Table of Content

▲

Every property is assigned a fundamental minimum value, and in India, this value is established by the state government, taking various factors into consideration. The term used to denote this basic minimum value varies across the country. In many northern states, including Delhi, it is commonly referred to as the "circle rate." Prospective buyers looking to acquire land or property in the national capital must be well-informed about the prevailing circle rates. This knowledge ensures that they pay a fair value for the property. Additionally, understanding circle rates is essential for effective purchase planning, as they directly impact the amount a buyer will need to pay for stamp duty and registration fees.

What is circle rate?

As per the income tax department, the circle rate is the value determined by state governments for calculating stamp duty payments related to the transfer of immovable property. Essentially, the circle rate represents the government-prescribed value assigned to land within a state. These rates undergo periodic adjustments to align them with the current market rates of properties. Circle rates vary across different areas within a city. Premium locations typically have higher circle rates, while other areas have comparatively lower rates. These adjustments ensure that circle rates remain reflective of the prevailing property market conditions.

How does circle rate impact a homebuyer?

Also known as guidance value, collector rate, collector rate and ready reckoner rate, circle rates help the buyer have a clear idea about the exact value of the property as assigned by the state government. Even though he might have to pay more than the government attached value of the property because the market rate of properties are often higher than the circle rate, knowledge of the circle rate helps him make an informed decision, which can also help him negotiate better with the seller.

More importantly, the buyer gets a clear idea about how much money he would be spending on his home purchase once he finds out the circle rate of the property. Since states charge a certain value of the circle rate-value of the property as stamp duty and registration fee, the buyer will be able to make exact calculations about this government mandated additional fee which is part and parcel of all property transactions.

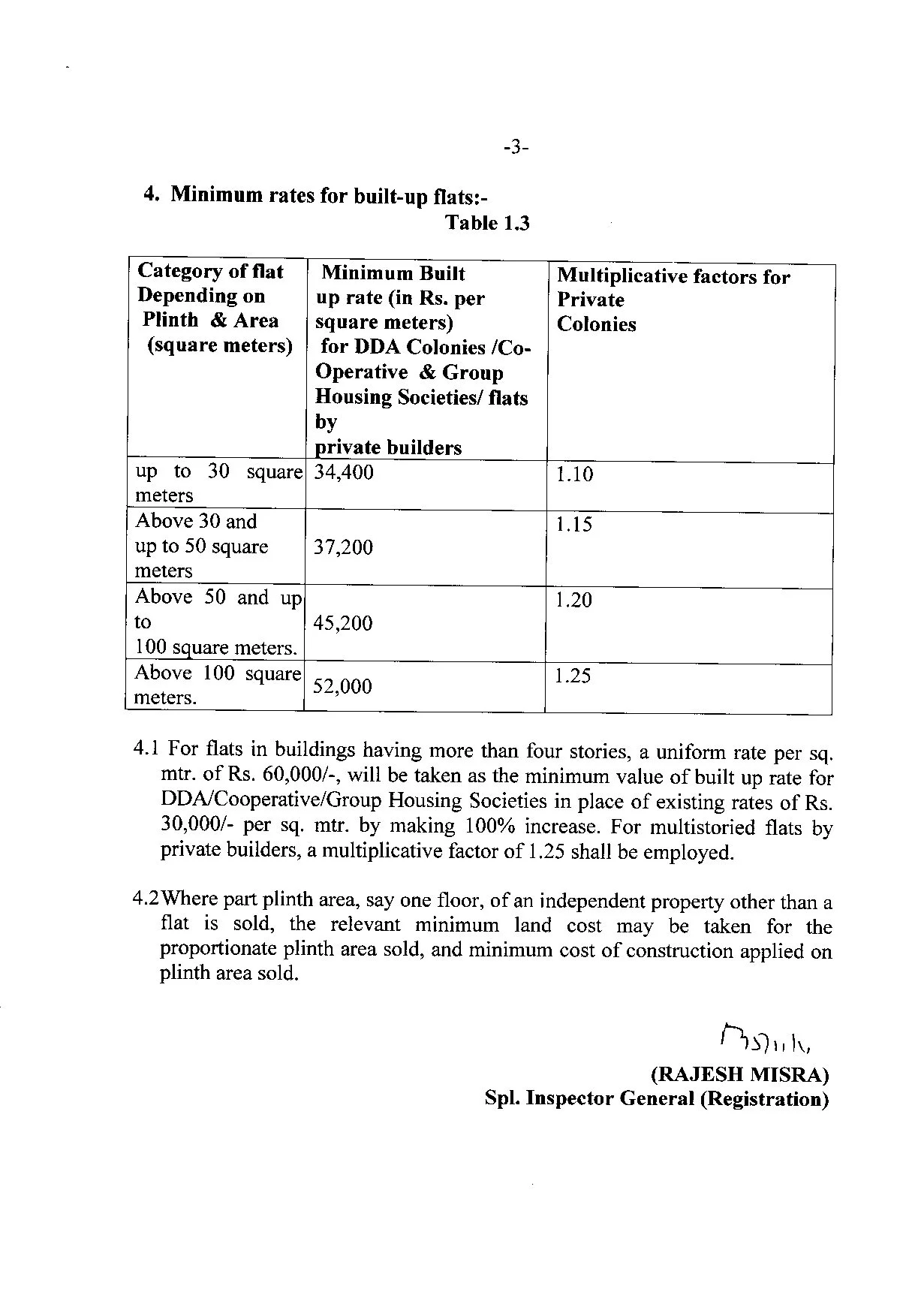

Delhi circle rate for flats in 2024

| Area | DDA, society flats (per square metre) | Private builder flats (per square metre) | Multiplying factors for private colonies |

| Up to 30 sqm | Rs 50,400 | Rs 55,400 | 1.1 |

| 30-50 sqm | Rs 54,480 | Rs 62,652 | 1.15 |

| 50-100 sqm | Rs 66,240 | Rs 79,488 | 1.2 |

| Over 100 sqm | Rs 76,200 | Rs 95,250 | 1.25 |

| Multi-storey apartment | Rs 87,840 | Rs 1.1 lakh | 1.25 |

A square metre is equal to 10.76 square foot.

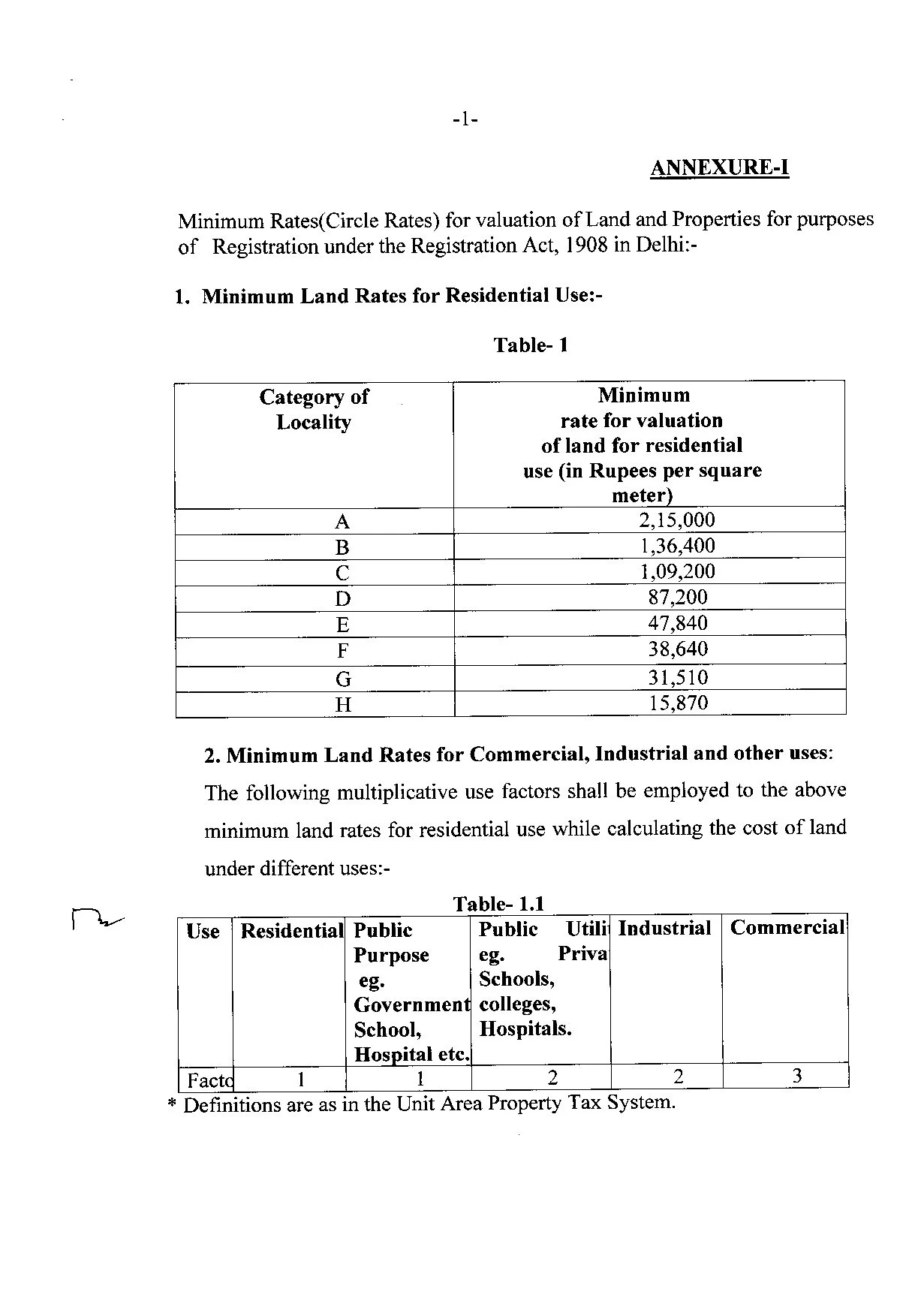

Delhi circle rate for residential and commercial plots in 2024

| Category | Land cost (per sqm) | Construction cost: Residential (per sqm) | Construction cost: Commercial (per sqm) |

| A | Rs 7.74 lakh | Rs 21,960 | Rs 25,200 |

| B | Rs 2.46 lakh | Rs 17,400 | Rs 19,920 |

| C | Rs 1.6 lakh | Rs 13,920 | Rs 15,960 |

| D | Rs 1.28 lakh | Rs 11,160 | Rs 12,840 |

| E | Rs 70,080 | Rs 9,360 | Rs 10,800 |

| F | Rs 56,640 | Rs 8,220 | Rs 9,480 |

| G | Rs 46,200 | Rs 6,960 | Rs 8,040 |

| H | Rs 23,280 | Rs 3,480 | Rs 3,960 |

Delhi circle rate for agricultural land 2024

| District | Green belt villages (in Rs crore per acre) | Urbanised villages (in Rs crore per acre) | Rural villages (in Rs crore per acre) |

| South | 5 | 5 | 5 |

| North | 3 | 3 | 3 |

| West | 3 | 3 | 3 |

| North-west | 3 | 3 | 3 |

| South-west | 3 | 4 | 3 |

| New Delhi | 5 | 5 | 5 |

| Central | NA | 2.5 | 2.5 |

| South-east | NA | 4 | 2.5 |

| Shahdara | 2.3 | 2.3 | 2.3 |

| North-east | NA | 2.3 | 2.3 |

| East | NA | 2.3 |

2.3 |

Delhi circle rate of land in colonies in 2024

| Area | Land cost per sqm | Construction cost |

| Lodi Road Industrial Area | Rs 7.74 lakh | Rs 21,960 |

| Maharani Bagh | Rs 7.74 lakh | Rs 21,960 |

| Nehru Place | Rs 7.74 lakh | Rs 21,960 |

| New Friends Colony | Rs 7.74 lakh | Rs 21,960 |

| Panchshila Park | Rs 7.74 lakh | Rs 21,960 |

| Rajendra Place | Rs 7.74 lakh | Rs 21,960 |

| Shanti Niketan | Rs 7.74 lakh | Rs 21,960 |

| Sunder Nagar | Rs 7.74 lakh | Rs 21,960 |

| Vasant Vihar | Rs 7.74 lakh | Rs 21,960 |

| Anand Niketan | Rs 7.74 lakh | Rs 21,960 |

| Basant Lok DDA Complex | Rs 7.74 lakh | Rs 21,960 |

| Bhikaji Cama Place | Rs 7.74 lakh | Rs 21,960 |

| Friends Colony | Rs 7.74 lakh | Rs 21,960 |

| Friends Colony East | Rs 7.74 lakh | Rs 21,960 |

| Friends Colony West | Rs 7.74 lakh | Rs 21,960 |

| Golf Links | Rs 7.74 lakh | Rs 21,960 |

| Kalindi Colony | Rs 7.74 lakh | Rs 21,960 |

| Anand Lok | Rs 2.46 lakh | Rs 17,400 |

| Andrews Ganj | Rs 2.46 lakh | Rs 17,400 |

| Defence Colony | Rs 2.46 lakh | Rs 17,400 |

| Greater Kailash I | Rs 2.46 lakh | Rs 17,400 |

| Greater Kailash II | Rs 2.46 lakh | Rs 17,400 |

| Greater Kailash III | Rs 2.46 lakh | Rs 17,400 |

| Greater Kailash IV | Rs 2.46 lakh | Rs 17,400 |

| Green Park | Rs 2.46 lakh | Rs 17,400 |

| Gulmohar Park | Rs 2.46 lakh | Rs 17,400 |

| Hamdard Nagar | Rs 2.46 lakh | Rs 17,400 |

| Hauz Khas | Rs 2.46 lakh | Rs 17,400 |

| Maurice Nagar | Rs 2.46 lakh | Rs 17,400 |

| Munirka Vihar | Rs 2.46 lakh | Rs 17,400 |

| Neeti Bagh | Rs 2.46 lakh | Rs 17,400 |

| Nehru Enclave | Rs 2.46 lakh | Rs 17,400 |

| Nizamuddin East | Rs 2.46 lakh | Rs 17,400 |

| Pamposh Enclave | Rs 2.46 lakh | Rs 17,400 |

| Panchsheel Park | Rs 2.46 lakh | Rs 17,400 |

| Safdarjang Enclave | Rs 2.46 lakh | Rs 17,400 |

| Sarvapriya Vihar | Rs 2.46 lakh | Rs 17,400 |

| Sarvodaya Enclave | Rs 2.46 lakh | Rs 17,400 |

| Civil Lines | Rs 1.60 lakh | Rs 13,920 |

| East of Kailash | Rs 1.60 lakh | Rs 13,920 |

| East Patel Nagar | Rs 1.60 lakh | Rs 13,920 |

| Jhandewalan Area | Rs 1.60 lakh | Rs 13,920 |

| Kailash Hill | Rs 1.60 lakh | Rs 13,920 |

| Kalkaji | Rs 1.60 lakh | Rs 13,920 |

| Lajpat Nagar I | Rs 1.60 lakh | Rs 13,920 |

| Lajpat Nagar II | Rs 1.60 lakh | Rs 13,920 |

| Lajpat Nagar III | Rs 1.60 lakh | Rs 13,920 |

| Lajpat Nagar IV | Rs 1.60 lakh | Rs 13,920 |

| Malviya Nagar | Rs 1.60 lakh | Rs 13,920 |

| Masjid Moth | Rs 1.60 lakh | Rs 13,920 |

| Munirka | Rs 1.60 lakh | Rs 13,920 |

| Nizamuddin West | Rs 1.60 lakh | Rs 13,920 |

| Panchsheel Extension | Rs 1.60 lakh | Rs 13,920 |

| Punjabi Bagh | Rs 1.60 lakh | Rs 13,920 |

| Som Vihar | Rs 1.60 lakh | Rs 13,920 |

| Vasant Kunj | Rs 1.60 lakh | Rs 13,920 |

| Alaknanda | Rs 1.60 lakh | Rs 13,920 |

| Chittaranjan Park | Rs 1.60 lakh | Rs 13,920 |

| New Rajinder Nagar | Rs 1.28 lakh | Rs 11,160 |

| Old Rajinder Nagar | Rs 1.28 lakh | Rs 11,160 |

| Rajouri Garden | Rs 1.28 lakh | Rs 11,160 |

| Anand Vihar | Rs 1.28 lakh | Rs 11,160 |

| Daryaganj | Rs 1.28 lakh | Rs 11,160 |

| Dwarka | Rs 1.28 lakh | Rs 11,160 |

| East End Apartments | Rs 1.28 lakh | Rs 11,160 |

| Gagan Vihar | Rs 1.28 lakh | Rs 11,160 |

| Hudson Line | Rs 1.28 lakh | Rs 11,160 |

| Indraprastha Extension | Rs 1.28 lakh | Rs 11,160 |

| Janakpuri | Rs 1.28 lakh | Rs 11,160 |

| Jangpura A | Rs 1.28 lakh | Rs 11,160 |

| Jangpura Extension | Rs 1.28 lakh | Rs 11,160 |

| Jasola Vihar | Rs 1.28 lakh | Rs 11,160 |

| Karol Bagh | Rs 1.28 lakh | Rs 11,160 |

| Kirti Nagar | Rs 1.28 lakh | Rs 11,160 |

| Mayur Vihar | Rs 1.28 lakh | Rs 11,160 |

| Chandni Chowk | Rs 70,080 | Rs 9,360 |

| East End Enclave | Rs 70,080 | Rs 9,360 |

| Gagan Vihar Extension | Rs 70,080 | Rs 9,360 |

| Hauz Qazi | Rs 70,080 | Rs 9,360 |

| Jama Masjid | Rs 70,080 | Rs 9,360 |

| Kashmere Gate | Rs 70,080 | Rs 9,360 |

| Khirki Extension | Rs 70,080 | Rs 9,360 |

| Madhuban Enclave | Rs 70,080 | Rs 9,360 |

| Mahavir Nagar | Rs 70,080 | Rs 9,360 |

| Moti Nagar | Rs 70,080 | Rs 9,360 |

| Pahar Ganj | Rs 70,080 | Rs 9,360 |

| Pandav Nagar | Rs 70,080 | Rs 9,360 |

| Rohini | Rs 70,080 | Rs 9,360 |

| Sarai Rihilla | Rs 70,080 | Rs 9,360 |

| Zakir Nagar Okhla | Rs 56,640 | Rs 8,220 |

| Anand Parbat | Rs 56,640 | Rs 8,220 |

| Arjun Nagar | Rs 56,640 | Rs 8,220 |

| Daya Basti | Rs 56,640 | Rs 8,220 |

| Dilshad Colony | Rs 56,640 | Rs 8,220 |

| Dishad Garden | Rs 56,640 | Rs 8,220 |

| BR Amdedkar Colony | Rs 56,640 | Rs 8,220 |

| Ganesh Nagar | Rs 56,640 | Rs 8,220 |

| Govindpuri | Rs 56,640 | Rs 8,220 |

| Hari Nagar | Rs 56,640 | Rs 8,220 |

| Jangpura B | Rs 56,640 | Rs 8,220 |

| Madhu Vihar | Rs 56,640 | Rs 8,220 |

| Majnu Ka Tila | Rs 56,640 | Rs 8,220 |

| Mukheree Park Extension | Rs 56,640 | Rs 8,220 |

| Nand Nagri | Rs 56,640 | Rs 8,220 |

| Uttam Nagar | Rs 56,640 | Rs 8,220 |

| Ambedkar Nagar Jahangirpuri | Rs 46,200 | Rs 6,960 |

| Amdedkar Nagar East Delhi | Rs 46,200 | Rs 6,960 |

| Amber Vihar | Rs 46,200 | Rs 6,960 |

| Dabri Extension | Rs 46,200 | Rs 6,960 |

| Dakshinpuri | Rs 46,200 | Rs 6,960 |

| Dashrath Puri | Rs 46,200 | Rs 6,960 |

| Hari Nagar Extension | Rs 46,200 | Rs 6,960 |

| Vivek Vihar Phase I | Rs 46,200 | Rs 6,960 |

| Tagore Garden | Rs 46,200 | Rs 6,960 |

| Sultanpur Majra | Rs 23,280 | Rs 3,480 |

Factors that impact circle rate in Delhi

Property circle rates in Delhi depend on a number of factors, such as:

Type of property

While circle rates are lower for residential properties in Delhi, they are comparatively higher for commercial properties.

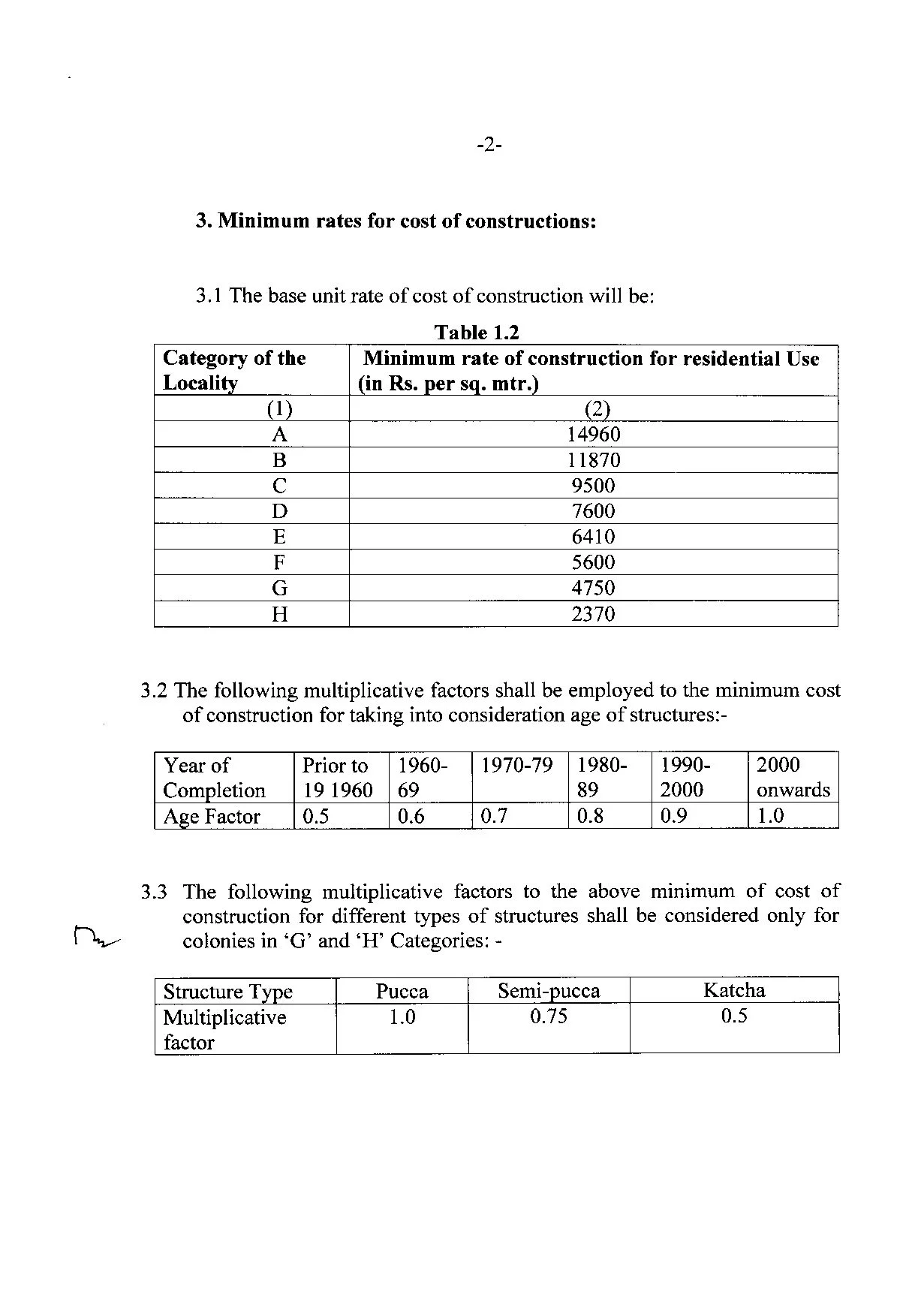

Age of the property

The age of the property is also considered while determining the circle rate of properties in the national capital.

Circle rates: Age factor in Delhi

| Factor | Rate |

| Pre-1960 | 0.5 |

| 1960-69 | 0.6 |

| 1970-79 | 0.7 |

| 1980-89 | 0.8 |

| 1990-1999 | 0.9 |

| 2000 onwards | 1 |

Facilities in the area

The more the facilities, the higher the circle rate in Delhi.

Locality

The higher the market value, the higher the circle rate in Delhi.

Category type of the area

Circle rates of properties in posh areas of Delhi are always higher than the rates in other areas. To ease the process and keep it uniform across the city, the Delhi government has divided the properties in Delhi into eight categories – A to H. Delhi’s most expensive posh areas are in Category A while Category H has the lowest-value areas of the city. We will touch up on this topic in the latter sections of this article.

List of colonies in Delhi by category

Category A

Friends Colony East

Friends Colony West

Golf Links

Kalindi Colony

Lodi Road Industrial Area

Maharani Bagh

Nehru Place

New Friends Colony

Panchshila Park

Rajendra Place

Shanti Niketan

Sunder Nagar

Vasant Vihar

Anand Niketan

Basant Lok DDA Complex

Bhikaji Cama Place

Friends Colony

Category B

Sarvapriya Vihar

Sarvodaya Enclave

Anand Lok

Andrews Ganj

Defence Colony

Greater Kailash-I

Greater Kailash-II

Greater Kailash-III

Greater Kailash-IV

Green Park

Gulmohar Park

Hamdard Nagar

Hauz Khas

Maurice Nagar

Munirka Vihar

Neeti Bagh

Nehru Enclave

Nizamuddin East

Pamposh Enclave

Panchsheel Park

Safdarjang Enclave

Category C

Alaknanda

Chittaranjan Park

Civil Lines

East of Kailash

East Patel Nagar

Jhandewalan Area

Kailash Hill

Kalkaji

Lajpat Nagar-I

Lajpat Nagar-II

Lajpat Nagar-III

Lajpat Nagar-IV

Malviya Nagar

Masjid Moth

Munirka

Nizamuddin West

Panchsheel Extension

Punjabi Bagh

Som Vihar

Vasant Kunj

Category D

Jasola Vihar

Karol Bagh

Kirti Nagar

Mayur Vihar

New Rajinder Nagar

Old Rajinder Nagar

Rajouri Garden

Anand Vihar

Daryaganj

Dwarka

East End Apartments

Gagan Vihar

Hudson Line

Indraprastha Extension

Janakpuri

Jangpura A

Jangpura Extension

Category E

Chandni Chowk

East End Enclave

Gagan Vihar Extension

Hauz Qazi

Jama Masjid

Kashmere Gate

Khirki Extension

Madhuban Enclave

Mahavir Nagar

Moti Nagar

Pahar Ganj

Pandav Nagar

Rohini

Sarai Rohilla

Category F

Majnu Ka Tila

Mukheree Park Extension

Nand Nagri

Uttam Nagar

Zakir Nagar Okhla

Anand Parbat

Arjun Nagar

Daya Basti

Dilshad Colony

Dilshad Garden

BR Ambedkar Colony

Ganesh Nagar

Govindpuri

Hari Nagar

Jangpura B

Madhu Vihar

Category G

Ambedkar Nagar Jahangirpuri

Ambedkar Nagar East Delhi

Amber Vihar

Dabri Extension

Dakshinpuri

Dashrath Puri

Hari Nagar Extension

Vivek Vihar Phase-I

Tagore Garden

Category H

Sultanpur Majra

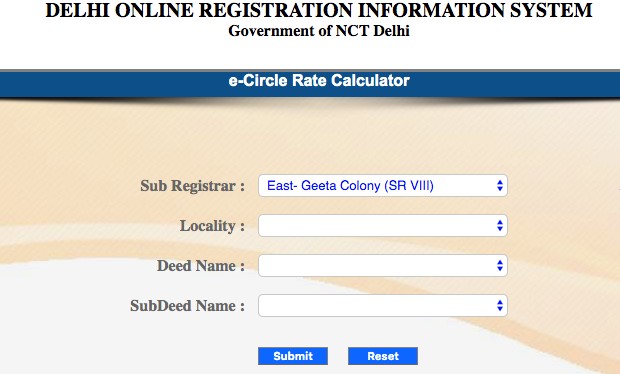

How to check circle rate in Delhi in 2024?

Step 1: To find circle rates in Vasant Kunj, visit the official website of revenue department of the Delhi government (https://revenue.delhi.gov.in/).

Step 2: On the home page, click on the Notice Borad option.

Step 3: Under the Notice Borad option, click on Previous Notifications.

Step 4: Now select the year 2014, the last time circle rates in Delhi were revised.

Step 5: You will find the revised circle rate file, which you can download. In the list you will be able to check the revised circle rate list for all localities in Delhi.

How to calculate circle rates in Delhi?

Home buyers and investors should know that the property registration process in Delhi and charges such as stamp duty, are based on the higher of the declared property value and the price calculated as per circle rate applicable for the sector or area of Delhi.

Usually, commercial properties have higher circle rates, as compared to residential properties. It may also vary, based on the type and age of the property. Properties built after the year 2000 have a maximum multiplier of 1 while the older buildings have it in the range of 0.5-0.9.

You can calculate the circle rates in Delhi by visiting the Delhi government’s online registration information system.

Alternatively, you can follow the below steps to calculate the circle rate in Delhi.

Step 1: Determine whether the property is used for residential or commercial purpose.

Step 2: Consider the type of property – whether it is a flat, apartment, independent house, or a plot of land. The circle rates of different property types vary, even if they fall in the same area.

Step 3: Factor in the ‘age multiplier’ to arrive at property valuation and determine the circle rate accordingly.

| Type of property | How to calculate? |

| Independent plot | Multiply the plot area with the applicable circle rate (in Rs/sq metre). |

| Builder floors, DDA flats, society flats | Multiply the minimum construction cost with the built-up area (in sq metres). Now, multiply the product with the applicable age factor. |

| For multi-storey flats | Multiply the flat’s built-up area with the applicable circle rates for the multi-storeyed flats (in Rs/sq metre). |

| For house constructed on a plot | Multiply the plot area with the applicable circle rate for the land in the respective locality.

Multiply the house’s built-up area with the minimum construction cost. Multiply the product with the applicable age factor for the construction. |

How to calculate property value in Delhi using circle rate?

Here is how to calculate the property value, using the circle rate:

- Ascertain the property’s built-up area, plot area, age of construction, amenities, floors, etc.

- Choose the type of property (residential or commercial unit, plot, house, apartment, builder floor, or shop).

- Select the locality of the property

- Calculate the minimum assessment figure as per the circle rates given

The formula for calculating the property value is as given below:

Property value = Built-up area (in sq metres) x circle rate for the locality (in Rs per sq metre).

Also Read: DDA’s begins e-auction for over 2,000 flats

_1770632737.webp)

Ans 1. Circle rates are the minimum property prices designated by the state government, below which sales transactions cannot take place.

Ans 2. You can check the circle rate on Delhi’s DORIS portal.

Ans 3. Stamp duty in Delhi varies between 4% and 6% of the transaction value, while the registration fee is 1% of the transaction value.

Ans 4. Circle rates are the government-determined benchmark value of property in an area below which a property can’t be sold. Market rates on the other hand, is the rate at which properties are sold in a specific market at a particular point of time. In most cases, circle rates of properties are lower than their market rates. To make sure the difference between the two rates is not vast, states periodically change circle rates. They either lower circle rates to bring those closer to the market rates or they hike the circle rates with the same intention.

Ans 5. In India, state governments fix circle rate.

Ans 6. There is no standard time limit for revision of circle rates. States reduce or hike circle rates from time to time to keep them closer to properties' market rates.

Ans 7. Circle rates were first introduced in Delhi in 2007. Those were notified under the provisions of Delhi Stamp (Prevention of Undervaluation of Instruments ) Rules, 2007.

Ans 8. Yes, circle rates of property in various parts of the country are often higher than its market rates. This is because of several factors. While the fluctuations in market rates of property are more prominent, the same can't be said about circle rates. States carefully watch the market trends and take a call on circle rates periodically. On the other hand, market rates reflect the immediate worth of the said property among buyers and sellers in that area.

Ans 9. yes, sometimes circle rates are lower than market rates of property because of the reasons mentioned above.

Ans 10. Under Section 56 (2)(x) of the Income Tax Act, the difference is taxed as ‘other income’ for the buyer, if the market value of the property is lower than its circle rate value. The seller, too, will have to pay capital gains tax on the circle rate of the property.