Table of Content

▲- What Is Property Tax Pune?

- Why the 40% Rebate Matters

- Eligibility for the 40% Rebate

- How to Get the 40% Rebate on Property Tax Pune in 2025

- 1. Check Eligibility

- 3. Download and Fill the PT3 Form

- 5. Await Verification and Refund

- 6. Pay Your Property Tax Online

- Additional Tips for Homeowners

- Conclusion

It can be difficult to navigate property taxation issues, and with the recent changes to the Property Tax Pune system, there are some really good news for homeowners. The Pune Municipal Corporation (PMC) has reinstated a 40% rebate on property tax for self-occupied residential properties for the 2025 tax year (last awarded in 2019). In this article, we will explain what Property Tax Pune is, who qualifies for the rebate, and how to obtain the 40% rebate step by step.

What Is Property Tax Pune?

Property Tax Pune is a yearly fee assessed by the Pune Municipal Corporation to property owners. The tax applies, regardless of property type, such as residential, commercial, and industrial properties. The obvious intent of Property Tax Pune is to cover municipal costs related to municipal services, public infrastructure, and urban development projects. Property Tax Pune is required to be paid by property owners, and if unpaid, the homeowner could encounter fines or the auctioning of his or her property by PMC as a result of default.

In the past, the Maharashtra government instituted a rebate of 40% on Property Tax Pune for self-occupied residential properties as a relief effort after the Khadakwasla Dam burst flooded Pune beyond capacity. In 2019, the Maharashtra government ended the rebate, however, in 2023, following extensive petitions from homeowners, the rebate was reinstated. With careful planning, the implementation of the new rebate in 2025 will present a real opportunity for homeowners to drastically reduce their annual tax liability.

Also Read: Pune to Debut Its First Trump-Branded Commercial Hub

Why the 40% Rebate Matters

The 40% rebate on Property Tax Pune offers several key benefits for self-occupied homeowners:

- Financial Relief: A 40% discount can substantially lower your annual tax expense, easing the financial strain on homeowners.

- Increased Affordability: Lower tax liabilities mean that homeowners can allocate more funds towards other essential expenses or even invest in property upgrades.

- Encouragement of Self-Occupancy: The rebate is a clear incentive for homeowners to use their property for personal residence rather than renting it out, thus fostering a sense of community stability.

- Support for Urban Development: The funds collected from Property Tax Pune are reinvested into city development projects. By ensuring fair tax rates, the PMC aims to balance revenue generation with public welfare.

Eligibility for the 40% Rebate

Not all properties in Pune qualify for the 40% rebate on Property Tax Pune. The rebate is specifically available to:

- Self-Occupied Residential Properties: Only those properties that are occupied by the owner for residential purposes can claim this discount. Investment properties or rented-out homes do not qualify.

- Properties Registered Under PMC: The rebate applies to properties that fall within the jurisdiction of the Pune Municipal Corporation. It is important to check that your property is included in the PMC’s records.

Homeowners need to show proof that they occupy the property themselves in order to qualify for the rebate on properties registered after April 1, 2019. Homeowners of properties that had a discount application in before the deadline (August 15, 2024 for the 2019-2023 period) do not have to re-apply.

How to Get the 40% Rebate on Property Tax Pune in 2025

Securing the 40% discount on Property Tax Pune involves a series of steps that homeowners need to follow carefully:

1. Check Eligibility

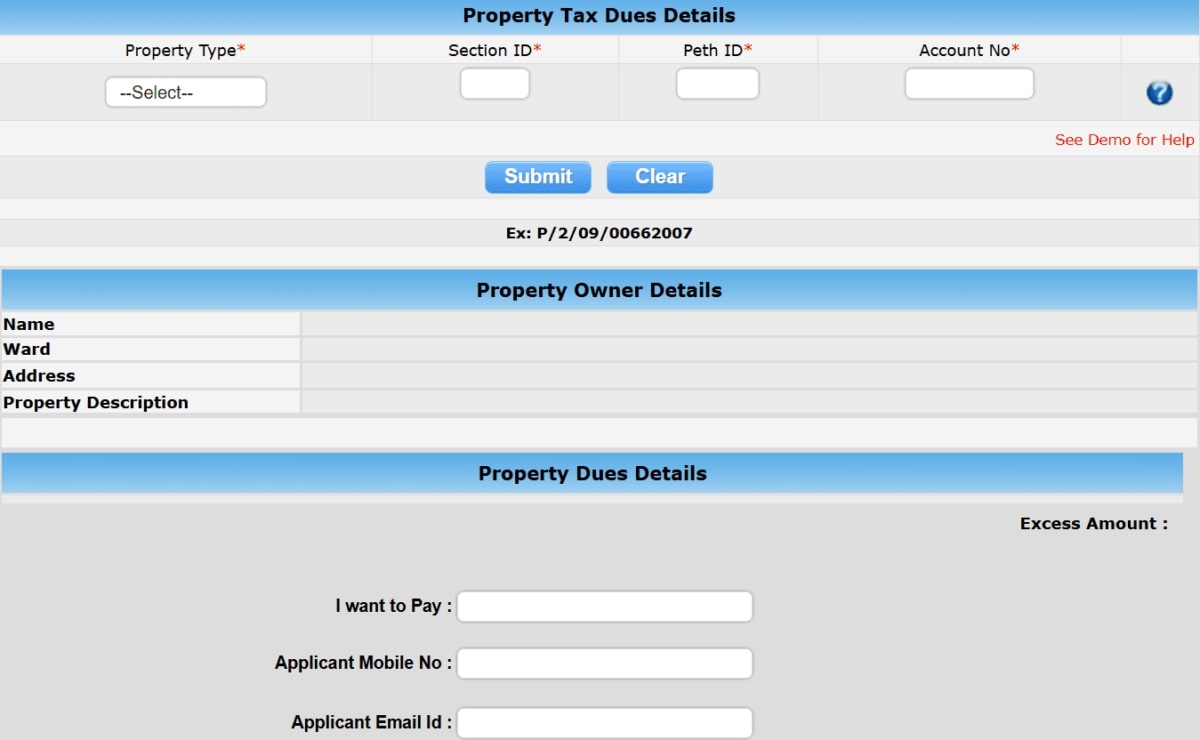

Before proceeding, visit the official PMC website at propertytax.punecorporation.org and use the online portal to check if your property qualifies for the 40% rebate. You will need to enter details such as your property registration number, Aadhaar number, and other pertinent information.

2. Gather Required Documents

To apply for the rebate, you must have all necessary documents ready. These include:

- No Objection Certificate (NOC): Issued by the housing society, this certificate confirms that the property is self-occupied and not rented out.

- Proof of Identity: Documents such as your Aadhaar card, passport, or driving license.

- Property Documents: Sale deed, property tax bills from previous years, and any other relevant property registration documents.

- Proof of Self-Occupancy: This can be in the form of a declaration or any other supporting documents showing that you reside in the property.

Also Read: Discover the Top 9 Builders In Pune: A Guide to Quality Projects

3. Download and Fill the PT3 Form

The key to availing the 40% discount on Property Tax Pune is the PT3 form. To download the PT3 form:

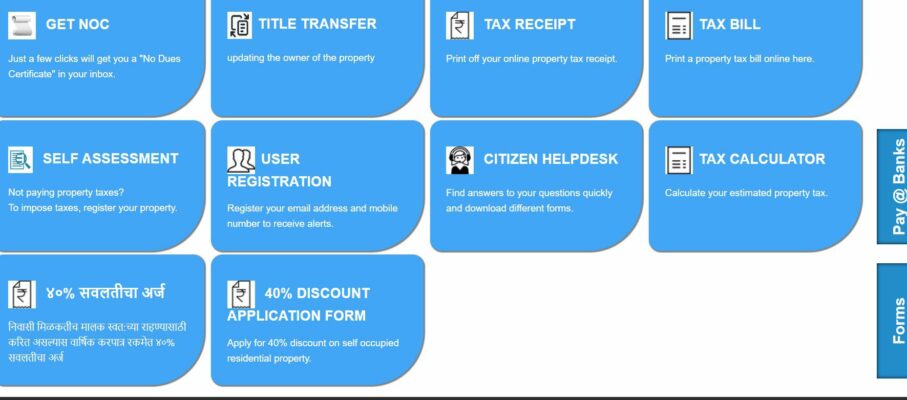

- Visit the PMC website and scroll to the bottom of the homepage.

- Click on the link for the “40% discount application form.”

- The form is available in both Marathi and English. Download the version that suits your preference.

Fill in the PT3 form carefully, ensuring that all details are accurate and complete. Incomplete or incorrect forms may delay the processing of your rebate.

4. Submit the PT3 Form and Supporting Documents

Once the PT3 form is filled, submit it along with the required supporting documents. This can be done at:

- PMC Citizen Facilitation Centres

- Regional Ward Offices

- Peth Inspectors’ Offices

Make sure to pay the applicable fee (₹25) when submitting the form. Remember, this is a one-time submission for eligible properties, so if you have already submitted the PT3 form in previous years, there is no need to resubmit it.

5. Await Verification and Refund

After your submission, the PMC will verify your documents. The Property Tax Pune department aims to process these applications promptly. If you are found eligible, the 40% rebate will be applied to your property tax bill. For those who have already paid their taxes without the rebate, the PMC has announced that refunds will be issued in four phases over four years.

6. Pay Your Property Tax Online

To finalize the process, you are able to pay your property tax online via the PMC website. After providing your property information, the tax liability will automatically show the adjusted amount reflecting the 40% rebate. Payment can be made by UPI, credit/debt cards, and banking online.

Additional Tips for Homeowners

- Stay Updated: Regularly check the PMC website for any updates regarding deadlines and changes in the rebate policy.

- Maintain Records: Keep a copy of the submitted PT3 form and all supporting documents. This is useful in case of discrepancies or follow-up queries from the PMC.

- Plan Ahead: If you haven’t yet submitted the PT3 form and your property qualifies, act quickly to avoid missing the deadline. The PMC has emphasized that no extensions will be provided beyond the stipulated deadline.

- Consult Experts: If you’re unsure about the process, consider consulting a property tax expert or a legal advisor who can guide you through the application process.

Conclusion

For homeowners in Pune, the 40% rebate for self-occupied residential properties is a welcome relief. By learning about the criteria and completing the PT3 form process, it will assist in lowering your annual tax amount significantly. This relief not only makes homeownership more affordable but likely increases the desirability of living in the PMC area. Make sure you continue to track the Pune Municipal Corporation (PMC) for news so you can receive the 40% rebate in 2025 and beyond. By being proactive and anticipating the rebate, you can reduce your tax amount by 40%, and support a more transparent, trustworthy, and efficiency-based system in property tax in Pune.

Also Read: Hiranandani Group Partners with Krisala Developers for a ₹7,000 Crore 105-Acre Township Project Near

(1)_1742899848.webp)

_1772441702.webp)

Ans 1. The 40% rebate is a discount on annual property tax for self-occupied residential properties, reinstated for the 2025 tax year to reduce homeowners’ tax burdens.

Ans 2. Only self-occupied residential properties registered under PMC qualify; investment or rented properties are not eligible for the 40% rebate.

Ans 3. Visit the PMC website, download the PT3 form, fill in your property details along with required documents (NOC, identity proof, etc.), and submit at designated PMC centers with the applicable fee.

Ans 4. You'll need a No Objection Certificate from your housing society, proof of identity (Aadhaar, passport, or driving license), property documents (sale deed, previous tax bills), and a declaration of self-occupancy.

Ans 5. The PMC aims to verify documents promptly, with refunds for previously overpaid taxes being issued in phased installments over four years.