. In both cases, the initial value of the home is Rs. 40 lakh. For the purchase option, he takes out a loan of Rs. 30 lakh with a term of 25 years, at an interest rate of 9%. Let's analyze how his financial situation would compare in the two scenarios by the time he reaches age 50, having fully repaid his loan. This highlights the quantitative advantages of buying a home over renting, shedding light on the monetary implications of each choice.

It becomes obvious through the above example, that buying a home makes financial / economic sense too. Sanjay is left nearly Rs.1 crore richer if he opts to buy a home rather than live on rent. This is no doubt a huge difference to his wealth. Considering that home loans fetch tax benefits too, the real difference in the wealth is likely to be higher.

Rise in Housing Costs

Take a look at how much you could spend on buying or renting flats in Mumbai, Delhi, and Bangalore:

| City | Flat Type | Sale Price Range (Approx.) |

Rent Price Range (Approx.) |

|---|---|---|---|

| Mumbai | 1 BHK | ₹36 lakh - ₹1.42 crore | ₹17,500 - ₹60,000 |

| 2 BHK | ₹96 lakh - ₹3.40 crore | ₹42,000 - ₹1.1 lakh | |

| 3 BHK | ₹2.18 crore - ₹7.35 crore | ₹70,500 - ₹2.5 lakh | |

| 4 BHK | ₹4.45 crore - ₹16 crore | ₹1.2 lakh - ₹5 lakh | |

| Delhi | 1 BHK | ₹16 lakh - ₹54.6 lakh | ₹8,000 - ₹24,000 |

| 2 BHK | ₹26 lakh - ₹1.50 crore | ₹14,000 - ₹40,000 | |

| 3 BHK | ₹57 lakh - ₹4 crore | ₹25,500 - ₹1.5 lakh | |

| 4 BHK | ₹2 crore - ₹13 crore | ₹42,000 - ₹2.5 lakh | |

| Bangalore | 1 BHK | ₹20.5 lakh - ₹74 lakh | ₹6,000 - ₹22,600 |

| 2 BHK | ₹44 lakh - ₹1.5crore | ₹14,000 - ₹50,000 | |

| 3 BHK | ₹66 lakh - ₹2.90 crore | ₹30,000 - ₹90,000 | |

| 4 BHK | ₹1.80 crore - ₹6.50 crore | ₹55,000 - ₹2.3 lakh |

CONCLUSION

Looking at the "rent or buy" question, purchasing property is the logical choice. Due to an increase in income levels, higher disposable incomes, availability of innovative loan options, and tax incentives, buying a home seems like a appealing option.

Also Read: Home Loan Benefits for Women in India

_1771582392.webp)

_1771577585.webp)

Ans 1. Buying a house can give you the comfort of knowing the space is entirely yours, with no eviction concerns. Renting brings the ease of mobility but can sometimes come with feelings of temporary belonging. Buying helps you build an asset to pass down through generations.

Ans 2. If done correctly, investment in rental properties can give you a steady monthly income that never stops. It also enables you to sell your homes for a profit that is significantly greater than the original investment.

Ans 3. There is no set "right" age to buy a house, as it depends on personal circumstances and financial stability. However, individuals in their 40s may need to consider retirement planning, financial stability, and long-term goals before committing to a purchase.

Ans 4. Only if you perceive value in living in a house. It comes with benefits and it also has some elements of risk and responsibility that not everyone wants to accept. Like everything else in life, home ownership is not for everyone

Ans 5. Ownership: The fundamental distinction between a lease and a mortgage lies in ownership. With a lease, the tenant does not own the property but rather has the right to use it temporarily. In contrast, a mortgage allows the borrower (mortgagor) to acquire ownership of the property, subject to repayment of the loan.